STRATEGIC INVESTMENT ADVISORY GROUP

Authors: Michael Cembalest, Felise Agranoff, Denise Valentine, Matthew Cohen, Eric Ghernati, Joe Wilson, Andrew Brill, David Chan, Jason Yum, John Bilton, Kay Herr

The world around us is changing rapidly. With countless new investment opportunities emerging, how do we distinguish what will be truly enduring innovation from a passing fad or trend? It’s a critical question investors are asking, at a time of increased volatility.

How long do investors have to respond before these innovations fall?

In our latest Strategic Investment Advisory Group analysis, the team takes a look at innovation: its historical returns to investors and four sectors whose innovations we believe will stand the test of time:

Genetics in Medicine

Several rapidly developing areas will use an expanding understanding of the human genome to increase quality of life.

Where are we headed and who will lead?

Diagnostics

AI-assisted drug development

Targeted therapies

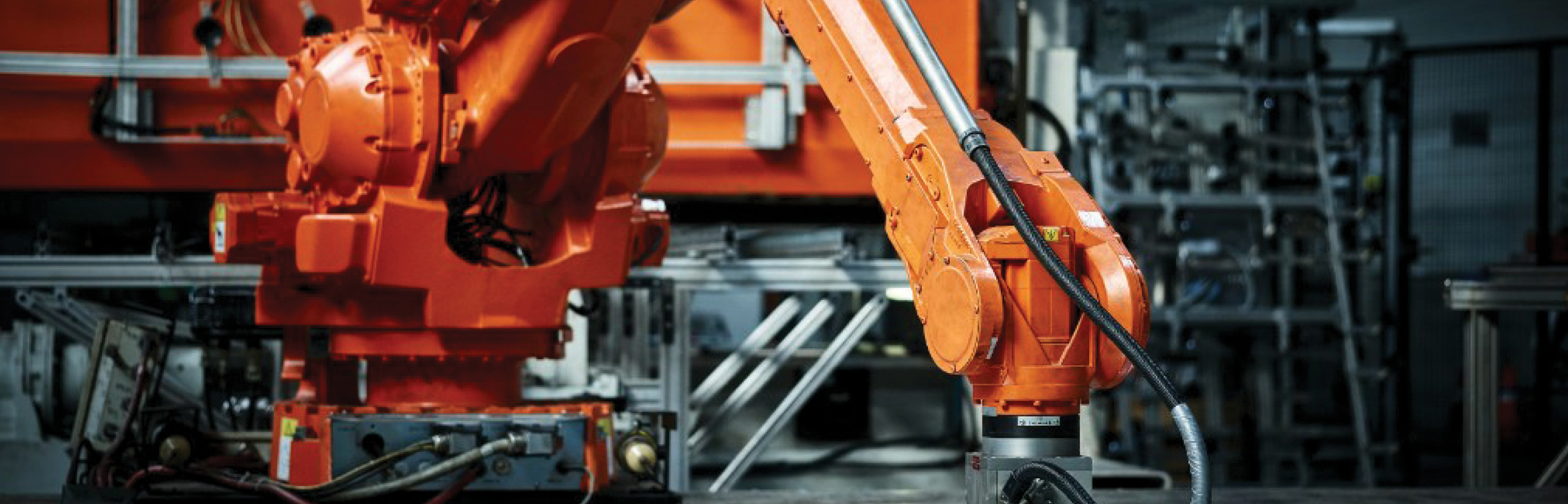

Automation / AI

The opportunity around industrial automation and robotics cuts across multiple sectors and regions and is still in its early days.

The most compelling opportunities are within the enabler hardware and software companies.

The Metaverse

Lower cost hardware and faster processing speeds have changed the paradigm. We think a growth phase still lies in the future.

We see compelling opportunities within critical, enabling technologies:

Augmented reality

Artificial intelligence

Enhanced semiconductors

5G

Fintech and Cybersecurity

Big banks that embrace machine learning and digitization effectively could thrive. In fintech, judiciously picking winners and monitoring performance is key.

We are optimistic that the cybersecurity industry has room to grow.