Given today’s ultra-low interest rates, more women need to consider investing if they want to achieve their retirement dreams.

In today’s world of low interest rates and rising inflation, savers may need to find another way to provide the income they need once their working days are over. Your dreams of retirement may have to be tempered if your savings don’t stretch far enough. Which is a real danger given we’re all living longer. It’s more likely than not that at least one half of a 65-year-old couple will celebrate a 90th birthday. Good health in your golden years could equate to a long and active retirement – but only if you have enough capital to get you through.

Our Women and Investing Survey, which was conducted in January 2021 and questioned nearly 4,000 women across 10 European countries, found that 42% of women cited saving for retirement as the primary reason to set aside funds. That figure increased to more than half (51%) for the older group of interviewees (those aged 45-60).

However, while women broadly understand the need to save for retirement, the survey does reveal a disconnect between the desire to build a pension pot and the methods used to achieve this aim, with many women continuing to rely only on cash savings. In the current low interest rate environment, with inflation on the rise, cash savers face the very real prospect of seeing their savings eroded over time, rather than growing to provide them with the retirement they dream of.

Investing, which offers the potential to grow savings ahead of inflation over the long term, is still seen as a risky game rife with volatility. Too few see investing as a stable path to achieving their retirement goals. However, investing provides the opportunity to build wealth that will be available once you retire in a way that cash currently can’t.

How to get started

It’s important to realise that investing isn’t necessarily as risky as you may think. Taking a long view and maintaining a diversified portfolio are key principles to stick to when devising a retirement investment plan. When it comes to retirement, most savers have decades to build their pension pot. Investing over a long period of time allows you to weather those inevitable market downturns brought on by unexpected events, such as we’ve recently seen with the Covid-19 pandemic. However, you should also look to reduce risk as you approach retirement to avoid nasty shocks, by moving towards government bonds and eventually back to cash.

Diversification is the other key component to pension investing. A portfolio that is spread across regions, markets and different types of investment (equities, bonds, property etc) allows you to balance the natural ups and downs of the market, and greatly reduces the possibility of suffering large losses all at once.

You can pick and choose the assets that most appeal to you: do you prefer the relative safety of investing in government bonds? Are you willing to take a chance on riskier equities? Or you can invest in multi-asset funds that use professional fund managers to choose allocations to equities and bonds (and other investments) depending on the market backdrop.

Particularly popular among investors today, and especially women investors according to our survey, are investment funds that support businesses focused on sustainability. In fact, 77% of the women who responded to our survey said they believe sustainable investing will make a positive difference to society. Sustainable investing provides an attractive way to align your retirement savings with your desire to effect positive change.

A hybrid retirement plan

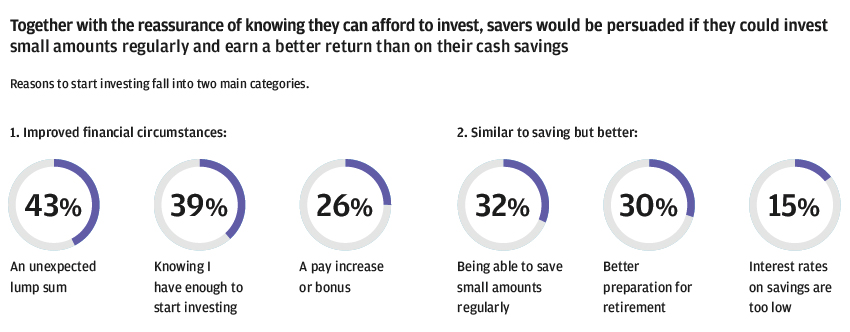

Our survey found that many women savers would also consider investing if they could invest small amounts regularly. Understandably, traditional savers are attracted to a retirement platform that behaves more like a savings account. Regular savings plans work in just this way, allowing investors to invest small amounts — as little as €50 — on the same day each month, whether the market is up or down. Rather than trying to time the market, you can build your wealth gradually over time.

Compounding is key

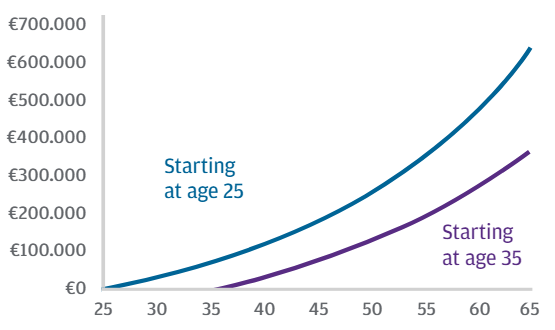

Investing regularly in a savings plan is so effective thanks to the magic of compound interest. Compounding is what happens when you earn returns not only on your initial investment, but also on any accumulated gains from prior years, allowing you to accelerate capital growth over time. It is akin to earning interest on interest: your money grows as you pay regular amounts in and is further enhanced by capital appreciation. The reinvestment of dividends is a great way to further boost funds through compounding.

To reap the greatest benefits from compounding and to have the greatest opportunity to achieve your retirement goals, it’s important to start investing as soon as you can. Don’t delay: compounding has a bigger effect the further from retirement you are.

Start sooner rather than later

Traditional cash savings no longer provide safe passage to financial security in your retirement years. Starting a regular savings plan and beginning to invest for your retirement sooner rather than later is perhaps your best bet for future financial security. The ability to put aside regular amounts makes the process affordable and familiar for cash investors, while the opportunity to benefit from compound growth and dividend reinvestment is a bonus that cash savers just can’t compete with in today’s low rate world.

Find out how to make your clients savings work harder for their retirement. Help them take the steps from being a saver to an investor today.