In brief

Green, social and sustainability (GSS) bonds are one lever through which investors can support the climate transition and promote social advancement.

The GSS bond market is growing, broadening out and becoming more diversified, particularly by issuer type.

GSS issuance looks set to continue as issuers look to raise capital efficiently to fund projects key to their business models.

GSS bonds are increasingly becoming part of global indices and can provide core fixed income exposure.

The ‘greenium’, or tendency for green bonds to trade at a premium, is an oft-cited drawback of the market, but is a function of the strong demand that provides technical support.

Established international principles provide guidance on best practice for GSS issuance, but active management is important to avoid greenwashing.

Introduction

With the scale of the climate emergency well-documented, the need for innovative solutions has never been greater. As the global population continues to grow, with an expected 9 billion people on the planet by 2050, global energy demand is expected to rise disproportionately, by 50% over the same period1. At the same time, annual greenhouse gas emissions need to fall from more than 50 billion tonnes of CO2 equivalents to zero in order to limit the global warming that will make much of the planet uninhabitable and lead to increasingly extreme weather events2. For us to get to net zero, energy-related emissions need to fall by more than 70% by 20503.

The Organisation for Economic Co-operation and Development (OECD) estimates that annual investment of almost USD 7 trillion will be needed each year until 2050 to fund the transition. While it will take a significant further step-change to bring about investment of that magnitude, companies and governments are waking up to the scale of the challenge, with 120 countries and thousands of businesses signing up to the UN’s Race to Zero. The investor community is also moving, with 273 investment firms – representing over USD 60 trillion dollars in assets under management – now signatories to the Net Zero Asset Managers Initiative. Financial markets have a key role to play in the transition to net zero, and green financing – through the issuance of green bonds – is one lever to pull.

But the challenges we face in today’s world don’t stop at the environment. The need for social advancement on a global scale was brought into heightened focus by the pandemic, with acute social issues facing large swathes of the global population. Lack of infrastructure in many parts of the world hampers economic growth and exacerbates inequality. Now, almost half of the world’s total wealth is held by 1% of the global population, with the poorest communities hit hardest by economic turbulence: for example, inflation disproportionately impacts the poor, with housing costs swallowing up almost all the income of the poorest US households. Social advancement and economics are therefore intrinsically linked. Moreover, the elimination of inequality is good for business: research from McKinsey suggests that there is a 48% performance differential between the most and least gender diverse companies4. Reflecting these challenges, recent research conducted by J.P. Morgan Asset Management in Europe showed that investors’ sustainability priorities, historically focused on the environment, are evolving to increasingly include social issues5.

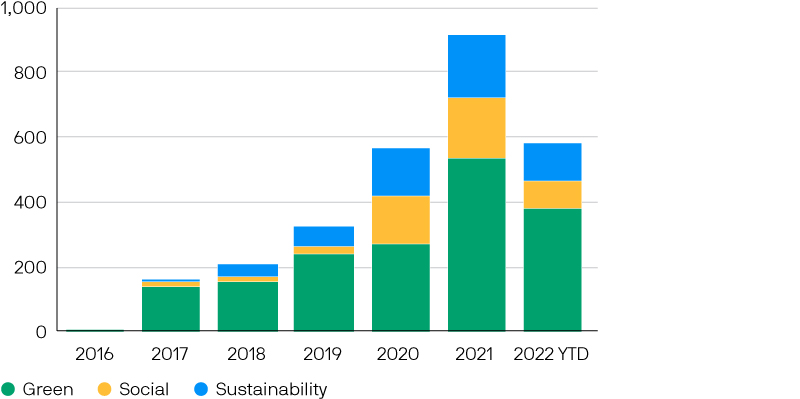

As with the climate challenge, a broad range of stakeholders are beginning to take deliberate steps to address these social challenges. Companies, governments, foundations and multilateral institutions are issuing social and sustainability bonds to fund community development and to facilitate access to essential services, with the aim of reducing poverty and inequality, creating jobs and empowering communities. The GSS market has been growing… Green bonds are debt instruments issued specifically to fund environmentally beneficial projects. This market has become a significant opportunity set for fixed income investors. In 2017, green bond issuance amounted to USD 141.5 billion. Fast forward to 2021, and the number had grown by over 280%, with over half a trillion dollars issued in that year alone. There is now around USD 1.5 trillion of green debt outstanding6.

