The investment environment over the past three years has been especially difficult to navigate because the drivers of market direction have fluctuated wildly. In the early days of the pandemic, technology and other growth stocks rose dramatically as investors focused on technology’s capacity to meet the many challenges posed by the pandemic. The advent of effective vaccines and an end to lockdowns saw investors rotate away from growth stocks into cyclical and value stocks as the post-pandemic economic rebound gathered momentum. But optimism soon collapsed as Russia’s invasion of Ukraine fuelled nascent inflation pressures and set central banks on a path of aggressive monetary tightening. This sudden rise in interest rates reduced the valuations of growth and long duration stocks, putting this sector of the market under renewed pressure, while also raising recession fears. More recently, a surge of interest in the potential of artificial intelligence (AI) to disrupt and transform business practices and raise productivity boosted a very select number of technology stocks at the forefront of the AI revolution. Many investors have found themselves on the wrong side of these major, and sudden, shifts in market direction, and investment returns have suffered accordingly.

Stock selection the main reason for JGGI’s success

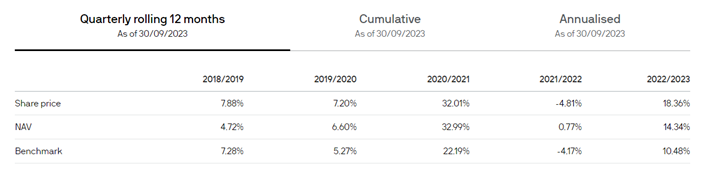

But this has not been the case for JPMorgan Global Growth and Income (JGGI). It has delivered consistently strong performance over the past three years, despite the dramatic fluctuations in market sentiment. The Company has outperformed its benchmark, the MSCI AC World Index, every calendar year since 2019, and is ahead of the index in 2023, year-to-date. In the three years ended 30 September 2023, JGGI has made an average annual return of 15.29% in NAV terms and 14.15% on a share price basis, compared to the index return of 8.96%. The Company has also outperformed its closest growth and income focused investment company peers over this period.

Stock selection has been the main reason for JGGI’s success. And its managers are very selective - less than 3% of the companies within its investment universe make it into JGGI’s portfolio. The managers only target high quality businesses with long-term earnings power and significant valuation upside, and they need to be very confident that prospective investments are ‘masters of their own fate’ thanks to their low debt levels, resilient balance sheets and incentivised management teams.

The result of this careful and discriminating selection process is that more than 75% of JGGI’s portfolio consists of stocks rated ‘premium’ or ‘quality’ according to J.P. Morgan Asset Management’s internal rating system. This compares to the index, where less than 50% of stocks have these high ratings. Furthermore, the forecast earnings growth of JGGI’s holdings averages almost 12% per annum, faster than the index’s 8.8% projected earnings growth. Yet, JGGI’s managers are always mindful of valuations and do not overpay for this quality - the forecast free cashflow yield of the portfolio, at 5.8%, is close to that of the benchmark.

High conviction portfolio

So, which companies are good enough to satisfy JGGI’s exacting selection criteria? Many are familiar, high growth names. The Company’s largest holdings include Amazon and Microsoft, as well as ChatGPT, the AI-powered language processor capable of conducting conversation and undertaking research and writing tasks. JGGI also holds semiconductor producers Taiwan Semiconductor Manufacturing Company (TSMC) and NVIDIA, which is the only company producing the sophisticated chips required for AI-powered tools.

All these businesses operate within strong oligopolies which facilitate attractive margins, and JGGI’s managers expect them all to generate further significant growth and valuation increases over time. The managers’ high conviction in Amazon is based in part on the fact that the company has invested heavily in state-of-the art distribution systems, which will improve its already substantial competitive edge. They like TSMC due to its dominant share of the global semiconductor market, while the positions in Microsoft and NVIDIA provide exposure to the burgeoning demand for AI-driven products. So too does JGGI’s smaller holding in Adobe, a digital media company with an AI business and significant barriers to entry due to its image copyrights.

JGGI’s managers seek to balance the portfolio by also owning a selection of defensive and cyclical stocks. Defensive holdings include Coca-Cola and Mastercard, which are high quality businesses well-positioned to cope with inflation. Coca-Cola’s pricing power has allowed it to maintain its margins despite rising costs, and it offers an attractive dividend yield, while Mastercard benefits from inflationary increases in the value of purchases, and from the rapid spread of cashless transactions. Both Coca-Cola and Mastercard feature in JGGI’s top 10 positions. The portfolio’s cyclical names include Taiwan Semiconductor Manufacturing Company (TSMC) and Deere. TSMC remains well poised to benefit from a cyclical uptick in semiconductor demand going into 2024 and remains ahead of competition in leading edge processes. Meanwhile Deere, the farming equipment company has a strong competitive moat around its business and remains a leader in utilizing data science and sensor-based technologies in their farming equipment.

