The US Labour Market: Cooling, but not collapsing

Understand why the US labour market is cooling and what it means for the economy.

Why Alternatives?

Discover the different categories of alternative investments and how they can enhance your portfolio.

Understand why the US labour market is cooling and what it means for the economy.

Explore our article on whether a slowing US economy challenges expectations for corporate earnings.

Read our latest On the Minds of Investors article to understand what the outcome of the French National Assembly elections could mean for investors.

We explore what the UK election means for the economy and markets.

Japanese equities are in the spotlight, but investors should be mindful of the risks as well as the opportunities

We explore the potential economic and market scenarios stemming from escalating tensions in the Middle East.

Europe has made structural improvements and we think investors should sit up and take notice.

We look at why we think investors should look to diversify their exposure to the magnificent seven US stocks.

This paper, written by Tilmann Galler and Chaoping Zhu, discusses the recent Chinese economic data releases and the investment implications.

This paper, written by Chaoping Zhu, Marcella Chow and Tilmann Galler, discusses the outlook of China and policy implications.

Understand the drivers of small cap valuations and find out why small cap stocks could still offer attractive opportunities for long-term investors.

Read about the complex issues at the heart of measuring the financial impact of ESG investing.

This paper, written by Tai Hui and Tilmann Galler, discusses the outlook for India equities and the investment implications.

Green bonds are attractive instruments for working towards positive environmental benefits. Find out why demand for green bonds from investors is expected to continue to grow.

A forced and rapid energy transition is under way. Discover what impact this will have on commodity markets and clean energy investment opportunities.

ETF Perspectives

Explore insights from J.P. Morgan Asset Management’s ETF research. In addition discover data and commentary on current topics related to ETF classes and strategies.

Sustainable Investing Insights

We believe that ESG considerations can play a critical role in a long-term investment strategy.

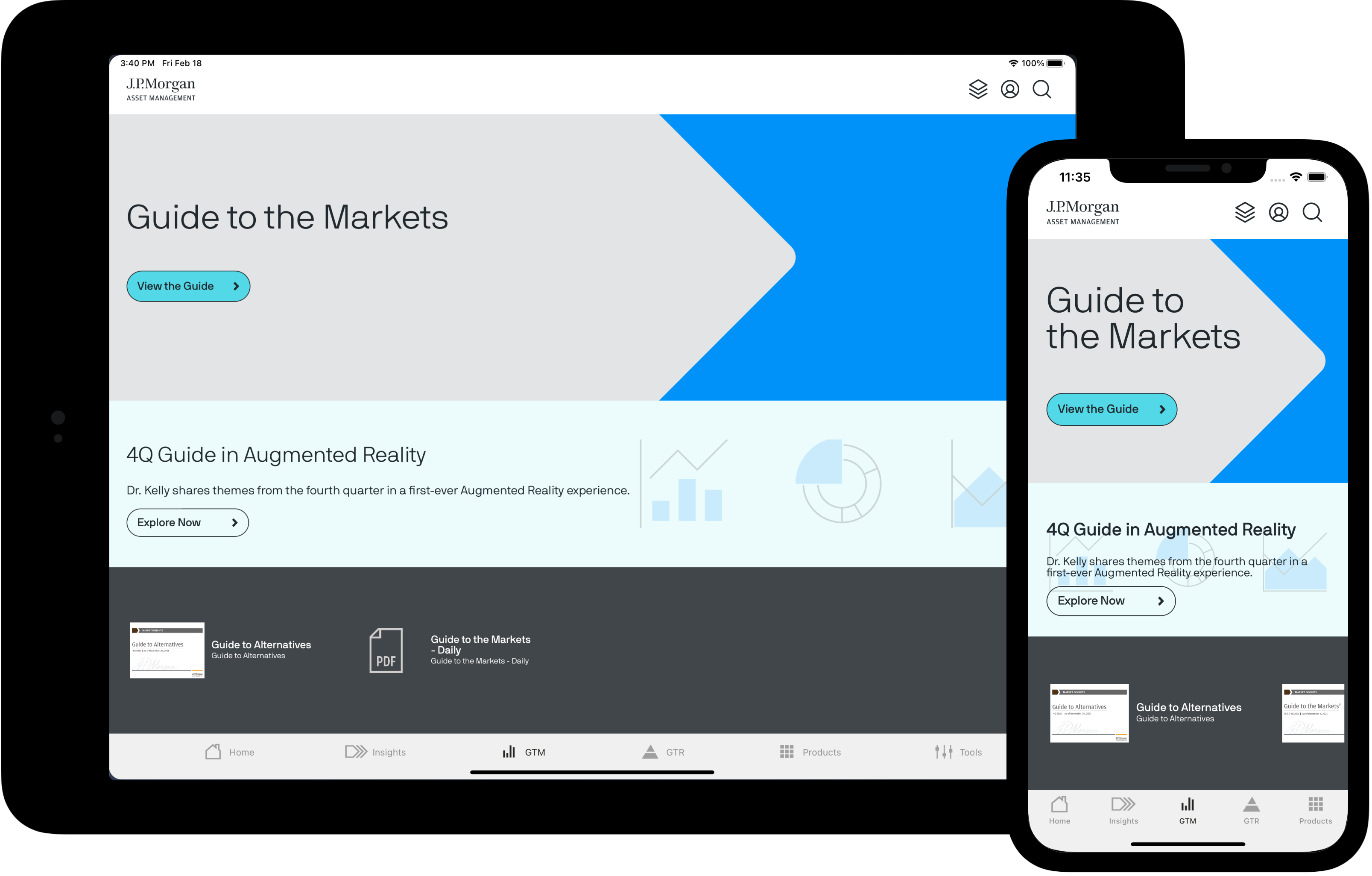

24/7 access to market views, allocation insights, portfolio analytics, presentation tools and more

The value of investments may go down as well as up and investors may not get back the full amount invested.