But it’s no longer just about green bonds. The ‘use of proceeds’ landscape has expanded to include social bonds (where the use of proceeds explicitly fund socially beneficial projects) and sustainability bonds (which fund a mix of green and social projects). Covid-19 appears to have acted as an accelerant for such issuance: social issuance grew 505% in 2020 to USD 190 billion, with sustainability bond issuance growing 12% to USD 149 billion. Taken together, GSS debt now stands at around USD 2.6 trillion.

Exhibit 1: GSS bond issuance continues at pace

Source: HSBC Research; data as of 30 September 2022.

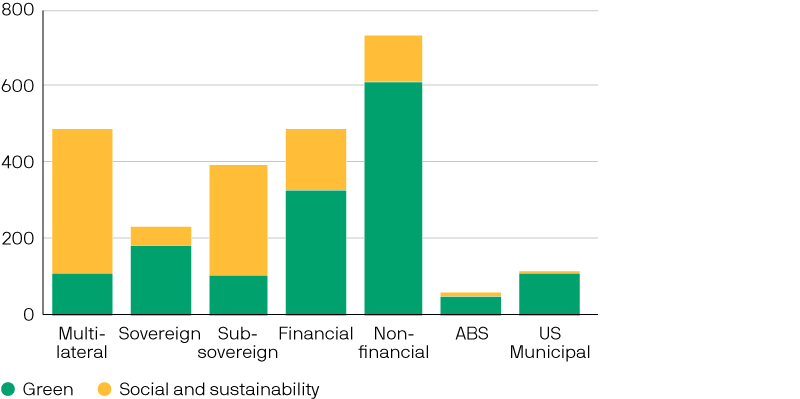

As the opportunity set has broadened from green bonds to include social and sustainability bonds, the market has become more diversified, particularly by issuer type. Exhibit 2 shows the amount currently outstanding in use of proceeds bonds. Looking only at green bonds, the private sector dominates the landscape by quite some margin (accounting for 63% of green bonds outstanding). The addition of social and sustainability bonds means that multilateral issuers (such as the European Union) and sub-sovereigns (such as local government bodies) have become a larger part of the market7.

Exhibit 2: Currently outstanding use of proceeds bonds by issuer type and the growth is set to continue

Source: HSBC Research; data as of 30 September 2022.

Importantly, GSS issuance looks set to continue as issuers seek to raise capital efficiently to fund projects key to their business models. For example, in the private sector, energy-intensive companies such as those in the utilities sector are actively engaged in the transition to a net-zero economy. By issuing green bonds to fund this transition, they may be able to access investors focused on ESG and sustainability, who might otherwise have been deterred from investing in these less sustainable business activities.

Government issuance of GSS bonds should also continue to grow. Higher government bond issuance is expected in years to come, particularly across Europe. The German government is the latest to commit to big spending, announcing in late September a EUR 200 billion energy package that will be financed by greater debt issuance. Against this backdrop of more issuance, governments will be forced to think hard about their issuance strategy, and green bond markets could be an area of focus, especially since Russia’s invasion of Ukraine has provided fresh impetus to accelerate the transition to renewables.

Issuers have been vocal about their intention to issue more in this space, with several European nations, including Germany, planning to build a ‘green yield curve’8 (the current offering in the market falls well short of this goal). In the supranational sector, the European Union is poised to become one of the world's largest green issuers in the coming years, with the European Commission stating that it will seek to raise up to 30% of its EUR 800 billion recovery fund through green issuance. It is likely that social bonds will also make up a significant part of the EU’s recovery agenda.

