In brief

- The Reserve Bank of Australia (RBA) reduced the cash rate target by 25 basis points (bps) to 3.60%, citing continued moderation in inflation and further easing of the labour market.

- Despite growth and inflation aligning with forecasts, the RBA noted that global economic uncertainty and trade policies pose risks to Australia's outlook.

- For AUD cash investors, deposit rates will decline following the rate cut, but the RBA’s cautious outlook suggests any future rate cuts will be gradual, with base rate nearing neutral.

Introduction

In its latest monetary policy decision, the Reserve Bank of Australia (RBA) opted to lower the cash rate target by 25 bps to 3.60%. The decision reflects the RBA’s satisfaction that inflation is “continuing to decline back toward the mid-point of the 2-3% range.” However, while the Board's decision was unanimous, the accompanying statement emphasized a cautious approach to monetary policy amidst a backdrop of global uncertainty.

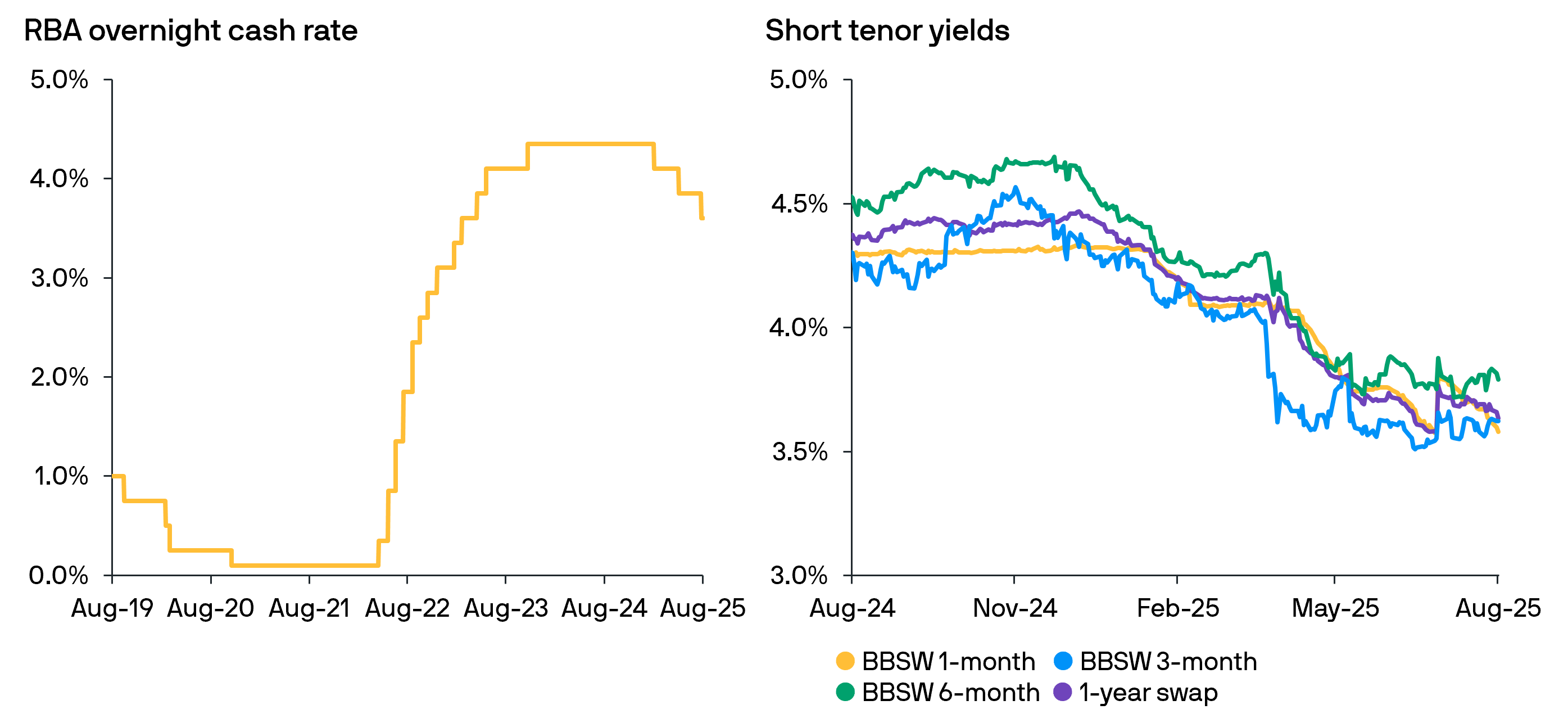

Fig 1: RBA cut rates for the third time in current cycle; BBSW yields have stabilized as markets priced in rate cuts.

Source: RBA, Bloomberg and J.P. Morgan Asset Management; data as at 12th August 2025.

