The Weekly Brief

09-12-2024

Thought of the week

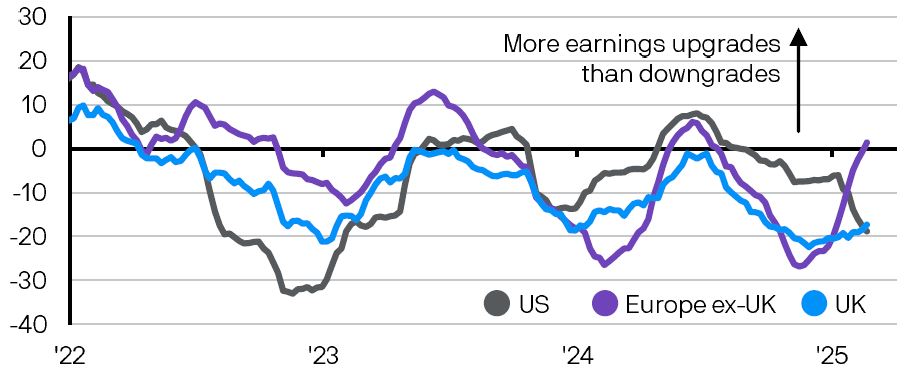

Following a recent period of weakness, China’s manufacturing sector is now showing some signs of improvement. November’s Caixin manufacturing survey comfortably beat expectations, with new export orders printing at the highest level in seven months. While revived US-China trade tensions could yet pose challenges in 2025, it appears that the prospect of higher US tariffs is leading to a front-loading of export activity. More broadly, it is important to note that China’s share of US imports has fallen significantly since President Trump’s first term, from 22% to 14% over the last seven years. Over the same period, China’s global export share has actually risen, as Chinese companies have re-organised their supply chains to incorporate countries such as Mexico and Vietnam. Emerging market investors will need to be active in 2025 to take advantage of these shifting trade patterns.

Chinese trade links reshuffled following the 2018 trade war

China exports, %, four-quarter moving average

More Insights

0903c02a81fb9234