In brief

- Adaptation should be seen as essential to tackling the climate impacts that cannot now be avoided – yet it’s too often ignored by investors, leaving the world at risk of ever-greater climate-related losses.

- Given the investment gap, early moving investors can potentially benefit from gaining an awareness of the current adaptation landscape and then allocating capital towards promising emerging solutions that may become an integral part of climate risk management as the world warms.

- Finding these solutions requires first identifying where the main economic risks of climate change lie – and the sectors that will be most impacted – and then looking for the diverse and innovative solutions to these risks that require funding or that have previously been overlooked.

- These adaptation opportunities, which can be found globally across sectors – and in private as well as public markets – can help the world to build the resilience needed to withstand the worst impacts of global warming, while also providing the potential for investors to generate attractive long-term returns.

The economic case for climate adaptation

Climate change presents risks that are too big for investors to ignore. Global warming matters because of the adverse impacts that extreme weather events, increased humidity, heavy precipitation, prolonged periods of drought and gradually rising sea levels can cause to physical infrastructure, human wellbeing and the natural ecosystem on which our economy relies.

Since even ambitious mitigation will not eliminate all future climate risks, tackling climate change also requires a level of adaptation to those impacts that cannot be avoided. As a result, proactive efforts are now urgently needed to reduce exposure and vulnerability to extreme weather events and other risks arising from global warming.

However, the annual Adaptation Gap Report produced by the United Nations Environment Programme (UNEP) has consistently concluded that planning for and investments in national- or project-level adaptation are not at sufficient scale to keep up with the sharp acceleration of observed climate impacts and projected climate risks. According to the 2021 Adaptation Gap report, adaptation costs are growing faster than financing, and there are few signs of the sizeable shifts in scale needed for rapid and ambitious adaptation.1 The previous year’s Adaptation Gap report highlighted the range of critical sectors in need of adaptation financing, including infrastructure, agriculture and health, and also showed the gap between their financing needs and what they were receiving.

Building on the findings of the 2021 report, we look in detail below at the climate-related risks facing these sectors, as well as the opportunities for investment in adaptation that they offer.

The lack of investment highlighted by the UNEP can be the result of difficulty in accurately measuring the need for and impact of investments in climate adaptation and resilience – since putting an explicit price on climate risk is challenging. However, without action, losses from climate events will continue to rise. In 2021, natural disasters amounted to an overall loss of USD 280 billion worldwide, with losses of USD 145 billion in the US alone – a developed region generally assumed to have a lower level of vulnerability to climate change.2 Less than half of these losses were insured, pointing to a clear lack of pre-emptive adaptation. While these developments show that no region is immune to the risks of climate change, they also suggest that the adaptation needs of developed as well as developing countries may be under-recognised and under-funded.

Developed countries and some developing countries may have the resources and ability to engage in actions to manage climate risk, but adaptive capacity does not necessarily translate into preparedness. For this planning and financing gap to be closed, targeted investment in adaptation is required across a range of industries – providing opportunities for private investors to lend their support.

According to the Global Commission on Adaptation 2019 report “Adapt Now: A Global Call for Leadership on Climate Resilience”, every dollar invested in climate adaptation (specifically related to early warning systems, climate-resilient infrastructure, improved dryland agriculture crop production, global mangrove protection, and climate resilient water resources) is estimated to generate a return of between two dollars and 10 dollars.3 The report concludes that adaptation actions, done right, are some of the most cost-effective investments that can be made. These investments are not just limited to the public sector, either. The need for more and alternative sources of financing, including from the private sector and through private-public- partnerships, is on the rise.

Identifying the key areas at risk from climate change

The Intergovernmental Panel on Climate Change (IPCC) identifies three key areas of the global economic system where the threats from global warming are multiple and only set to increase: cities and settlements; the natural environment; and human health and wellbeing. Based on these three primary risk areas, Exhibit 1 lays out the economic sectors that are most vulnerable to the effects of climate change, and the potential solutions that can help to address climate risks through pre- emptive adaptation.

Exhibit 1: Key climate change risks and potential solutions

Source: J.P. Morgan Asset Management, IPCC, United Nations Environment Programme Adaptation Gap Report 2021.

