Holiday Eye on the Market: the YUCs, the MUCs, FTX, the Gensler Rule and the Summers Rule

Non-Fungible Trainwreck. First, I’m pleased to offer readers of the Eye on the Market a holiday gift that I commissioned for you: a one-of-a-kind “APE Innovation ETF” non-fungible token. Just copy and paste the image below and your digital journey will begin. Maybe hang it in the digital living space that you bought this year1.

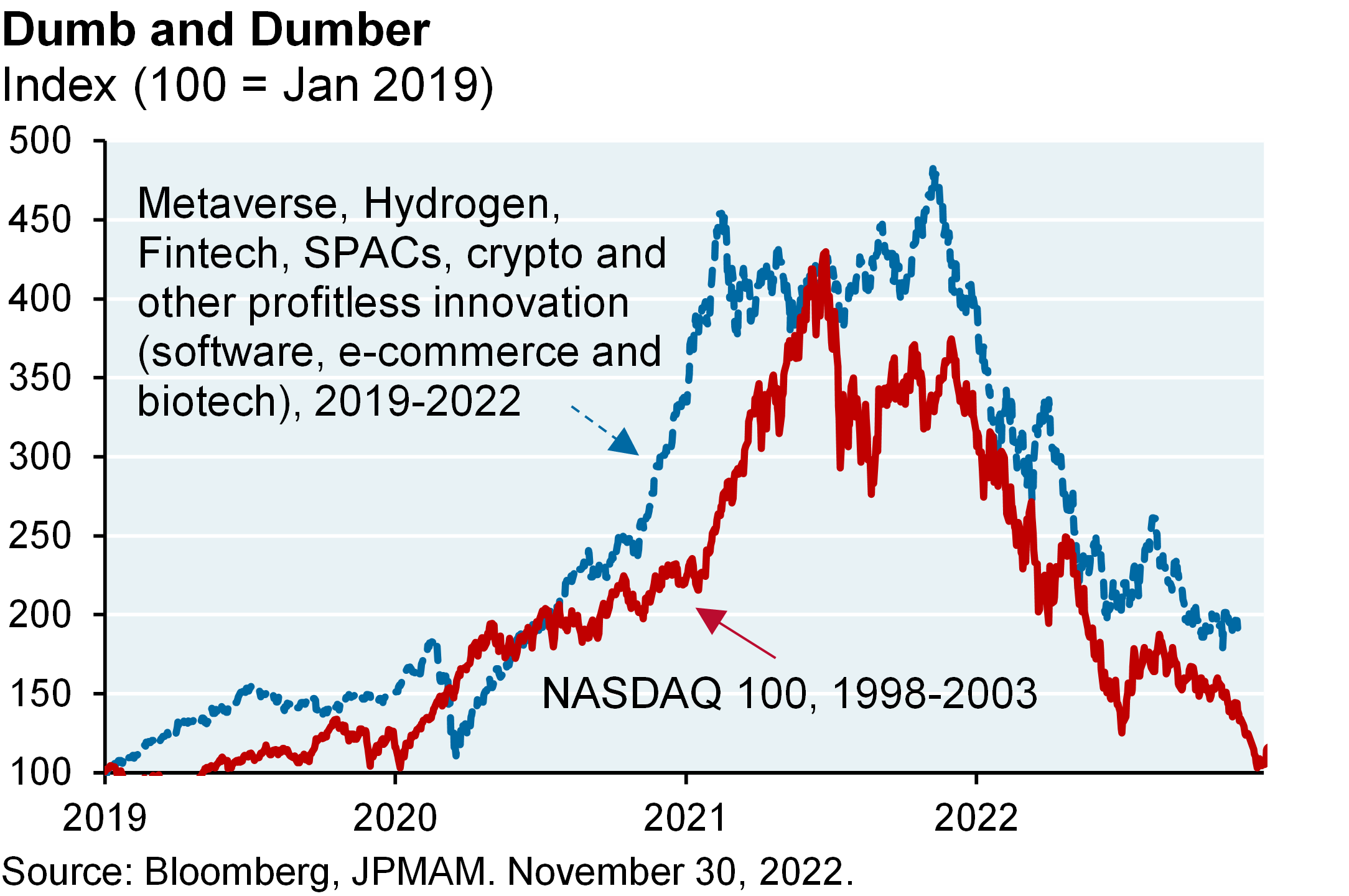

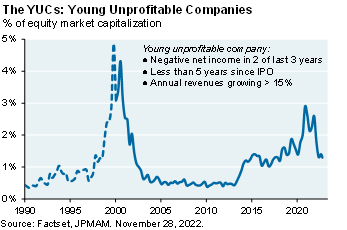

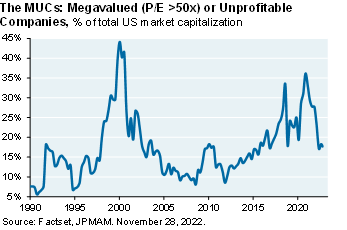

Like 2002, 2022 was also a year when unprofitable companies got repriced. The 2019-2022 cycle was arguably “dumber” since there was a historical precedent for this kind of thing. The second and third charts you will have seen before in this piece (I started writing about the YUCs in our 2020 Outlook), and are part of how we monitor the price for equity risk. Around 60%-70% of the YUC/MUC surge has now been reversed.

