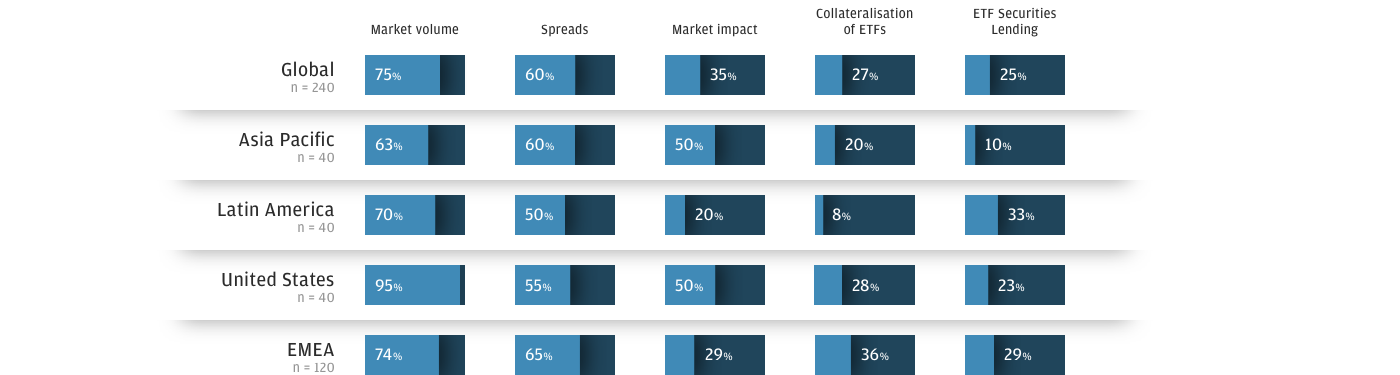

Most important factors when trading ETFs

Q4. What factors do you consider, or would you consider, when trading ETFs? (Multiple answers were allowed)

Key Take Outs

Three quarters of respondents consider market volume when trading ETFs, while bid-ask spreads are also an important factor.

Almost all of US respondents take market volume into consideration when trading ETFs, while in EMEA, bid-ask spreads, collateralisation of ETFs and securities lending are more important considerations than in other regions.

Market impact is a more important consideration for Asia Pacific and US investors when trading ETFs.

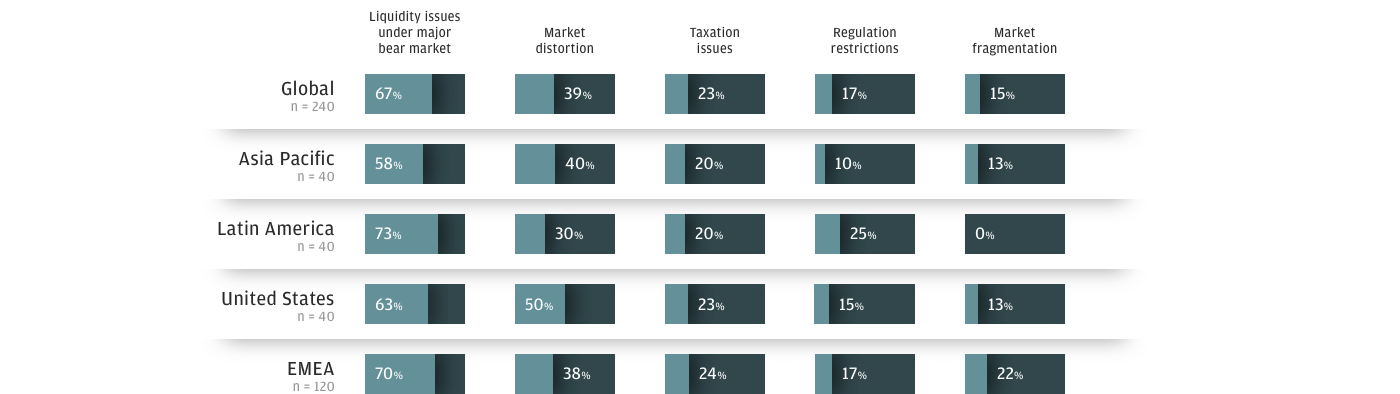

Biggest risks when investing in ETFs

Q5. What do you see as the biggest threats/risks of investing in ETFs? (Multiple answers were allowed)

Key Take Outs

Perhaps because respondents see the enhanced levels of liquidity provided as a key reason to use ETFs, they are also highly sensitive to any threats to ETF liquidity, with two thirds of professional buyers citing liquidity issues under a major bear market as a big risk of investing in ETFs.

Some investors may have worries that that recent changes to market liquidity, such as the greater use of automated trading systems and the rise of high-frequency trading, have increased liquidity risks during periods of market stress. Liquidity concerns may also explain why investors are focused on market volume and bid-ask spreads when trading ETFs (see question 4).

The risk of market distortion is also a concern for four out of ten respondents, and half of US respondents.

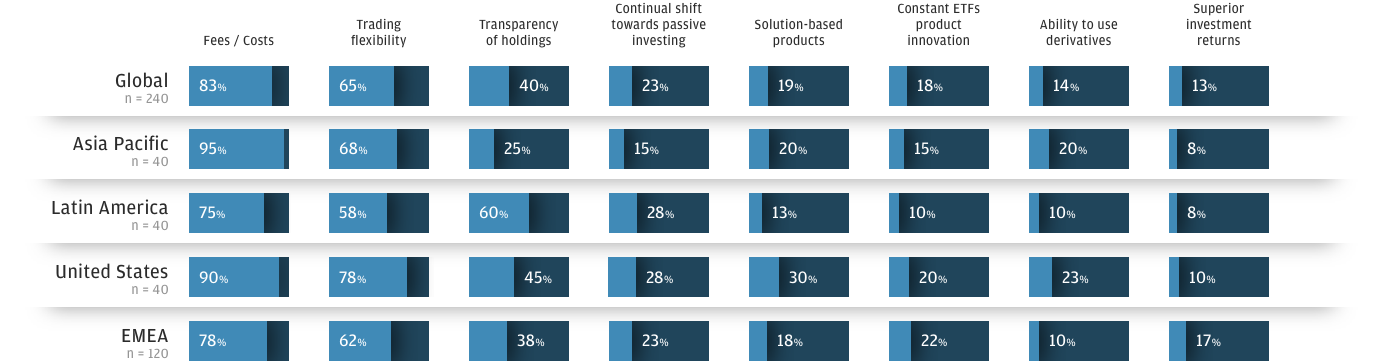

ETF advantages

Q6. What do you see as the biggest advantages of investing in ETFs? (Multiple answers were allowed)

Key Take Outs

Fees/costs, trading flexibility and transparency are the top three advantages of investing in ETFs according to respondents to the survey.

US respondents give increased weight to cost, trading flexibility and solution-based products compared to respondents from other regions.

Just under a quarter of respondents feel that ETFs help them make a general shift to passive investing, while just under a fifth said that the constant innovation in ETF products was an advantage.

0903c02a826c474d