We first investigate each of these risk areas to illustrate the climate risks facing crucial economic sectors. By appreciating the adaptation measures required to manage these risks, investors can start identifying investable solutions and begin to direct their capital towards those companies that are helping to build long- term climate resilience.

1. Cities

In the context of climate change, cities are often subject to heightened levels of risk. The combination of a built- up environment, dense populations and locations often in hazard-prone areas, such as floodplains, riversides, and islands, means that cities are more exposed to a multitude of adverse events, including flooding, heatwaves and droughts. It’s not always the cities one might expect that are at greatest risk, either. London and Melbourne, for example, potentially face more climate hazards than cities in developing countries, such as Karachi or Addis Ababa.4

Extreme weather and natural disasters are some of the most immediate risks. A single extreme climate event, such as flooding, wildfire and wind, can lead to cascading hazards and a breakdown of a city’s infrastructure. Wetlands, mangroves and estuaries, which tend to be heavily urbanised areas, are particularly at risk from sea level rise and heavier rainfall. In all, it’s estimated that 800 million people living in cities could be at risk of coastal flooding and storm surges by 2050.5

Cities are also at risk from the urban heat island effect, whereby temperatures within built-up areas are higher than their surroundings. By 2050, around 970 cities worldwide could experience summer temperature highs of over 35°C – compared to just 350 in 2018 – putting their infrastructure at risk of degradation and their populations at risk of ill health. The costs of climate risks to transport infrastructure, for example, could rise from USD 0.5 billion to over USD 10 billion in Europe by the 2080s, while in the US, over 50% more roads could require rehabilitation following degradation by extreme heat.6

Another climate change-related risk to cities is forced migration, as certain regions become dangerous or even uninhabitable, which can lead to unplanned and unsustainable increases in city populations. This population rise in turn necessitates the rapid and often disorderly expansion of cities, increasing the risk of social unrest as well as magnifying the impacts of climate change.

With cities expected to account for 70% of the world’s population and 80% of the world’s GDP by 2050,7 it is vital from both a social and economic standpoint they remain resilient to climate change. As a result, investment in sectors related to cities can play a key role in shaping our adaptive response to global warming.

2. Nature

Ecosystems underpin economies in many countries, creating employment opportunities and wealth. Given the potential impact of global warming on ecosystems, adaptation must be a priority to ensure the continued viability of crucial industries and the services they provide.

For example, the World Economic Forum in 2020 estimated that the three largest sectors that are dependent on nature – agriculture, food and beverages, and construction – generate close to USD 8 trillion of gross value added.8 The gross value added generated by agriculture, forestry and fishing grew by 73% alone in real terms between 2000 and 2019, reaching USD 3.5 trillion in 2018 – and globally, 27% of employment is in agriculture. These industries rely on the availability, and sustainable stewardship, of natural capital, but are also at risk from its destruction.

Risks posed to natural capital and its related industries by global warming include extreme heat, natural disasters, water scarcity, and – perhaps most crucially – biodiversity loss. At 2°C of global warming, it is projected that one in 10 species is likely to face a very high risk of extinction, with this proportion rising to 12% at 3°C and 15% at 5°C.9

It can be hard to grasp the full extent of the consequences of biodiversity loss for the economy and society. Take the availability of food as one example. One billion people globally rely on fish as their primary source of protein, but fish stocks everywhere are in severe decline.10 And even where the quantity of food is unchanged, the nutritional value is at risk. Plants can lose as much as 10% of their zinc and iron, and 8% of their protein content, when exposed to atmospheric CO2 levels as high as those predicted for 205011.

Another important example is medicine. Penicillin, morphine, and cancer chemotherapies are just some of the medicines derived from natural sources. With the World Health Organization estimating that 11% of the world’s essential medicines come from flowering plants, biodiversity decline severely threatens drug production and discovery.12

The destruction of natural capital is also a risk for industries such as forestry, construction and tourism, which have multiple dependencies on nature through their services and supply chains. Close to 1.6 billion people – 25% of the world’s population – rely on forest resources for their livelihoods.13

