Sustainability, which includes environmental, social and governance (ESG) considerations, has long been a focus for the European investment community, European governments and regulators. In recent years, the European Union (EU) has taken specific legislative actions to encourage the flow of capital towards a sustainable economy, including developing and enacting regulation related to sustainable finance.

The EU Sustainable Finance Disclosure Regulation (EU SFDR), which went into effect 10 March 2021, aims to increase transparency and standardisation within financial products with regards to their environmental and social characteristics and sustainable objectives.

The EU Taxonomy Regulation (EU TR), which went into effect 01 January 2022, provides an additional level of transparency to financial market participants by recognising and outlining six specific environmental objectives. The EU TR supports the EU’s goal of helping capital flow to sustainable finance and green projects.

An EU taxonomy specific to social objectives is currently being developed and a draft report was released by the social taxonomy subgroup of the EU Platform for Sustainable Finance in July 2021. We expect to learn more about the progress of the social taxonomy in the near term. Throughout this article we refer only to the EU TR related to environmental objectives.

It is important for investors to understand the scope of the EU TR. In-scope firms are not required to have binding commitments to make EU TR-aligned investments within their financial products; they are only required to disclose the degree to which their financial products commit to aligning with the EU TR. For example, zero alignment is permitted.

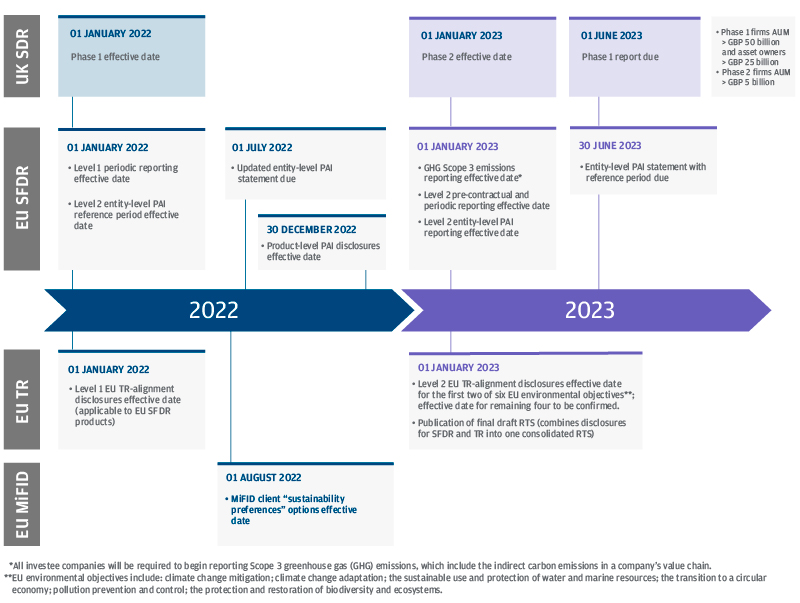

Taken all together, elements of the EU TR and the EU SFDR, along with ESG-related changes to the EU Market in Financial Instruments Directive (MiFID), introduce enhanced levels of ESG-related disclosures. Investors will see the most significant impact by mid-2022.

What is the EU Taxonomy Regulation (EU TR) and why is it important?

The EU TR is the EU classification system for environmentally sustainable economic activities. It translates the EU’s environmental objectives into a clear framework for investment purposes. The EU TR creates a common, standardised language, criteria and due diligence (quality assurance) process related to identifying economic activities that align to recognised environmental objectives.

The EU TR specifies six EU environmental objectives:

- Climate change mitigation*

- Climate change adaptation*

- Sustainable use and protection of water and marine resources**

- Transition to a circular economy**

- Pollution prevention and control**

- Protection and restoration of biodiversity and ecosystems**

*Level 2 standards confirmed as of 9 December 2021.

**Level 2 standards under review.

Broadly, an economic activity may be considered “environmentally sustainable” if it meets the following conditions:

- Makes a substantial contribution to at least one of the EU’s six environmental objectives

- Does not cause significant harm to any of the other EU environmental objectives to which it is not aligned

- Meets prescribed minimum ESG safeguards

- Meets the “technical screening criteria” set out by the EU TR

In addition, the EU TR mandates a series of disclosures that in-scope financial firms and financial products are required to make with regards to the degree to which their activities and/or investments are aligned to the EU TR.

Who is affected by the EU TR?

