Is there green in the graying baby boomers? Why we like non-profit tax-exempt senior living bonds

08-10-2020

Amy Murphy

Disruptions brought on by the spread of COVID-19 gripped markets and wreaked havoc on certain areas of the global economy, including the municipal market: high yield and non-rated sectors were under pressure. Within the municipal high yield sector, market valuations on senior living bonds were among the hardest hit.

We witnessed unprecedented bond price swings on projects, such as senior living, whose fundamental credit characteristics had not changed since prior to the pandemic. Price volatility was driven by the general market liquidity crunch as well as media headlines indicating that nursing homes were hotbeds for COVID-19 outbreaks, and a misunderstanding of the fundamentals of Life Plan Communities (“LPCs”) or Continuing Care Retirement Communities (“CCRCs”). Below we discuss the fundamentals of LPCs and CCRCs investments, and why we believe these may provide solid investment opportunities with attractive yields.

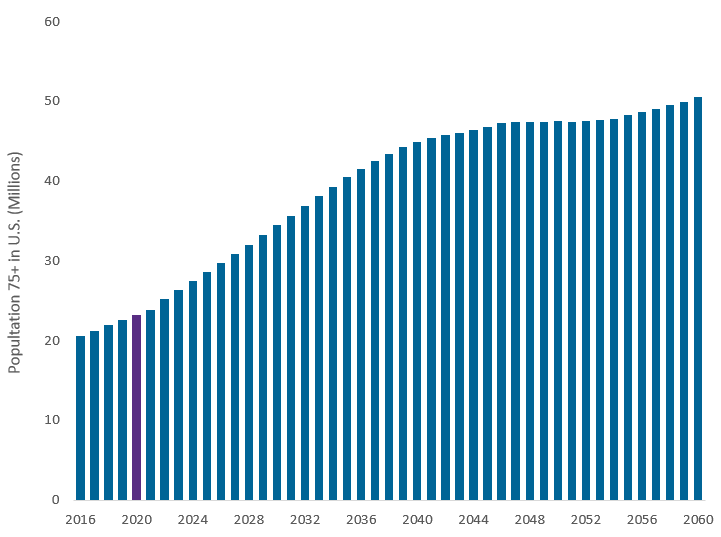

The population is aging! The nation’s population of 75+ and older is projected to more than double from 22 million currently to over 50 million in the next 30 years. While some baby boomers continue to assume the laws of nature don’t apply to them, most septuagenarians and octogenarians and beyond will face challenges performing daily living tasks at some point in the years ahead. These challenges may include health and/or mobility issues, physical and financial maintenance of homes, potential feelings of isolation, or a combination of all of these. Consequently the pipeline is solid for senior focused living alternatives. As individuals age, these needs evolve from hypothetical to essential.

U.S. Population 75+ (2016 - 2060)

Source: U.S. Census Bureau, data released September 2018

Senior Living Communities are not Nursing Homes: Tax exempt LPCs/CCRCs are sponsored by non-profits for 75+ year-olds who chooses to live in a communal setting, typically with generous amenities and services. Typically, these communities also dedicate a portion of their campuses to provide health care services, just in case it’s needed as residents age. Imagine these settings as you would a college campus – but for the engaged, active and relatively affluent senior, who is a planner – but with better dorm rooms, much better food options, tons of amenities (though not a lot of climbing walls – but often pools), and a better healthcare clinic if needed, all without the pressure of mid-terms!

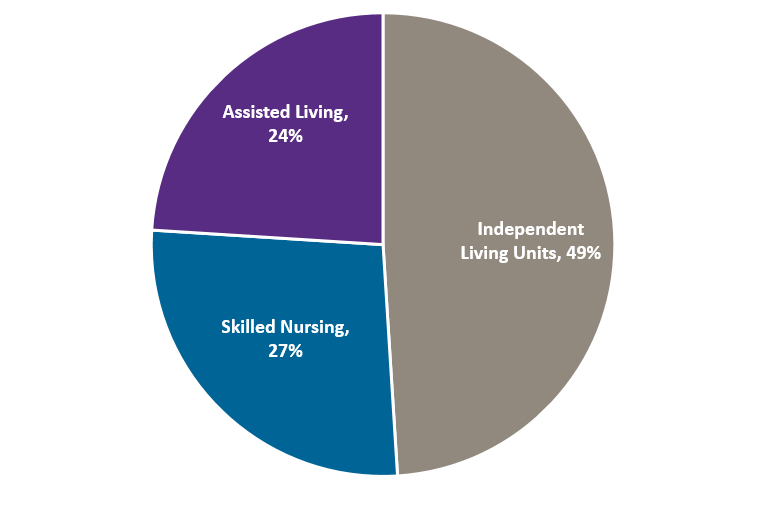

On average 50% or more of the units on these campuses are dedicated to completely independent seniors. Another 25% of the units provide some level of assistance with daily living as residents decline with age. Typically 25% or less of the beds are dedicated to high acuity nursing care. This ratio continues to skew towards more private pay independent and assisted living units, thus reducing communities’ exposure to Medicare and Medicaid which underwrite a significant amount of nursing care. To the extent nursing care is provided on these campuses an increasing portion are single room units, which provide a clear advantage in infection control, which is critical in a COVID-19 world.

