Surviving the short term to thrive in the long term

29-10-2018

Sorca Kelly-Scholte

Tim Lintern

Building investor resilience in a downturn

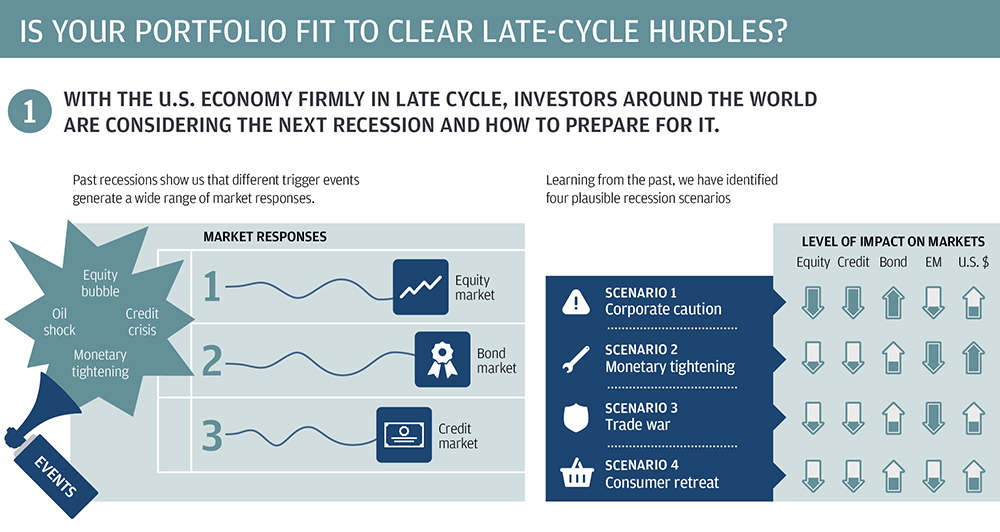

With the U.S. economy firmly in late cycle, investors are concerned. How can they ensure their portfolios survive the short term so they can thrive in the long term? The answer would be fairly straightforward if recessions were all alike and had a predictable impact across markets—but they’re not, and they don’t.

We can’t predict how the next recession will unfold, but we can provide a framework to help investors prepare for the late-cycle risks most relevant to their investment needs and objectives. This article:

- Looks back at a range of developed market recession experiences over the past four decades and the resulting sequence of market reactions for each

- Looks ahead at four plausible downturn scenarios and assesses potential market responses

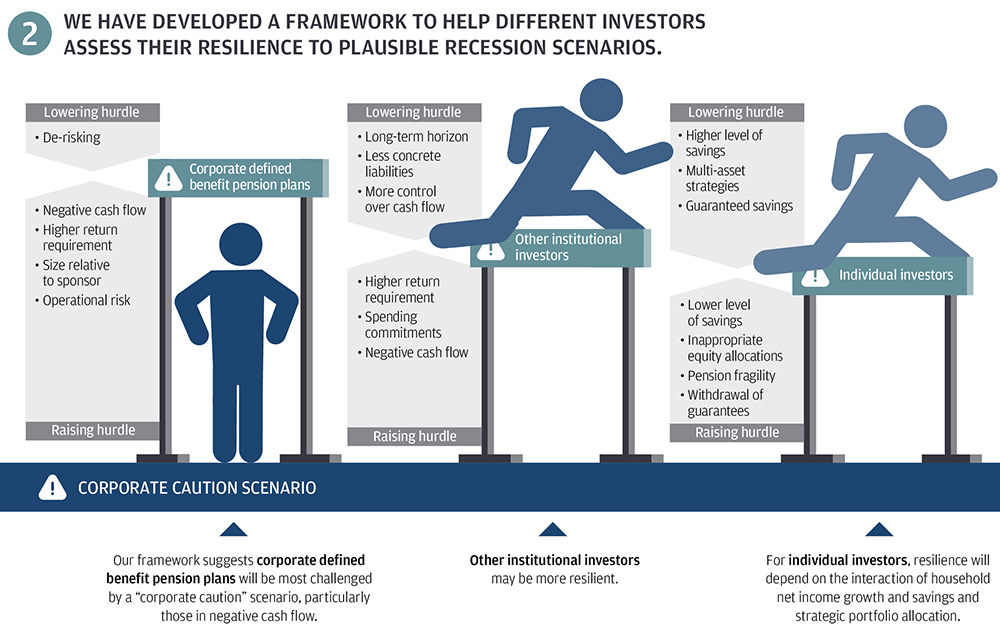

- Analyzes the likely impact of these scenarios and market responses for different types of investors

The infographic below uses illustrations to convey the main talking points and areas of interest covered in the article.

1. With the U.S. economy firmly in late cycle, investors around the world are considering the next recession and how to prepare for it.

2. We have developed a framework to help different investors assess their resilience to plausible recession scenarios.

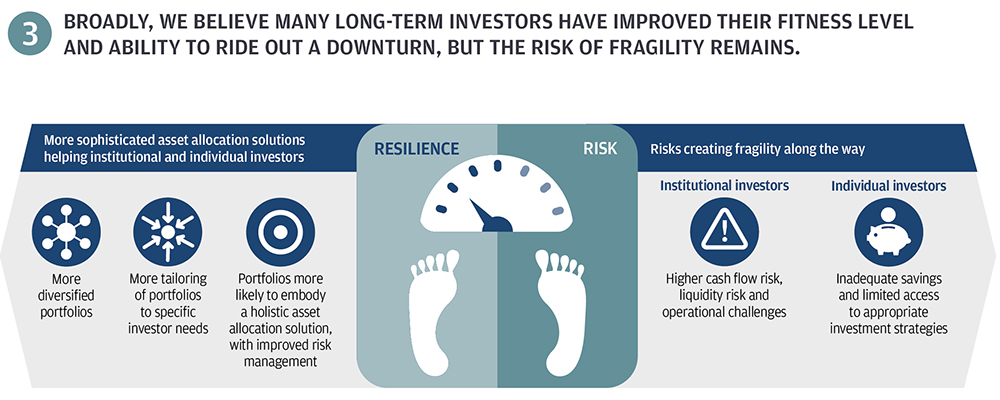

3. Broadly, we believe many long-term investors have improved their fitness level and ability to ride out a downturn, but the risk of fragility remains.

You should also read

Full report and executive summary

Choose between a comprehensive analysis of our forecasts and critical investment themes, or a simpler overview of our macro and asset class assumptions.

Download the latest full report >

Download the latest executive summary >

The taming of the business cycle

In recent decades, the U.S. economy has become more stable – the business cycle has certainly not been eliminated, but perhaps it has been tamed.

LTCMA

J.P. Morgan Asset Management's Long-Term Capital Market Assumptions draws on the best thinking of our experienced investment professionals worldwide.

0903c02a823f8052