The EU TR affects all financial market participants in the EU. Asset managers and financial advisers need to disclose the degree to which they commit to being invested in taxonomy-aligned activities within their financial products. As a result:

- Companies have clearer guidance on sustainable finance initiatives and regulation, which helps in strategic planning and raising capital for these projects.

- Investment managers can design credible green products that meet the approved common standards.

- Retail investors can better compare financial products based on EU TR-aligned activities.

- Professional investors (portfolio managers) can better compare companies through improved disclosure of EU TR-aligned activities.

How does the EU TR apply to an investment portfolio?

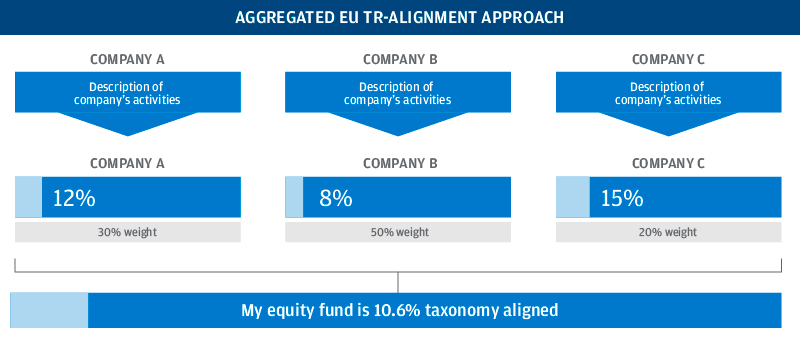

The disclosure of EU TR-aligned activities at the company level feeds up into disclosures of EU TR-aligned activities at the portfolio level. In-scope EU companies will be required to disclose the degree to which their economic activities align to the EU TR. Asset managers aggregate the company disclosures, incorporating all key conditions, so they can disclose the percentage of the fund that is aligned to the EU TR.

Aggregated EU TR-alignment approach

Source: “Taxonomy: Final Report of the Technical Expert Group on Sustainable Finance”, EU Technical Expert Group on Sustainable Finance, March 2020. Level 2 reporting standards for investee companies confirmed as of 10 December 2021.

The quality, completeness and timeliness of the corresponding disclosures from investee companies is critical to ensuring the ability of asset managers to meet their own obligations under the EU TR. In time, the improved corporate disclosures will help portfolio managers better incorporate environmental considerations into investment decisions and portfolio construction.

How will the EU TR interact with the EU SFDR and other EU sustainable finance initiatives?

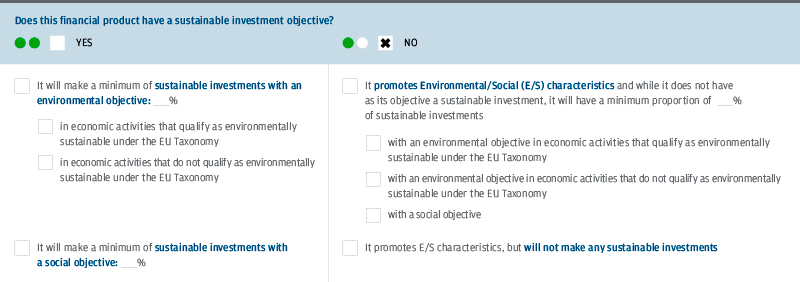

The EU TR is being integrated into the disclosure obligations set out by the EU SFDR. A firm is expected to reflect its minimum alignment to the EU TR alongside EU SFDR considerations. In addition, both Article 8 and Article 9 EU SFDR financial products need to disclose the degree to which they are committed to making sustainable investments, referencing both the EU SFDR and EU TR standards.

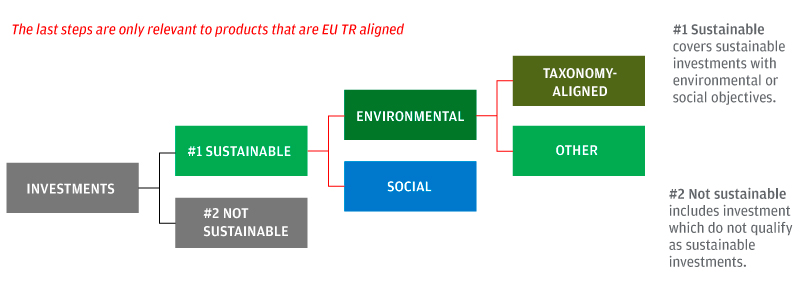

Under the EU SFDR, “sustainable investment” broadly means an investment in any economic activity that contributes to an environmental and/or social objective, provided that such investments do not significantly harm any of those objectives and that investee companies follow good governance practices.