CCRC Community Profile weighted towards lower acuity patients

Source: Ziegler Investment Banking, National LPC database, April 2020

Headline Risk: In the height of the COVID-19 pandemic, a number of nursing homes experienced devastating and widely reported outbreaks. The municipal market conflated these two sectors, senior living and nursing homes, without understanding the low nursing care exposure within senior living. Certainly, like all sectors of the economy these facilities experienced cases of COVID-19. However, these care providers were uniquely prepared to address this risk and minimize the spread, as it is their main business to care for vulnerable seniors. Non-profit senior living providers quickly became among the leaders in infection mitigation and care. With their non-profit roots, these facilities offer higher staffing rates and a true mission driven emphasis on resident care. During the second quarter of 2020, to the extent these facilities experienced negative variances in occupancy, in general this was limited to an inability to fill normal turnover due to restrictions on the admission of new residents (particularly in the nursing units) not necessarily due to a lack of demand. Not only did independent and assisted living occupancy largely hold in the height of the pandemic, but many facilities witnessed a strong rebound from pent up demand as these communities reopened. While communal living certainly presents risks in a pandemic, for some, the experience of being locked down and isolated in their homes has reinforced the attraction of CCRCs.

Strong Credit Fundamentals: Senior living bonds benefit from strong security structures, generally including a first mortgage lien on often beautiful campuses with valuable assets in their extensive housing units and amenities, a direct revenue pledge, typically a full year of debt service in reserve, and strong cash and performance covenants. These bonds are typically collateralized with solid, tangible assets and cash, and are further supported with a series of operating and occupancy covenants. This provides investors with the ability to intervene early should projects show signs of struggling.

Federal Support: Many facilities with less than 500 employees benefited from participation in the PPP program. Further, in many instances the CARES Act provided funding to offset PPE costs, additional COVID-19 related care expenses, and revenue shortfalls for nursing care. For many facilities this aid helped to significantly mitigate COVID-19 related revenue and expense pressures. This allowed them to preserve cash and maintain adequate liquidity.

Strong Market Technicals: The search for yield, combined with a limited supply of tax-exempt, senior living bonds should support continued strong primary and secondary market demand. Non-profit issuers are increasingly sophisticated and are bringing forth well-conceived expansions and market re-positionings, as well as a limited number of start-up campuses.

LPC/CCRC Headwinds: The senior living market is evolving, and must constantly respond to changing consumer preferences for unit design, size and features, the amenities provided and the services expected. Further, CCRCs must constantly adapt to changing best practices in the delivery of health care services, as we have witnessed the migration from skilled nursing beds towards assisted living. Keeping physical plants competitive and attractive given evolving market and healthcare demands can require substantial capital investments. Operating expenses continue to be challenged with COVID-19. While many facilities did well in holding their independent living census, they will need to build back occupancy as many facilities were closed to new residents for a number of months.

Fundamentally, this market segment faces competition on many levels, including for-profit rental options which may or may not offer ancillary services. However, the main competition remains seniors choosing to stay in their own homes. Macro-economic trends will continue to impact the attractiveness and viability of this sector, as these communities rely upon a sufficient pool of potential residents with sufficient wealth and income. Consequently, weak real estate markets can make it difficult for potential residents to sell a house – which they may need to do to make this move. Lower real returns on investment portfolios can challenge individuals’ ability to afford this lifestyle option overtime. Many financings are undertaken for expansion and repositioning, and management teams need to bring these projects in on-time and on-budget, and fill them. These challenges are amplified for new facilities. With approximately 600,000 units nationwide in 1,950 facilities[1], non-profit LPCs/CCRCs are catering to a small slice of our total senior population with this unique life style option. Management teams need to stay agile to continue to provide an attractive product for their target market.

Senior living financings have a unique level of complexity and nuance. They finance a service that combines residential, hospitality, healthcare and insurance into one product. This makes acquisition analysis critically important. Accurate market evaluation and pricing will likely continue to be a challenge given the number, diversity, size and infrequency of borrowing for most issuers. Successful project completion and stabilization may reward investors with price and rating appreciation. The demand should just keep on building. Thank you baby boomers!

[1] Ziegler National CCRC Listing and Profile, June 2020