JPMorgan SmartRetirement® Income

For individuals born before 1959

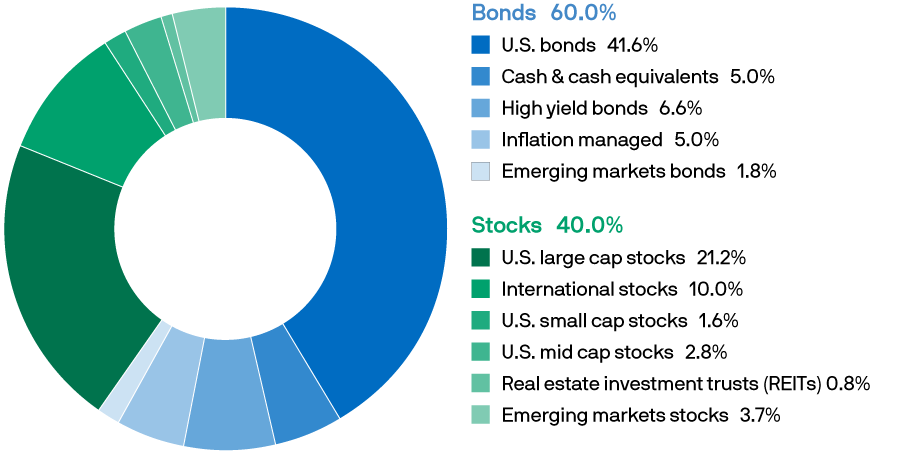

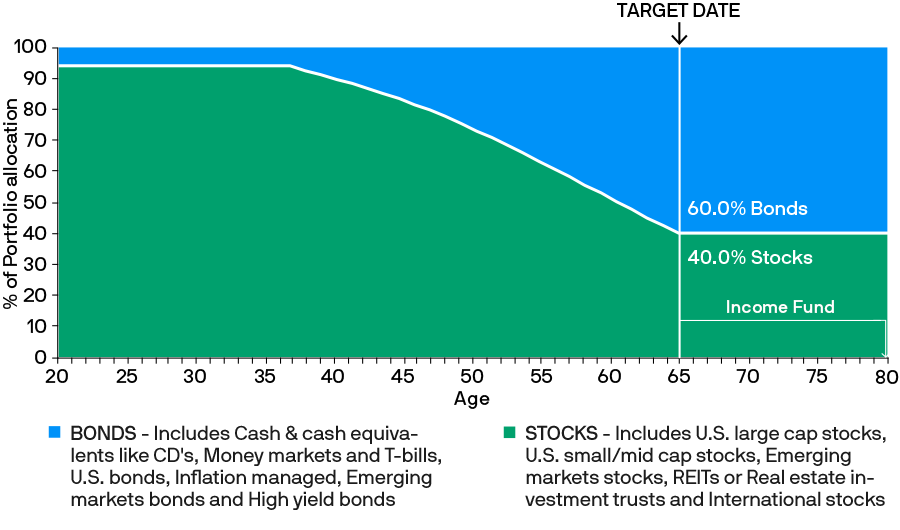

When you select a SmartRetirement Fund, you're automatically invested in more than 20 underlying funds across two asset classes - stocks and bonds. By investing in the fund, a team of more than 100 investment professionals at J.P. Morgan is responsible for shifting the allocation from stocks to bonds as the fund approaches its target date. This way your fund automatically changes to become more conservative as you approach your target retirement date.

Since each SmartRetirement Fund is dynamically managed for a specific date in the future, you'll want to consider selecting one named for the year closest to when you plan to retire and begin withdrawing from your account.

Select a different Fund

- JPMorgan SmartRetirement Income

- JPMorgan SmartRetirement 2025

- JPMorgan SmartRetirement 2030

- JPMorgan SmartRetirement 2035

- JPMorgan SmartRetirement 2040

- JPMorgan SmartRetirement 2045

- JPMorgan SmartRetirement 2050

- JPMorgan SmartRetirement 2055

- JPMorgan SmartRetirement 2060

- JPMorgan SmartRetirement 2065

Why SmartRetirement? Hear from investors like you.

