Investing in forestry: The case for timber allocations in insurance portfolios

Valérie Stephan

05-05-2022

How can insurance investors achieve effective inflation protection, while also benefiting from a high return on capital, a regular income and a low volatility return profile?

For insurers with long-term investment horizons, the answer could be provided by investing in forestry, via a portfolio allocation to timber assets.

A timber allocation provides several benefits

High return on capital

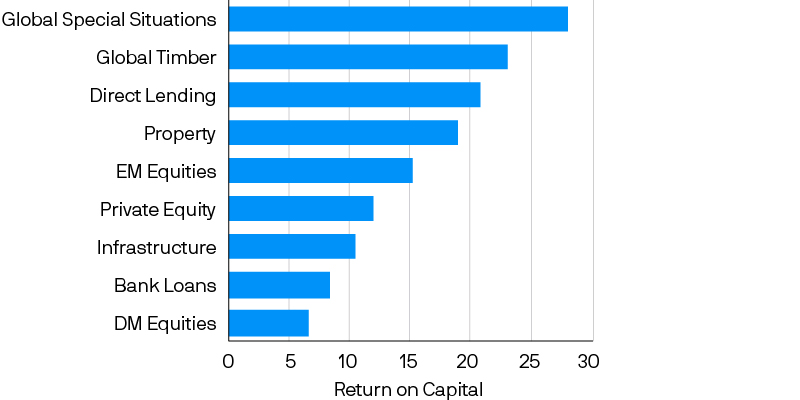

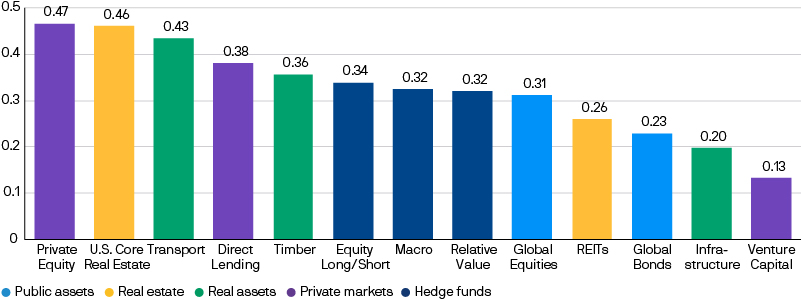

Forestry ranks highly from a return-on-capital perspective under the Solvency II standard formula, offering a comparable return on capital to direct lending.

Exhibit 1: Solvency II capital rankings of equity and alternative assets

Source: Barclays Point, Bloomberg PORT, J.P. Morgan Asset Management. Expected returns and volatilities are taken from the local currency JPMAM Long-Term Capital Market Assumptions except for Global Timber which is provided by Campbell Global and Special Situations which is provide by the JPMAM Lynstone team under USD assumptions hedged using the LTCMA hedging cost. Market Risk Solvency Capital Requirement (Market SCR) is calculated based on a 1% incremental allocation to each asset class relative to the average EUR life insurance portfolio. Interest rate risk is excluded under assumption of asset liability matching. Diversification factor 93% (derived from EUR life SFCR reports) is applied to Market Risk SCR (excluding interest rate risk). Equity symmetric adjustment set to zero to reflect longer term view. Target Solvency II Ratio 188%. Overseas assets hedged by rolling short term FX forwards. These are estimates and are not guaranteed. Past performance is not a reliable indicator of current and future results. Guide to the Markets – Insurance Supplement. Data as of 31 December 2021.

Attractive risk and return profile

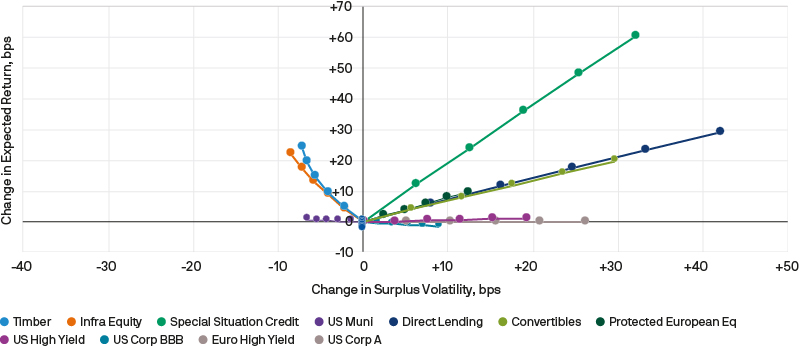

Our risk/return analysis suggests that making a 1%-5% strategic allocation to timberland from existing allocations could improve returns and reduce balance sheet risk for a typical European life insurer.

Exhibit 2: Risk/Return impact of reallocating 1%-5% of current portfolio allocations to selected asset classes

Source: J.P. Morgan analysis. Data as of January 2022. Forecast and analysis are not a reliable indicator of future results.

