Apples, oranges, and best practices

In brief

- Time-weighted returns (TWRs) and the internal rate of return (IRR) are not directly comparable—and these different metrics, used by private alternatives (alts) funds with different structures (open-end, perpetual life funds (“open-end”) vs. closed-end, vintage funds (“closed-end”)) can signal different investment outcomes. For comparability, we recommend using the metric net multiples on invested capital (MOICs).

Our analysis suggests private open-end core/core-plus alts funds1 may deliver similar or better net MOICs to median manager private closed-end noncore2 alts funds , with greater transparency and a lower risk profile.

Open-end core/core-plus alts funds benefit from faster capital deployment, being more fully invested for longer, and having more liquidity that can be reinvested or reallocated.

In noncore closed-end alts funds, investing using a multi-vintage program (diversified by vintage) can enhance net returns and reduce risk, but execution is critical and uncertainties abound.

We also believe it is crucial to understand and position alternatives investments in accordance with sources of performance dispersion, as this can potentially generate additional alpha and manage risk.3

Investing in alternatives may be ever more essential, yet comparing returns across different types of alternatives funds—here, we examine core and noncore alternatives —is not straightforward. Returns are calculated differently, in ways not directly comparable, depending on a fund’s structure.

Solving for comparability when fund return metrics differ

Two different alts fund structures typically use different return calculation methodologies:

Open-end, perpetual-life or evergreen funds typically use time-weighted returns (TWRs) to calculate performance, a compound rate of growth that excludes the impact of cash flows. This approach is appropriate for core/core-plus open-end funds as it more accurately measures the performance of an investment manager irrespective of the pacing of invested capital over time, as this is less of a consideration in perpetual-life core/core-plus funds.

Noncore closed-end vintage funds report performance using an internal rate of return (IRR), also referred to as money-weighted return. IRR is more relevant here because IRR considers cash inflows and outflows in solving for a discount rate. This approach is more appropriate for closed-end funds given the greater level of control that managers have over the timing and magnitude of a fund’s cash flows. As a result, it is most appropriate to use a performance measure that reflects this.

TWR and IRR are not directly comparable, in fact they are apples and oranges—comparing performance is less meaningful between funds using the two approaches—and the different metrics can signal very different outcomes for investors. To solve this problem, we recommend investors instead compare net multiples on invested capital (MOICs) over similar time horizons. MOICs are the ending value of investments (including any asset sales or distributions), relative to how much was invested over the time period.

Select examples in Exhibit 1 show why net MOIC is a more meaningful measurement across fund types, as the pace at which capital is invested and/or distributed can materially impact the IRR achieved. Furthermore, a comparable net MOIC can be achieved through a lower TWR, and over a comparable time period (given the faster capital drawdown pace and being more fully invested for longer).

Looking beyond the headline return numbers using net MOIC paints a different picture

EXHIBIT 1: Closed-end fund scenarios vs. an open-end scenario

Source: J.P. Morgan Asset Management; data as of June 7, 2022. The exhibit compares an illustrative standalone open-end core fund with a single vintage noncore fund. We note that a noncore fund recycling capital efficiently between vintages would achieve a more fully invested profile.

Efficient capital recycling can improve returns but execution is key

A well-executed capital recycling approach can enhance capital efficiency and improve net MOICs. Exhibit 1 does not capture the impact of reinvesting distributions from closed-end funds, which would impact performance. In a multi-vintage program, capital returned from earlier vintages in the harvest period can be recycled into subsequent funds. Recycling capital efficiently between vintages this way can produce a more fully invested profile over a comparable period, which could improve the program’s performance.

For this reason, we suggest investors consider comparing open-end funds that are reinvesting income to diversified multi-vintage noncore closed-end programs that are recycling capital across vintages. If executed successfully, a diversified multi-vintage program could potentially deliver a slightly higher net MOIC over 10 years than a core/core-plus multi-alts fund. But achieving this outcome requires getting several key factors right. In short, successful execution would be critical for a multi-vintage noncore program—and that is inherently challenging given private markets’ uncertain nature (EXHIBIT 2A and 2B).

A consideration for long-term returns

EXHIBIT 2A: Factors to consider in building a diversified portfolio of closed-end funds

Source: J.P. Morgan Asset Management; data as of June 7, 2022.

Recycling capital across closed-end noncore funds can improve net MOICs when executed efficiently

EXHIBIT 2B: Expected 10-yr net MOIC, open-end core vs. multi-vintage noncore closed-end funds, with capital recycling

Source: J.P. Morgan Asset Management; as of June 7, 2022.

A consideration for long-term returns

We recommend a simple rule of thumb for multi-vintage private noncore alts allocations.

As we have noted, it is incorrect to compare TWRs and IRRs on an absolute basis because they are not directly comparable. IRRs are sensitive to the pacing, timing and magnitude of capital deployed and returned and the length of time capital is invested—cash flows—which are not factors for the TWR metric.

