China Real Estate: Still very relevant on Earth

China’s property market, once galactic in scale, has shrunk considerably. Will it follow Japan’s path and enter a lost decade? We think not, but volatility will persist.

30-05-2023

Andrew Chong

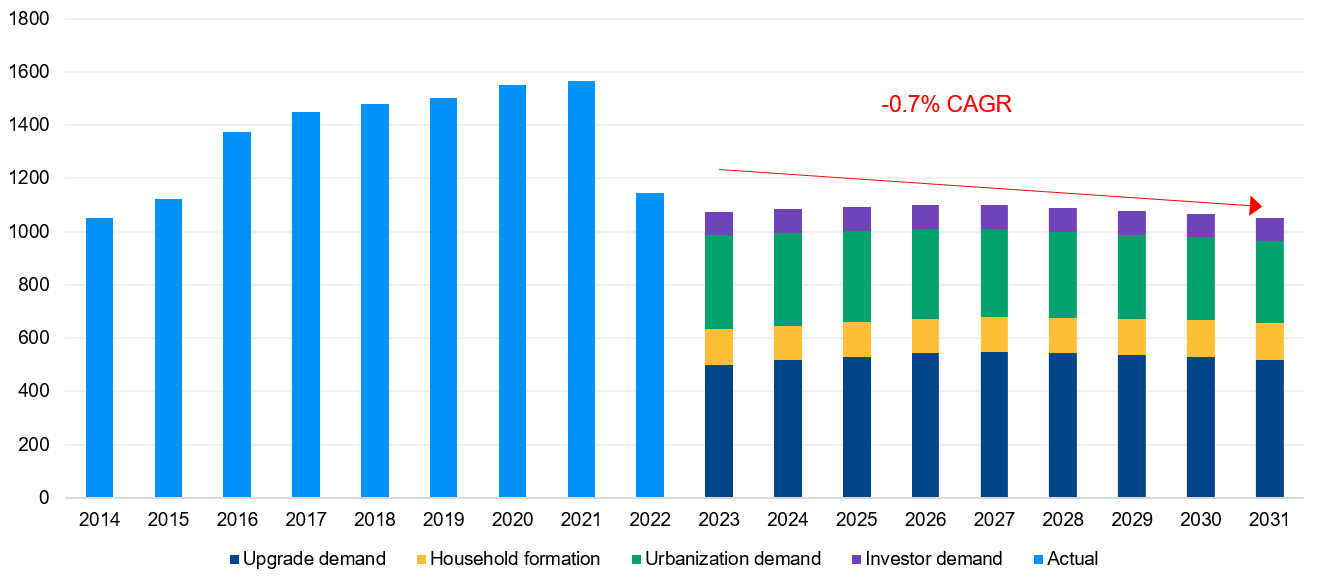

2022 was a difficult year for Chinese developers. Around half of the largest 100 Chinese developers defaulted, while the housing market shrunk by a third. After such a difficult year, it is fair to ask where the Chinese real estate market, a sector once dubbed the most important sector in the universe, can go from here, and whether that pathway presents opportunities for investors. While the heyday of high growth is likely over, we are expecting overall market to remain stable while the market size to shrink gradually in the medium to long term. We expect challenges from slowing urbanization to be partially cushioned by a steady rate of household formation which, in turn, should be underpinned by shrinking household size. The upside risk to our view mainly comes from solid upgrader demand, which could trigger volatility in the market. In our base case scenario, we forecast primary home sales (by area) to drop by a Compound Annual Growth Rate (CAGR) of 0.7% towards the end of this decade.

Sources: UN population estimates, JPMAM estimates, JPM Equity Research, China National Bureau of Statistics; As of April 30, 2023.

We view demand from property upgraders positively. Our view is supported by an expected increase in the size of the 35-45 aged cohort and the (still) above average China GDP growth rate through 2031. That being said, we foresee an uneven release of upgraders demand in the future, which likely will depend on the short term economic performance of the country. This trend should benefit developers that have good geographic and product diversification which should allow them to stay nimble and adjust swiftly to the latest market trend. On the other hand, we expect net household formation, or the net change in the number of households, to have a neutral impact on demand despite the shrinking population. Our analysis indicates that household formation is best explained by the population in the 20-25 age group which will remain stable in the near and medium term till 2040. Housing demand in China could see more downside pressure when China approaches the average developed market urbanization rate of 75%.

