Gabriela Santos

Chief Market Strategist for the Americas

A summary of the latest trends for China (December 2023)

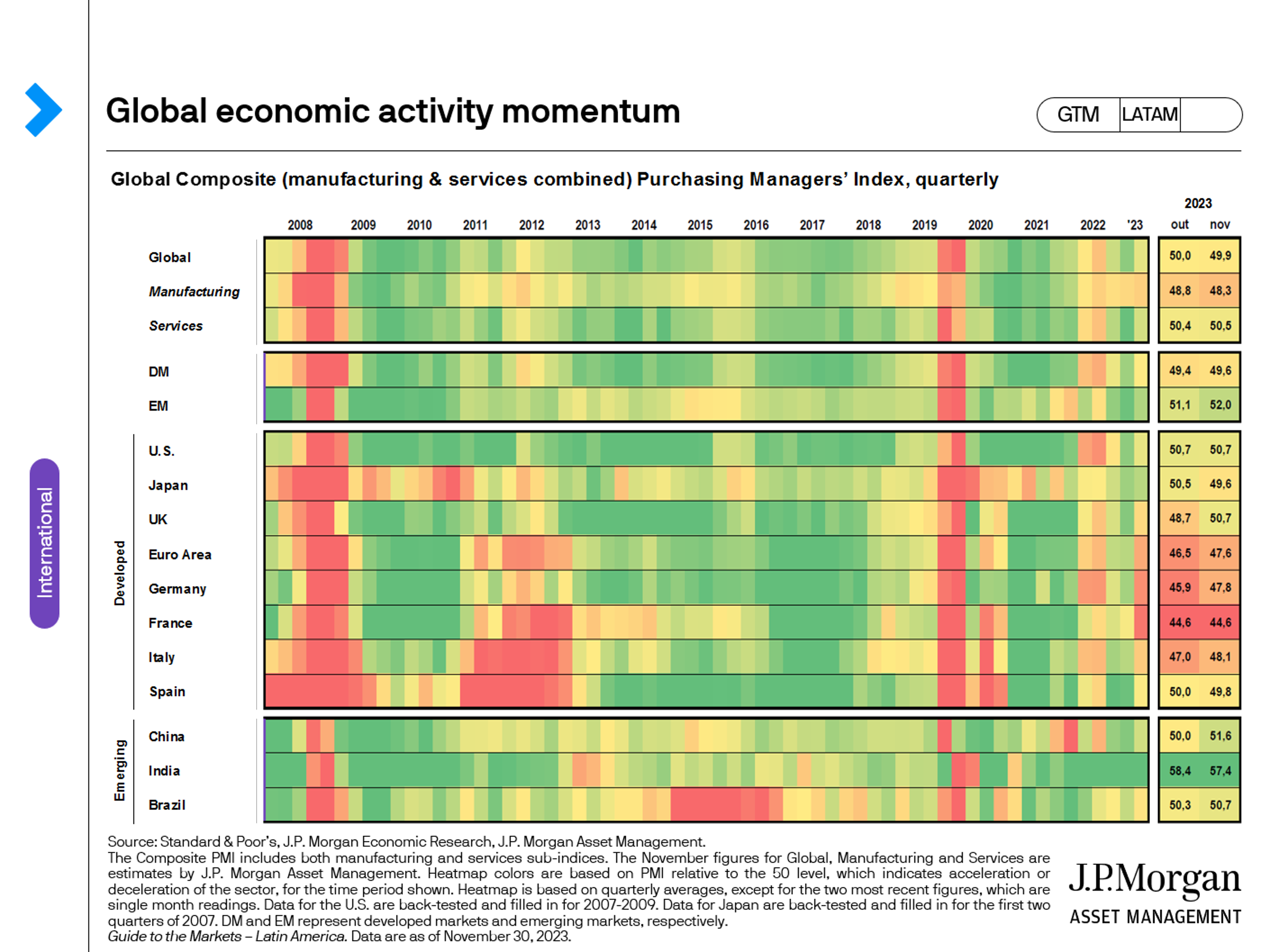

Despite the negative headlines, the global economy has grown 2.8% this year, in line with its 15-year average pace. Beneath the surface, however, a lot of divergence is on display: Europe and China ended up disappointing, while the U.S., Japan and Emerging Markets ex-China ended up surprising positively. In Europe, energy rationing did not occur, but neither did falling energy prices deliver an uplift. In China, the end of “Zero COVID policy” did not prove disruptive, but low confidence restrained consumption and investment. On the positive side, the U.S. “hard landing” never occurred, with growth remaining quite resilient and in EM ex-China, growth was solid despite China’s slower than expected pace.