3. Wellbeing

Beyond the fact that extreme weather and natural disasters can have direct negative consequences for human health and often prove deadly, global warming presents other significant health risks. Precipitation and flooding, for example, can overwhelm and damage water treatment and sanitation infrastructure, causing wastewater discharge and spreading bacteria and toxins. Higher temperatures also increase pathogens’ chances of survival, which leads to higher incidences of vector-borne diseases, such as malaria, dengue, and yellow fever.14 These effects are already observable: the likelihood of dengue transmission in the 2012 to 2021 period, for example, was 12% higher than in the period from 1951 to 1960.15

Furthermore, climate change may increase the likelihood of cross-species viral transmission, as a reduction of species and biodiversity due to changes in ecosystems – and shrinking habitats due to climate extremes, such as forest fires – lead to more encounters between wildlife and humans. This interaction could facilitate novel viruses, and increase the likelihood of epidemics.16

The health implications of climate change entail significant economic costs. Currently, the total health cost of fossil fuel-related air pollution is estimated to total USD 820 billion per year in the US.17 Resulting productivity losses impact the wider economy, with evidence to suggest both increases in temperature and pollution reduce labour efficiency. In industries regularly exposed to heat, such as agriculture, landscaping, and construction, the number of hours worked declines significantly when daily maximum temperatures exceed 32°C.18 Heat exposure led to 470 billion potential labour hours lost globally in 2021.19

Given that labour productivity is a function of health, efforts to adapt to climate change can be viewed as an investment in human capital. Solutions for the risks to our health and to the health care sector are urgently needed as a result.

Capitalising on adaptation solutions

Given the multiple risks facing our cities, natural world and wellbeing as a result of climate change, the urgent need for solutions to help adapt to some of these changes is clear. But what are the potential solutions? Which companies are best positioned to provide these solutions? And how can investors seek to support climate adaptation while also preparing their portfolios for the negative economic impacts of climate change?

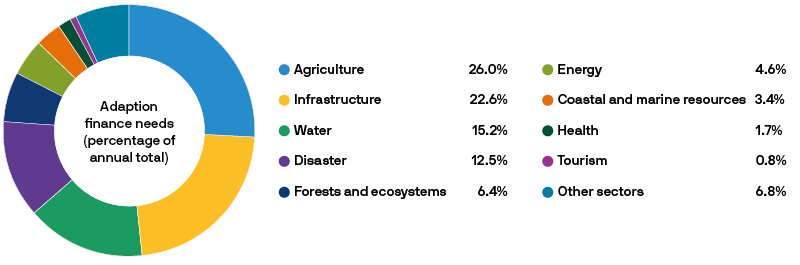

One starting point is to consider the adaptation financing needs of different sectors, based on their economic significance and level of exposure to climate change risk (see Exhibit 2). From there, investors can look to identify potential opportunities from the range of diverse and innovative solutions that are emerging to protect human lives and livelihoods in these sectors.

While a high proportion of data and estimates relating to adaptation focus on developing countries, the need for adaptation financing and investment in developed countries is also not insignificant, and we expect to see more analysis on this over time. For example, the United Nations Environment Programme 2022 Adaptation Gap Report found that while most European Union member states have actively mainstreamed adaptation into planning and decision-making processes, many adaptation actions remain limited to capacity building, and only a few member states have dedicated budgets for adaptation. A higher proportion of adaptation responses in Europe compared with other global regions consists of technological or infrastructural measures, but evidence of systematic or transformative adaptation remains scarce.20

Exhibit 2: Adaptation finance needs by sector based on 26 developing countries’ nationally determined contributions and national adaptation plans

Source: United Nations Environment Programme Adaptation Gap Report 2021.

Crucially, adaptation solutions will be difficult to scale up and implement without an expansion in options for financing to support them. A rise in blended finance structures, such as public-private partnerships, are emerging as one of the key routes to increased investment in adaptation. Many of these mechanisms have been successfully rolled out to date in collaboration with organisations such as the International Finance Corporation (IFC), targeting issues including access to clean water and basic sanitation under climate-stressed conditions, climate-resilient critical transport, or energy infrastructure. Such partnerships can help allocate risk across the public and private sectors to where it can best be managed, while ensuring that resources are effectively distributed and the long-term stability of projects is more reliably guaranteed.

