On Friday, 3 April 2020, the Peoples Bank of China (PBoC) announced its second targeted Reserve Requirement Rate (RRR) cut in less than three weeks, reducing the effective RRR for medium and smaller banks to record lows. Arguably, what’s more important was the accompanying reduction in the interest rate on excess reserves (IOER), the first cut in over a decade; which will pave the way for additional rate cuts and further interest rate reforms. Both actions also help the PBoC address concerns that its policy response was lagging the aggressive actions taken by other central banks.

The PBoC’s RRR Hat-Trick:

The 100bps RRR cut was widely expected following calls for additional monetary policy support at the State Council meetings three days earlier. The third RRR cut in 2020 will release ~CNY400bn of liquidity, while reducing bank funding costs, alleviating pressure on their loan-to-deposit ratios and increasing their ability to lend to small and medium enterprise clients.

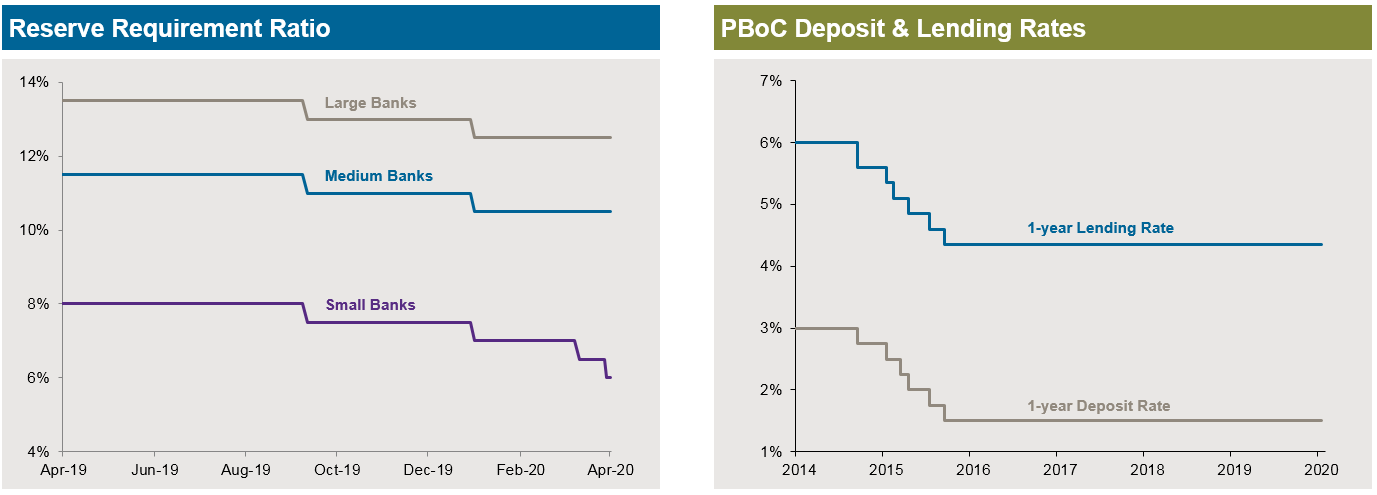

Unlike open market operations, RRR represent permanent and free increases in commercial bank liquidity. The previous 50bps targeted rate cut on 13 March released ~CNY550bn of liquidity, while the 2 January 50bps cut released ~CNY800bn of liquidity. Following the cuts, the RRR for large banks is 12.5%, while it is 9-10.5% for medium banks and 6% for smaller banks.

Fig 1: RRR rates for small and medium size banks are at record lows while benchmark interest rates remain unchanged

Source: Bloomberg & J.P. Morgan Asset Management; data as at 5 Apr 2020

The PBoC’s focus on RRR cuts has also clarified its policy stance and confirmed its hesitancy to change benchmark interest rates - reducing market expectations of a deposit or lending rate cut. Since interest rates were liberalized in 2015, the central bank has de-emphasized benchmark rates and focused on using its growing arsenal of quasi-monetary policy tools to fine tune liquidity and interest rates.

A benchmark lending rate cut would be an extremely strong signal of PBoC’s intentions and directly reduce funding costs for borrowers. But it would also reduce commercial bank’s net interest rate margins unless accompanied by a benchmark deposit rate cut – which the PBoC appears reluctant to do – given the risk of penalizing small retail deposits, which still represent over 60% of commercial bank liabilities.

