PBoC reinforces its dovish stance

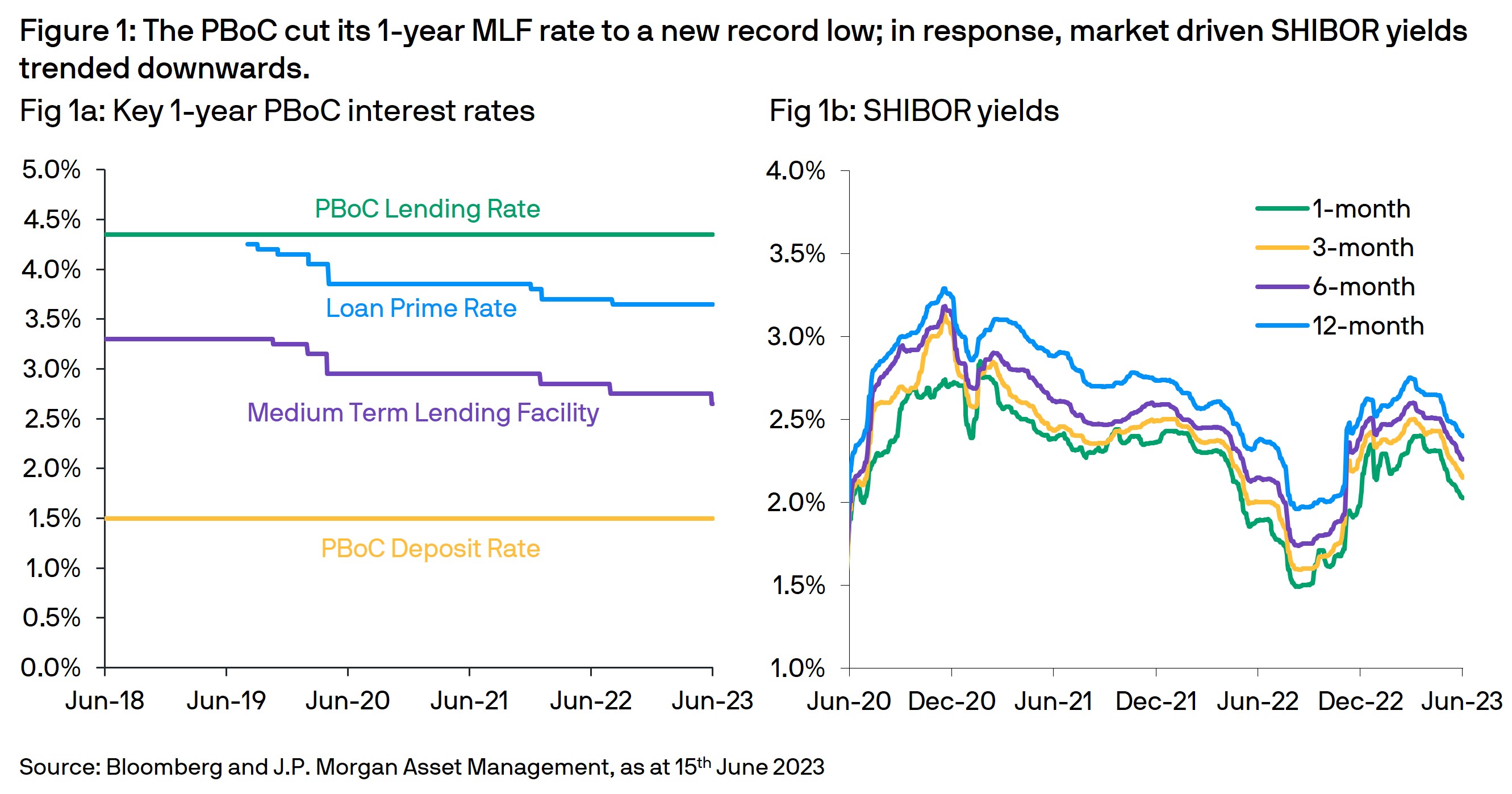

In a widely anticipated move, the Peoples Bank of China (PBoC) cut its 1-year Medium-Term Lending Facility (MLF) by 10bps to 2.65% (Fig 1a) on the 15th of June. The action follows a 7-day Repo cut and a Standing Lending Facility (SLF) rate cut last week and highlights the central bank’s decisively dovish pivot as the authorities seek to stabilize China’s faltering economic recovery.

