The amendments to the European Union Markets in Financial Instruments Directive II (EU MiFID II) Delegated Regulation integrated sustainability preferences into financial firms’ advisory and portfolio management processes to ensure that clients’ sustainability preferences are taken into account.1

Effective 2 August 2022, firms within the scope of EU MiFID II (those providing investment advice and/or portfolio management services) are required to determine client sustainability preferences in conjunction with suitability assessments.

This inclusion of sustainability preferences builds on key product-level environmental, social and governance (ESG) criteria, definitions, considerations and disclosures introduced by the EU Sustainable Finance Disclosure Regulation (EU SFDR) and the EU Taxonomy Regulation (EU TR).

The EU MiFID II Level 2 legislation was updated to integrate sustainability preferences into the suitability assessment within the advisory and portfolio management process.

The legislation applies primarily to intermediaries, such as independent financial advisers, and asset managers who work with clients to help them choose investments. The updated regulation requires in-scope entities to ask their clients about their sustainability preferences and the extent to which they want these preferences incorporated into their investments.

The updated regulation explains how suitability preferences should be integrated into the existing suitability requirement:

The information about the investment objectives of the client or potential client shall include, where relevant, information about the length of time for which the client wishes to hold the investment, his or her preferences regarding risk taking, his or her risk tolerance, the purpose of the investment and, in addition, his or her sustainability preferences.

Sustainability preferences refer to clients’ or potential clients’ choices as to whether and/or to what extent they wish to have their sustainability perspectives, which are outlined in the EU TR and EU SFDR, integrated into an investment product.

Clients can express their sustainability preference as one or more of the following options:

(a) A minimum proportion of environmentally sustainable investments as defined by the EU TR

(b) A minimum proportion of sustainable investments as defined by the EU SFDR

(c) The consideration of Principal Adverse Impacts (PAIs) on sustainability factors, from a qualitative and/or quantitative perspective

We further describe each of these choices in detail:

(a) Environmentally sustainable investment as defined by the EU TR

According to the EU TR, a sustainable investment is an investment in an economic activity that aligns to a limited number of recognised sustainable objectives and activities, and is subject to a technical screening criteria.

The EU TR specifies six EU environmental objectives:

1. Climate change mitigation*

2. Climate change adaptation*

3. Sustainable use and protection of water and marine resources**

4. Transition to a circular economy**

5. Pollution prevention and control**

6. Protection and restoration of biodiversity and ecosystems**

*Level 2 standards confirmed as of 9 December 2021.

**Level 2 standards under review.2

Broadly, an economic activity may be considered “environmentally sustainable” under the EU TR if it meets the following conditions (known as the technical screening criteria):

1. Makes a substantial contribution to at least one of the EU’s six environmental objectives

2. Does not cause significant harm to any of the other EU environmental objectives to which it is not aligned

3. Meets prescribed minimum ESG safeguards

4. Meets the technical screening criteria set out by the EU TR

(b) Sustainable investments defined by the EU SFDR

The EU SFDR definition of a sustainable investment is broader and accommodates investments outside the EU TR definition subject to base conditions being met. These include:

1. A measurable contribution of an environmental and/or social objective

- From an environmental perspective, this could include key resource efficiency indicators on the use of energy, renewable energy, raw materials, water and land; or similar measurements of the production of waste or greenhouse gas emissions.

- From a social perspective this could include an investment that contributes to tackling inequality or that fosters social cohesion, social integration and labour relations; it could also include an investment in human capital or economically or socially disadvantaged communities.

2. No significant harm to any other environmental and/or social objective

3. Good governance practices at investee companies, particularly with respect to sound management structures, employee relations, remuneration of staff and tax compliance

Importantly, the MiFID definition does not recognise those investments that only have environmental and/or social characteristics as sustainable investments.

(c) Consideration of PAIs

PAIs look at the material effect investments can have on a wide range of environmental and social considerations, regardless of any financial impact. For example, an investment in a commodity producer may be profitable from a purely financial standpoint, but PAIs might include an extraction process that is harmful to the environment and poor safety standards that put workers at risk.

