Sector review: Technology

30-11-2020

Joseph Wilson

The disruption resulting from Covid-19 has emphasised technology’s vital role in keeping the world connected, as well as accelerating some longer-term shifts.

The disruption to the global economy caused by the Covid-19 outbreak had a generally positive impact on the technology sector, due to the acceleration of structural changes already underway before the pandemic. In particular, the crisis has emphasised the important role that technology plays in keeping the world connected, and—as a result—businesses of all sizes are now far more dependent on various technologies. The pandemic forced workers and businesses to change the way they operate, while the continued containment measures increased the adoption of technology for work and life at home. This translated into increasing demand for cloud storage, communication solutions, ecommerce and electronic payments, among others.

Looking forward

Generally speaking, the technology trends that have benefited from the situation created by Covid-19 are structural in nature. Therefore, we expect the effects to be long lasting and to continue to drive higher penetration rates for these technologies. For example, cloud solutions for communications, e-commerce, customer service, infrastructure and communications will become critical to the ability of businesses to improve efficiencies and be able to operate effectively at any time. While most companies have realised that technology is the catalyst for growth in every disruptor and the catalyst for change in every mature industry, the pandemic will likely be the motivating force to accelerate disruptions and transitions.

Investment opportunities

Beyond the companies offering the technology that is helping us to stay connected and move more of our spending online in 2020, we see opportunities resulting from longerterm structural shifts.

Machine learning is spurring an acceleration of innovation across sectors and businesses. An application of artificial intelligence (AI), machine learning draws on extensive sets of data and large-scale cloud computing infrastructure to produce innovations like the Alexa voice assistant and Tesla’s autonomous driving software. Simply put, machine learning is software writing software, with a level of complexity that humans cannot achieve.

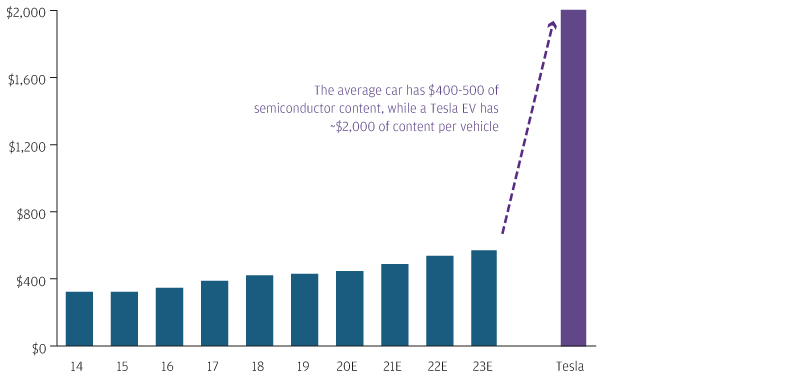

In the auto sector, we believe companies that are able to collect and harness data to build autonomous driving software and deploy it on hardware will have the greatest opportunity. Today we see Google and Tesla leading the way in this secular shift. We think the business models that emerge from here will be analogous to Apple’s vertical integration of software and hardware or the Microsoft Windows (or Google Android) model of licensing software to a large ecosystem of hardware manufacturers. Semiconductor companies will also benefit from this secular shift, given the significant demand for sensing, collecting and processing required for 90 million cars annually.

Average semiconductor content per car vs. Tesla

Sources: Gartner, J.P. Morgan Asset Management, company reports. The securities highlighted above has been selected based on its significance and is shown for illustrative purposes only. It should not be interpreted as a recommendation to buy or sell. It should not be assumed that other securities in the portfolio have performed in a similar manner.

The disruptive power of AI is also evident across the financial services, consumer discretionary and healthcare sectors – from new models to help lenders identify creditworthy borrowers, to technologies that combine AI and augmented reality to help consumers understand how goods would look in their homes, to AI-designed clinical trials and diagnostic image recognition technology.

Looking ahead, we think the disruptive power of technology will continue to spur shifts in market share within industries, as well as shifts in market capitalisation among companies. Over time, it will pave the way for new market leadership. For investors, it will be critical to understand how market leadership might evolve and who the major long-term winners could be. This will require an open mind and the ability to imagine how different an industry or consumer experience might be if technological advancement were to progress at an accelerating pace.

We believe an active investment approach can be especially useful in identifying which companies are best positioned to benefit from powerful secular shifts.

Past performance is not indicative of future returns.