Invest in emerging market sustainable leaders

Emerging market equities are an important part of a diversified portfolio, enabling investors to tap into long-term growth trends in dynamic markets. But limited ESG data availability and lack of consistency among third-party ratings providers mean in-house research is vital when investing sustainably. Emerging Markets Sustainable Equity Fund draws on deep research resources to seek companies that are sustainable in the broadest sense.

The fund invests primarily in emerging market companies with positive environmental or social characteristics, or those demonstrating improvements in these characteristics.

Approach

- Uses a fundamental, bottom-up stock selection process.

- Uses a high conviction approach to finding the best investment ideas.

- Seeks to identify high quality companies with superior and sustainable growth potential.

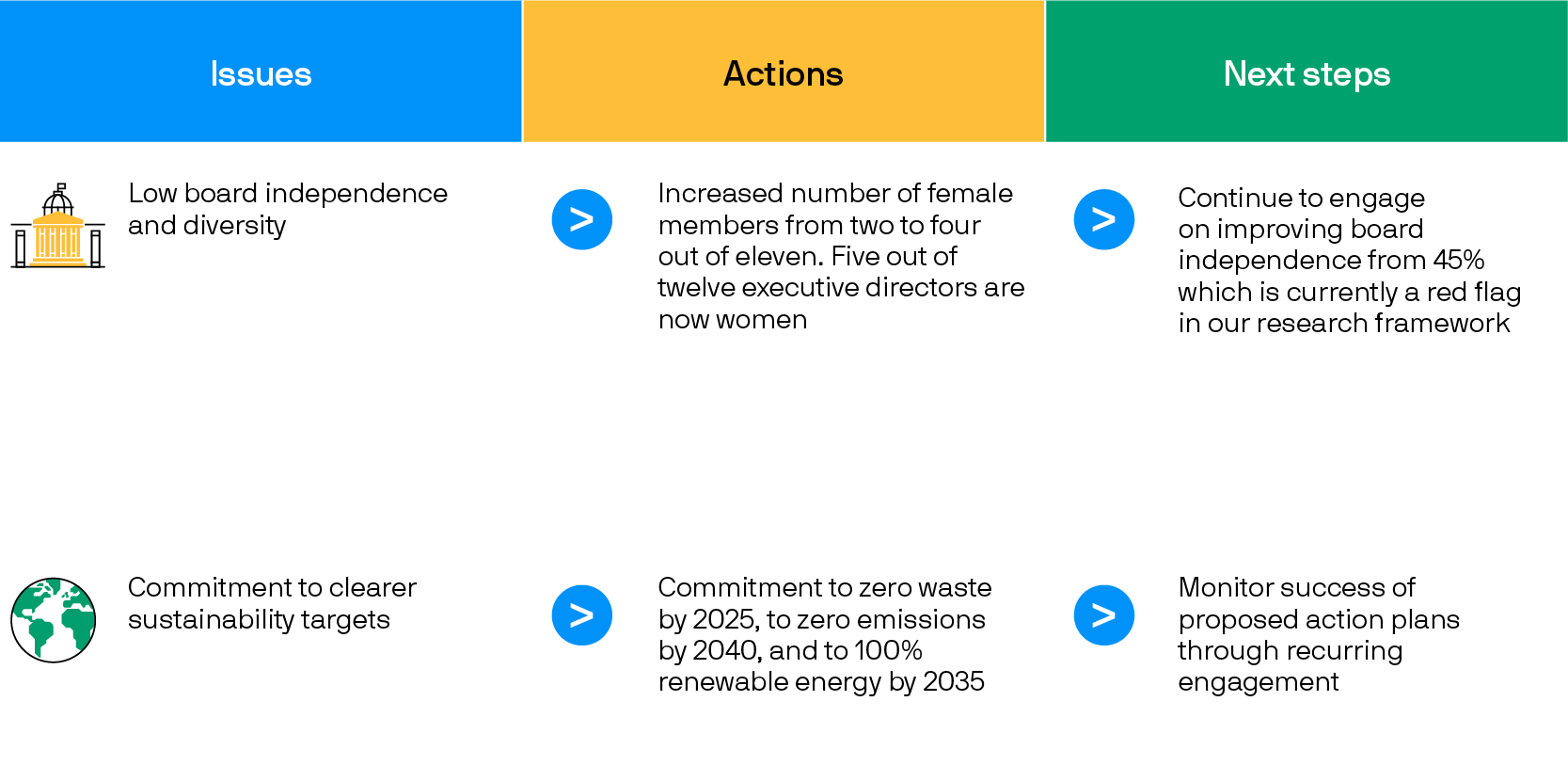

- Integrates ESG aspects to identify companies with strong or improving sustainability characteristics.

Identifying best-in-class sustainability credentials

Using a four-step process, the fund* takes a best-in-class approach to sustainable investing, seeking to manage the risks associated with environmental, social and governance (ESG) factors and capture potential opportunities.

*The fund is categorised under Article 8 SFDR.

**Includes full and partial exclusion (on the basis of varying revenue thresholds, as applicable), as outlined in the fund’s exclusion policy.

Find out more about our sustainable investing capabilities >