Under the EU TR, a “sustainable investment” (being aligned to the EU TR) means specifically an investment in any economic activity that contributes to one of the six environmental objectives recognised by the regulation, on the condition that the investment meets the four-step due diligence standards outlined earlier.

Integrating EU TR considerations into an EU SFDR Article 8 product

Source: Final Report on Draft Regulatory Technical Standards, Joint Committee of the European Supervisory Authorities, 22 October 2021.

How the EU TR is considered in an EU SFDR Article 9 product

Source: Final Report on Draft Regulatory Technical Standards, Joint Committee of the European Supervisory Authorities, 22 October 2021.

Source: Final Report on Draft Regulatory Technical Standards, Joint Committee of the European Supervisory Authorities, 22 October 2021.

The Article 8 and Article 9 disclosures will provide investors with a detailed understanding of the sustainable investment commitments of financial products via precontractual (ex-ante) disclosure obligations, such as a prospectus. Investors will also be able to see how financial products fared in terms of those commitments via periodic reporting (ex-post) disclosure obligations.

Several EU sustainable finance initiatives, in various stages of development, will likely incorporate elements of the EU TR, such as:

- EU Ecolabel for Retail Financial Products

- Future EU standards for green bonds and green mortgages

- EU Climate Benchmarks Regulation

- EU Non-Financial Reporting Directive (NFRD) and Corporate Sustainability Reporting Directive (CSRD)

Will there be a UK version of the EU TR?

The UK is planning to follow a hybrid, parallel model of regulation potentially incorporating:

- The Task Force on Climate-Related Financial Disclosures recommendations for climate-related entity- and product-level disclosures that came into effect 1 January 2022

- Possible Sustainable Disclosure Requirements (UK SDR) based on a discussion paper issued 3 November 2021

- Possible Environmental Taxonomy Regulation, similar to the EU, expected at the end of 2022

The UK authorities have not yet decided whether they are planning to integrate ESG into their own legacy regulations.

What further developments related to the EU TR should investors look out for?

Integrating “sustainable preferences” within existing suitability rules defined by MiFID will be one of the next developments that will impact investors.

Recent EU rules regarding the integration of sustainability factors, risks and preferences into certain organisational requirements and operating conditions for investment firms, as outlined within MiFID, will also incorporate “sustainability preferences” within existing suitability rules. This is currently scheduled to take effect in August 2022, alongside other ESG-related changes affecting several EU regulatory frameworks including Undertakings for Collective Investment in Transferable Securities (UCITS) and the Alternative Investment Fund Managers Directive (AIFMD).

Sustainability preferences allow clients (or potential clients) to determine whether they would like to consider sustainability in their investments, and to what extent, through a financial instrument with one of the following options:

- Minimum proportion invested in environmentally sustainable investments as defined by the EU TR

- Minimum proportion invested in sustainable investments as defined by the EU SFDR

- Considers principal adverse impacts (PAI) on sustainability factors with qualitative or quantitative elements demonstrating that consideration

Additional amendments will incorporate key terms, such as “sustainability factors” and “sustainability risk”, and incorporate ESG considerations to align with the EU SFDR.

What is the timeline for implementing the EU TR?

The EU TR is effective 01 January 2022, when the Level 1 precontractual ex-ante disclosure standards are applied.

Subject to corresponding Level 2 standards of the EU TR being passed into EU law, the enhanced disclosure standards will be integrated into the disclosure templates set out by the EU SFDR effective 1 January 2023 (this date is subject to confirmation).

Source: J.P. Morgan Asset Management

How will the EU TR benefit investors?

The impact of the EU TR is expected to be incremental over the coming years, rather than immediately transformative, particularly for non-professional investors.

As elements of the EU TR are integrated into the EU SFDR, investors will be able to gain additional detailed understanding of the minimum sustainable investment commitments of financial products and their alignment to the EU TR, both before making an investment and while invested in a particular product. In other words, investors will be able to better compare and monitor the sustainability commitments of financial products over time.

Ultimately, along with additional ESG-related changes to MiFID, investors will benefit from enhanced levels of ESG-related disclosures in financial products.

09gh210112120836