In addition, green bonds targeting climate resilience could offer a diversified source of funding for public sector investment grade issuers to mainstream resilience as climate change intensifies. Analysis by the Global Commission on Adaptation found that 16.4% of green bonds issued to date had use of proceeds related to resilience – so the opportunity for expanding this source of financing is clear. Infrastructure projects with large capital expenditure and resilience benefits present clear reasons for issuing bonds targeting climate resilience – but issuance is possible for other activities such as sustainable landscapes, agriculture and watershed management as well.

By identifying pipelines of eligible projects and programmes, investor demand for these instruments can be effectively harnessed.21 In this instance, developed countries are much further ahead than their emerging market counterparts. 79% of green bonds including activities related to adaptation and resilience have been issued in developed markets, 15% from supranational institutions and 6% from emerging markets.

Infrastructure and energy

The United Nations Environment Programme Adaptation Gap Report 2021 suggested that the infrastructure and energy sectors together account for around 27% of adaptation financing needs in developing countries. There are a wide range of solutions within these sectors towards which financing can be directed, and as the Global Commission on Adaptation notes, many of these solutions provide a positive return on investment. In cities, for example, infrastructure-based adaptation can include efforts to combat the urban heat island effect through air conditioning, public cooling centres, planting street trees, pavement watering, or cool surface treatments, such as applying white paint to reflect sunlight and absorb less heat. Individual buildings, meanwhile, can be made more climate- responsive through improved insulation, ventilation, or shading. Chicago’s green rooftops have helped to slow stormwater runoff by 36%, while Toronto and Montreal are significantly expanding tree coverage to battle extreme heat.22 Companies providing these products and services will likely present increasingly attractive investment opportunities as global demand for effective urban adaptation increases.

New infrastructure or modifications to existing infrastructure can also help cities to cope with specific hazards from climate change. Once again, cost- effectiveness is a key advantage of adaptation versus other measures to combat climate change: the Global Commission on Adaptation estimates that making new infrastructure resilient to climate change can offer a cost-benefit ratio of nearly five to one.

Increasing permeable surfaces and wetlands to allow natural infiltration of rainwater can reduce impacts from storms and flooding. China’s Sponge City initiative, for example, sets a goal of 80% of urban land being able to absorb or reuse 70% of stormwater through underground storage tanks and tunnels.23 Investment in water and sanitation infrastructure to increase resilience to extreme weather events is also integral to preventing the transmission of disease. Meanwhile, energy infrastructure assets can be strengthened, upgraded or relocated to better protect them from damage and disruption during extreme weather events – an opportunity for proactive investment with the advantage of built-in risk-reduction benefits.

One of the most effective protective measures that can be taken is the implementation of early warning systems. Disaster management accounts for 12.5% of adaptation financing needs in developing countries, according to the United Nations Environment Programme Adaptation Gap Report 2021. There are several examples of solutions that should become an essential part of the design and operation of at-risk cities, including: updated topographic maps, weather and climate information, and satellite and remote sensing data; the use of models that reveal risks of climate impacts to local areas; and the updating of disaster preparedness and response systems.

As the need for adaptation becomes more widely recognised and cities seek to assimilate adaptive solutions into their day-to-day functioning, investors may see a benefit from early allocations towards these areas. Simply choosing to invest in climate-resilient regions and projects, which is another form of integrating adaptation awareness into investment decisions, also has the potential to generate higher returns on real estate portfolios as climate threats multiply.

Transport

Another key source of adaptation solutions for cities concerns transport. In this case, the most effective solutions are often low-cost and low-tech, with multiple co-benefits for nature and wellbeing. For example, safe and convenient cycling and walking reduces emissions from vehicle use, and also promotes health and self-sufficiency. However, it is not feasible to replace all journeys with walking and cycling, so there is likely to be increasing emphasis on the resilience of transport systems – for example: reshaping cities to accommodate changing transport technologies (electric vehicles, hydrogen transport and more public transport options); digital enhancement of rail infrastructure and electrification; and the strengthening and rebuilding of coastal transport systems and ports. These areas offer a multitude of investable opportunities, which look set to become increasingly viable as the need for climate adaptation comes to the fore.

