Week in review

- ECB kept rates steady and maintained data dependence

- Japan core inflation at 2.6% y/y in June

- U.S. June retail sales flat m/m, versus expected 0.2% decline

Week ahead

- Taiwan export orders

- U.S. real GDP

- U.S. consumer sentiment, durable goods, home sales

Thought of the week

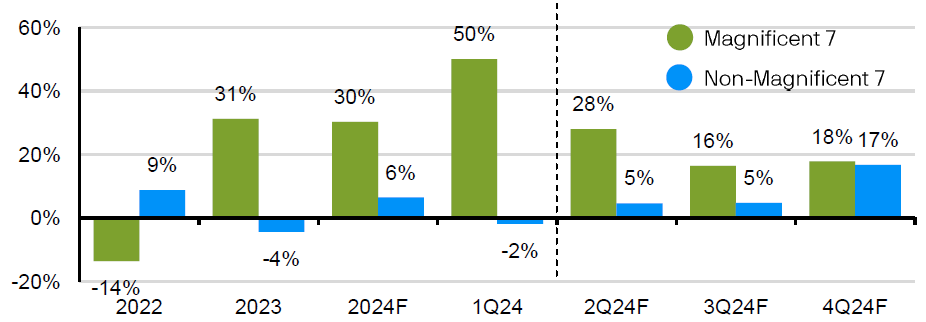

U.S. equities last week is one characterized by rotations: from big cap to small cap, growth to value, leaders to laggards. After being up over 20%, NASDAQ saw the biggest one-day drop (-2.8%) since Dec 2022, marking some of its largest one-day underperformance against Russell 2000 since 1986. After being chronically unloved, renewed interest in small caps and value sectors was first sparked by the encouraging June inflation report, along with dovish comments from Powell. At the time of writing, a September cut is nearly fully priced in, up from only 61.7% probability in mid-June. Such rotations in investor interest and allocations can point to a healthy broadening out, but small caps remain vulnerable with the recent downshift in growth, given its cyclicality and weak profit fundamentals (44% of small caps are unprofitable, with weaker free cash flow margins, higher debt to EBITDA, weaker pricing power), so investors should be cautious of any overexposure. On another hand, upcoming 2Q24 earnings will shed more light on the sustainability of the rally. The 61 net upward revisions so far compared to 221 last quarter lowers the bar for a high beat rate. But for Magnificent 7, the bar is still high, with EPS expected to grow at 28%, versus 5% from the others. But a broadening in earnings is also evident compared to the last quarter, as seen from the chart, which will be key for a more sustainable broadening in returns.

Earnings growth for S&P 500

Pro-forma EPS, y/y change

Source: FactSet, S&P, J.P. Morgan Asset Management. Data reflect most recently available as of 18/07/24.

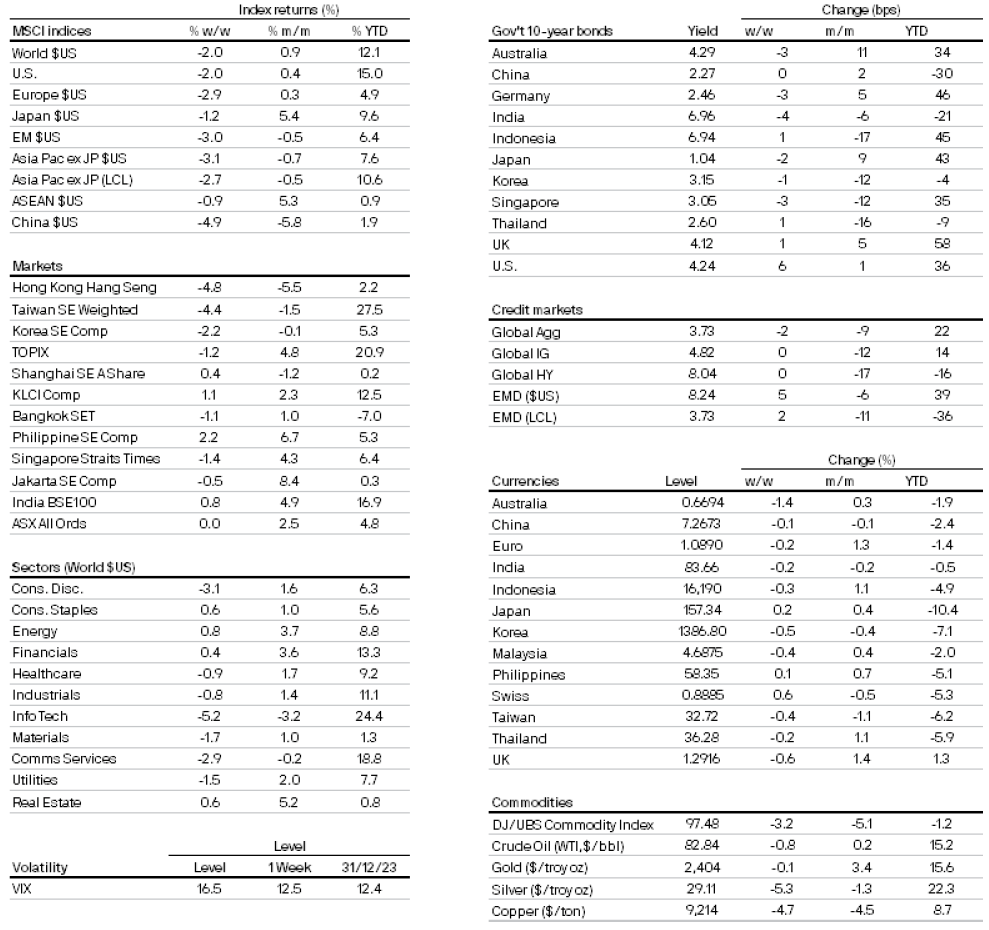

Market data

0903c02a82467a72

All returns in local currency unless stated otherwise.

Currencies’ return are based on foreign currencies per U.S. dollar. An appreciation of the foreign currency against the U.S. dollar would be positive and a depreciation of the foreign currency against the U.S. dollar would be negative.