Why the US dollar may not be as overvalued as you think

13/11/2019

GFICC Investors

In Brief

- With the real value of the US dollar close to its strongest level in the last 50 years, many strategists are expecting the currency to suffer a relatively significant fall in value at some stage in the next few years.

- However, we believe the US dollar is currently experiencing a rare structural change in valuation level that means it may be far less overvalued than is widely believed.

- A steep rise in US energy exports, boosted by gas production from fracking, is supporting the US current account balance and lifting the dollar, even as nonenergy trade deteriorates similar to in other cycles.

- With the full significance of US energy exports still looking underappreciated from a macroeconomic and geopolitical perspective, and with the development of new energy infrastructure expected to further boost export capacity, any fall in the dollar does not look like it will be due to valuation reasons.

Tracking the dollar’s rise

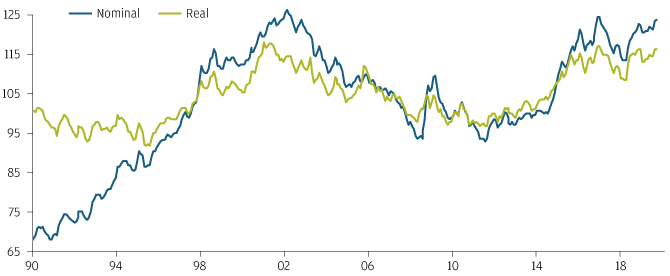

The US dollar has been strong in recent years against major peers, such as the euro and renminbi. The dollar has also been strong on broader measures, including the tradeweighted exchange rate. After adjusting for differences in inflation rates, the real value of the dollar is close to the strongest it has been during the near 50-year modern history of floating exchange rates.

The stability of real exchange rates over long time periods is one of the most widely accepted features of currency markets. Hence, there is a broadly accepted view among currency strategists that an apparently expensive US dollar must fall in value reasonably significantly at some point in the next few years.

US DOLLAR EFFECTIVE EXCHANGE RATES

Source: Bloomberg. J.P. Morgan Asset Management; data as of 30 September 2019.

We agree with the broad premise of stable real exchange rates, which is a factor we use in our quantitative currency models. However, we don’t believe it is an infallible rule. Our model’s success is based on real exchange rates being stable, on average, across a range of currencies and over long periods of time. However, the model is also designed to be robust to occasional dislocations in particular currencies.

Current account stability

When we assess currency valuation, we look to confirm the results from the type of purchasing power parity analysis described above by cross checking against balance of payments dynamics.

If a currency is expensive we would expect the current account to slowly deteriorate, usually through a worsening goods trade balance as cheaper imports gain market share and exporters struggle with an uncompetitive exchange rate.

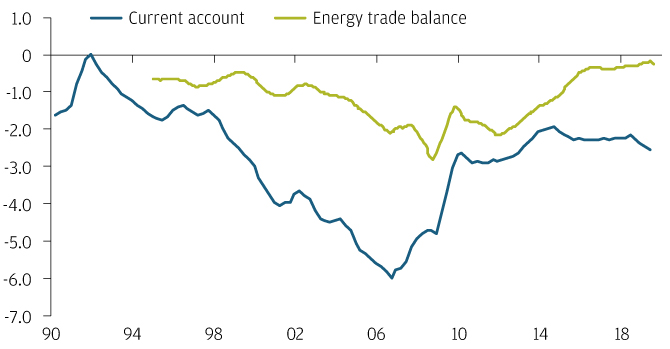

It is striking that the US has experienced almost no deterioration in its current account balance despite the appreciation of the US dollar since 2011, in stark contrast to the early 2000s when the dollar did appear overvalued using this framework.

The stability in the US current account masks a deterioration in the non-energy trade balance that is broadly similar to prior cycles, but matched by an offsetting improvement in the energy trade balance. It is this resurrection of the US energy sector—boosted by fracking technology and the accompanying investment—that we believe is behind the structural change in the dollar’s valuation.