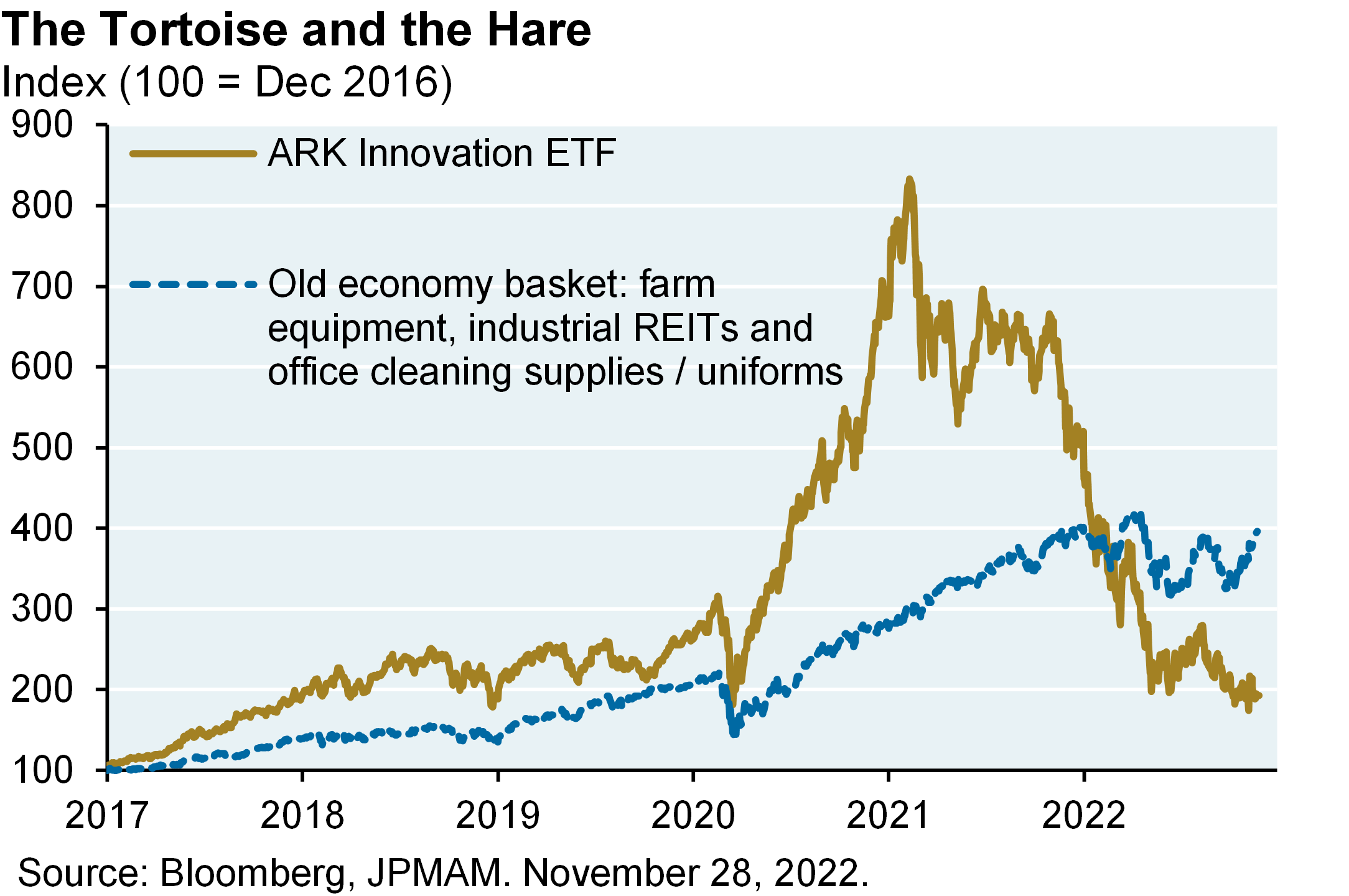

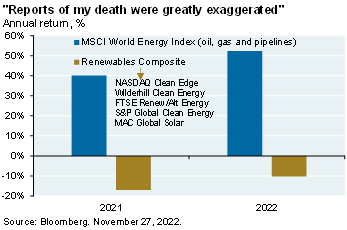

During the stimulus bonanza, digital assets were priced at an unrealistic premium relative to physical ones. Monetary and fiscal policy are normalizing now after the longest period of negative real interest rates since 1820 and the largest fiscal deficits since 1800 (other than during WWI and WWII), so I’m not surprised to see a basket of farm equipment, office cleaning supplies and industrial REITs finally outperforming “innovation” stocks. I’m also not surprised to see oil, gas and pipeline companies outperforming renewable energy companies again this year given all the issues we discuss in our energy paper. The real world is a tough and unforgiving place, and my job is to help investors navigate that.

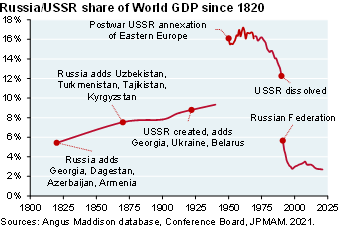

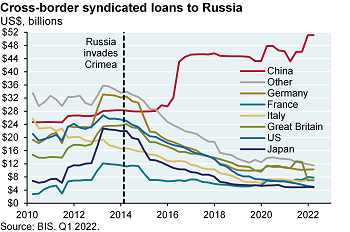

On energy, many investors and politicians underestimated the importance of Russia; after all how much damage could a country do if their share of world GDP was just 3%, its lowest in 200 years? This miscalculation was part of a broader underappreciation for thermal energy and ammonia/fertilizer at a time when the world was more focused on wind and solar power instead. That’s changing now; Germany just completed the first of five floating LNG regasification units, France plans for a substantial nuclear renaissance and China is importing record amounts of Russian gas and coal as part of a broader geopolitical realignment, one example of which is illustrated below. And while Russia is ruthlessly laying waste to Ukraine’s power grid, don’t be surprised if there is a ceasefire at some point, partially driven by the need for Europe to regain access to some Russian energy (oil and natural gas via land-based pipelines given damage to Nord Stream).

To wrap up 2022, I have created three rules for investors to follow…

#1: The Gensler Rule: Don’t be a complete hypocrite

Existing rules give the SEC jurisdiction over onshore and offshore crypto intermediary platforms (exchanges and broker-dealers) to prevent fraud, manipulation, front-running, wash sales and other misconduct. However, this also usually requires an SEC determination that the intermediary is trafficking in “securities”, a loaded phrase in crypto. In doing so, the SEC is acting pursuant to a decades-old Howey test definition of a security (which has been upheld by Federal Courts so far, most recently in SEC vs LBRY), and almost always over the objections of the crypto industry, politicians in both parties, influential venture capital firms and people within the SEC itself (including SEC Commissioner Peirce, known as “Crypto-Mom” based on her support for the industry).