The integration of technology into transport and infrastructure solutions will also be a key angle for adaptation. The emergence of “smart cities” is one example of transformative climate adaptation through technology. Singapore has created accessible “green” mobility options by encouraging the take-up of electric vehicles and public transport; these areas may benefit from increased government support, making them potentially attractive prospects for investors.

Agriculture, fishing, forestry and tourism

Firms operating in natural capital-dependent industries, such as agriculture, fishing, forestry and tourism, can make their own operations and supply chains more resilient and profitable by investing in adaptation – as well as contributing to wider societal climate adaptation needs in the process. This area should be key for investors when engaging on corporate environmental, social and governance issues.

Concepts such as climate-smart agriculture and agroecology, which looks to prioritise species diversity over conventional monocultures, can help to build resilience against a number of risks, including extreme weather and biodiversity loss. In the aftermath of Hurricane Mitch in Central America in 1998, biodiverse farms, including agroforestry, contour farming and cover cropping, retained more topsoil, and suffered less erosion and lower economic losses than neighbouring farms practicing monocultures.24

Risks arising from global warming, such as water scarcity, can be addressed via a number of solutions, including precision agriculture, which involves using information technologies to analyse data to inform decision making. Access to agronomic data allows farmers to reduce inputs such as water and pesticides, at the same time as making productivity gains, as applications can be targeted to crops and areas when required.

Agricultural connectivity could unlock more than USD 500 billion in GDP by 2030, and companies that provide sensors, connectivity products and smart monitoring would be expected to benefit from increased demand.25 Investment opportunities exist for companies providing equipment in this space, as well as for telecom operators, which may benefit from increases in rural demand, and food producers, which can utilise this equipment to produce superior yields.

Other opportunities also exist among agricultural chemical companies, which may be best placed to develop bio-based solutions as increasing regulatory pressure and changing practices force farmers to adapt to climate change and increasing land degradation by reducing traditional chemical use (although chemical companies are also at risk from this change).

Shifting agricultural practices may demonstrate the link between mitigation and adaptation, as measures that strengthen long-term resilience will mitigate some of the worst climate impacts. Adaptation options to solve for future potential food shortages extend to demand- side measures for adapting to potential resource scarcity, such as the exploration of alternative proteins and mechanisms for reducing food loss and waste. Analysis by the Food and Land Use Coalition estimates that new investment of USD 350 billion a year in sustainable food and land use systems could ultimately create more than 120 million new jobs annually, and USD 4.5 trillion in new business opportunities worldwide, each year by 2030.26

All of these possibilities should be on the minds of investors, since the need for adaptation in this crucial sector will only increase as climate change intensifies.

Forestry and pharmaceuticals

It might seem counter-intuitive, but technological adaptation can also be valuable for nature and reliant industries, such as forestry and pharmaceuticals – since when it comes to biodiversity, the best solution is not necessarily to replicate what has been lost. Vegetation loss and change in genetic baselines may naturally enhance resilience to future stress through natural selection, so restoring forests using past genetic baselines may actually create more vulnerable populations.

Synthetic biology is the process of engineering new biological systems or re-designing existing ones to provide alternatives to wildlife products. Over the last 15 years there has been a five-fold growth in companies working on aspects of synthetic biology, with public and private investment approaching USD 10 billion over this period.27 Biobanking, which is the collection, processing and storing of biological samples and data for research, is increasingly relevant to pharmaceutical innovation in the face of biodiversity decline. In addition, the data generated through bio-samples can be a key resource for the digital transformation of health systems.28 None of these solutions are capable of single-handedly reversing biodiversity loss, but they should be of interest to investors looking to efficiently allocate capital towards adaptation in the face of climate change.

Ecosystems themselves also play a vital role in mitigating the effects of climate change, with forests and oceans acting as sinks for excess heat and carbon emissions – so preserving them can be an adaptation strategy in and of itself. Simply maintaining nature’s capacity to buffer the impacts of climate change is often less costly than replacing these lost ecosystem functions with heavy infrastructure or technology. In São Paulo, the reduction of sediment flow from restoring 4,000 hectares of forests near the city’s watershed was estimated to be USD 4.5 million cheaper than the cost of dredging reservoirs to improve urban water quality.29 Similarly, protecting mangroves, according to the Global Commission on Adaptation, could offer net benefits worth USD 1 trillion. Moreover, when implemented effectively, ecosystem-based adaptation strategies can have substantial co-benefits for social goals, such as poverty alleviation and community development.