Faltering economic growth

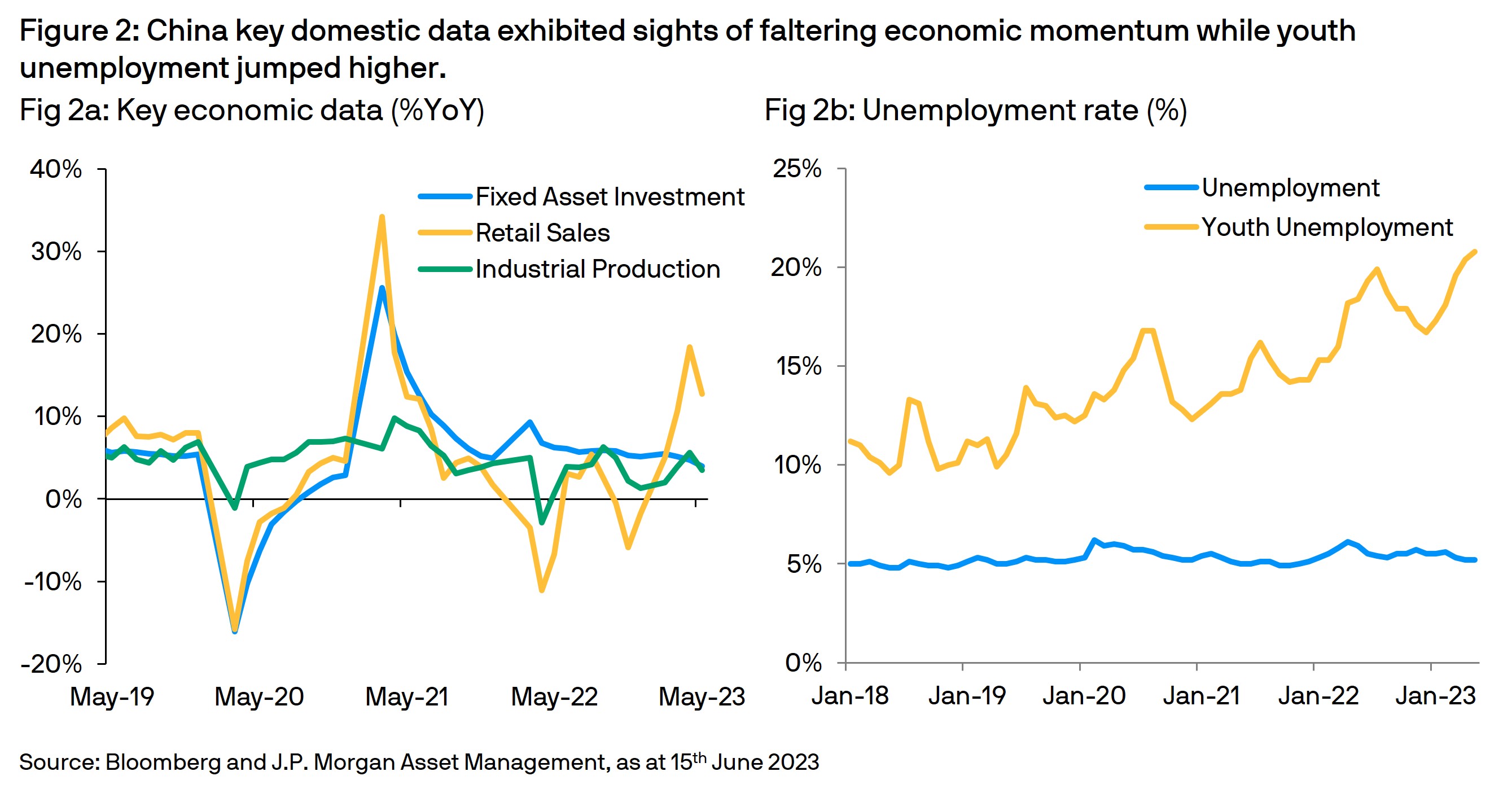

The latest, Chinese economy activity indicators (Fig 2a) for May 2023 were weaker than expected, magnifying concerns that economic momentum is fading. Industrial production softened to 3.5%y/y as sharply weaker automobile, steel and export demand impacted factory output. Meanwhile, fixed asset investments moderated to a 30-month low of 4.0%y/y, as solid state-owned enterprise investment was offset by declining private sector investment. Finally, retail sales slowed to 12.7%y/y on broad based lower spending. Concurrently, unemployment (Fig 2b) remained relatively elevated at 5.2% while youth unemployment jumped to a new record high of 20.8% in May.

Pro-growth pivot:

Following a period of hesitant and tentative government actions, the recent broad-based weakness across investment, consumption and property has triggered a decisive pro-growth pivot by the PBoC. While small in size, cutting the 7-day Open Market Operations (OMO) rate and 1-year MLF rate are strong signals of intent and suggest further monetary policy action is likely. Nevertheless, without additional and coordinated fiscal policy actions to counteract the persistent economic weakness and boost consumer and business confidence, the positive impact of monetary policy support will be limited.

Outlook:

Investors now generally expect the Loan Prime Rate (LPR) to be cut in the coming week. With the cut likely to be asymmetric, and focused on lowering the 5-year LPR to support the critical property sector. However, in our opinion, any subsequent PBoC actions are likely to be data dependent and unlikely in the near term. Meanwhile, the upcoming State Council meeting and July’s Politburo meeting will also be critical indicators of future fiscal policy actions.

For RMB cash investors, interest rates are likely to remain on a downward trend for the foreseeable future. We believe a diversified strategy across different investment options and tenors – including liquidity and ultra-short duration strategies – remain a high conviction option to present a relatively attractive return while balancing the needs for liquidity and security.

09yu231606080439

Diversification does not guarantee investment returns and does not eliminate the risk of loss.

This information is generic in nature provided to illustrate macro trends based on current market conditions that are subject to change from time to time. This generic information does not take into account any investor’s specific circumstances or objectives and should not be construed as offer, research or investment advice.