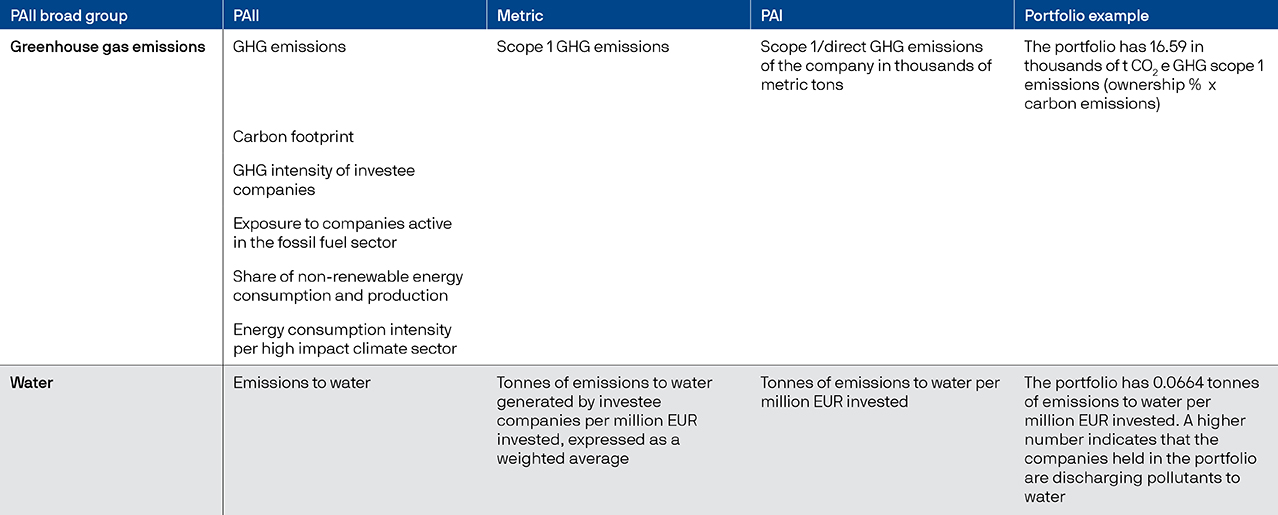

The EU SFDR does not provide one comprehensive definition for PAIs but instead identifies specific Principal Adverse Impact Indicators (PAIIs) and their corresponding PAIs, which are based on actual metrics for measurement. Some of the PAIIs and PAIs are grouped together in related categories. For example, “Greenhouse gas emissions” is a broad PAII grouping for six PAIIs, each with their own corresponding PAI. Other categories, such as “Emissions to water” are not further divided (see example).

When considering the potential for PAI integration with clients, firms may discuss an approach based on the broader categories rather than each separate PAII.

Example of considering PAI in an investment

For a complete list of PAIs click here .

The definition of sustainable preferences under EU MiFID II narrows the range of sustainable investing possibilities outlined in the EU SFDR and EU TR; in practice the MiFID definition only applies to SFDR Article 8 and Article 9 funds and does not recognise investments that only have environmental and/or social characteristics.

As a result, the introduction of EU MiFID II’s sustainable preferences refocuses how funds are viewed from a sustainability perspective. Essentially, once end clients are viewing their investment choices through the prism of the EU MiFID II sustainability preference options, the focus on where an investment product sits relative to EU SFDR Articles 6, 8 and 9 to becomes a secondary consideration.

In January 2022, the European Securities and Markets Authority (ESMA) issued a consultation paper outlining updated guidelines on certain aspects of the MiFID II suitability requirements, primarily focused on the actual integration of client sustainable preferences.3 The guidelines state that as part of the suitability assessment, firms should help clients understand the concept of sustainability preferences, the different types of products included under the definition of sustainability investment and the choices to be made in this context.

In practice, once the suitability of a product has been determined (using criteria such as client knowledge and experience, financial situation and other investment objectives) the sustainability preferences of the client must then be assessed.

The guidelines state that information with regards to client sustainable preferences can be included as part of the next regular update of the client’s information or during the first meeting with the client following the effective date of 2 August 2022.

There are several key themes running through the guidance on collecting sustainability preferences. The information must be sufficiently granular and obtained in a neutral way by appropriately trained staff.

ESMA guides that the level of information collected from clients regarding their sustainability preferences should be granular enough to enable those preferences to be matched with the sustainability-related features of financial products.

Throughout the process, firms should adopt a neutral and unbiased approach so that they do not influence clients’ answers. For example, in cases where firms work with model portfolios that combine some or all of the sustainable preferences, these model portfolios should allow for a granular assessment of a client’s preferences and should not be translated into a questionnaire that pushes a client into a certain combination of the criteria that would not meet the client’s sustainability preferences.

In order to help clients understand the concept of sustainability preferences and the choices to be made in this context, firms are required to explain the terms and the distinctions between the different types of sustainability preferences and also between relevant products in clear and non-technical terms. To that end, firms should give their staff appropriate training in this area, so that they have the necessary knowledge and competence to communicate sustainability preference options and related investment advice or information.

Firms should determine the following preferences from clients:

- Any sustainability preferences, which can be a yes/no question.

- If sustainability preferences are in line with the EU TR, EU SFDR and/or PAI definition of a sustainable investment.

o In the case of a combination of one or more of these three perspectives, this could be either assessed and matched on a portfolio level or on the level of the financial instrument, depending on the service provided.

o Firms should also determine if the client has any particular focus on environmental, social or governance criteria or no particular focus.

