Reserve Bank of Australia: From patience to pragmatism

At its monetary policy meeting on Tuesday 5th of April, the Reserve Bank of Australia (RBA), in-line with expectations, left base rates unchanged at a record low of 0.1%. However, in the accompanying comments, it acknowledged that “inflation has picked up and a further increase is expected”. Notably the RBA removed the words “prepared to be patient” from the accompanying statement, confirming its hawkish tilt and giving a clear hint to potential rate rises in the coming months.

Faster than expected rebound:

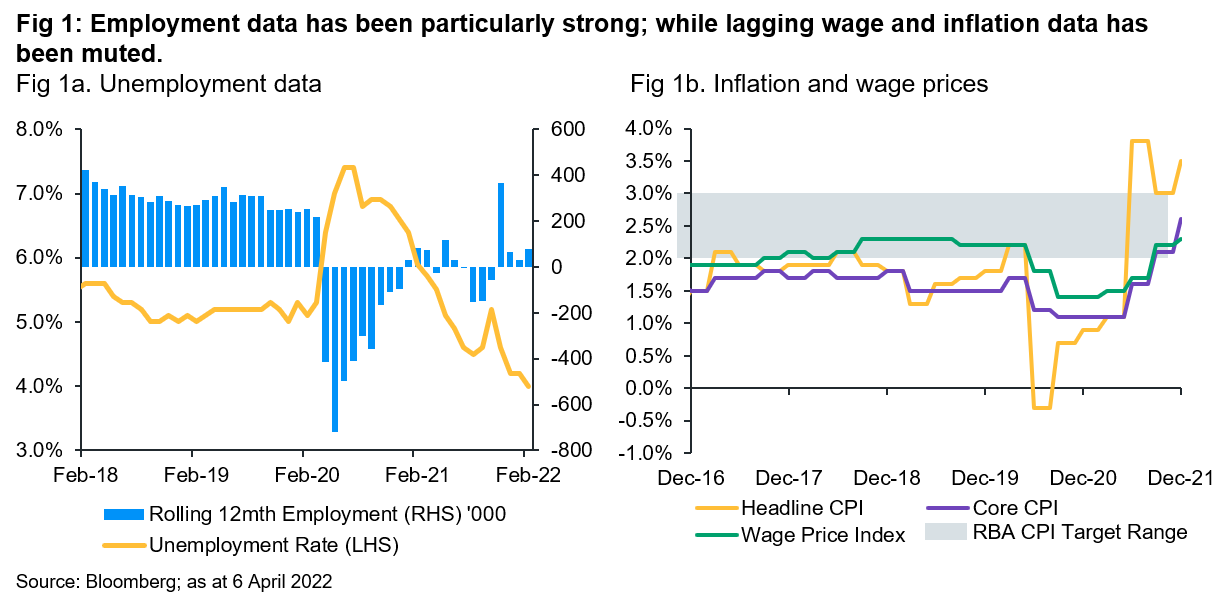

Recent economic data was very robust, with the central bank noting that “the economy remains resilient and spending is picking up following the Omicron setback”. Property prices hit a new record high in February after increasing for the past 17 months, while the latest retail sales data was the second highest on record as consumer spending on services rebounded and consumer confidence improved. Meanwhile, elevated commodity prices and healthy demand have pushed the value of exports and the trade surplus to a record high. Employment numbers (Fig 1a) were particularly strong with four months of positive job creation pushing the unemployment rate down to a multi decade low of 4% in February. Finally, the latest federal budget was very stimulatory and included multiple measure designed to assuage the increased cost of living.

Historically, the key rationale for lower interest rates has been muted official wage prices and inflation data (Fig 1b). The former declined to a decade low of 1.4% in Q4-20, before recovering slightly to a still muted 2.3% in Q4-21; while the latter has printed below the RBA’s 2-3% target for the past five years, before recovering modestly to 2.6% at the latest reading in Q4-21. However, both data points are lagging indicators and the RBA, pivoting to forward looking guidance, confirmed that “inflation has increased in Australia” and “higher prices for petrol and other commodities will result in a further lift in inflation over coming quarters”, although it also noted that local inflation “remains lower than in many other countries”.