IOER – Guiding rates lower:

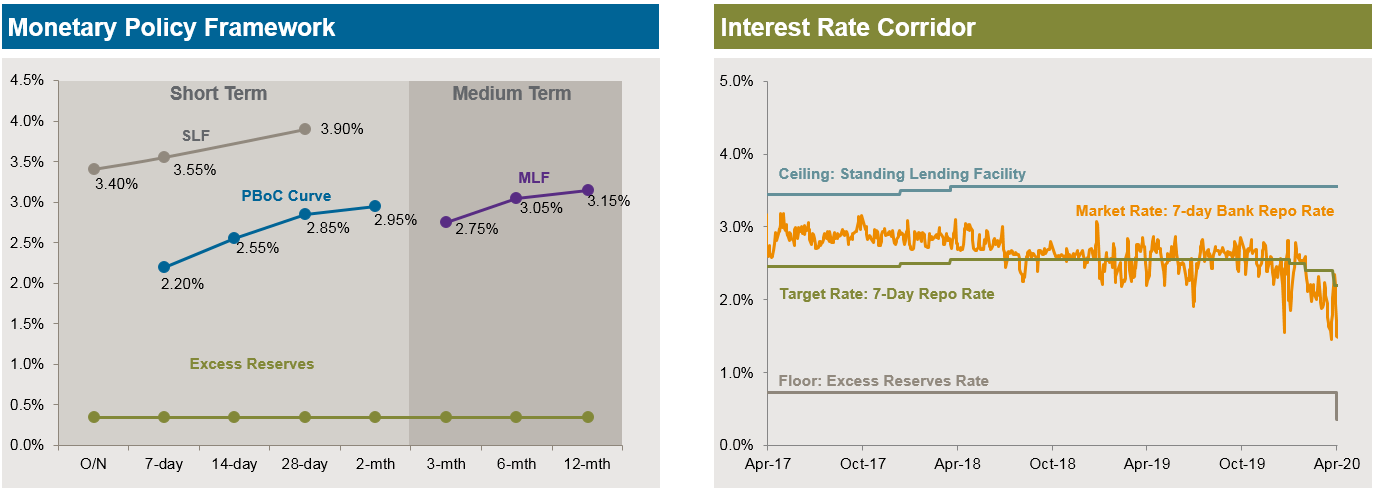

Excess reserves are the additional cash balances that commercial banks hold with the PBoC. The 37bps IOER cut is the first time this rate has been reduced since November 2008. At the end of 2019, excess cash balances represented 2.4% of total deposits; reducing the IOER will encourage commercial banks to invest their excess cash balances elsewhere – pushing interest rates on risky assets lower.

Fig 2: China’s monetary policy framework is focused on controlling the 7-day reverse repo rate within an interest rate corridor.

Source: Bloomberg & J.P. Morgan Asset Management: data as at 5 Apr 2020

The IOER also forms the lower bound of the central banks interest rate corridor, while the 7-day reserve repo rate acts as the target rate and the standing lending facility (SLF) forms the upper bound.

Reducing the IOER paves the way for additional rate cuts and improves forward guidance. The PBoC has already cut the 7-day reverse repo rate three times this year - the latest 20bps reduction on the 30th of March to 2.20%. A SLF cut is now likely as the central bank guides market driven interest rates even lower.

PBoC - Converging and clarifying:

As the first country to be affected by the COVID-19 outbreak, the Chinese economy has witnessed significant economic disruption. The government and PBoC reacted quickly to stabilize the economy, however, their subsequent fiscal and monetary policy response has been relatively muted by international standards. While major central banks have slashed interest rates and introduced quantitative easing, the PBoC has relied on a series of mini-steps, including liquidity injections and modest quasi-monetary policy rate cuts to stabilize and support financial markets.

While high frequency trackers signal a revival in domestic economic activity, the expanding global shutdown threatens to derail China’s prospects of a v-shaped recovery, prompted renewed dovish comments from the Politburo and Standing Committee - which triggered the latest PBoC actions.

Implications for RMB Money Markets:

The recent PBoC rate cuts will place additional downward pressure on market driven rates, Shibor rates have already trended lower while the yield curve has flattened. Meanwhile, refinements to the central bank interest rate corridor will pave the way for more aggressive future monetary policy actions, but the PBoCs reluctance to cut benchmark interest rates will increase the divergence between policy and market driven rates – creating additional investment challenges for money market investors.