In 2024, the key question for the global economy is: will this divergence persist, and if not, will it close in the positive or negative direction? Central to this question is consumer spending. Japanese and U.S. consumer goods spending has been robust and is now above pre-pandemic trends, but consumers in Europe and China have been more cautious. The good news is this is where pent-up pandemic savings persist, so we expect some modest reacceleration in Europe and China next year. Meanwhile, growth in the U.S., Japan and Emerging Markets ex-China should downshift from this year’s pace given used up savings. But, our base case is still for a “soft landing” in the U.S., with the outlook summarized by four numbers: 2-0-2-4 (2% growth, 0 recessions, 2% inflation and unemployment staying at roughly 4%). Of course, there are clearly risks that could divert us from that path.

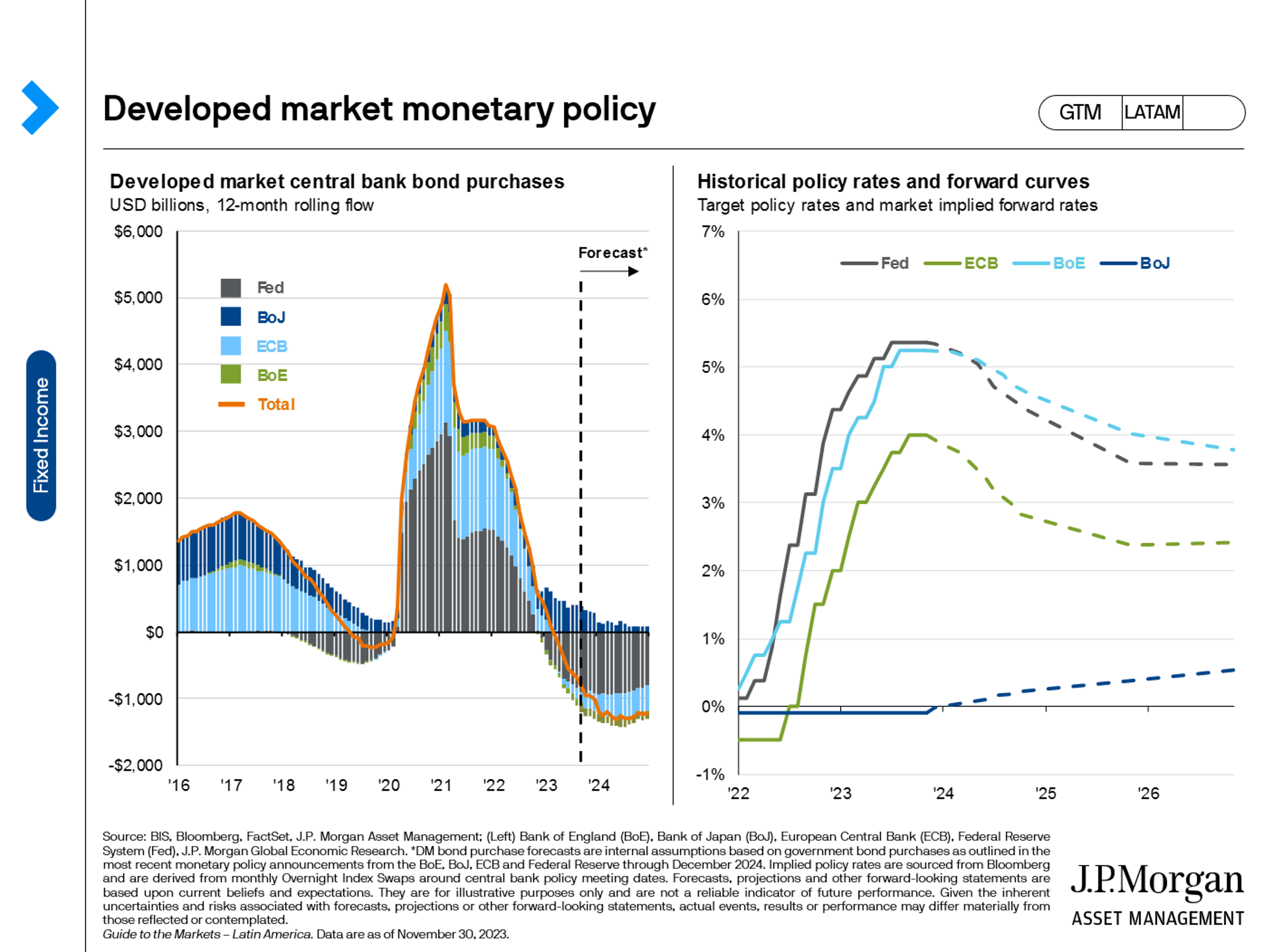

Central bank action has been more uniform since 2022 (with notable exceptions of easy policy in Japan and China), as central banks hiked rates aggressively to combat globally elevated inflation. Next year, more divergence may creep in: as the year ends, U.S. core inflation has already retraced about half of its pandemic surge, with a reasonable expectation of a return to target by the end of next year. Meanwhile, in the Eurozone and UK inflation has only retraced about a third of its surge and Japan’s is still hovering at its peak. This means the Fed is like to move first to cut rates next year, with European central banks lagging behind and pressure on the Bank of Japan to finally get going on exiting negative rates. The lone exception to stimulative policy should remain China, given below-target inflation. As a result, next year should result in a weaker U.S. dollar as growth and interest rate differentials between the U.S. and the rest of world shrink.