As a result, the Gensler Rule works as follows: you may only criticize Commissioner Gensler and the rest of the SEC for the FTX failure if you meet all of the following criteria. No exceptions.

you have stated that many cryptocurrencies (although not Bitcoin) qualify as securities and not commodities, and that the SEC should make this judgment based on the existing test unless Congress legislates a new one

you have stated that the SEC should have responsibility for regulating onshore and offshore crypto exchanges dealing with US customers when “securities” are involved. SEC and CFTC jurisdiction over offshore platforms requires a nexus with US individuals. This is often not difficult to establish: it’s an open secret that US crypto investors frequently evade jurisdictional requirements; roughly 60% of all US crypto derivative trades were reportedly executed at the offshore unit of FTX.com2

you support the many speeches by Gensler and SEC predecessor Clayton on crypto risks, and support the SEC’s 100+ crypto enforcement actions to-date (Grayscale, Telegram, Kik, BlockFi, BitTorrent, Coinbase, LBRY etc), and support Clayton’s 2018 stinging rebuke to a group of attorneys who worked on initial coin offerings

you are not one of the Senators or Representatives that receive campaign contributions from Coinbase, Digital Currency Group, Ripple, Andreesen Horowitz, Blockchain Capital and other firms that generally argue against SEC jurisdiction, and you are not one of the eight House members that wrote directly to Gensler at the SEC in March of 2022 stating that SEC information gathering from FTX and other crypto exchanges was “burdensome”, “stifling innovation” and that it might violate Federal Law

you acknowledge that Binance, Bitfinex, Huobi, Deribit etc domicile outside the US because of more stringent US rules3. US investors don’t transact in crypto offshore because there isn’t enough “regulatory clarity” onshore; they transact offshore since that’s where the crypto industry offers the highest margin lending, the widest selection of tokens and the widest array of derivative products (i.e., crypto free-for-all)

you do not own any books, articles or pamphlets by Ayn Rand

In other words, “lack of regulatory clarity” criticism of the SEC after the FTX failure is often hypocritical nonsense. Securities laws are rarely prescriptive and are instead part of a principles-based regulatory framework designed to be flexible enough to apply to new instruments as they’re created. The crypto industry litigated against retailer and exchange reporting requirements in the 2021 Infrastructure Act that are designed to prevent fraud, and both the Blockchain Association and the Association for Digital Asset Markets complained about SEC efforts to put crypto exchanges under its purview in January 20224. Just ignore them.

For two very different views of the crypto world, compare our “Maltese Falcoin” piece from February 2022 to the hilarious profile of FTX CEO Sam Bankman-Fried from Sequoia Capital’s website, which you can still find archived online.

#2: The Sirens Rule: Watch out for shifting priorities in developing countries

In Greek mythology, the Sirens lured sailors to their deaths by drawing them in with song. The same thing sometimes happens in emerging markets: countries enact policies to draw in foreign capital just before either defaulting on it, or enacting policies which then destroy its value. The Sirens Rule: beware of false promises and of shifting priorities.

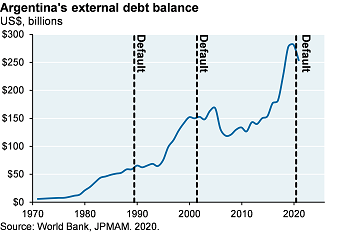

The classic example of course is Argentina, whose external debt borrowing ballooned right before its bond defaults in 1989, 2001 and 2020

Russia nationalized foreign assets as far back as 1917, a practice Putin then revived; by 2008, half of Russian industrial output was produced by corporations under state control5. Despite that history, foreign direct investment into Russia rose sharply from 2005 to 2013, right before Russia’s invasion of Crimea and the initial imposition of sanctions (which were tightened again in 2022 after its invasion of all of Ukraine). Firms whose investments are at risk: BP, Shell, Equinor, Exxon, ENI, Wintershall, German automakers and 4,000 other German companies doing business in Russia. In 2022, Russia banned foreign investors from selling Russian assets

The latest example is China, which enacted “market-friendly” policies that lured MSCI into increasing China’s weight in the Emerging Markets Equity Index to 40% by January 2021. Then, Xi’s campaign of progressive authoritarianism6 began which led to the largest underperformance of China vs world equities on record (-50%)

See Three Sirens charts in the Appendix

#3: The Summers Rule: Pay attention to Larry

Larry Summers is willing to take unpopular positions when he thinks his economic views are right, even if they conflict with the economic orthodoxy of the day. The Summers Rule: when Larry talks you should listen.

