No longer “why” but “how”: the case for emerging markets debt matures

26-09-2019

Giles Bedford

Emerging Markets’ role in fixed income portfolios is changing.

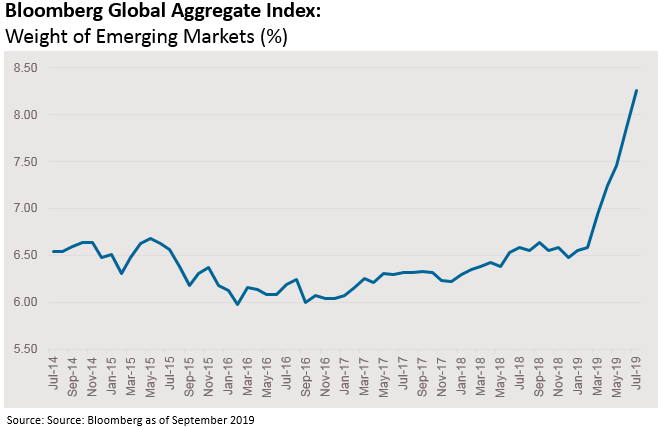

Emerging markets, long a source of tactical volatility for asset allocators, is in danger of going mainstream. For investors challenged by the current dearth of real yield, emerging market debt’s juice is attracting net inflows. Meanwhile, the inclusion of China has increased the weight of emerging market debt within the Bloomberg Global Aggregate; having increased sharply towards 9% this year, it may go higher still. This is a change from previous decades, when emerging markets’ gradual evolution from irrelevance proceeded at a glacial pace. While the global financial crises brought increases in interest, breadth and depth to the space, only recently have we seen the step change in index weight that enables strategic diversity. Yet the industry appears poorly placed to grow with the change, given a widespread track record of selling aggressive exposure at many houses.

At 9% of a widely followed global bond benchmark, emerging market debt is outgrowing its traditional role for some portfolio selectors. For most of the last 5 years, the class has hovered around 6.25% of the Bloomberg Global Aggregate, meaning many managers used the space tactically. Deploying EMD to add beta to bond portfolios in turn subsidised an industry narrative that EMD was exclusively a “risk on” asset class.

In response, enterprising specialist emerging market bond managers evolved ever riskier strategies, advertising higher alpha while achieving higher beta with less diversification. The results were sometimes proven unsatisfactory, with greater downside capture versus peers a common result.

Left to complete the narrative circle were the bears. Bearish investors bought higher risk emerging market strategies for a different reason: they believe that EM’s “true” risk was unquantifiable and therefore the highest reward was needed to compensate for it. By using higher risk funds to express an underweight view, a half weight proxy play could release risk budget for allocation elsewhere with limited impact on the portfolio yield. With both bulls and bears adding higher risk exposure, riskier funds grew more rapidly than more moderate alternatives.

