Currencies through an ESG lens

10-10-2019

GFICC Investors

In Brief

- We believe a well-designed, tailored approach to using ESG factors for active currency management can be a source of added value for clients over the long term.

- We have designed our ESG approach as a framework that incorporates insights from longer-term ESG developments into our existing active currency process.

- Our framework of social factors provides forward-looking insight into future currency valuation, and we use governance factors to assess risk premia for currencies, while we produce environmental rankings to help us identify how currencies are exposed to commodity price developments.

- We mirror the philosophy behind our quantitative models to combine our individual environmental, social and governance insights into an overall ESG score for each currency.

Linking ESG to currency markets

Currency markets pose some challenges when designing an environmental, social and governance (ESG) framework. Specifically, the differences in timescale between a typical investment horizon of active manager views and the long-term nature of ESG themes.

Because currency markets consist of a small universe of inherently relative-value investment decisions (when you buy one currency you must sell another), we sought to design our ESG approach as a framework that could add value by incorporating insights from longer-term ESG developments, in the right way, and at the right time.

When we re-examined our investment approach we realised that we already looked at factors that were affected by ESG considerations. We also realised that by trying to go a step further and search for ways to anticipate inputs we took as given, we could improve upon what we were already doing.

Social factors in currency markets

Our approach to social factors provides a particularly strong example of how ESG analysis can add value to currency investing. We started from an existing strategy that had observed a strong linkage between high levels of GDP per capita and currency valuations relative to simple absolute purchasing power parity measures.

As we compiled a list of potentially relevant social factors, (e.g. education spending, innovation scores, Gini coefficients etc.), many of which appear to be related to prospects for future wealth, we found a relationship emerged between our results and currency valuations.

Our research process narrowed down this list until we had a framework of social factors based on data from a range of international sources that we felt provided forward-looking insight into future currency direction. As an example, two currencies that screen as undervalued are the Israeli shekel and Korean won. Both of these currencies are issued by countries where highly educated workforces are driving technological progress. Israel and South Korea also both run significant trade balance surpluses in goods where their economies have significant competitive advantages.

We do not view our list of social indicators as exhaustive and recognise any approach based on a limited selection of indicators will inevitably miss some important aspects of particular societies. Hence we use our social scores as important insight for further detailed research.

Governance factors in currency markets

Some of the largest moves in currency markets in recent years have been driven by issues surrounding governance, from the political influence over economic policy in Turkey last year, through to the effect of territorial expansion on the Russian ruble in 2014.

These political factors have always been a consideration in our investment process, particularly for emerging market currencies, but again we have been able to improve our process by taking a fresh look at how to best measure and anticipate these governance risks. Our approach combines data-based measures of governance metrics, covering areas from corruption to the perception of government accountability, with our own judgemental scoring focused on central banks as the most important institutions from a currency perspective.

Environmental factors in currency markets

Environmental factors were the most challenging to link to currency markets. Relationships between currencies and commodity prices are reasonably well established, with importer currencies tending to underperform exporters when a major commodity price rises, such as oil. However, the impact of environmental factors on commodity prices themselves is complex. For instance, oil prices could rise or fall if both supply and demand fall as the world switches to greener sources of energy.

Despite including more clearly positive and negative factors, such as energy intensity of GDP, we have settled for producing rankings that help us to identify how currencies are exposed to commodity price developments rather than attempting to answer the more challenging question of how those prices will evolve.

Combining currency ESG factors

To combine these individual social, governance and environmental insights into aggregate ESG rankings, we have chosen to mirror the philosophy behind our quantitative models. We translate the underlying data into scores that fall on a similar and limited range and allocate equal weights to each factor rather than risk over-optimising our process.

We have identified a greater number of social and governance factors that we believe will drive currency performance within our investment horizon compared to environmental factors. For this reason we weight “S” and “G” more heavily in our aggregate ESG scores relative to “E”.

Integrating ESG score into the currency investment process

While producing high quality ESG scores based on those factors that we believe determine currency market outcomes is a good start, it is ultimately the inclusion within our investment process that matters most for our clients.

The long time horizon over which we expect many aspects of ESG analysis to drive currency performance, combined with the relatively short history and infrequent updates provided by many of our sources, means that we have not yet found a suitable way to include ESG factors in our quantitative framework, which aims to extract alpha from currency markets on a one- to three-month time horizon. Instead, we have chosen to integrate ESG analysis into our qualitative strategy process, with the aim of providing an important input into our thinking on the long-term outlook for currency performance.

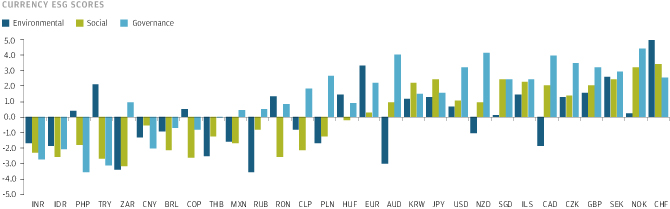

CURRENCY ESG SCORES

Source: J.P. Morgan Asset Management, data as of 1 October 2019

The Turkish lira in 2018 is an example of how this nimble approach to incorporating major changes to ESG factors worked in practice. We began 2018 underweight despite the optically attractive valuation and carry, due to the very poor governance score coming out of our ESG assessment. We closed the position when the lira’s extreme undervaluation better reflected the governance risks that we had identified. In September 2018 we upgraded our scores, as the new finance minister reasserted central bank independence and committed to institutional reforms. With carry and valuation remaining attractive, we moved overweight.

Even when scores remained stable we have found they have added or reduced conviction in our positions with positive benefits to our performance. For example, where we have been underweight the euro for much of this year due to weak growth and inflation dynamics, our poor social score for the euro compared to other developed market currencies strengthened our conviction that the underperformance could persist. A weak governance score also helped us evaluate the risks around Italy and institutional reform.

Currency Management

Since our first segregated currency overlay mandate funded in 1989, J.P Morgan Currency Group has grown to manage a total of USD 361 billion in bespoke currency strategies. Our clients include governments, pension funds, insurance clients and fund providers. Based in London, the team consists of 20 people dedicated exclusively to currency management with an average of over 15 years of investment experience.

We offer a range of hedging solutions for managing currency risk as well as a tailored optimal hedge ratio analysis:

- Passive currency hedging serves to reduce the currency volatility from the underlying international assets. It is a simple, low cost solution designed to achieve the correct balance between minimising tracking error, effectively controlling transaction costs and efficiently managing cash flows.

- Dynamic ‘intelligent’ currency hedging aims to reduce currency volatility from the underlying international assets and add long-term value over the strategic benchmark. A proprietary valuation framework is used to assess whether a currency looks cheap or expensive relative to the base currency and the hedging strategy is adjusted accordingly.

- Active ‘alpha’ currency overlay strategy offers clients’ passive currency hedging, if required, combined with an active investment process to deliver excess returns relative to the currency benchmark. Our approach is to build a global currency portfolio combining the output of fundamental models and incorporating the qualitative views of our strategy team.

0903c02a826ee620