Energy production boost

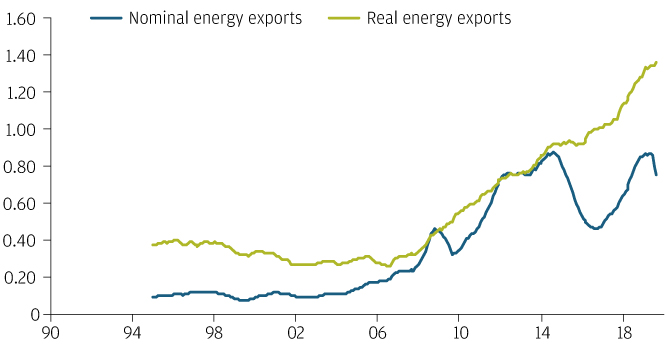

While the growth of US energy production is well known, we feel the significance is still under-appreciated from a macroeconomic and geopolitical perspective. Shale oil production has passed peak growth rates but is not forecast to plateau until 2025, while infrastructure bottlenecks continue to get resolved as pipelines and other long lead-time projects reach completion in coming years.

US CURRENT ACCOUNT AND ENERGY TRADE BALANCE (% GDP)

Source: Bloomberg. J.P. Morgan Asset Management; data as of 30 August 2019.

Perhaps the most interesting of these projects for the dollar is the expansion of gas export facilities begun nearly a decade ago. With five of the six trains at the vast Sabine Pass complex now operational US energy exports to Europe are growing rapidly, as American gas is competitively priced compared to traditional supplies from Russia and Norway despite the higher transportation and liquefaction costs.

The beneficial effect for the dollar is amplified in an economy that has the ability to fund the required investment domestically and where other major export categories, such as services and technology, have little sensitivity to exchange rates, reducing the risk of Dutch disease.

US outperformance to continue?

We accept it is difficult to quantify exactly how much energy independence has boosted the dollar, given the fundamental equilibrium models that determine currency levels based on current account positions are notoriously unreliable and very sensitive to arbitrary assumptions. But our best estimate is that this structural change may add around another five to ten percentage points to the dollar’s valuation, which is broadly consistent with the level of overvaluation that is being suggested by purchasing power parity frameworks at present.

On a forward looking basis, we therefore believe the dollar does not need to fall for valuation reasons. With the expansion of export infrastructure for US natural gas continuing over the next couple of years and prices in the US remaining well below those in Europe and Asia, a further improvement in energy balances is likely.

There are, of course, various cyclical and geopolitical risks that the dollar must navigate, but we do not expect the currency alone to curtail US outperformance.

US ENERGY EXPORTS (% GDP)

Source: Bloomberg. J.P. Morgan Asset Management; data as of 30 August 2019.

Currency Management

Since our first segregated currency overlay mandate funded in 1989, J.P Morgan Currency Group has grown to manage a total of USD 361 billion in bespoke currency strategies. Our clients include governments, pension funds, insurance clients and fund providers. Based in London, the team consists of 20 people dedicated exclusively to currency management with an average of over 15 years of investment experience.

We offer a range of hedging solutions for managing currency risk as well as a tailored optimal hedge ratio analysis:

- Passive currency hedging serves to reduce the currency volatility from the underlying international assets. It is a simple, low cost solution designed to achieve the correct balance between minimising tracking error, effectively controlling transaction costs and efficiently managing cash flows.

- Dynamic ‘intelligent’ currency hedging aims to reduce currency volatility from the underlying international assets and add long-term value over the strategic benchmark. A proprietary valuation framework is used to assess whether a currency looks cheap or expensive relative to the base currency and the hedging strategy is adjusted accordingly.

- Active ‘alpha’ currency overlay strategy offers clients’ passive currency hedging, if required, combined with an active investment process to deliver excess returns relative to the currency benchmark. Our approach is to build a global currency portfolio combining the output of fundamental models and incorporating the qualitative views of our strategy team.

0903c02a82745e2b