Bonds are back, and GSS bonds can give you core exposure

The need for green and social financing is clear, but how should investors think about allocating to this market?

As the GSS universe becomes bigger, the bonds are increasingly becoming part of global indices: for example, Bloomberg recently launched a new Global Aggregate Green Social & Sustainability Bond Index. This index exhibits core-like characteristics, as shown in Exhibit 3.

Exhibit 3: Full maturity indices display core-like characteristics – but duration carve-outs allow investors some flexibility

| Bloomberg Global Aggregate | Bloomberg MSCI Global Green Bond | Bloomberg Global Aggregate Green Social & Sustainability Bond | Bloomberg Global Aggregate Green Social & Sustainability 1-10 year Bond Index | |

| Number of issuers | 28,240 | 1,081 | 1,763 | 1,450 |

| Duration | 6.7 | 7.2 | 7.1 | 4.9 |

| Yield | 3.8% | 4.0% | 4.1% | 4.1% |

| Credit quality | A+ | AA- | AA- | AA- |

Source: Bloomberg; data as of 27 October 2022.

Core-like characteristics mean GSS instruments tend to be high quality, and to exhibit a longer duration profile, although active management can allow investors to mitigate this risk according to preference, while retaining some of the GSS market’s key characteristics. In our view, this is a good time to be looking at the market: with recessionary risk increasing across the global economy, and with yields having reset materially higher, bonds are very much back as part of a diversified portfolio.

Meanwhile, given the increased focus – through regulation and engagement from end investors – on sustainable investing, asset managers are actively seeking ways to participate in the drive for a more sustainable and inclusive economy. For bond investors, a clear link between their capital and sustainable projects can be appealing, as reflected in survey data, which suggests investor interest in use-of-proceeds bonds is trending upwards. A survey conducted by PwC indicated that two-thirds of issuers have experienced oversubscription when issuing GSS bonds, reflecting strong demand. On the investor side, 88% of investors were expecting to increase their allocation over the next two years, with three quarters expecting to do so by more than 5%9.

Getting past the greenium

Strong demand for GSS instruments leads to the ‘greenium’ so often cited as a drawback of the market, with green bonds tending to trade at a premium to their ‘non-green’ counterparts – resulting in a lower yield. The greenium tends to vary depending on factors such as sector, credit rating and geography, as well as sensitivity to broader market liquidity conditions.

Federal Reserve analysis earlier this year estimated that corporate spreads are 8 basis points lower, on average, for green bonds than traditional bonds10. Interestingly, social bonds appear to suffer less from greenium. A report by HSBC demonstrates that, since 2018, social bonds have exhibited less of a yield give-up than green bonds, across European sub-sovereign and corporate bonds. This supports a case for investors to look at the GSS market as a whole, rather than the green subset specifically, to mitigate the premium paid.

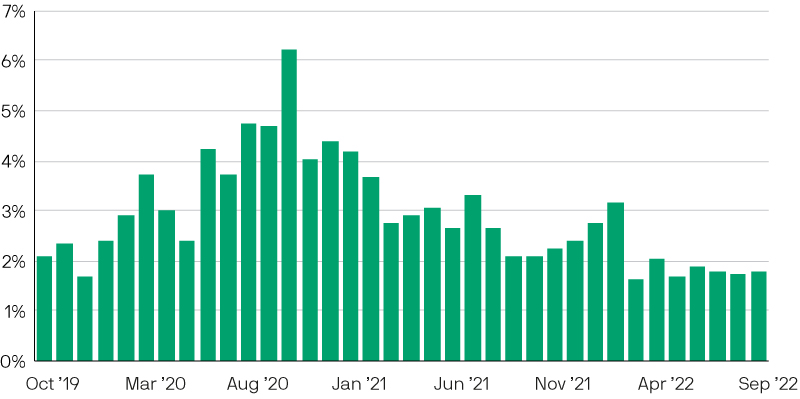

Exhibit 4: When yields are higher, the greenium isn’t as painful

Corporate GSS greenium as a proportion of overall yield

Source: Bloomberg, J.P. Morgan Asset Management Quantitative Research Group; data as of 30 September 2022.

