What would a Conservative government mean for sterling?

01-12-2019

GFICC Investors

In Brief

- With current general election polling consistent with a victory for the Conservative Party, the pound has outperformed over the last few months. Under the assumption these polls do indeed come to fruition, the focus for the pound in 2020 remains on Brexit.

- During the transition period, scheduled to finish at the end of 2020, a future trade agreement will need to be reached or the UK would revert to trading with the European Union (EU) on World Trade Organisation (WTO) terms.

- The Withdrawal Agreement and the current Conservative Party agenda are, however, incompatible. We believe the stark choice faced by the UK will soon become the central focus of currency markets after the election, limiting potential GBPUSD gains from a Conservative victory to the low 1.30s. Sterling could also fall back towards its recent lows if it becomes clear that the UK will not extend the transition period.

- There are also reasons to be optimistic for the pound, if the transition period is extended. Should these positive scenarios play out, we could see GBPUSD rising towards 1.40.

Why the pound’s gains could be limited

Current general election polling is consistent with the Conservative Party securing a working majority following the December 2019 general election. If the polls are correct, sterling will face several potential issues in 2020. Brexit, in particular, remains crucial to our outlook for sterling because the structure of the UK’s exit from the EU will have a significant impact on capital flows, longer-term growth potential, investment and the Bank of England’s monetary policy stance.

Sterling has outperformed as polls have continued to favour the Conservative Party. Sterling’s strength is based on the belief that certainty in the direction of the Brexit process, along with an avoidance of Labour’s more socialist agenda, will lead to a rebound in business confidence, some fiscal spending and a postponement of easing by the Bank of England. Many expect GBPUSD to rise further, towards 1.35, in the event that the Conservative Party achieves a working majority. However, the Withdrawal Agreement negotiated by Boris Johnson does represent a relatively hard Brexit in substance. During the transition period, scheduled to finish at the end of 2020, a future trade agreement will need to be reached or the UK would revert to trading with the EU on WTO terms—a scenario that would confirm the worst fears of the currency markets from earlier this year. The UK will therefore face a critical choice soon after the Withdrawal Agreement is ratified in January 2020: attempt to complete a free trade agreement with the EU in 11 months with failure resulting in a hard Brexit, or extend the transition period. The Withdrawal Agreement allows for a one-time extension of the transition period, for a maximum of two years, and must be agreed by 1 July 2020. It is worth noting that the Conservative Party election manifesto states the intention to end the transition period in 2020. We believe the stark choice faced by the UK will soon become the central focus of currency markets after the election, limiting sterling’s potential gains from a Conservative victory to the low 1.30s against the US dollar. Sterling could also fall back towards recent lows if it becomes clear that the UK will not extend the transition period.

Challenges posed by the Withdrawal Agreement

Brexiteers argue that a trade deal with the EU should be relatively straightforward based on current trading arrangements. However, we find it difficult to believe the EU will agree to a deal on this basis given the wide range of issues that it has stated it intends to cover, and given the previous disagreements on the technical details of a deal. In particular, from the European perspective, the precedent of the EU-Canada free trade agreement appears an unlikely model for an agreement with a country that is geographically much closer and far more integrated into the European economy.

The experience this year has demonstrated the ability of the Johnson government to find a way to avoid outcomes that would be so disruptive as to undermine the prime minister’s domestic policy agenda. We believe this intention will persist beyond the election but note that calculations will change once the Withdrawal Agreement has been ratified.

First, the deadline to extend the transition period on 1 July will not result in immediate changes to the UK’s trading terms with the EU. But changes will come into effect six months later if there is no extension, so the risk that this deadline is missed will be greater. The Withdrawal Agreement, of course, will have been ratified by a parliament under a Conservative Party government that campaigned in the election to end the transition period in 2020.

Second, the mechanisms relied on at every prior major decision point, such as short, last minute extensions by the EU Commission, will be problematic once the 1 July deadline has passed, as re-opening/amending the Withdrawal Agreement would require unanimous agreement among EU nations and ratification in national parliaments.

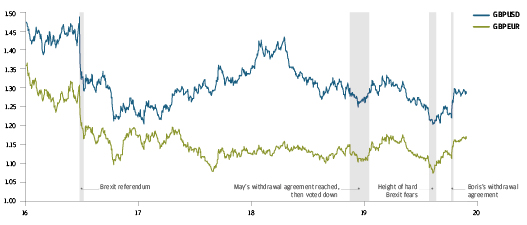

BREXIT IMPACT ON GBP/USD & GBP/EUR

Source: Bloomberg, JP Morgan Asset Management, data as of 26 November 2019.

Source: Bloomberg, JP Morgan Asset Management, data as of 26 November 2019.

Reasons to be positive on the pound

There are, of course, more positive outcomes for sterling. Should the Conservative party change tack and agree to extend the transition period until 2022, the extended time to implement required changes to trading relationships would provide a boost to business confidence. This, along with higher fiscal spending, would likely reduce the need for the Bank of England to ease policy.

While the balance of payments deficit remains a longer-term challenge for sterling, the impact would be far less acute if UK growth was strengthening and rising investment was able to attract capital inflows to the UK. Under this more positive scenario we could well envisage GBPUSD rising towards the 1.40s. This further serves to highlight the importance of the transition period decision for sterling.

Currency Management

Since our first segregated currency overlay mandate funded in 1989, J.P Morgan Currency Group has grown to manage a total of USD 330 billion (as of 31 May 2019) in bespoke currency strategies. Our clients include governments, pension funds, insurance clients and fund providers. Based in London, the team consists of 20 people dedicated exclusively to currency management with an average of over 15 years of investment experience.

We offer a range of hedging solutions for managing currency risk as well as a tailored optimal hedge ratio analysis:

- Passive currency hedging serves to reduce the currency volatility from underlying international assets. It is a simple, low cost solution designed to achieve the correct balance between minimising tracking error, effectively controlling transaction costs and efficiently managing cash flows.

- Dynamic “intelligent” currency hedging aims to reduce currency volatility from the underlying international assets and add long-term value over the strategic benchmark. A proprietary valuation framework is used to assess whether a currency looks cheap or expensive relative to the base currency and the hedging strategy is adjusted accordingly.

- Active “alpha” currency overlay offers passive currency hedging, if required, combined with an active investment process to deliver excess returns relative to the currency benchmark. Our approach is to build a global currency portfolio combining the output of fundamental models and incorporating the qualitative views of our strategy team.

0903c02a8276e573