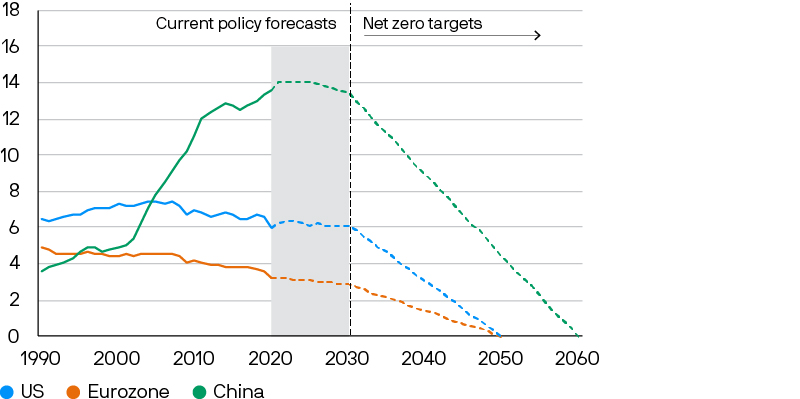

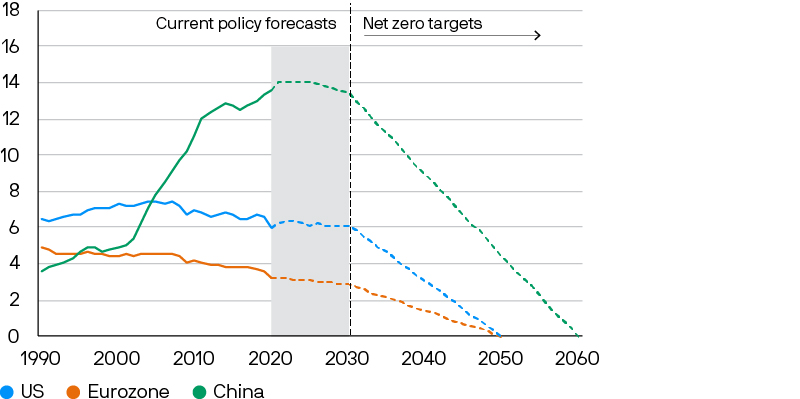

Government policy is the first driver. On the environment, for example, the Paris Agreement has created significant momentum behind tackling climate change since it was signed in 2016, with the goal of limiting global warming to well below 2 degrees Celsius compared to pre-industrial levels. More than 70 countries and regions – representing over 75% of global greenhouse gas (GHG) emissions – have now set ambitious targets to slash emissions over the coming decades, yet progress remains limited so far (see Exhibit 1).

Exhibit 1: Greenhouse gas emission targets

Billion tonnes / year, CO2 equivalent

Source: Climate Action Tracker, J.P. Morgan Asset Management. Current policy forecast is the September 2021 forecast provided by Climate Action Tracker for the US and EU, and the May 2022 forecast for China. CO2 equivalent tonnes standardise emissions to allow for comparison between gases. One equivalent tonne has the same warming effect as one tonne of CO2 over 100 years. Guide to the Markets - UK. Data as of 30 June 2022.

Significant policy changes will be required to get the climate trajectory back on track, both in the form of “carrots”, such as new spending on climate-friendly projects, and “sticks”, which include new taxes and regulations. In response, we’ve seen the creation of several private sector initiatives to align with the goals of the Paris Agreement, such as the Net Zero Asset Managers Initiative (NZAMI) and the Net Zero Asset Owners Alliance (NZAOA). Through setting targets and requirements for signatories, such as setting interim net-zero portfolio targets, these initiatives aim to translate the science into concrete actions and facilitate the transition across the investment landscape.

Major changes to the global energy mix are a key pillar of climate ambitions. Renewables make up less than 10% of the energy mix today, but estimates from the BP Energy Outlook 2020 suggest that they will need to increase to around 60% over the next 30 years if net zero targets are to be reached. This shift may pose major challenges for industries that are heavily reliant on fossil fuels while also creating opportunities for companies that can facilitate the transition, which highlights the importance of reflecting environmental factors in any investment decision. (We discuss these trends in more detail in “Achieving net zero: The path to a carbon-neutral world”.)

ESG considerations are also impacting consumer preferences and public attitudes, which in turn are driving corporate action. Consumers are making purchasing decisions with sustainability in mind, and they are voting with their wallets. These changes have ripple effects. Not only are companies under pressure from the bottom up via the way that their customers spend their money, but governments are also under pressure to apply “top down” pressure given increased scrutiny from their electorates. For investors, this creates compelling opportunities to invest in those companies that have responded by incorporating ESG considerations into their operations or those offering products and services that directly address sustainability challenges.