Nevertheless, it’s clear that the greenium exists, potentially leading to some hesitancy from investors who are not willing to give up yield to achieve sustainability goals. However, there are a few key reasons why the greenium isn’t necessarily the drawback it once was:

First, as described above, the greenium is a function of demand, which can be viewed as a strong technical factor when determining whether an investment will perform well. Active investors, with the capability to analyse bonds quickly and act decisively at the time of issuance, may benefit from this increased demand, which can lead to further spread tightening in the secondary market.

Second, given the scale of the repricing in fixed income markets in the past year, the greenium is smaller than it used to be. Our quantitative research has observed that when spreads were tight in investment grade credit markets, the greenium accounted for a more significant chunk of the spread than today, when spreads are wider and all-in yields are higher.

Finally, the growth in GSS markets means that there are more opportunities in extended sectors such as high yield and emerging market debt. Active managers have an opportunity to branch out into these sectors to mitigate some of the premium paid on high quality, investment grade GSS bonds. Greenium also has the potential to create a positive feedback loop that will result in a more liquid and diversified GSS market for investors. Because greenium is a reflection of strong demand, it should in turn lead to more issuance, since the cost of capital for GSS issuers is lower.

To summarise, we believe the GSS market represents a significant opportunity for investors for the following reasons:

Clear link between capital invested and sustainable projects

Strong demand dynamic and potential for capital appreciation

Opportunity for increased liquidity and diversification given growth of the market

Evaluating the sustainability of GSS bonds

Established international principles can provide guidance to issuers and investors around best practice for GSS bonds. The most prominent set of standards comes from the International Capital Markets Association, through their Green, Social and Sustainability Bond Principles. These set forth guidance for issuers on how they should select and articulate the projects to be financed, as well as setting standards for post-issuance compliance and reporting. Other initiatives, such as the Climate Bonds Initiative and the forthcoming EU Green Bond Standard, are aimed at increasing the quality of such issuances from a sustainability point of view. In addition, issuers will typically seek a second-party review of their framework, typically from specialist research and data providers, to add a layer of assurance for investors.

However, while these are legitimate and widely used handrails, investors should be aware that they are entirely voluntary. This increases the risk of greenwashing since, as we have seen, there is a strong incentive to issue GSS bonds given the lower cost of capital often achieved. We have seen issuers coming to market with bonds that profess to adhere to such priorities, but with inadequate reporting frameworks, or without a robust oversight committee dedicated to ensuring high standards. Some issuers have failed to provide clarity on how they will deploy the proceeds, with large numbers of projects but no clear commitment to segregate proceeds appropriately.

Moreover, the mere categorisation of an issuance as a green, social or sustainability bond doesn’t necessarily guarantee regulatory alignment in certain jurisdictions. Article 9 of the EU’s Sustainable Finance Disclosure Regulation, for example, demands a far more comprehensive set of hurdles to be overcome before a security can be considered suitable for inclusion in an Article 9 portfolio. For example, issuers must have good governance, and must do no significant harm against EU taxonomy objectives: these are not explicitly accounted for in international GSS bond frameworks, and it is down to investors to make these judgements.

This is why active management is particularly important in the GSS market: it may be tempting to take the word of a second-party opinion, and take the label at face value, but we think investors need to apply particular scrutiny, to reduce the risk of greenwashing and to be confident that bonds are being issued in good faith.

Conclusion

Given the scale of the global challenges we face, there is clear momentum for green and social financing. The green, social and sustainability bond markets have experienced huge growth in recent years, and the broader GSS universe is now a sizeable and diversified opportunity set, with core fixed income characteristics. We believe this is an opportune moment to be adding such exposure to a broader portfolio, given the economic outlook and the repricing we have seen in fixed income markets. The sustainability characteristics of GSS bonds can also help investors meet regulatory requirements and see that their capital is being directed toward sustainable initiatives.

