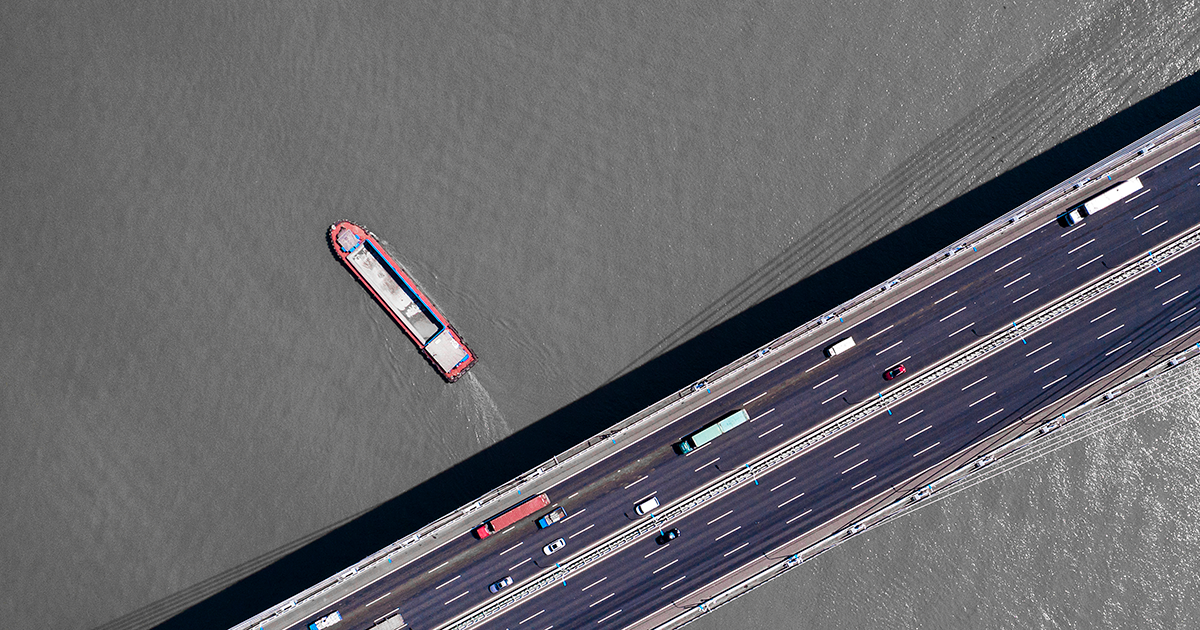

Core Transportation investing generates steady and resilient returns through economic and geopolitical disruption.

In Brief

- Limited supply of backbone assets amidst global trade growth underpins the necessity of transportation investment.

- Investing in the most energy efficient assets, ensures longevity and demand from end users.

Supply Chains In Focus

Geopolitical conflicts and tensions, shifting global supply chains, and a continued need for investment supporting decarbonization efforts underpin our positive 12–18-month outlook for the transportation sector. The transportation asset class is expected to maintain its low correlation to public markets and other alternative asset classes while delivering diversified source of consistent income-oriented returns.

Given transportation’s resilient and stable returns during the past several years of volatile markets, we expect the asset class to continue providing investors with reliable returns and income through today’s volatility and a looming global economic slowdown. We attribute this resilience to these assets' key function in driving the global economic engine by moving raw materials and finished goods to their next stage in the value chain.

As global supply chains shift due to sanctions and conflict, key commodities must be sourced further away from their end markets, leading to forecasted strength in lease rates as tonne-miles increase even in the face of slower growth in global demand.

Recent increases in geopolitical tensions near critical trade corridors in the Red Sea have led some maritime charterers to take alternative routes for trade. For example, shifting trade away from the Suez Canal to the Cape of Good Hope in southern Africa can add on average 10-14 days to normal transit times; potentially significantly increasing the tonne-mile demand for maritime assets around the world. Assets remain protected with insurance coverage and though premiums have risen 10X due to conflict, these additional costs are borne by charterers/lessees.