[MUSIC PLAYING] My name's Elizabeth Swartwood. I am invested in my 401(k) at my work. I have nine children, and we raised them, and then I went to work to help pay to raise them. So I worked at night part time. My husband always came home-- he was a structural engineer-- always came home promptly at 5 o'clock, and I left a little bit early, had dinner on the table, and worked at night for many years [INAUDIBLE] and I think in 1961 is when I started.

And I've worked ever since. My husband talked me into quitting. Why don't know I quit? And he said, the kids are gone. Enjoy some time off. Quit working. So I did for a year, and I got bored, went back to work. No, I wasn't able to. Because I had so many children, we were paying from paycheck to paycheck. I remember we had $500 money saved, and we were just blessing ourselves and patting ourselves on the back, and the car went bad and we had to get a new car.

All of my children, of course, are grown, and are marvelous savers. We must have instilled something at home because they all have savings accounts that are listed with investing companies. They're all on their 401(k) or whatever their companies have. I do you have grandchildren and great grandchildren, and I have two new great grandsons that'll will be year old next month.

And I've started what I've started doing with them, and I've told their parents, I'm giving them money for their birthday. Any occasion-- Valentine's Day, whatever-- I'm giving them money for them to put it in an account so that that boy will be-- have some money when he's grown. I'm sure I won't be around when he's grown, but she's promised me she's going to tell him about me.

I would advise them to start putting something-- a few dollars, anything-- every pay day to put it in, because they're not going to miss it, and it will amount to a lot of money later on in their life. If they can just leave it and let it grow, it's going to be fabulous for them when they need it later on.

This material has been prepared for informational and educational purposes only. It is not intended to provide and should not be relied upon for investment, accounting, legal, or tax advice. JP Morgan Asset Management is the marketing name for the asset management businesses of JPMorgan Chase and Company and its affiliates worldwide.

Elizabeth understands the importance of starting early, from the start the fund will ensure her children and grandchildren are well-diversified with just one fund

[MUSIC PLAYING] I chose my fund based on my lifestyle. I have a really, really busy lifestyle. So I wanted a fund that would give me the necessary amount of risk and growth. So I didn't want to have to proactively manage those funds and make sure that I had the right mix, because that would sort of make me a little nervous to have to do that on a constant basis. So I love that there is a fund that does that for me.

I know that a target date fund is a fund that is a specified mix of income and growth. So if I am 25 years old, then I would probably have a more aggressive mix. And that mix would change over time, as I grow older.

I think they do research, and they look at statistics, and they look at what's out there in the marketplace. And then they determine the best companies to invest in and the best markets to invest in for the various types of target date funds that are out there. I think they probably love what they do. And they want to see the fund be successful, and they want to see people who invest in the fund be successful as well.

I would say, just think about that there is a professional that's doing this for you that really understands the mix behind these funds. And just think about all the research that you would have to do if you select these funds individually for yourself.

[MUSIC PLAYING]

For Sharida, having the right mix of investments is very important, so she likes that our investment professionals do the hard work for her.

[MUSIC PLAYING] Well, I chose them because it looked like it would make better sense than what I was doing now. Before there were target date funds, I think I really just guessed what what was happening in my portfolio-- what I wanted to happen in my portfolio. They gave me a long list-- almost was felt like it was a cafeteria list-- of different funds, and I pretty much just guessed what fund and how much percentage, and looked every quarter to see what kind of performance I was getting.

So let's say I'm going to retire in 2020. And what it does is it creates a path of investments so I can actually-- when I get closer to retirement, the funds will a little be a little bit more conservative. And that's how it works. Very best thing about a target date fund for me is the people behind the scenes, the people who-- the money managers, the people who are helping me retire.

This material has been prepared for informational and educational purposes only. It is not intended to provide and should not be relied upon for investment, accounting, legal, or tax advice. JP Morgan Asset Management is the marketing name for the asset management businesses of JPMorgan Chase and Company and its affiliates worldwide.

The fund’s clear path makes Valerie feel confident that her investment will be automatically adjusted as she nears retirement

What's in the Income Fund?*