Market Reaction:

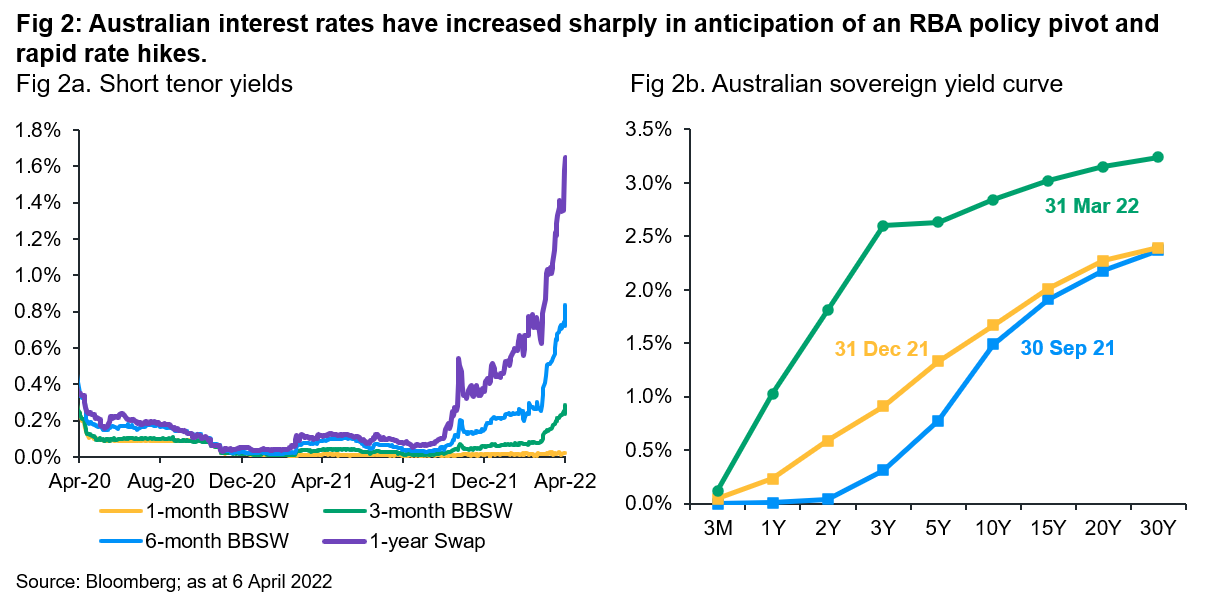

Following the RBA’s announcement, bond yields increased (Fig 2a) and the curve flattened (Fig 2b) with 2-year yields sharply higher. Meanwhile, the AUD, already one of the top performing major currencies in 2022, jumped to a ten-month high versus the USD on expectation of narrower US-Australian bond yields.

The market reconfirmed its expectations of multiple rate hikes in 2022, although the terminal rate for the official cash rate remains uncertain. The market’s aggressive view on the frequency and quantity of rate hikes are at odds with historic rate hike cycles and the RBA’s current concerns about the residual downside risks and the sustainability of higher inflation.

The market reconfirmed its expectations of multiple rate hikes in 2022, although the terminal rate for the official cash rate remains uncertain. The market’s aggressive view on the frequency and quantity of rate hikes are at odds with historic rate hike cycles and the RBA’s current concerns about the residual downside risks and the sustainability of higher inflation.

Conclusion:

The RBA’s pragmatic, hawkish tilt was broadly in-line with market expectations, which have moved aggressively ahead of the central bank’s previously “patient” stance. However, while recognizing the likelihood of higher inflation, the central bank confirmed its data dependent focus, noting that “over the coming months, important additional evidence will be available to the Board on both inflation and the evolution of labor costs”.

Recent, anecdotal evidence suggesting rapid price increases and higher wage settlements are already occurring whilst other economic data remains very robust. First quarter inflation and wage data (due in late April and mid-May) remains a key focus. With economists anticipating that price data will continue to print higher than RBA forecasts, we believe the era of emergency, record low interest rates and accommodative monetary policies is likely over and the RBA is expected to raise base rates in the coming months.

Australian dollar cash investors, grappling with record low yields since late 2020, should welcome this hawkish pivot and sharp contraction of the RBA’s timeline for rate hikes. Steeper yield curves have already allowed liquidity and ultra-short duration strategies to boost returns – albeit with a delay due to the need to reinvest maturities. However, cash yields are unlikely to increase until the RBA actually announces a hike, and with markets pricing in a significant number of hikes, investors should consider maintaining a disciplined approach to cash segmentation in expectation of potential market volatility.