Three reasons why small businesses are increasingly offering 401(k) plans

12/03/2020

Meghan Jacobson

Alexandra Nobile

Surveying the small business retirement plan landscape

J.P. Morgan recently conducted a pulse survey to capture a quick snapshot of U.S. small business owners’ thoughts around offering retirement plans for their companies. The online survey took place between June 16 and 23 of this year and was conducted with owners of small businesses with $50,000 to $20 million in annual revenue and five to 50 employees, excluding nonprofit organizations.

Key findings:

- A large majority of respondents—85%—are confident that their businesses will survive the current economic climate, even though the survey occurred in the midst of the COVID-19 pandemic and stay-at-home mandates across the nation.

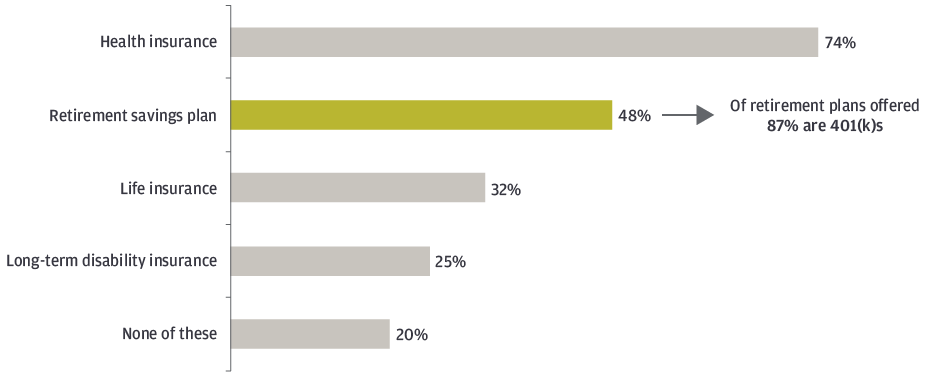

- Almost half of small business owners offer a retirement plan as an employee benefit, and most of those are 401(k)s (EXHIBIT 1).

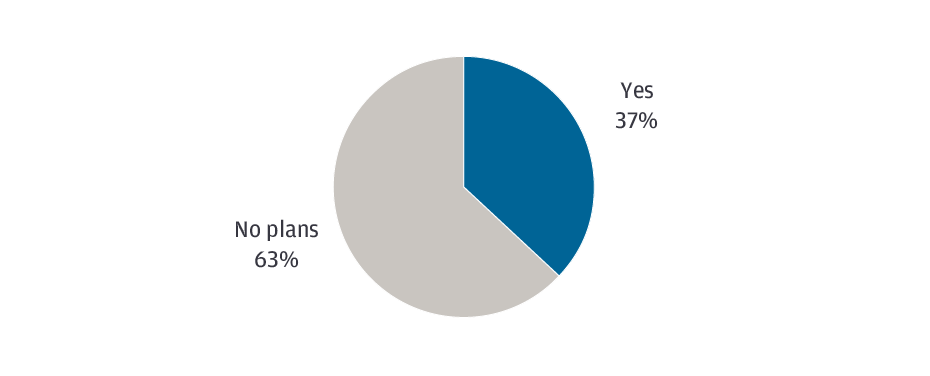

- More than one-third of small business owners who do not currently offer a 401(k) plan expect to introduce one within the next 12 months (EXHIBIT 2).

Retirement savings plans were the second most frequently offered employee benefit

EXHIBIT 1: EMPLOYEE BENEFITS OFFERED

Note: Total screened (n=590); total companies that offer a retirement savings plan (n=282).

Source: J.P. Morgan Small Business Retirement Research 2020.

Many businesses that do not currently offer a 401(k) plan expect to offer one in the next 12 months

Exhibit 2: FUTURE PLANS OF OFFERING A 401(k)

Note: Companies not offering a 401(k) plan (n=200).

Source: J.P. Morgan Small Business Retirement Research 2020.