Preserving nature allows for the continued flourishing of related industries, such as tourism, and the jobs that depend on them. Wildlife tourism represents around 4.4% of global GDP and sustains around 22 million jobs.30 Coastal and marine tourism represents a significant share of the overall industry, with coral reefs alone with coral reefs alone responsible for USD 36 billion of this total.31 As a result, while ecosystem- based adaptation may not always have been viewed as a profitable investment opportunity, an appreciation of the reliance on nature of economically significant sectors – and the potential for natural solutions to dramatically reduce climate change impacts – should contribute to a change in this perception.

Health

The health sector is thought to account for a relatively small proportion of adaptation financing needs – around 2% – but even so, the finance that has so far been directed to health adaptation to climate change has fallen far short of what is needed.

Adaptation to the health-related impacts of climate change can take a wide range of forms, but several technological solutions are coming to the fore. The integration of air pollutant warnings into smart technology, for example, can be very effective as an adaptation solution, with hospital admissions for respiratory illness found to be lower on days with active pollution alerts.32 These monitoring systems can give real-time predictions that inform targeted smart control to improve public health.33

As populations grow and there is increasing strain on health systems, telehealth may gain in importance as a way of reaching patients that may not be able to travel for myriad reasons ranging from transport costs to isolated rural locations. Furthermore, resilience of hospitals to shocks may require increased investment in generators and energy capabilities. As with other adaptation solutions, access to some of these opportunities could require innovations in financing models, such as increased use of public-private partnerships.

Although strategies exist for dealing with temperature extremes (for example, US Occupational Safety and Health Administration advice to consider the adjustment of work shifts to allow for earlier start times or evening and night shifts) the extent to which such adaptations can be implemented will vary by labour sector. Future research should therefore consider technical adaptation (for example, air conditioning), behavioural changes (for example, shifts in work patterns) and infrastructure and regulatory interventions (for example, the installation of green roofs).

In the case of pandemics, viral surveillance and discovery efforts, and tracking changes in animal activity may be key to predicting and understanding novel viruses.

These efforts at health adaptation will require funding, but they offer the opportunity for return on investment in areas that have perhaps previously been undervalued by investors. They are also highly reliant on successful adaptation of settlements and nature. Well-designed and non-polluted cities with resilient water and sanitation infrastructure support the long-term wellbeing of their inhabitants. Healthy ecosystems enable the continued availability of the resources and processes upon which human health depends. Overall, it is evident that a holistic approach to adaptation investment, taking into account the need for regeneration of cities and settlements, the preservation of nature, and innovation to support health and other economic sectors, has the potential to become a significant and sustained investment trend.

Conclusion

Alongside accelerating efforts at climate change mitigation, we think that now is the time to begin considering how capital can be allocated to support adaptation for a more uncertain future. As the UN’s most recent Adaptation Gap Report 2022 notes, adaptation needs to move beyond the incremental, with significant increases in scientific research, advance planning and, crucially, more and better financing – leveraging the innovations in financing structures such as public-private partnerships and green and other sustainability-related bonds for climate resilience that are starting to emerge.

Investment in climate adaptation has the potential to bolster growth and deliver a “triple dividend”, by helping to avoid future losses, generate positive economic gains through innovation, and – when thoughtfully implemented – by delivering additional social and environmental benefits. Adaptation can reduce negative economic impacts from climate change and help transform industries to become more resilient, more innovative, and better prepared for the range of challenges that a warming world might throw at them.

All in all, effective adaptation opens pathways to increased efficiency, growth, innovation and sustainability. Large-scale public and private sector adaptation efforts are needed to protect businesses, communities and ecosystems from climate change impacts. These efforts require investment in adaptation strategies across sectors, as well as the integration of adaptation with mitigation. The result will be the generation of demand for products and services, and the opening up of new markets, all of which can help generate revenue and achieve efficiency while making ecosystems and communities resilient.34

Crucially, because this shift is only just beginning, these solutions provide a promising source of long-term return for investors who move early to build climate- resilient portfolios that support innovation in favour of climate adaptation.