Low correlation to other assets

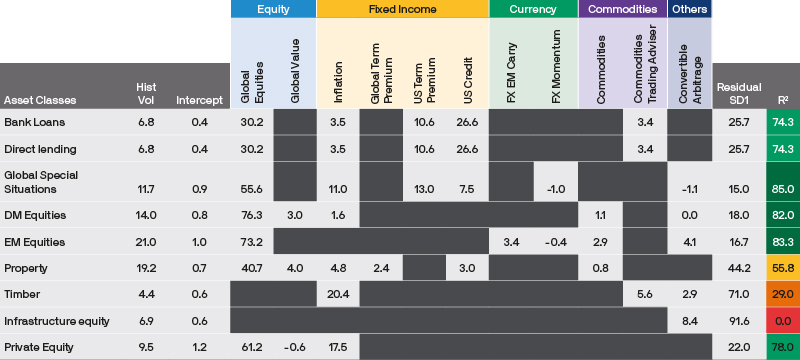

Timber can bring strong diversification properties to portfolios. In our regression-based factor model, timber, along with infrastructure equity, has a low R-squared score, which means historical returns are not well explained by most standard investment factors. In turn, this means that these asset classes arguably bring new factor exposures to a portfolio.

Exhibit 3: Asset class correlations to standard investment factors

Source: J.P. Morgan Asset Management analysis. For illustrative purposes only. Analysis and forecast are not a reliable indicative of future results. Factor loadings/estimates are based on return data for the six-year period from January 2003 to November 2021.

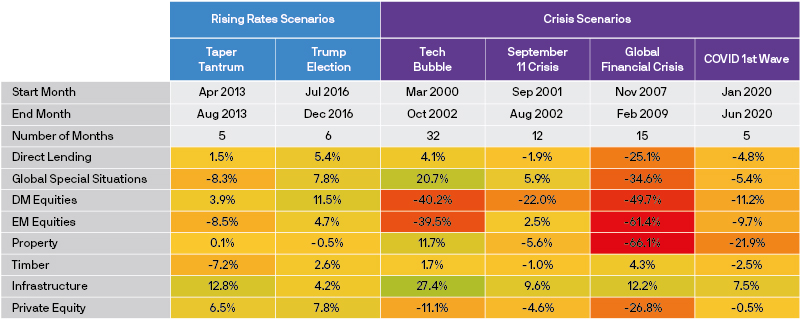

Defensive exposure in volatile markets

In historical market stress events, exposure to diversifying risk factors not found in public markets has helped forestry to perform well compared to the majority of risk assets, with only modest losses (or even modest gains) produced through the biggest crises and rising rate scenarios of the last 20 years.

Exhibit 4: Historical asset class stress tests

Source: J.P. Morgan Asset Management analysis. Data as of January 2022. Forecast and analysis are not a reliable indicator of future results.

Inflation protection

Forestry exhibits a strong positive correlation to inflation, which is helpful in the current inflationary economic environment.

Exhibit 5: Correlations between asset classes and inflation

Source: J.P. Morgan Asset Management Guide to Alternatives 2021

Alignment with sustainability goals

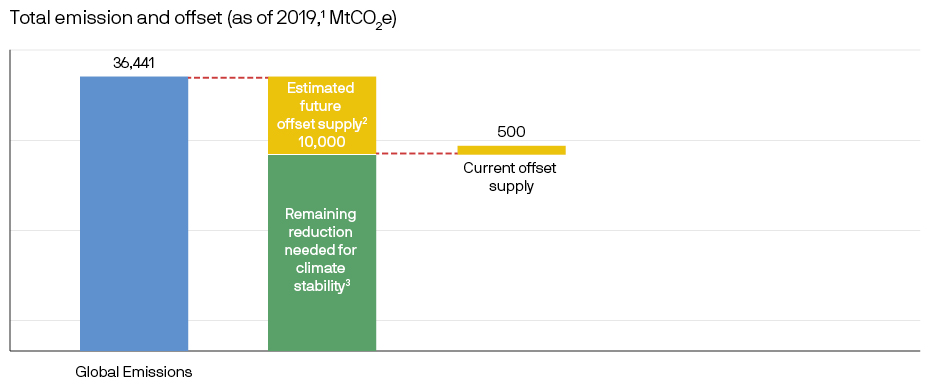

Investing in the preservation of forest land results in environmental and societal benefits, which align with many clients’ corporate values. Forestry, for example, provides an effective and scalable mechanism for sequestering atmospheric carbon, and represents just under 40% of the current supply of carbon offsets at a time when many businesses are looking to achieve low or even net-zero carbon emissions from their operations.

Exhibit 6: Global carbon emissions and offsets

Source: Global Carbon Atlas (http://www.globalcarbonatlas.org/en/CO2-emissions); Carbon Registries (total of carbon offset registered on Climate Action Reserve, American Carbon Registry, Carbon Plan, Gold Standard, Verra, Clean Development Mechanism); ARB is not included since projects are also registered in American Carbon Registry, Climate Action Reserve, and Verra. 1 Data as of 2019 - unless unavailable (Carbon Plan as of 2021 and Verra as of latest yearly data). 2 Annual carbon reduction needed to achieve the Paris Agreement goal of 1.5oC temperature reduction by 2100.

The strategic case for timber investing

Timber provides a middle ground between liquid and illiquid alternatives. While levels of liquidity can be relatively low, timber has attractive long-term return potential and can generate a regular income, which can be particularly valuable in periods of high inflation and rising interest rates. Timber’s ability to offset greenhouse gas emissions through the sequestration of atmospheric carbon provides additional sustainability credentials to any portfolio allocation.

At J.P. Morgan Asset Management, our sustainable timberland investor and forestry management company Campbell Global offers expert timber investment solutions.