In Larry’s February 2021 Op-Ed in the Washington Post, he argued that rapid labor market healing, deployment of pent-up savings and stimulus tacked on to the largest deficits in the post-war era would reignite wage/price inflation7. He was earlier than anyone else (only one month into the vaccination process), and he was right.

Here’s what I wrote at the time: “I think Larry is onto something here; I expect Powell to face difficult decisions well before the mid-term elections in 2022, particularly as it relates to how the Fed will message a policy exit for a stock market used to zero rates and lots of Fed asset purchases. Markets are pricing in a Fed largely on hold for several years. Even if the Fed goes slow on the policy rate, the bigger question for markets is what happens to longer term rates; 2.5%+ inflation and 3.5% on 10-year US Treasuries could be a journey that involves substantial equity and credit market corrections, depending on how quickly we get there.” Larry’s inflation road map ended up being a useful roadmap for us on financial markets.

Our 2023 Eye on the Market Outlook will be released as usual on January 1st. Have a safe and happy holiday season.

Michael Cembalest

JP Morgan Asset Management

Appendix charts: the Three Sirens

1 Virtual real estate trading volumes and prices are down 98% and 88% from peak levels [Protos.com/Delphi Digital]. Another fun fact: McKinsey estimates that so far, $120 billion has been invested in the Metaverse.

2 See “US Crypto Traders Evade Offshore Exchange Bans; Americans can easily bypass measures that seek to block them from trading risky crypto derivatives outside the US”, WSJ, July 30, 2021

3 See “FTX’s Failure Is Proof that Crypto Regulation Works”, Kevin Werbach (UPenn), Barron’s, November 21, 2022

4 John Reed Stark on the Duke Financial Economics Center FinReg Blog, November 28, 2022

5 "A History of President Putin’s Campaign to Renationalize Industry”, US Army War College, 2008

6 For an explanation of progressive authoritarianism, see “Xi Jinping’s Capitalist Smackdown Sparks a $1 Trillion Reckoning”, Bloomberg, August 1, 2021

7 In economic terms, Larry essentially argued that a lot of fiscal stimulus and a 0.50 or 0.75 multiplier would push the output gap into inflationary territory, and to a greater degree than at any time since the 1970’s

This report uses rigorous security protocols for selected data sourced from Chase credit and debit card transactions to ensure all information is kept confidential and secure. All selected data is highly aggregated and all unique identifiable information, including names, account numbers, addresses, dates of birth, and Social Security Numbers, is removed from the data before the report’s author receives it. The data in this report is not representative of Chase’s overall credit and debit cardholder population.

The views, opinions and estimates expressed herein constitute Michael Cembalest’s judgment based on current market conditions and are subject to change without notice. Information herein may differ from those expressed by other areas of J.P. Morgan. This information in no way constitutes J.P. Morgan Research and should not be treated as such.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from J.P. Morgan or any of its subsidiaries to participate in any of the transactions mentioned herein. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. In addition, users should make an independent assessment of the legal, regulatory, tax, credit and accounting implications and determine, together with their own professional advisers, if any investment mentioned herein is believed to be suitable to their personal goals. Investors should ensure that they obtain all available relevant information before making any investment. It should be noted that investment involves risks, the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Both past performance and yields are not reliable indicators of current and future results.

Non-affiliated entities mentioned are for informational purposes only and should not be construed as an endorsement or sponsorship of J.P. Morgan Chase & Co. or its affiliates.

For J.P. Morgan Asset Management Clients:

J.P. Morgan Asset Management is the brand for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide.

To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our privacy policies at https://am.jpmorgan.com/global/privacy.

ACCESSIBILITY

For U.S. only: If you are a person with a disability and need additional support in viewing the material, please call us at 1-800-343-1113 for assistance.