- The minimum proportion to invest sustainably (relevant to the EU TR and EU SFDR perspectives). If a firm collects this information by ranges or sizes, rather than percentages, these ranges should be presented in a neutral way to the client and should be sufficiently granular.

- Which principal adverse impacts should be considered, including quantitative and qualitative criteria demonstrating that consideration, when a client chooses to use the PAI perspective.

o In particular, firms should discuss the potential for PAI integration via the broader categories presented in the SFDR Regulatory Technical Standards (RTS), such as emissions, energy performance, water usage and waste production, rather than an approach based on individual PAIIs.

o Categories deemed important to the client could then be evaluated qualitatively based on the approaches products use to consider PAI, such as exclusion strategies, controversies policies, and voting and engagement policies.

ESMA is aware that the current availability of funds with the required sustainability features that meet clients’ sustainability preferences may be limited and that the introduction of these funds in a firm’s product inventory might be gradual. However, ESMA advises that firms should collect all information concerning client sustainability preferences even when they do not have any funds included in their product range that would meet the client’s sustainability preferences at the time the information is collected. In this situation, the firm should clearly indicate that there are currently no products available that would meet those preferences and the client should be given the possibility to adapt their sustainability preferences.

In summary, firms can still recommend products that do not meet the sustainability preferences of the client, but only once the client has adapted their preferences. The firm’s explanation and the client’s decision should be documented in the suitability report.

In June 2023 ESMA issued a formal call for evidence on the integration of sustainability preferences in the suitability assessment and product governance arrangements.4 It is expected that this consultation may result in changes to how this regime is applied, but not to the underlying sustainable preferences.

Where can I find out more about sustainable investing regulations?

The sustainability preferences update to EU MiFID II is part of a broader set of ESG-related uplifts across the various EU regulatory frameworks and is likely to be the one most visible to clients, given their direct involvement.

Learn more about the EU’s efforts to increase transparency and help capital flow toward sustainable investing in our related articles: EU Sustainable Finance Disclosure Regulation (EU SFDR) and EU Taxonomy Regulation (EU TR).

1 “European Commission Delegated Regulation (EU) 2021/1253 of 21 April 2021 amending Delegated Regulation (EU) 2017/565 as regards the integration of sustainability factors, risks and preferences into certain organisational requirements and operating conditions for investment firms”, Official Journal of the European Union, L 277 pp. 1-5 (2 August 2022).

2 On 28 June 2023 the European Commission officially adopted the Level 2 standards, plus amendments to the preceding Level 2 standards. These will now be subject to a scrutiny period of four months by the European Council and the European Parliament, which can be extended for two additional months. These Level 2 requirements will be applicable from 1 January 2024.

3 European Securities and Markets Authority, “Consultation on Guidelines on Certain Aspects of the MiFID II Suitability Requirements”, (27 January 2022).

4 European Securities and Markets Authority, “Call for Evidence on the Integration of Sustainability Preferences in the Suitability Assessment and Product Governance Arrangements”, ESMA35-43-3599 (16 June 2023).

For Professional Clients/ Qualified Investors only – not for Retail use or distribution.

This is a marketing communication and as such the views contained herein are not to be taken as advice or a recommendation to buy or sell any investment or interest thereto. Reliance upon information in this material is at the sole discretion of the reader. Any research in this document has been obtained and may have been acted upon by J.P. Morgan Asset Management for its own purpose. The results of such research are being made available as additional information and do not necessarily reflect the views of J.P. Morgan Asset Management. Any forecasts, figures, opinions, statements of financial market trends or investment techniques and strategies expressed are, unless otherwise stated, J.P. Morgan Asset Management’s own at the date of this document. They are considered to be reliable at the time of writing, may not necessarily be all inclusive and are not guaranteed as to accuracy. They may be subject to change without reference or notification to you. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and investors may not get back the full amount invested. Past performance and yield are not a reliable indicator of current and future results. There is no guarantee that any forecast made will come to pass. J.P. Morgan Asset Management is the brand name for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide. To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our EMEA Privacy Policy www.jpmorgan.com/emea-privacy-policy. This communication is issued in Europe (excluding UK) by JPMorgan Asset Management (Europe) S.à r.l., 6 route de Trèves, L-2633 Senningerberg, Grand Duchy of Luxembourg, R.C.S. Luxembourg B27900, corporate capital EUR 10.000.000. This communication is issued in the UK by JPMorgan Asset Management (UK) Limited, which is authorised and regulated by the Financial Conduct Authority. Registered in England No. 01161446. Registered address: 25 Bank Street, Canary Wharf, London E14 5JP.