JPMorgan SmartRetirement® Passive Blend 2060

For individuals born from 1994 to 1998

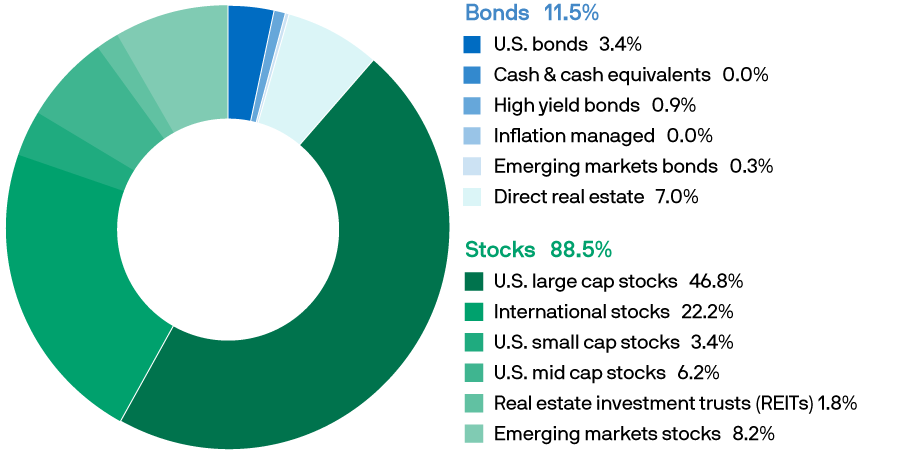

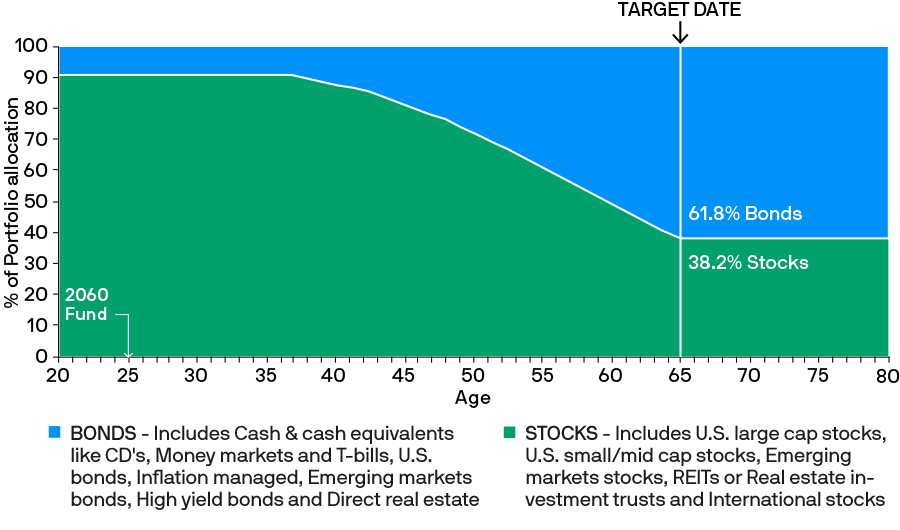

When you select a SmartRetirement Passive Blend Fund, you're automatically invested in more than 20 underlying funds across two asset classes - stocks and bonds. By investing in the fund, a team of more than 100 investment professionals at J.P. Morgan is responsible for shifting the allocation from stocks to bonds as the fund approaches its target date. This way your fund automatically changes to become more conservative as you approach your target retirement date.

Since each SmartRetirement Passive Blend Fund is dynamically managed for a specific date in the future, you'll want to consider selecting one named for the year closest to when you plan to retire and begin withdrawing from your account.

