ETFs: enhanced portfolio solutions for insurers

02-12-2019

John Adu

Edward Malcolm

Charles Matterson

Exchange-traded funds (ETFs) provide low cost and easily tradeable investment solutions for insurers looking to manage portfolio cash flows and maintain liquidity. In addition, new active and strategic beta1 ETF strategies are increasingly helping insurers to design and build full portfolio solutions that can maximise income within individual duration and solvency capital constraints.

Access the power of ETFs

Thanks to their liquid, transparent and low cost structure, ETFs provide attractive tools for insurers looking to efficiently manage their portfolios or implement tactical changes to long-term portfolio allocations.

One of the key features of ETFs is their obligation to provide full portfolio transparency, thereby allowing insurers on a daily basis to look through to underlying portfolio holdings for full reporting purposes and to make accurate Solvency II capital charge calculations. Active and Passive ETFs that physically own bonds (rather than those that use synthetic replication) allow for full transparency and look-through within the Solvency II regulatory regime.

Another advantage of ETFs is the intra-day liquidity facility that they provide, which can help insurers manage cash flows (for example, claims) or achieve a “fair” price in challenging markets, without modifying long-term allocations. The ability to get up-todate pricing throughout the trading day also allows risk managers to monitor changes in a portfolio’s market exposure in real time.

ETFs are increasingly looked upon as market access tools, irrespective of an active or passive investment engine. They offer investors an increased level of transparency and liquidity, in addition to low cost market exposure compared to conventional active mutual funds. Investors now have a broad range of active and passive strategies to choose from across different maturities—providing the ideal risk and return building blocks for insurance portfolios.

Helping insurance portfolios reach their full potential

Different types of insurers can use ETFs to achieve different portfolio solutions. For example, the low cost, liquid and transparent market exposure provided by ETFs can help insurers to manage portfolio transitions, allowing market exposure to be maintained while changing investment manager, making a significant change to asset allocation or even while waiting for an appropriate market entry point to deploy cash.

Similarly, ETFs are often used by insurers to make tactical asset allocation changes (within their fixed asset class bands) by dialling up or down market exposure in reaction to changes in macroeconomic sentiment or market opportunities—all at low cost and with full look-through for regulatory capital purposes.

As well as being used for efficient portfolio management, some insurers are now beginning to use ETFs to design and build full, low cost portfolio solutions—blending active as well as passive strategies to meet long-term return targets or to match a particular portfolio duration to manage their individual liabilities, within a specified solvency capital ratio (SCR) range.

Building model ETF portfolios: an insurance case study

The ability of ETFs to provide full portfolio solutions can be particularly useful for smaller insurers, who tend to have high cash balances and who are not usually able to access dedicated segregated investment mandates.

Our simple case study shows how a blended portfolio of both passive and active ETFs can help insurers target a particular return and portfolio duration, within a given SCR budget. In the below case study we look at the example of a short duration property and casualty (P&C) insurance company that is looking to target a 1.5 year duration to match its liabilities, while also seeking to gain more yield than is typically available from money market funds.

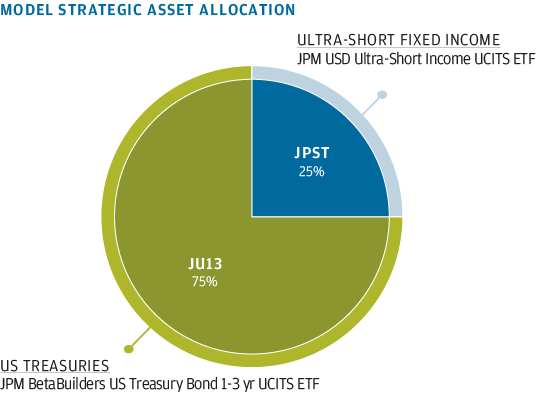

The model portfolio consists of two fixed income ETFs (combining a benchmark-tracking ETF with an actively managed ETF), designed to help insurers make their cash balances work harder while managing risk. 75% of the portfolio is invested in the JPM BetaBuilders US Treasury Bond 1-3 yr UCITS ETF (JU13), which is a passively managed fund that provides access to short-dated US Treasury bonds by tracking the J.P. Morgan Government Bond Index United States 1-3 Year.

25% is invested in the JPM USD Ultra-Short Income UCITS ETF (JPST), an actively managed ultra-short duration fund that is designed to help investors seek an attractive yield compared to cash, while focusing on active credit risk management to target stable returns.

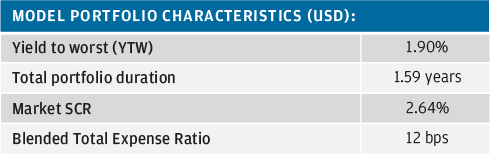

By investing in this blend of active and passive fixed income ETFs, the model portfolio provides an attractive low cost investment outcome compared to holding inefficient cash on 2019, a duration of only 1.59 years and a market SCR of 2.64%. All this is achieved with a blended total expense ratio of just 12 basis points (bps).

CASE STUDY: USING FIXED INCOME ETFS TO TARGET A 1.5 YEAR DURATION THROUGH CASH TIERING

The model portfolio characteristics are simulated, which are subject to change without notice and are not reliable indicators of current and future results. As in any investment, there are risks to return and capital.

Source: J.P. Morgan Asset Management, extracted from PRISM, our proprietary portfolio management tool. The portfolio’s yield-to-worst is the weighted average of each ETF’s weighted average individual bond holding yields-to-worst as at 9th November 2019, in USD (unhedged). Both JU13 and JPST are two examples out of a number of subfunds of JPMorgan ETFs (Ireland) ICAV.

Both JU13 and JPST are two examples out of a number of sub-funds of JPMorgan ETFs (Ireland) ICAV

Target superior outcomes with ETFs

In summary ETFs offer a low cost, transparent and liquid structure. They are often used by insurers for efficient portfolio management, such as to manage portfolio transitions or to implement tactical asset allocation decisions.

However, insurers can also use ETFs to design and build stronger outcome-oriented portfolio solutions that can help them to reduce inefficient cash holdings and target attractive levels of income, while managing duration and SCRs within individual risk parameters.

J.P. Morgan asset management: helping insurers use ETFs to their full potential

At J.P. Morgan Asset Management, our ETFs offer access to our full range of investment capabilities — providing insurers with all the tools they need to achieve superior outcomes.

Our specialist Global Insurance Solutions team can build model ETF portfolios designed to target specific outcomes and minimise capital charges based on individual yield, maturity and duration constraints.

For more information on our ETF range (including pricing, liquidity and trading options), or to discuss using ETFs in insurance portfolios, please contact our insurance solutions team (GIS & International ETF team contact details: jpmorgan.etf@jpmorgan.com / +44 207 742 8361).

1In the case that ETFs by JPMorgan track a strategic beta index, such indices will have been designed by or in collaboration with JPMorgan Asset Management.

0903c02a82726861