There are international standards against which such bonds can be assessed, but in order to gain real confidence in the validity of these bonds, active management is required.

A note on sustainability-linked bonds

An interesting – and more recent – development is the growth in the sustainability-linked bond market. These bonds – popular in the high yield market – are different from ‘use of proceeds’ bonds in that capital can be used for any purpose. Instead of financing sustainable projects, the issuer will be required to meet certain sustainability targets – reducing carbon emissions, for example. If they fail to meet these targets, a penalty – typically a step-up in the coupon paid on the bond – may be applied, or the issuer might be rewarded with a lower coupon for successfully meeting targets.

There are key challenges in this relatively nascent market: some sustainability-linked bonds might look sustainable on the face of it, but in some cases the issuer’s targets might not be very ambitious, and the magnitude and timing of penalties is insufficient. Therefore, as with use of proceeds bonds, active management and heightened scrutiny is key. Nevertheless, sustainability-linked bonds can be an interesting proposition, and their emergence reflects broad-based innovation in fixed income when it comes to sustainability.

1 Organisation for Economic Co-operation and Development (OECD), estimate as of December 2020.

2 Estimate by Intergovernmental Panel on Climate Change (IPCC), based on global emissions data from 2010.

3 International Renewable Energy Agency (IRENA), “How to Transform the Energy System and Reduce Carbon Emissions” (https://www.irena.org/Digital-content/Digital-Story/2019/Apr/ How-To-Transform-Energy-System-And-Reduce-Carbon-Emissions)

4 McKinsey, ‘Diversity Wins: How Inclusion Matters’, May 2020 (https://www.mckinsey.com/featured-insights/diversity-and-inclusion/diversity-winshow-inclusion-matters).

5 J.P. Morgan Asset Management 2022 Future Focus Survey, November 2022.

6 HSBC Green Bond Insights, 30 September 2022.

7 HSBC Global Research, Green Bond Insights, September 2022.

8 JPMorgan Chase & Co, ‘Going Green in Europe’, August 2022.

9 PwC, ‘ESG Transformation of the Fixed Income Market’, 2022. https://www.pwc.lu/en/sustainable-finance/esg-transformation-fixed-incomemarket.html

10 John Caramichael and Andreas Rapp, ‘The Green Corporate Bond Isuance Premium’, June 2022.

This is a marketing communication. The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment or interest thereto. Reliance upon information in this material is at the sole discretion of the reader. Any research in this document has been obtained and may have been acted upon by J.P. Morgan Asset Management for its own purpose. The results of such research are being made available as additional information and do not necessarily reflect the views of J.P. Morgan Asset Management. Any forecasts, figures, opinions, statements of financial market trends or investment techniques and strategies expressed are, unless otherwise stated, J.P. Morgan Asset Management's own at the date of this document. They are considered to be reliable at the time of writing, may not necessarily be all inclusive and are not guaranteed as to accuracy. They may be subject to change without reference or notification to you. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and investors may not get back the full amount invested. Past performance and yield are not a reliable indicator of current and future results. There is no guarantee that any forecast made will come to pass. J.P. Morgan Asset Management is the brand name for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide. To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our EMEA Privacy Policy www.jpmorgan.com/emea-privacy-policy. This communication is issued in Europe (excluding UK) by JPMorgan Asset Management (Europe) S.à r.l., 6 route de Trèves, L-2633 Senningerberg, Grand Duchy of Luxembourg, R.C.S. Luxembourg B27900, corporate capital EUR 10.000.000. This communication is issued in the UK by JPMorgan Asset Management (UK) Limited, which is authorised and regulated by the Financial Conduct Authority. Registered in England No. 01161446. Registered address: 25 Bank Street, Canary Wharf, London E14 5JP

09gu223110162427