Select a target date fund

- SmartRetirement Passive Blend Income

- SmartRetirement Passive Blend 2025

- SmartRetirement Passive Blend 2030

- SmartRetirement Passive Blend 2035

- SmartRetirement Passive Blend 2040

- SmartRetirement Passive Blend 2045

- SmartRetirement Passive Blend 2050

- SmartRetirement Passive Blend 2055

- SmartRetirement Passive Blend 2060

- SmartRetirement Passive Blend 2065

Why SmartRetirement Passive Blend? Hear from investors like you.

Coming out of college retirement seems pretty far off into the future. So when I joined with the firm, we were given a rundown of our benefits, and among those were our retirement options-- investment options. We were informed that one of the options was a target date fund that would be geared towards our retirement predicted age.

It's a portfolio I'm invested in that is adjusted over time. As I get older and able to tolerate less risk, the fund becomes more conservative overall, so at retirement, I have a much safer investment. I've actually been having this conversation a lot with my friends, trying to convince them that now is a really important time to invest. Being able to use the amount of time that we have between now and retiring provides a lot of opportunity for a compounding interest and generating better returns.

It's something that I think is really important for myself and my friends at our age. Target date funds aren't guaranteed. Like any investment, they carry inherent risks. The greater risk is not having any money to retire. That's a certain outcome, and it's much more likely to have a better outcome by investing and taking advantage of those opportunities.

This material has been prepared for informational and educational purposes only. It is not intended to provide and should not be relied upon for investment, accounting, legal, or tax advice. JPMorgan Asset Management is the marketing name for the asset management businesses of JPMorgan Chase and company and its affiliates worldwide.

Mary understands there is no guarantee with investments, but having a diversified portfolio to ride out market swings can help her achieve her future goals.

[MUSIC PLAYING] What I know about target date funds is that they're more aggressive for younger people, and as you get closer to retirement, they become more conservative. It's automatic, which is very convenient. I chose a target date fund because I'm a graphic designer. I'm not a financial expert, and it's something that I'm trusting the financial experts to take care of it for me. And so I'm putting myself in their good hands.

I'm saving because it's responsible. I know that, to be prepared for retirement, which-- quite a ways away from it-- is just a certain level of security, being invested now, hoping that putting things in place now is going to hopefully be OK for me later on, and not having to rush around to make sure things are taken care of when I'm ready for retirement. The very best thing about being in a target date fund is, for me, to not have to worry about it, and for me, to not have to be hands-on. I'm trusting those people to take care of me, and I think they're doing a really good job.

This material has been prepared for informational and educational purposes only. It is not intended to provide and should not be relied upon for investment, accounting, legal, or tax advice. JP Morgan Asset Management is the marketing name for the asset management businesses of JPMorgan Chase and company and its affiliates worldwide.

Colby likes the hands-off approach of picking a target date, he’s confident his investment will automatically adjust as he gets closer to retiring.

[MUSIC PLAYING] I chose a target date fund and because I'm not very active in investing, and so I thought it might be easier if someone just did the busy work for me, and I could check in and just see how it was doing. As far is my understanding goes, a target date fund is something that you choose, and it gets conservative over time. So I'm 22 right now, and so I can take a more aggressive approach at a target date fund, and then over time, it would become more conservative.

When I hear the word retirement, I think about-- I think that people that manage my money are more knowledgeable about the subject, and they're-- they know how to make decisions for both my age, and also they know what the markets are doing. And I think that's something that they're more knowledgeable about than me, so I think that they're researching and doing the things they need to do to check in on a daily basis, whereas I don't have to monitor it that often. The very best thing about investing in a target date fund is that I can just set it once and then go back to check on it when I want, as opposed to worrying about it on a daily basis.

This material has been prepared for informational and educational purposes only. It is not intended to provide and should not be relied upon for investment, accounting, legal, or tax advice. JPMorgan Asset Management is the marketing name for the asset management businesses of JPMorgan Chase and company and its affiliates worldwide.

Kelly likes knowing she doesn’t have to continually check on her money since the fund is being managed by experts.

What's in the 2060 Fund?*