Why we’re in the early innings of a secular bull market

The S&P 500 could hit 10,000 by the mid-2030s

22-08-2019

Giri Devulapally

In Brief

- Stocks are widely viewed as expensive and over-owned. According to the current consensus, the market has had extremely strong returns and, as a result, future returns will be disappointing. We firmly reject that perspective.

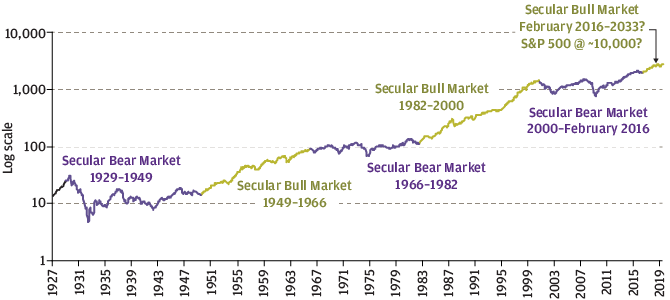

- We believe that a new secular bull market for equities began in February 2016. Our analysis finds that annualized total returns should average in the double digits until 2033–2035.

- The historical pattern of equity returns, the relative valuation of equities to other assets, the pessimism reflected by the lack of flows into equities, and demographic and productivity tailwinds all argue for above-average equity returns.

- The S&P 500 could approach or exceed the 10,000 level by the early to mid-2030s.

Many investors take it as a given that—since returns on the S&P 500 have been strong for 10-plus years—stocks are expensive and over-owned. The demographic headwind from the aging of the baby boomers is widely viewed as another impediment to equity returns.

Solve It: Secular Bull

This week on Solve It, Portfolio Manager, Giri Devulapally explains his 4 points on why he believes we are in the early innings of a secular bull market that will have much higher returns for much longer than most people believe.

But conventional wisdom is often wrong, and we think this is one of those times. Here we make a contrarian argument: A secular bull market for equities began in February 2016. We believe that annualized total returns should average in the double digits until 2033–2035. The S&P 500 could hit 10,000 by the mid-2030s.

In the following pages we present our analysis, which draws on four key observations:

- The historical pattern of market returns suggests strong future returns.

- Equity valuation is attractive relative to other assets.

- A sustained period of weak equity inflows suggests high levels of investor pessimism, a bullish signal.

- Demographic trends in the labor force—mostly notably the rising ratio of middle aged (35- to 49-year-old) to young (20- to 34-year-old)—will be a tailwind for equities until the mid-2030s.

EXHIBIT 1: S&P 500 INDEX, LOGARITHMIC SCALE, 1927–JUNE 2019

Source: Robert Shiller, FactSet. Data shown in log scale to best illustrate long-term index patterns. The performance quoted is past performance and is not a guarantee of future results.

0903c02a82689815