Despite the global economic headwinds and continued focus on global growth expectations, we are constructive on global transport in the year ahead, with sanctions shifting and lengthening existing supply chains. Global maritime order books remain low in specific sectors, and shipyard overcapacity will keep supply of assets tight even in the face of slower global trade growth. However, ambiguity surrounding asset configurations has restrained the pace of new orders and kept supply tight.

Energy Logistics: The ongoing war in Ukraine has largely shifted natural gas supplies away from legacy sources in Russia. A Limited supply of liquid natural gas (LNG) carriers, due to constrained shipyard capacity to build more assets, has led to elevated lease rates in both spot and long-term charter markets, that are expected to continue beyond 2024. Continued investment in floating storage regasification units (FSRUs) and other land based fixed regasification facilities is required in Europe to meet ongoing demand because of the monumental shift in energy supply chains.

Maritime: The maritime segment outlook remains stable and has normalized to historical averages after several years of supply chain pressures from the pandemic. We expect slow growth in the coming year but limited orderbooks to contain the downside. Long duration leases with high credit quality counterparties should insulate against the downside pressures.

Aviation: We expect continued improvements in domestic passenger volumes as pandemic-induced travel restrictions have phased out and aviation travel has returned largely to pre-pandemic levels. Lease rates for aircraft should be positively impacted by the continued recovery in travel demand, a low supply of new aircraft, and inflation kickers in 2024. Sovereign-backed carriers remain attractive counterparties if, governments prioritize airline service and continue to support their national carriers as they have historically demonstrated.

Railcar Leasing: The outlook for the rail freight market remains positive with the potential of a Fed soft landing in the United States. Supported by investments in the recent Inflation Reduction Act and increased retirement of older assets, railcar leasing remains an attractive market, especially in North America. Jones Act restrictions on international maritime trade in the United States continues to make freight rail a critical conduit for moving goods across the continent. Rail remains the most fuel-efficient method to transport cargo over land, an attractive alternative for shippers in a higher fuel cost environment.

ESG Aligned Investing

An intense focus on reducing the transportation sector’s impact on global emissions has been the goal of end users, regulatory bodies, customers, and investors. Innovative fuel solutions ranging from methanol and biomass sources to hydrogen and ammonia are being researched as low carbon emitting energy sources but require further investment and R&D to become commercially viable.

With these new fuels will be increased requirements for investment in modifying existing assets, designing and constructing next-generation assets, and the associated global infrastructure to support these new fuelling methods.

Attaining financing is increasingly linked to environmental performance as ESG standards rise. Market participants with ample access to capital will be better positioned to make the necessary investments in green technology solutions, and to meet end-user demand for environmentally friendly assets.

Looking Forward.

Against a weaker global economic macro backdrop, we expect consistent returns through several preferred strategies.

A diversified portfolio: A diversified approach to core-plus transportation investing allows for shifting to the subsectors with the best relative value. For example, the Covid-19 pandemic significantly impacted the aviation sector. As such, our capital deployment was tactically redirected to the maritime and energy logistics sectors, where industry fundamentals remained strong.

Energy transition: With the severance of gas pipelines from Russia to the European Union, we continue to like investments in assets that directly support the energy transition. These include next-generation liquefied natural gas (LNG) carriers, offshore wind farm maintenance and installation vessels, and charging infrastructure for electric vehicles (EVs).

The supply chain disruption in natural gas markets is expected to continue through 2024 and beyond, with traditional gas pipelines to the European Union being supplemented or replaced by LNG carriers acting as floating pipelines from North America and the Middle East which create further supply tightness and continued profitability for asset owners.

Partnering with leading operators: Partnering enables the asset owner (investor) and operator to develop solutions that reduce the carbon footprint along the operator’s supply chain. In anticipation of changes coming to global industry standards across the maritime and land transport sectors, such partnerships enable technology transfer and capital risk sharing.

Looking ahead, risks include the headwinds associated with global demand and potential for slower global growth; the duration and severity of any economic contraction adds risks to future lease rates.

Other risks: The threat of technological obsolescence for older assets, uncertainty of clean fuel options, and how these fuels will be supplied and distributed (over the long term).