However, using a relatively standard portfolio model over a 10-year period, we can construct a rule of thumb for comparing IRRs and TWRs (Exhibit 3A):

IRR ≈ 2 * TWR

IRR of a single vintage within a multi-vintage construct is roughly twice the TWR that delivers a similar MOIC in a 10-year horizon. The differential is largely attributable to the importance of the timing of cash flows in closed-end funds, and the “j-curve effect.” The j-curve illustrates the turning point, when typically inferior performance in the early years (when fund management fees and expenses outweigh valuation uplift) shifts in the fund’s later years when operational improvements and/or asset sales spur a rise in asset values .5

We reiterate that the variables in Exhibit 2B must be accounted for, and that it is challenging to execute according to plan given private markets’ uncertainties.

A simple rule of thumb: IRR ≈ 2 * TWR

EXHIBIT 3A: MOIC equivalency: Understanding the relationship between TWR and IRRs

Source: J.P. Morgan Asset Management, data as of June 7, 2022.

EXHIBIT 3B: Impact to net MOIC of various assumed rates of return on idle capital6

Exhibit 3A does not factor in a return for idle capital (committed but not yet deployed) nor capital returned from a noncore closed-end multi-vintage program’s prior investments not yet reinvested. A multi-vintage program has less idle capital than a single vintage, but not a negligible amount. Exhibit 3B illustrates how various assumed rates of return on idle capital would impact the net MOIC and relationship between TWR and IRR (using the 16% single vintage net IRR within a multi-vintage construct from Exhibit 3A). As idle capital get invested in riskier assets, the net MOIC of the multi-vintage program can be improved but this upside comes with a greater downside risk; we demonstrate this by include the VaR (Value-at-Risk) at 95% confidence level for the idle capital proxies.

Generating resilient net multiples on invested capital via an actively managed core/core-plus multi-alts program

The compounding of returns over time is another important consideration in generating long-term sustainable returns in core/core-plus multi-alts funds. Being more fully invested over the longer term and actively reinvesting income distributions can have a meaningful impact on outcomes, potentially by generating higher compounded returns and also as a tool for actively re-positioning the portfolio over time to capture high-conviction views.

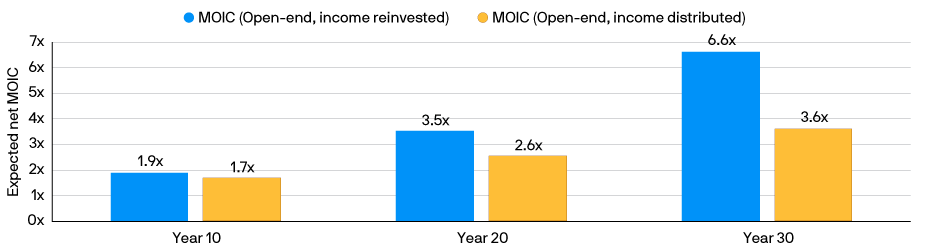

Exhibit 4 shows our analysis of the positive impact on net MOICs over time when income is reinvested, rather than taken as a distribution. Reinvesting should lift net MOIC by a widening margin as the period of investment lengthens—illustrating the importance of compounded returns and being fully invested over the long-term. Net MOICs increase by (10% over 10 years; 37% over 20 years; 83% over 30 years).

Analysis suggests reinvesting income increases net MOIC by a widening margin over time

EXHIBIT 4: Expected net MOIC, open-end fund, income reinvested vs. income distributed (years 10–30)

Source: J.P. Morgan Asset Management; data as of June 7, 2022. Scenario assumes a 6.5% total return with 70% of returns derived from income.

From a risk management perspective, broader is better when allocating to core/core-plus alternatives.7 When core/core-plus alternatives are combined in a multi-alts portfolio, risk metrics, such as volatility and downside risk, should be superior to the underlying strategies’ simple average, due to the noncorrelation among core/core-plus alts funds (EXHIBIT 5).

Diversifying across core/core-plus alts may achieve more resilient long-term outcomes

EXHIBIT 5: Expected volatility, downside risk of core and noncore (avg) and multi-alts funds

Source: J.P. Morgan Asset Management; data as of June 7, 2022.

Conclusion

We recommend using net MOICs to compare core/core-plus alts fund performance to that of noncore alts funds. Using MOICs, we find these two fund types may deliver similar outcomes. Open-end core/core-plus have greater transparency and a lower risk profile; their faster capital deployment and longer periods being fully invested allow for compounding returns. Using net MOICs, we find that reinvesting/recycling capital in both fund types can impact performance.

In noncore closed-end funds, we find that using a multi-vintage program, diversified by vintage year, may enhance net returns and reduce risk, but execution is a critical challenge.