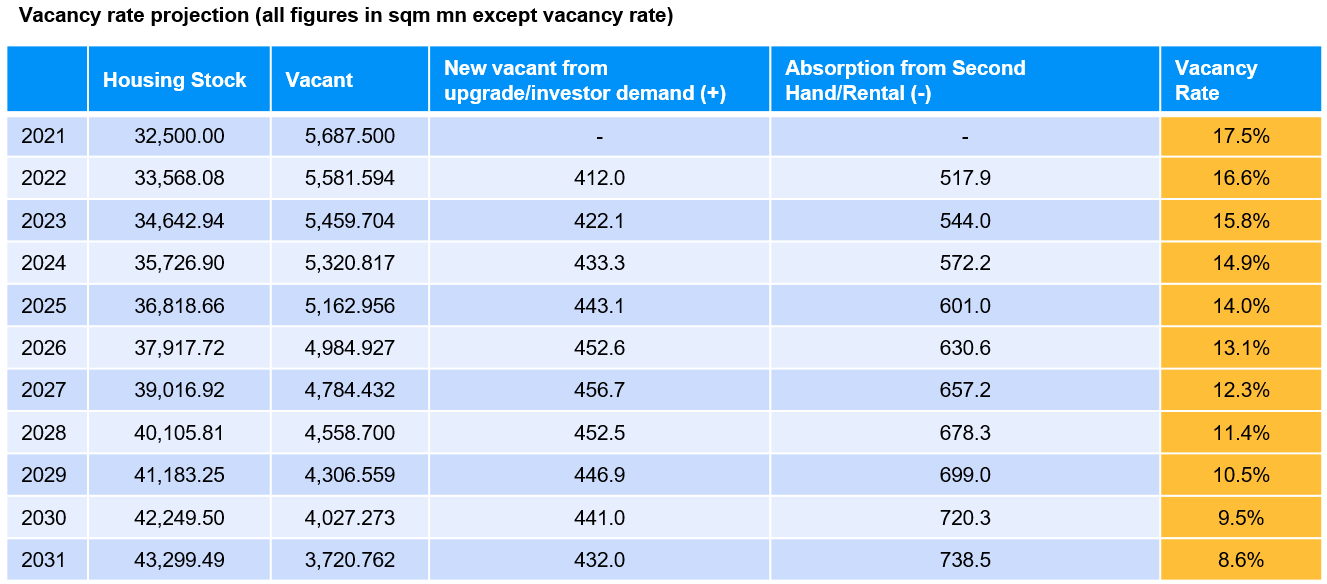

Further supporting our thesis are findings from our own proprietary research on the ground. Our channel checks show that the sharp drop in housing sales last year largely reflected a decline in investor demand. Previously, investor demand accounted for over 20% of total property demand in China and that dropped to virtually zero in the second half of 2022. To contain subsequent negative investor sentiments impacting real owner-occupier demand, the Chinese government introduced price floors when the situation was at its worst in 2022. We believe that this policy successfully averted a decades long property slump akin to that seen in Japan previously. Buying a presale apartment on a mortgage is similar to making a levered investment for two years: a lower price begets even lower prices (is this needed?) Going forward, we think that some investor demand remerge but that will be in the range of 8-10% and this will lead to a healthier (lower) vacancy market (please refer to the table below). We expect Chinese investors to continue to treat real estate as a key asset class in their portfolios but, overtime, reduce the proportion of wealth locked in this sector (from the current >50%). We also do not expect the recent increase in property listing in the secondary market to lead to fresh price pressure. We think that the listings surge is a result of secondary apartment viewings not being available during Covid and, thus, some pent-up demand for secondary houses has now been released. Primary market apartments are still satisfying over 70% of total housing demand in 1Q23.

Sources: JPMAM estimates, China National Bureau of Statistics; As of April 30, 2023.

Investment implications

First, we do not expect a repeat of 2022’s developer default event. With the market finding some investor support at the margin, we are constructive in identifying survivors among the remaining names. Second, volatility remains as a feature for the sector, meaning bottom-up bond selection will remain critical. Given that developers largely rely on elusive upgraders’ demand to support their credit profile, we believe investment performance could vary. Our fundamental analysis will focus on the liquidity, diversity of product offerings and geographic concentration to ensure that the developers which we invest in will be able to survive periods of temporary sales weakness. Overall, we think China real estate should stay as a high-risk high-reward sector in the bond market.

09t1232405184410