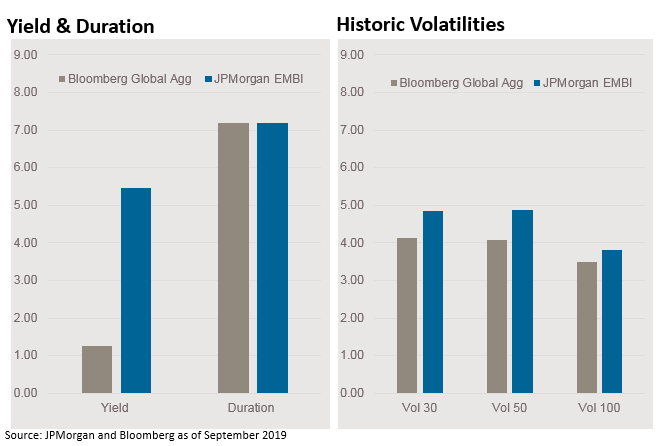

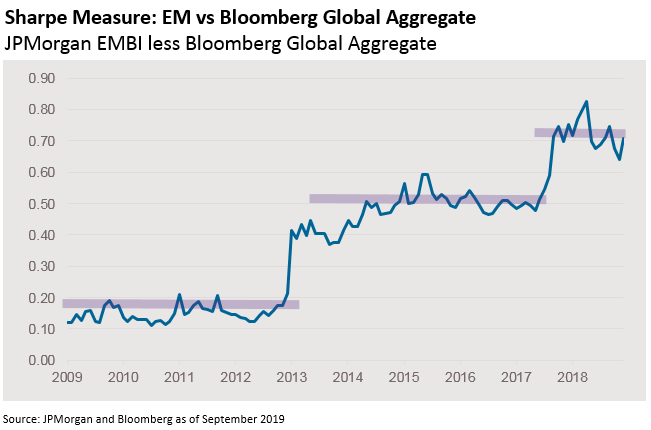

A larger index weighting challenges these conventions, because it enables emerging markets debt to play a wider variety of roles in the portfolio. An example of a new role would be the provision of core income, as emerging markets offers a substantial yield premium over many European and Japanese bonds. It might be possible, for example, for a selector to use a higher risk emerging market strategy to express a beta view, while choosing a second, lower volatility offering to generate income. We think it is likely that the community embraces this opportunity, especially as emerging markets debt offers a higher Sharpe measure than the Bloomberg Global Aggregate, helped by a substantially higher yield and roughly equivalent duration and volatility. In our second chart, we show the evolution of this Sharpe measure premium, which we think nicely summarises the importance of emerging markets debt to the global allocator. Between 2009 and 2013, the space offered little performance pickup over the broader universe. By 2015, a more pronounced yield pickup reflected in a higher Sharpe measure, a feature accentuated more recently by the recent surfeit of negative yielding bonds. At 0.70, emerging markets’ Sharpe measure is getting harder for selectors to ignore: What’s changing is the approach to risk they require to play it.

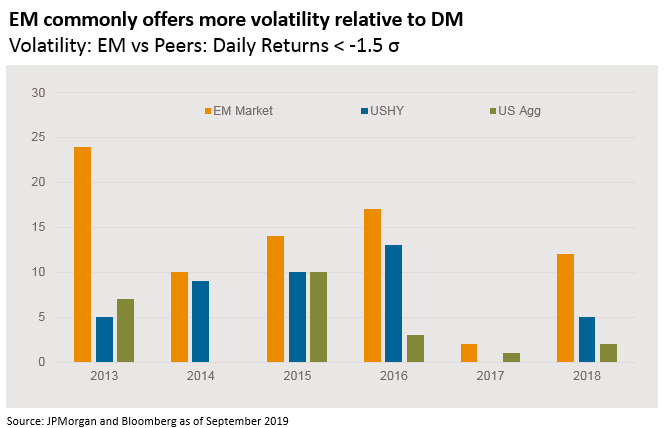

Risk inevitably worries investors in emerging markets, and these concerns are not without foundation. Emerging markets’ apparent propensity for unpredictable drawdown is the stuff of industry legend. With 72 countries in the most widely followed sovereign benchmark (JPMorgan EMBI Global Diversified) the potential for a little excess volatility is never far away. Spare a prayer for the EM corporate community, trying to avoid default while finding value from 1,484 instruments from 676 issuers across 53 countries and jurisdictions around the world. Many of these issuers are complex, requiring deep diligence by analysts. Features like these can make finding opportunity a labour intensive occupation for EM credit researchers, yet many houses understaff the capability regardless. As a result, selectors are increasingly interested in managers’ ability to mitigate risks in the space, because that ability enables their access to the income they need.

Investment processes with a proven ability to mitigate tail risk in EM are prized by larger, longer term investors. The ability to reduce the opportunity’s potential volatility enables investors to use the space in greater size– a useful quality when seeking income. The challenge is real: our third chart shows the number of days where emerging markets experienced a large decline, compared with US high yield and the broader US Aggregate. It will surprise few readers that emerging markets dominates this contest, and while the overall trend is down, in absolute the level remains high. If a manager can reduce the impact of drawdowns by even 10%, the performance impact is material. Veteran selectors may be happy to give up a little extra income for commensurate reduction in volatility, a view supported by the size of the EM yield premium.

The problem, of course, is the scarcity of strategy options to gain this exposure. Proven ability to manage risk in emerging markets is rare, and when combined with a risk profile that will qualify for the core of the portfolio becomes rarer still. The increasing importance of emerging market debt, in both index weight and income terms, presents selectors with an opportunity to deploy a more nuanced approach to the asset class. With this opportunity comes a need for more diverse approaches to the space than the ubiquitous “risk on” that has dominated the narrative in recent years. For many larger investors, the absence of more conservative product options that offer access to a proven ability to mitigate tail risk has been a motivation to look more closely at passive options.

In our view, emerging markets debt deserves a larger role in a global fixed income portfolio. In a world where real yield is increasingly scarce, we think an approach that seeks to reduce, rather than increase, risk should enable greater portfolio participation for those seeking income. The relative size of the income opportunity is well known; much less so is the availability of a long term approach that can credibly deliver that opportunity to the core of the portfolio.