Why are an increasing number of small business owners offering 401(k) plans?

No. 1: Small business owners feel responsible for their employees.

Survey results showed a clear trend of respondents wanting to help their employees across a range of issues (EXHIBIT 3). The vast majority felt a high level of responsibility to provide health care coverage, as well as to help with employees’ overall well-being and work-life balance. Most, albeit fewer, also reported feeling responsible to help with employees’ financial wellness and retirement savings. Interestingly, significantly more small business owners who offered a retirement savings plan felt a high sense of responsibility to their employees compared with those who did not offer one (74% vs. 33%). It is important to remember that retirement savings can be a key component of financial wellness. In fact, research has found that workers are 45% more confident about their retirement when an employer offers a defined contribution plan.1

Most feel a high level of responsibility to help employees across a range of issues

EXHIBIT 3: LEVEL OF RESPONSIBILITY FELT FOR EMPLOYEES

Note: Percentage responding “very high”/“some high” to the question: As an employer, which of the following best describes the level of responsibility you feel for your employees on each of the following? Total respondents (n=400).

Source: J.P. Morgan Small Business Retirement Research 2020.

No. 2: They see the benefits of 401(k) plans.

Small business owners who reported offering a 401(k) plan clearly see the benefits—not just for their employees but for their businesses as well. The top reason cited for offering a 401(k) plan was to encourage employees to save for retirement. Retaining and attracting employees were the close second and third reasons, respectively (EXHIBIT 4).

Top three reasons for offering a 401(k) plan

EXHIBIT 4: REASONS FOR OFFERING A 401(K) PLAN

Note: Companies offering a 401(k) plan (n=200).

Source: J.P. Morgan Small Business Retirement Research 2020.

No. 3: Employees are asking for it—and employers can benefit too.

Respondents who did not offer a 401(k) cited the following top five reasons:

- Business not generating enough revenue to offer this benefit (39%)

- Employees don’t care/aren’t asking (28%)

- Employees are saving in other ways (25%)

- Other benefits are good enough (24%)

- Administration is too costly (24%)

Cost-benefit analysis is always an important part of successful business ownership. However, research has shown that 76% of employees believe that their employers have some degree of responsibility to help them save for retirement.2 Offering a 401(k) plan can be an easy way to help them invest in their future. Research from a recent collaboration between the Employee Benefit Research Institute and J.P. Morgan Asset Management found that 401(k)s are the only savings vehicle many Americans have, underscoring the importance of employers’ role in retirement savings.

In addition, offering a 401(k) plan may be more affordable than many small business owners might think, and costs have been trending even lower in the past several years.3 Furthermore, companies can receive up to $5,000 per year in tax credits for the first three years after starting a 401(k) plan.4 In fact, 31% of survey respondents noted tax deductions, credits or other tax benefits as motivators for them to offer a plan.

What small businesses are eligible for a potential 401(k) tax credit?

There are three key requirements:5

- The business must have no more than 100 employees who received a minimum of $5,000 in compensation from the business in the prior year.

- The plan must cover at least one non-highly compensated employee.

- The business did not maintain a plan covering substantially the same employees during the three years preceding the year for which the employer is claiming the credit.

Planning for the future

Our survey found small business owners largely optimistic about their companies’ outlook, with many recognizing the importance of offering a retirement plan, both for the benefit of their employees and for their businesses as well. A 401(k) plan can help acquire and retain top talent while building stronger retirement savings for employees and owners alike. In addition, advancements in 401(k) delivery have made offering employees a defined contribution retirement plan benefit more realistic and more achievable for businesses of all sizes, with less complexity and expenses than one might think.

1Employee Benefit Research Institute (EBRI) and Greenwald & Associates, 2020 Retirement Confidence Survey.

2J.P. Morgan Plan Participant Research, 2018.

3 401k Averages Book, 2019.

4 Internal Revenue Code Section 45E

5 Ibid.

0903c02a82aa1edf