There are hopes for better times, and less volatile markets, ahead - inflation pressures are receding, interest rates are near their peak, and likely to begin falling in 2024, while global growth is forecast to continue, albeit at a modest pace, this year and next. But it seems reasonable for JGGI’s shareholders to remain positive in the year to come.

More Insights

Image source: Shutterstock

The companies above are shown for illustrative purposes only. Their inclusion should not be interpreted as a recommendation to buy or sell.

Past performance is not a guide to current and future performance. The value of your investments and any income from them may fall as well as rise and you may not get back the full amount you invested.

Source: J.P. Morgan Asset Management/Morningstar. Net asset value performance data has been calculated on a NAV to NAV basis, including ongoing charges and any applicable fees, with any income reinvested, in GBP.

NAV is the cum income NAV with debt at fair value, diluted for treasury and/or subscription shares if applicable, with any income reinvested. Share price performance figures are calculated on a mid market basis in GBP with income reinvested on the ex-dividend date. The performance of the company's portfolio, or NAV performance, is not the same as share price performance and shareholders may not realise returns which are the same as NAV performance.

Summary Risk Indicator

The risk indicator assumes you keep the product for 5 year(s). The risk of the product may be significantly higher if held for less than the recommended holding period

Investment Objective:

To provide superior total returns and outperform the MSCI All Country World Index over the long-term by investing in companies based around the world. The Company makes quarterly distributions, that are set at the beginning of each financial year. On aggregate, the intention is to pay dividends totalling at least 4% of the NAV at the time of announcement. The manager is focused on building a high conviction portfolio of typically 50 - 90 stocks, drawing on an investment process underpinned by fundamental research. Portfolio construction is driven by bottom up stock selection rather than geographical or sector allocation. Currency exposure is predominantly hedged back towards the benchmark. The Company uses borrowing to gear the portfolio within a range of 5% cash to 20% geared under normal market conditions. The Company will repurchase its shares with the aim of maintaining an average discount of around 5% or less calculated with debt at par value.

Key Risks:

Exchange rate changes may cause the value of underlying overseas investments to go down as well as up. Investments in emerging markets may involve a higher element of risk due to political and economic instability and underdeveloped markets and systems. Shares may also be traded less frequently than those on established markets. This means that there may be difficulty in both buying and selling shares and individual share prices may be subject to short-term price fluctuations. Where permitted, a Company may invest in other Investment Funds that utilise gearing (borrowing) which will exaggerate market movements both up and down. This Company may use derivatives for investment purposes or for efficient portfolio management. External factors may cause an entire asset class to decline in value. Prices and values of all shares or all bonds and income could decline at the same time, or fluctuate in response to the performance of individual companies and general market conditions. This Company may utilise gearing (borrowing) which will exaggerate market movements both up and down. This Company may also invest in smaller companies which may increase its risk profile. The share price may trade at a discount to the Net Asset Value of the Company.

For Professional Clients only – not for Retail use or distribution.

This is a marketing communication and as such the views contained herein do not form part of an offer, nor are they to be taken as advice or a recommendation, to buy or sell any investment or interest thereto. Reliance upon information in this material is at the sole discretion of the reader. Any research in this document has been obtained and may have been acted upon by J.P. Morgan Asset Management for its own purpose. The results of such research are being made available as additional information and do not necessarily reflect the views of J.P. Morgan Asset Management. Any forecasts, figures, opinions, statements of financial market trends or investment techniques and strategies expressed are unless otherwise stated, J.P. Morgan Asset Management’s own at the date of this document. They are considered to be reliable at the time of writing, may not necessarily be all inclusive and are not guaranteed as to accuracy. They may be subject to change without reference or notification to you. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Changes in exchange rates may have an adverse effect on the value, price or income of the products or underlying overseas investments. Past performance and yield are not reliable indicators of current and future results. There is no guarantee that any forecast made will come to pass. Furthermore, whilst it is the intention to achieve the investment objective of the investment products, there can be no assurance that those objectives will be met. J.P. Morgan Asset Management is the brand name for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide. To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our EMEA Privacy Policy www.jpmorgan.com/emea-privacy-policy. Investment is subject to documentation. The Annual Reports and Financial Statements, AIFMD art. 23 Investor Disclosure Document and PRIIPs Key Information Document can be obtained in English from JPMorgan Funds Limited or at www.jpmam.co.uk/investmenttrust. This communication is issued by JPMorgan Asset Management (UK) Limited, which is authorised and regulated in the UK by the Financial Conduct Authority. Registered in England No: 01161446. Registered address: 25 Bank Street, Canary Wharf, London E14 5JP.

09z8240407104115