This communication is issued by the following entities:

In the United States, by J.P. Morgan Investment Management Inc. or J.P. Morgan Alternative Asset Management, Inc., both regulated by the Securities and Exchange Commission; in Latin America, for intended recipients’ use only, by local J.P. Morgan entities, as the case may be.; in Canada, for institutional clients’ use only, by JPMorgan Asset Management (Canada) Inc., which is a registered Portfolio Manager and Exempt Market Dealer in all Canadian provinces and territories except the Yukon and is also registered as an Investment Fund Manager in British Columbia, Ontario, Quebec and Newfoundland and Labrador. In the United Kingdom, by JPMorgan Asset Management (UK) Limited, which is authorized and regulated by the Financial Conduct Authority; in other European jurisdictions, by JPMorgan Asset Management (Europe) S.à r.l. In Asia Pacific (“APAC”), by the following issuing entities and in the respective jurisdictions in which they are primarily regulated: JPMorgan Asset Management (Asia Pacific) Limited, or JPMorgan Funds (Asia) Limited, or JPMorgan Asset Management Real Assets (Asia) Limited, each of which is regulated by the Securities and Futures Commission of Hong Kong; JPMorgan Asset Management (Singapore) Limited (Co. Reg. No. 197601586K), which this advertisement or publication has not been reviewed by the Monetary Authority of Singapore; JPMorgan Asset Management (Taiwan) Limited; JPMorgan Asset Management (Japan) Limited, which is a member of the Investment Trusts Association, Japan, the Japan Investment Advisers Association, Type II Financial Instruments Firms Association and the Japan Securities Dealers Association and is regulated by the Financial Services Agency (registration number “Kanto Local Finance Bureau (Financial Instruments Firm) No. 330”); in Australia, to wholesale clients only as defined in section 761A and 761G of the Corporations Act 2001 (Commonwealth), by JPMorgan Asset Management (Australia) Limited (ABN 55143832080) (AFSL 376919). For all other markets in APAC, to intended recipients only.

For J.P. Morgan Private Bank Clients:

ACCESSIBILITY

J.P. Morgan is committed to making our products and services accessible to meet the financial services needs of all our clients. Please direct any accessibility issues to the Private Bank Client Service Center at 1-866-265-1727.

LEGAL ENTITY, BRAND & REGULATORY INFORMATION

In the United States, bank deposit accounts and related services, such as checking, savings and bank lending, are offered by JPMorgan Chase Bank, N.A. Member FDIC.

JPMorgan Chase Bank, N.A. and its affiliates (collectively “JPMCB”) offer investment products, which may include bank-managed investment accounts and custody, as part of its trust and fiduciary services. Other investment products and services, such as brokerage and advisory accounts, are offered through J.P. Morgan Securities LLC (“JPMS”), a member of FINRA and SIPC. Annuities are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. JPMCB, JPMS and CIA are affiliated companies under the common control of JPM. Products not available in all states.

