Sector review: Healthcare

30-11-2020

Victoria Darbyshire

For a sector at the forefront of the pandemic, the crisis presents both investment opportunities and the potential for long-term behavioural shifts.

The healthcare sector has demonstrated its defensive qualities during the Covid-19 pandemic. The sector outperformed in the early months of the outbreak and subsequently underperformed as rising expectations for an effective vaccine and V-shaped recovery triggered a rotation out of the sector. During the third quarter and more recently, the US election has dominated the narrative; however, with the world seeing another spike in infections, we expect Covid-19 to come back to the fore.

Longer-term implications

Covid-19 has caused significant disruption to healthcare stocks, as to the world more broadly. While we believe most of the impact will be transient and short term in nature - such as delays to elective procedures and limited access to healthcare professionals - there are likely to be some more lasting consequences. The wider adoption of technology and the move towards healthcare digitalisation has been accelerated by Covid-related travel restrictions. One of the most visible examples is the switch to online pharmacies and medical consultations, such as those offered by Teladoc, the multinational telemedicine and virtual healthcare company based in the US.

According to a survey published in April by technology vendor Sykes, around 67% of respondents said that Covid-19 has increased their willingness to try telemedicine in the future, while 25% of these respondents had not considered this as an option before the crisis. Another survey conducted in April by electronic health records provider Sevocity showed that 85% of medical practices were providing telemedicine visits compared to only 6% prior to the virus outbreak.

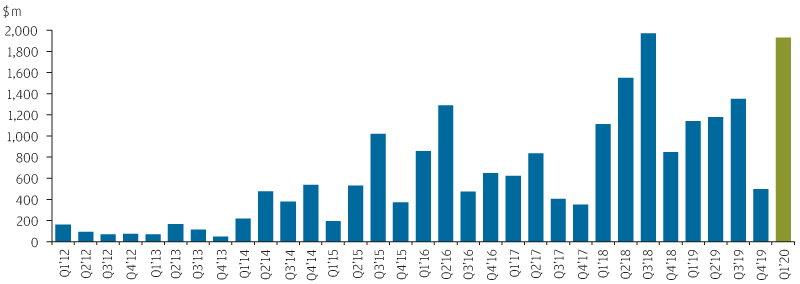

Both public and private (venture capital) funding for telemedicine services and remote patient monitoring increased substantially in the first quarter of 2020 (see chart). This change is also here to stay, as technology enables the industry and payors to reduce costs and/or improve outcomes for patients.

Exhibit 1: Venture capital funding for telemedicine

CAD/USD FX rate

Source: CB Insights, Goldman Sachs Global Investment Research. Data as of 31 March 2020.

Investment opportunities

Covid-19 related headwinds were evident in the second-quarter earnings reported by pharmaceutical companies, as prescription hoarding reversed and access to physicians remained limited. Despite an easing in restrictions, activity remains below pre-Covid levels in many geographies. It is important to note that we remain focused on identifying quality companies that are innovating for the future and can weather these short-term downturns.

One of the key focus areas for pharmaceutical and biotech companies globally has been the development of effective therapeutics and the creation of a vaccine against Covid-19. Vaccine trial data has just been released by Pfizer, which is extremely promising; however, there is not enough follow up from this trial to draw firm conclusions yet. While we do not focus on this specific area when building our investment thesis, the perception of adequate safety and efficacy will have and has had broad impact on market sentiment. A word of caution: even this or other `good data’ may not mean broad availability and distribution of any vaccine well into next year.

Given the highly effective antiviral drugs that have been developed over the past three decades to treat HPV (Human Papilloma Virus) and Hepatitis C, we are also somewhat optimistic for the antiviral approaches to a Covid-19 treatment, and also for the development of effective antibody therapeutics.

A key question that remains unanswered is whether the pandemic will end with the virus disappearing completely, or whether this is a new disease that we will need to bring under control over the coming years and learn to live with for the coming decades. We look forward to the publication of more data from the early virus studies, which should give us a better understanding of the disease pathology. At this stage we view Covid-19 research as an added option to our investment case rather than central to any thesis.