LIBOR cessation

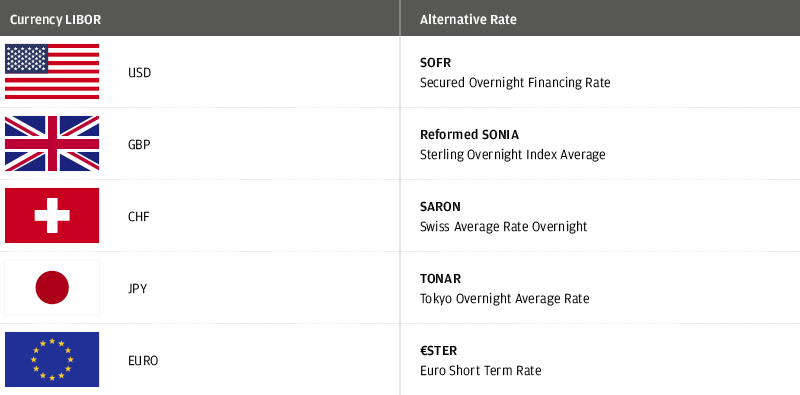

The London Interbank Offered Rate (LIBOR) and certain other interest rate benchmarks will be phased out starting from the end of 2021. Alternative nearly risk-free reference rates (RFRs) have been identified by Public-private National Working Groups:

J.P. Morgan Asset Management, as part of a firm wide effort, is working in conjunction with the industry and regulators as it seeks to facilitate the transition to alternative rates.

Further information

If you would like further information please contact your J.P. Morgan Asset Management representative.