In Germany, this material is issued by J.P. Morgan SE, with its registered office at Taunustor 1 (TaunusTurm), 60310 Frankfurt am Main, Germany, authorized by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) and jointly supervised by the BaFin, the German Central Bank (Deutsche Bundesbank) and the European Central Bank (ECB). In Luxembourg, this material is issued by J.P. Morgan SE – Luxembourg Branch, with registered office at European Bank and Business Centre, 6 route de Treves, L-2633, Senningerberg, Luxembourg, authorized by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) and jointly supervised by the BaFin, the German Central Bank (Deutsche Bundesbank) and the European Central Bank (ECB); J.P. Morgan SE – Luxembourg Branch is also supervised by the Commission de Surveillance du Secteur Financier (CSSF); registered under R.C.S Luxembourg B255938. In the United Kingdom, this material is issued by J.P. Morgan SE – London Branch, registered office at 25 Bank Street, Canary Wharf, London E14 5JP, authorized by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) and jointly supervised by the BaFin, the German Central Bank (Deutsche Bundesbank) and the European Central Bank (ECB); J.P. Morgan SE – London Branch is also supervised by the Financial Conduct Authority and Prudential Regulation Authority. In Spain, this material is distributed by J.P. Morgan SE, Sucursal en España, with registered office at Paseo de la Castellana, 31, 28046 Madrid, Spain, authorized by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) and jointly supervised by the BaFin, the German Central Bank (Deutsche Bundesbank) and the European Central Bank (ECB); J.P. Morgan SE, Sucursal en España is also supervised by the Spanish Securities Market Commission (CNMV); registered with Bank of Spain as a branch of J.P. Morgan SE under code 1567. In Italy, this material is distributed by J.P. Morgan SE – Milan Branch, with its registered office at Via Cordusio, n.3, Milan 20123, Italy, authorized by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) and jointly supervised by the BaFin, the German Central Bank (Deutsche Bundesbank) and the European Central Bank (ECB); J.P. Morgan SE – Milan Branch is also supervised by Bank of Italy and the Commissione Nazionale per le Società e la Borsa (CONSOB); registered with Bank of Italy as a branch of J.P. Morgan SE under code 8076; Milan Chamber of Commerce Registered Number: REA MI 2536325. In the Netherlands, this material is distributed by J.P. Morgan SE – Amsterdam Branch, with registered office at World Trade Centre, Tower B, Strawinskylaan 1135, 1077 XX, Amsterdam, The Netherlands, authorized by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) and jointly supervised by the BaFin, the German Central Bank (Deutsche Bundesbank) and the European Central Bank (ECB); J.P. Morgan SE – Amsterdam Branch is also supervised by De Nederlandsche Bank (DNB) and the Autoriteit Financiële Markten (AFM) in the Netherlands. Registered with the Kamer van Koophandel as a branch of J.P. Morgan SE under registration number 72610220. In Denmark, this material is distributed by J.P. Morgan SE – Copenhagen Branch, filial af J.P. Morgan SE, Tyskland, with registered office at Kalvebod Brygge 39-41, 1560 København V, Denmark, authorized by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) and jointly supervised by the BaFin, the German Central Bank (Deutsche Bundesbank) and the European Central Bank (ECB); J.P. Morgan SE – Copenhagen Branch, filial af J.P. Morgan SE, Tyskland is also supervised by Finanstilsynet (Danish FSA) and is registered with Finanstilsynet as a branch of J.P. Morgan SE under code 29010. In Sweden, this material is distributed by J.P. Morgan SE – Stockholm Bankfilial, with registered office at Hamngatan 15, Stockholm, 11147, Sweden, authorized by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) and jointly supervised by the BaFin, the German Central Bank (Deutsche Bundesbank) and the European Central Bank (ECB); J.P. Morgan SE – Stockholm Bankfilial is also supervised by Finansinspektionen (Swedish FSA); registered with Finansinspektionen as a branch of J.P. Morgan SE. In France, this material is distributed by JPMCB, Paris branch, which is regulated by the French banking authorities Autorité de Contrôle Prudentiel et de Résolution and Autorité des Marchés Financiers. In Switzerland, this material is distributed by J.P. Morgan (Suisse) SA, with registered address at rue de la Confédération, 8, 1211, Geneva, Switzerland, which is authorised and supervised by the Swiss Financial Market Supervisory Authority (FINMA), as a bank and a securities dealer in Switzerland. Please consult the following link to obtain information regarding J.P. Morgan’s EMEA data protection policy: https://www.jpmorgan.com/privacy.

In Hong Kong, this material is distributed by JPMCB, Hong Kong branch. JPMCB, Hong Kong branch is regulated by the Hong Kong Monetary Authority and the Securities and Futures Commission of Hong Kong. In Hong Kong, we will cease to use your personal data for our marketing purposes without charge if you so request. In Singapore, this material is distributed by JPMCB, Singapore branch. JPMCB, Singapore branch is regulated by the Monetary Authority of Singapore. Dealing and advisory services and discretionary investment management services are provided to you by JPMCB, Hong Kong/Singapore branch (as notified to you). Banking and custody services are provided to you by JPMCB Singapore Branch. The contents of this document have not been reviewed by any regulatory authority in Hong Kong, Singapore or any other jurisdictions. You are advised to exercise caution in relation to this document. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. For materials which constitute product advertisement under the Securities and Futures Act and the Financial Advisers Act, this advertisement has not been reviewed by the Monetary Authority of Singapore. JPMorgan Chase Bank, N.A. is a national banking association chartered under the laws of the United States, and as a body corporate, its shareholder’s liability is limited.