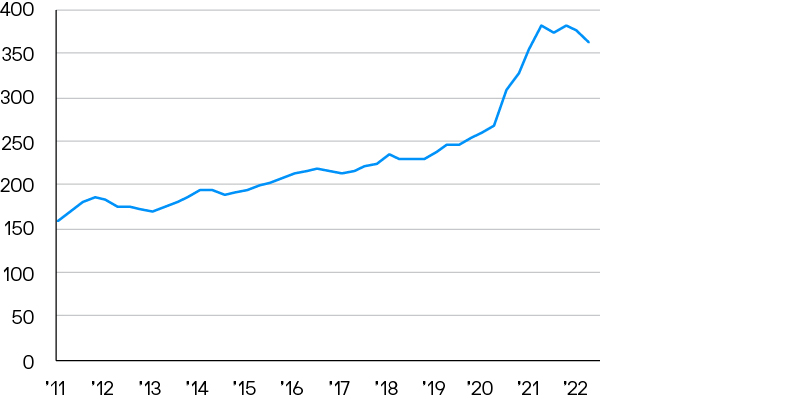

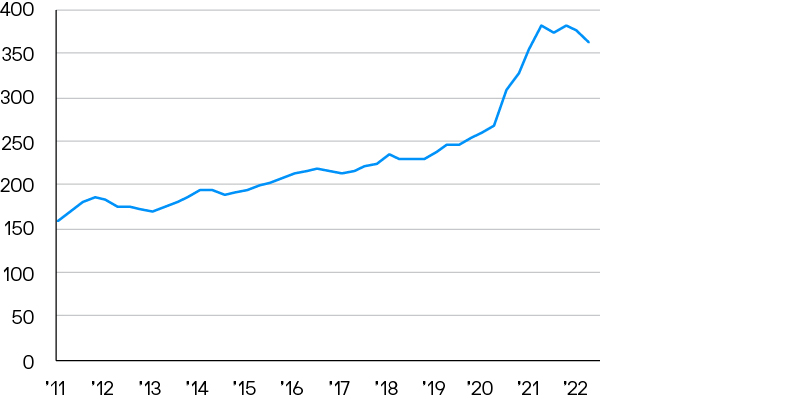

At the same time, social and governance factors are coming to the fore after a decade of lacklustre real wage growth, particularly in low- and middle-income households, and with the Covid-19 pandemic shining a spotlight on the way in which companies treat their workforce. Corporate recognition of the importance of diversity and inclusion within the workforce, for example, has accelerated, as evidenced by the sharp increase in the number of times these terms have been mentioned during earnings calls over the past two years (see Exhibit 2). In the EU, a social taxonomy is under consultation (to complement the existing environmental taxonomy) which will help define more clearly what constitutes a social investment and those activities that contribute to achieving social objectives. Meanwhile, governance standards, such as board diversity and risk management practices, are also receiving much greater scrutiny.

Exhibit 2: Corporate mentions of diversity and inclusion in earnings calls

Number of mentions for MSCI ACWI companies, four-quarter moving average

Source: MSCI, J.P. Morgan Asset Management. Data as of 30 June 2022.

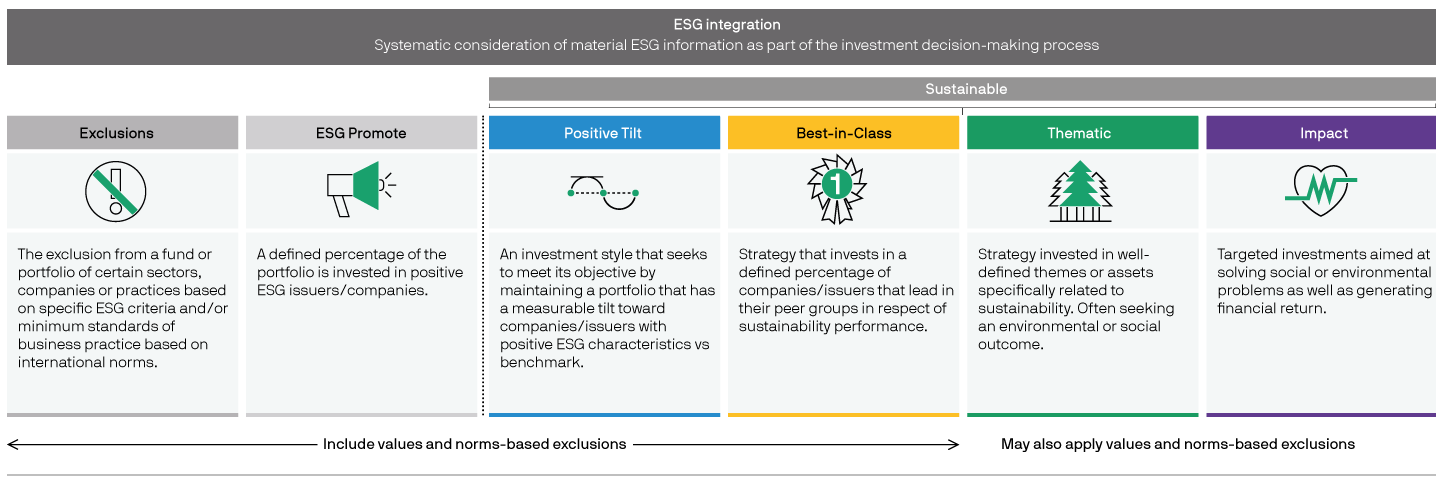

As investors look to better reflect ESG factors within their portfolios, the nature of investment flows is changing, further boosted by regulators raising the bar around disclosures, such as the EU Sustainable Finance Disclosure Regulation (SFDR). Sustainable investment funds in Europe have gone from receiving 15% of net flows in 2017 to more than 100% of net flows in the first half of 2022, according to data from Morningstar. This trend, in itself, could influence valuations over time, with companies that rank highly on ESG metrics benefiting from a lower cost of financing.