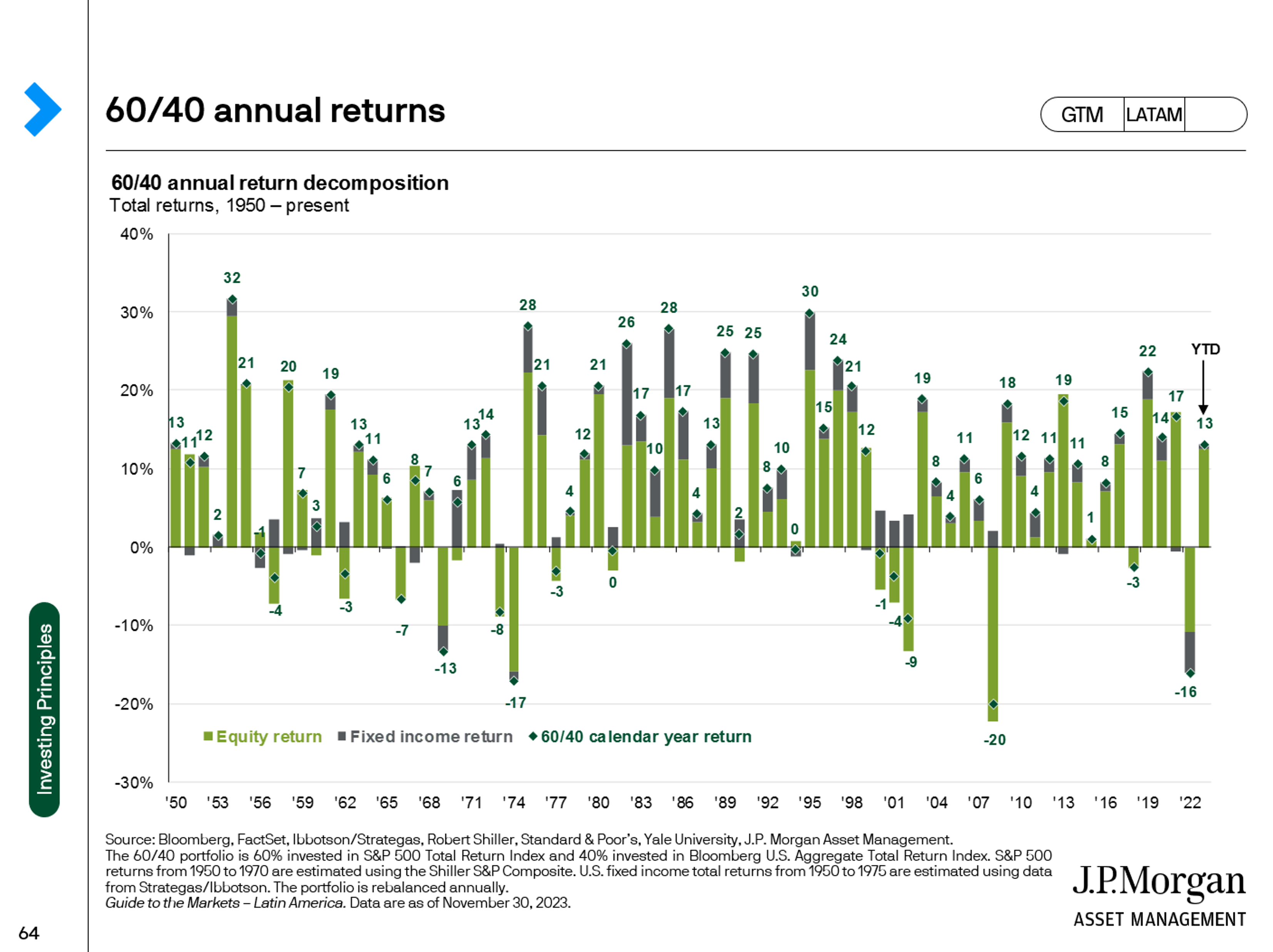

Despite the many headlines this year, market global performance has been positive, with an international 60/40 portfolio returning 14% so far. For next year, the biggest question is what will happen to U.S. rates. Assuming that the Fed is done hiking, history suggests the U.S. 10 year Treasury yield has also peaked this year. Notably, long rates have consistently declined following the end of a tightening cycle. This suggests that investors should consider stepping out of cash now and extending duration as falling yields could generate strong price appreciation in longer maturity bonds.

2023 has turned out to be a surprisingly strong year for equity markets, many markets boasting double-digit returns. For the U.S., the key question for next year is if returns will be so concentrated on so few companies, like has been the case this year. The top 10 stocks are now 45% more expensive relative to 25-year averages vs. only 7% for the rest of the S&P 500. Next year, it’s less about growth vs. value as and more about stock selection, gearing toward companies with resilient profits, solid balance sheets and favorable relative valuations. It is also about diversifying regionally, with a better valuation starting point and earnings per share growth potential in places like Japan and Emerging Markets.

As a result, when investors look forward to 2024, asset allocation must reflect a hard-learned mantra: “expect the unexpected”. But the biggest portfolio risk is that investors are still broadly overweight cash, weighing on returns in 2023 and positioning portfolios poorly relative to the opportunity set in 2024.

5 reasons to invest in China

2nd largest economy in the world

In 2010, China passed Japan to become the second largest economy in the world, contributing about a third to global growth. We estimate that by 2027 it will overtake the United States to become the largest economy in the world. This is two years earlier than we had estimated pre-pandemic.

2nd largest markets in the world

China has the 2nd largest equity market and the 2nd largest bond market in the world. Only behind the United States.

Potential to double GDP per capita

More interesting than the size of its economy itself, is China's potential to double its GDP per capita in the next decade: from $ 10,000 per person today to $ 20,000 per person, which will qualify it as a country high income. Close to half a billion Chinese will enter the middle class during this time period.

Focusing on innovation

China is focusing its economy on new growth drivers, such as: technological innovation, services, and domestic demand. Instead of the factory in the world, we should think of China as a country of global consumers. It represents a unique opportunity for diversification.

More accessible markets to global investors

Global investors can now access China’s domestic equity and bond markets. These markets provide the potential for higher return, higher income and diversification. Investors are still underweight Chinese markets given their size and the benefits they provide to portfolios.

For important information, please refer to the homepage.