J.P. Morgan Global Liquidity

European Domiciled Product Offering

As one of the world’s largest liquidity managers, J.P. Morgan Global Liquidity believes in creating long-term, strategic relationships with clients by providing consultation, expertise and high-quality investment solutions. Our global capabilities allow us to provide a wide range of clients with the insights and solutions to meet their investment needs.

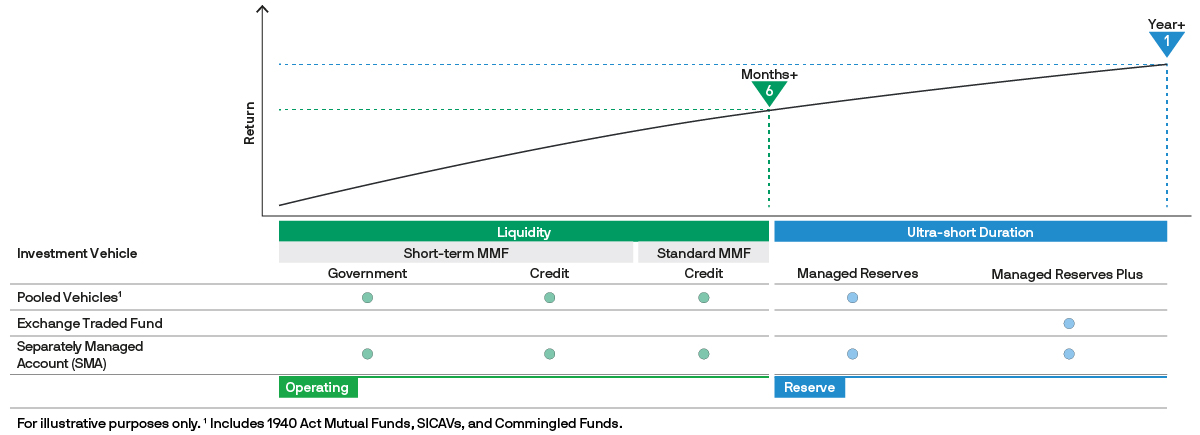

J.P. Morgan Global Liquidity offers a broad range of solutions for the investment of short-term euro cash balances to meet a variety of risk and return objectives. These include:

Liquidity Funds

- Short-term MMFs – Our CNAV or LVNAV short-term MMFs take a conservative approach to managing high quality government and corporate credit, with a focus on capital preservation and liquidity. They offer investors a risk management tool for their operating cash balances and an investment horizon of 1 day+.

- Standard MMFs – Our standard VNAV MMFs take a conservative approach to managing high quality corporate credit, with a focus on capital preservation and liquidity and offer investors a solution that seeks to generate around 15-30 basis points of additional returns versus short-term money market funds or equally versus the 3-month Treasury Bill benchmark. The incremental risk/return profile sets the funds one step up from the short-term MMFs landscape, but takes less credit and duration risk than the ultra-short duration space.

Ultra-Short Duration Funds

- Managed Reserves – Our ultra-short duration strategy diversifies risk across high quality, investment grade fixed and floating securities. The strategy seeks to achieve incremental returns of between 20-60 basis points versus short-term MMFs or equally versus the 3-month Treasury Bill benchmark. The strategy is designed for reserve cash assets that have an investment horizon of six-months+ and is available as a fund, ETF or as a fully customised separately managed account. Our separately managed accounts allow investors to define their own parameters for security, returns and liquidity based upon their risk tolerance and cash flow needs.

CNAV: Constant Net Asset Value

LVNAV: Low Volatility Net Asset Value

VNAV: Variable Net Asset Value

MMF: Money Market Fund

ETF: Exchange Traded Fund

Put cash in its place

Utilising longer-term investments where appropriate for enhanced return potential

European Domiciled Product Offering

| Liquidity | Ultra-short duation | |||||

|---|---|---|---|---|---|---|

| Short-term MMFs | Standard MMFs | Managed Reserves | Managed Reserves Plus (ETF) | |||

| Treasury | Credit | Credit | ||||

| Structures | CNAV | LVNAV | VNAV | |||

| Currencies | USD | USD, GBP, EUR, SGD, AUD | USD, GBP, EUR | USD, GBP | USD, GBP, EUR | |

| Risk | Investment Horizon | 1 day + | 1 day + | 3 months + | 6 months + | 6 months + |

| Min rating per security | A-1/A | A-1/A | A-2/BBB | BBB- | BBB- | |

| Max WAM / Duration | 60 days | 60 days | 6 months | 1 year | 1 year | |

| Max final maturity | 397 days | 397 days | 2 years w/ 397 days reset | 3 years | 5 years | |

| Return | Benchmark | N/A | N/A | 3 month Treasury Bill | 3 month Treasury Bill | 3 month Treasury Bill |

| Target excess return (bps) | N/A | N/A | 15-30 | 20-40 | 40-60 | |

| Permitted Investments | Treasury | |||||

| Agency | ||||||

| Repo | ||||||

| CP/CD | ||||||

| Corporate Bonds | ||||||

| ABS | ||||||

| ABCP | ||||||

| MBS | ||||||

| Non-currency holdings | ||||||

Source: J.P. Morgan Asset Management, as of 30 September 2023. All information displayed above are typical but are subject for discussion and adjustment in the context of separately managed accounts. All mutual funds are subject to their regional and structural regulatory requirements and the guidelines set forth in their respective prospectuses. Volatility measures are calculated using 10 years of trailing composite monthly returns. Excess return targets are gross of fees and are in relation to the stated benchmark or in relation to the 3 month Treasury Bill if no benchmark is stated. These targets are the investment manager’s internal guidelines only to achieve the fund’s investment objectives and policies as stated in the prospectus. The targets are gross of fees and subject to change. There is no guarantee that these targets will be met.

WAM: Weighted Average Maturity

CP/CD: Commercial Paper/Certificate of Deposit

ABS: Asset Backed Securities

ABCP: Asset Backed Commercial Paper

MBS: Mortgage Backed Securities

09ge222410160035