PBOC attempts to jump-start the economy

In brief:

- On August 15, the People’s Bank of China announced a MLF rate cut of 10bps to 2.75%. Immediately after, CNY weakened versus USD, money market and bond yields declined and yield curve bear steepened.

- The rate cut was triggered by weaker domestic growth and suggests a significant policy shift by the PBOC, further rate cuts and additional credit support are now probable.

- The recent downward trend in interest rates is likely to persist, with the PBOC having ample capacity to cut rates further and utilize its numerous quasi-monetary policy tools to help revive economic growth.

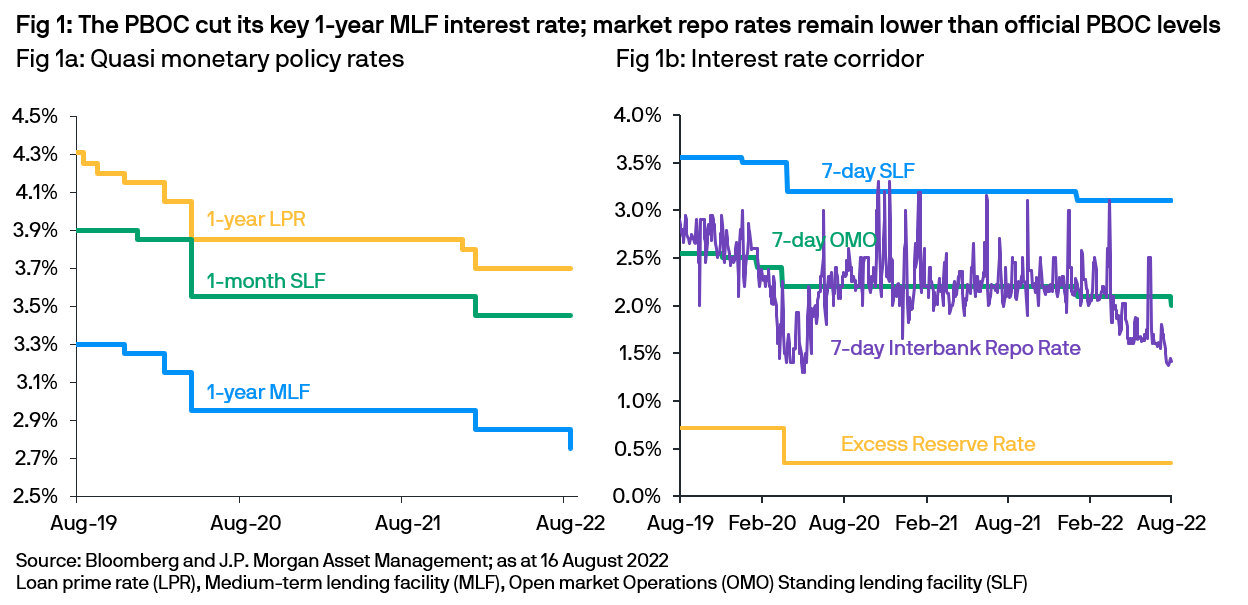

On August 15, the People’s Bank of China (PBOC) announced a MLF (Medium Term Lending Facility) rate cut of 10bps to 2.75% (Fig 1a). In addition, the 7-day reverse repo open market operations rate was cut by 10bps to 2.00% (Fig 1b) while the size of the latest MLF operation was cut by CNY200bn to CNY400bn.

The surprise cut to the central bank’s de-facto policy rate came after much weaker than expected money supply and economic data. This underlines the government’s challenge of achieving its 2022 growth target. Although small in size, the rate cut confirms the PBOC’s desire to jump-start the economy and sends an important monetary policy signal with significant implications for interest rates and RMB cash investors.

Stalling growth:

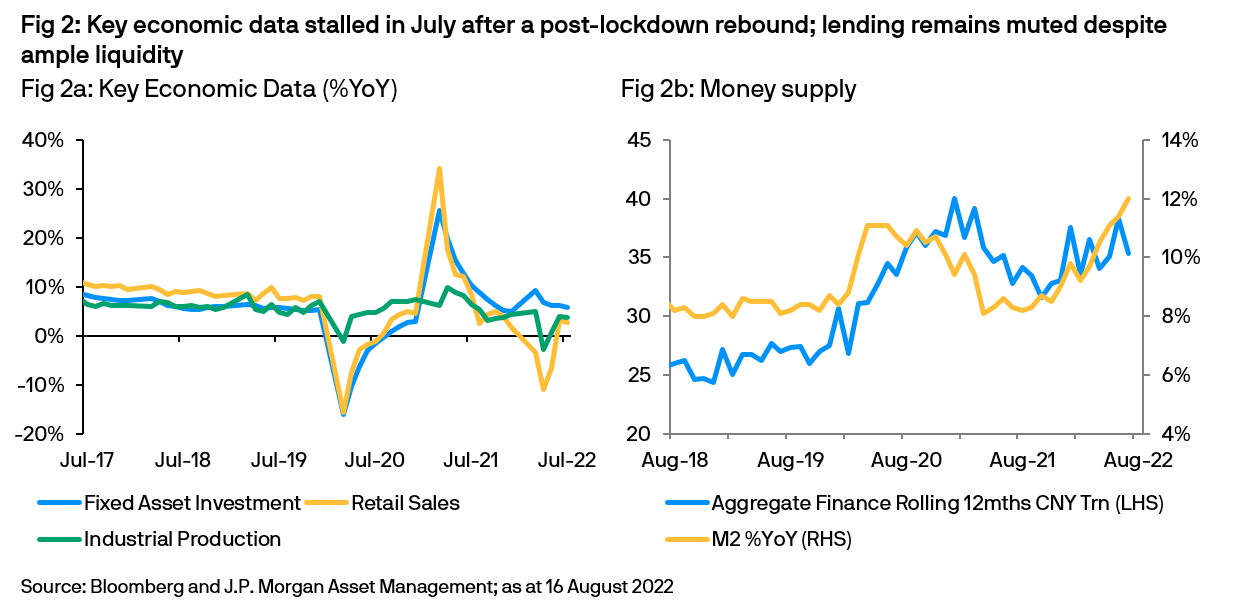

Key economic data (Fig 2a), which rebounded in May and June as Covid lockdowns eased, stalled in July – despite additional fiscal support and a further reduction of social distancing restrictions. Industrial production slipped to 3.8%y/y on fading manufacturing demand, while retail sales was muted at 2.7%y/y with a rise in online sales failing to offset declines in offline sales. Fixed asset investments declined to a 6-month low on weaker construction and property market sentiment.

Concurrently, the credit and lending data in July was subdued with total social financing slowing to 10.7% while M2 money supply increased by 12%y/y (Fig 2b). This highlighted the dilemma of the PBOC’s recent strategy of maintaining ample market liquidity while abstaining from interest rate cuts during a period of aggressive global central bank rate hikes.

A significant policy pivot

The MLF cut suggests a significant policy shift by the PBOC, implying further rate cuts and additional credit support are now probable. While the cut was triggered by weaker domestic growth, the expectation that the pace of Federal Reserve rate hikes has peaked and enabled the PBOC’s dovish pivot, reducing the risks of a sharp CNY devaluation or further substantial capital outflows.

We believe the Loan Prime Rate (LPR) will be trimmed later in August. The 1-year rate, linked to corporate loans, was last reduced in January by 15bps to 3.70%; while the 5-year rate, linked to mortgages, has been cut twice by a total of 20bps to 4.45%. Both rates could witness larger cuts to revive weak property market sentiment and reinvigorate loan growth. Market liquidity is expected to remain ample as the PBOC is likely to boost its lending programs and targeted support for small businesses.

Market Reaction:

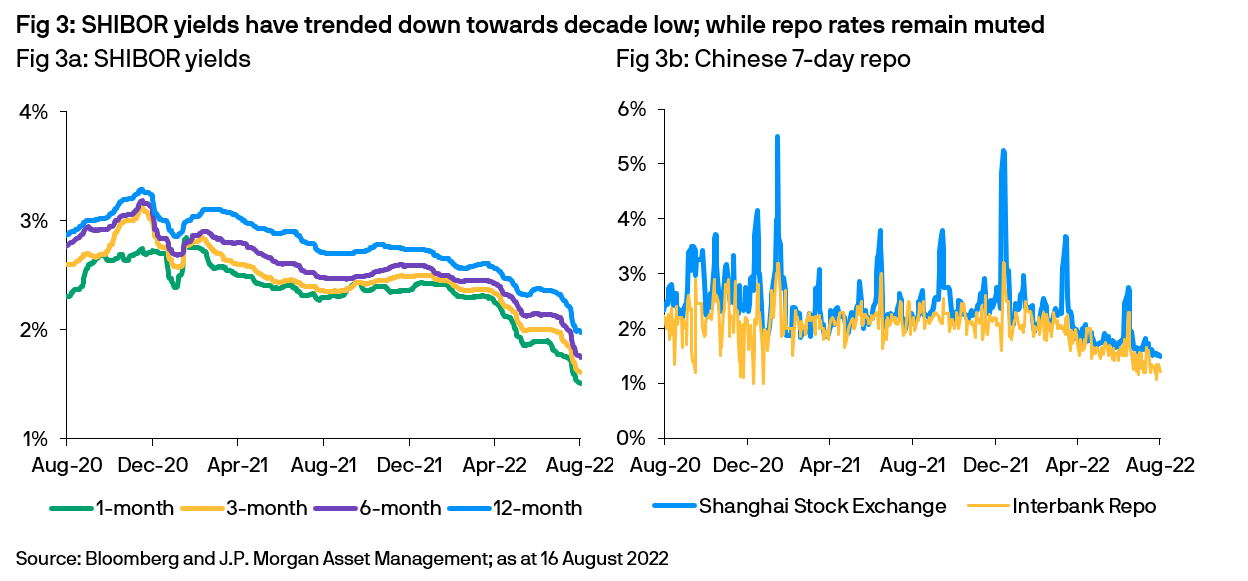

Immediately after the MLF rate cut, the CNY weakened versus the USD, money market and bond yields declined and yield curve bear steepened. In contrast, domestic equity markets rebounded. From a recent peak in December 2020, short tenor interest rates have trended downwards towards a decade low (Fig 3) - with significant declines in April and May as the Covid lockdown in Shanghai weighted on market sentiment, and further falls in August as additional government policy impacted the interest rates outlook.

Investment implications:

While the size of the MLF cut was restrained, it signals PBOC’s intention to jump-start the economy. As household and corporate sentiment remain weak, we believe that lower interest rates are much more likely to revive demand than excess liquidity. Some of the current economic weakness may be transitory; however, continued property softness, muted consumer confidence and the authority’s commitment to zero-Covid are likely to weigh on growth for a considerable period of time.

For RMB cash investors, the recent downward trend in interest rates is likely to persist, with the PBOC having ample capacity to cut rates further and utilize its numerous quasi-monetary policy tools to help revive economic growth. Yet, global economic crosswinds and uncertainty about the pace of future Fed rate hikes will continue to generate volatility. We believe extending investment tenors and diversifying investment options will be important to seeking an optimal balance of return, security and liquidity opportunities.

Diversification does not guarantee positive returns or eliminate risk of loss.