Growth and Inflation Developments

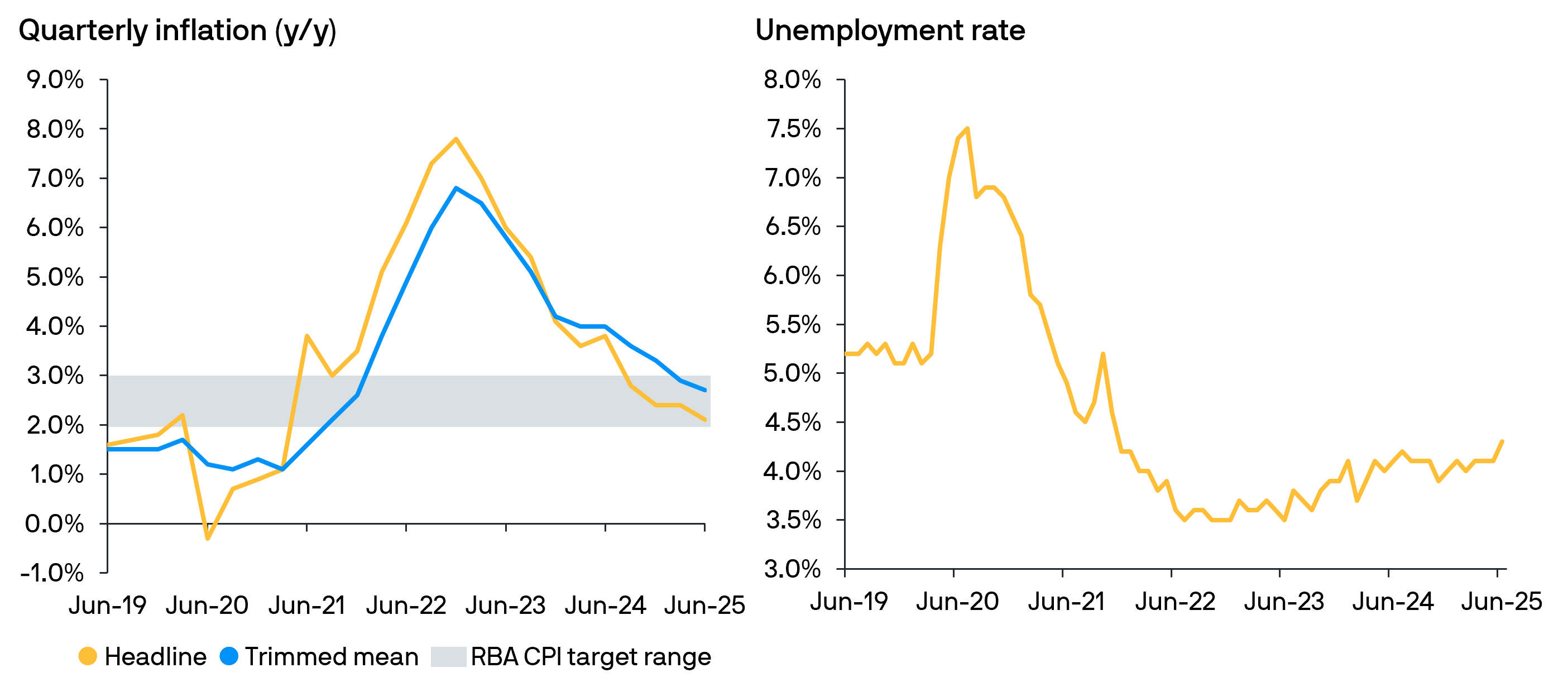

The RBA's decision to cut the cash rate was underpinned by a continued moderation in inflation. Governor Bullock noted that they "had made good progress on bringing inflation down over the past 18 months.” Higher interest rates have helped align aggregate demand and potential supply. The central bank confirmed that the latest headline and core inflation prints were in-line with earlier forecasts. The updated staff projections suggest that underlying inflation will continue to moderate towards the mid-point of the 2–3% range, assuming a gradual easing path for the cash rate.

Fig 2: Headline and core inflation are now within RBA’s target range; unemployment has ticked higher but remains low.

Source: Bloomberg and J.P. Morgan Asset Management; data as at 12th August 2025.

Despite the positive inflation developments, the RBA highlighted that "uncertainty in the world economy remains elevated." Trade policy developments are expected to adversely affect global economic activity as households and firms delay investments and expenditure.

Nevertheless, the RBA's forecasts for economic growth remain optimistic. Private demand appears to be gradually recovering, supported by rising real incomes, easier financial conditions, and a still robust labour market. However, they noted that unemployment rate has ticked higher. This indicates some easing in labour market conditions while productivity remains low.

A Cautious Path

At the subsequent press conference, Governor Bullock confirmed that the RBA's decision to lower the cash rate reflected their “increasing confidence that inflation is on track to be in the target range on a sustainable basis.” However, she maintained a cautious outlook, acknowledging the heightened economic uncertainty. She also noted the delicate balance the RBA is striving to achieve between maintaining price stability and supporting economic growth. While emphasizing the bank’s commitment to data dependent, Governor Bullock indicated that "the cash rate might need to be a bit lower than it is today to keep inflation low and stable and employment growing."

Governor Bullock’s comments suggest the possibility of further rate cuts, but we expect this will be a slow and gradual process. With the cash rate already reduced by 75 bps from a lower peak compared to other central banks, the RBA is likely approaching a neutral stance. Given the modestly positive economic outlook, the bank is unlikely to see a need to increase the pace or magnitude of future rate cuts.

For AUD cash investors, interest rates have declined to a two-year low but remain attractive compared to historical levels. With the central bank likely nearing the end of its rate-cutting cycle, a normalization of the yield curve could present opportunities to slightly extend duration. However, amid global economic uncertainty, we continue to emphasize diversification across maturities and instruments to achieve optimal risk-adjusted returns.