With respect to countries in Latin America, the distribution of this material may be restricted in certain jurisdictions. We may offer and/or sell to you securities or other financial instruments which may not be registered under, and are not the subject of a public offering under, the securities or other financial regulatory laws of your home country. Such securities or instruments are offered and/or sold to you on a private basis only. Any communication by us to you regarding such securities or instruments, including without limitation the delivery of a prospectus, term sheet or other offering document, is not intended by us as an offer to sell or a solicitation of an offer to buy any securities or instruments in any jurisdiction in which such an offer or a solicitation is unlawful. Furthermore, such securities or instruments may be subject to certain regulatory and/or contractual restrictions on subsequent transfer by you, and you are solely responsible for ascertaining and complying with such restrictions. To the extent this content makes reference to a fund, the Fund may not be publicly offered in any Latin American country, without previous registration of such fund’s securities in compliance with the laws of the corresponding jurisdiction. Public offering of any security, including the shares of the Fund, without previous registration at Brazilian Securities and Exchange Commission— CVM is completely prohibited. Some products or services contained in the materials might not be currently provided by the Brazilian and Mexican platforms.

JPMorgan Chase Bank, N.A. (JPMCBNA) (ABN 43 074 112 011/AFS Licence No: 238367) is regulated by the Australian Securities and Investment Commission and the Australian Prudential Regulation Authority. Material provided by JPMCBNA in Australia is to “wholesale clients” only. For the purposes of this paragraph the term “wholesale client” has the meaning given in section 761G of the Corporations Act 2001 (Cth). Please inform us if you are not a Wholesale Client now or if you cease to be a Wholesale Client at any time in the future.

JPMS is a registered foreign company (overseas) (ARBN 109293610) incorporated in Delaware, U.S.A. Under Australian financial services licensing requirements, carrying on a financial services business in Australia requires a financial service provider, such as J.P. Morgan Securities LLC (JPMS), to hold an Australian Financial Services Licence (AFSL), unless an exemption applies. JPMS is exempt from the requirement to hold an AFSL under the Corporations Act 2001 (Cth) (Act) in respect of financial services it provides to you, and is regulated by the SEC, FINRA and CFTC under U.S. laws, which differ from Australian laws. Material provided by JPMS in Australia is to “wholesale clients” only. The information provided in this material is not intended to be, and must not be, distributed or passed on, directly or indirectly, to any other class of persons in Australia. For the purposes of this paragraph the term “wholesale client” has the meaning given in section 761G of the Act. Please inform us immediately if you are not a Wholesale Client now or if you cease to be a Wholesale Client at any time in the future.

This material has not been prepared specifically for Australian investors. It:

May contain references to dollar amounts which are not Australian dollars;

May contain financial information which is not prepared in accordance with Australian law or practices;

May not address risks associated with investment in foreign currency denominated investments; and

Does not address Australian tax issues.

Holiday Eye on the Market: Non-Fungible Trainwreck

A discussion of the YUCs, the MUCs, FTX and three rules for investors: the Gensler Rule, the Sirens Rule and the Summers Rule. Our 2023 Outlook will be released as usual on January 1st.

[START RECORDING]

FEMALE VOICE 1: This podcast has been prepared exclusively for institutional, wholesale, professional clients and qualified investors only as defined by local laws and regulations. Please read other important information, which can be found on the link at the end of the podcast episode.

MR. MICHAEL CEMBALEST: Good morning, everybody and welcome to the 2022 holiday Eye on the Market. First, I'm pleased to offer everyone this week's piece, a holiday gift I had commissioned for you. It's a one-of-a-kind non fungible token drawing in here of a Bored Ape. And if you follow the NFT market at all, you will know what that's all about. And it's a cute little ape and he's holding a dollar bill that he's burnt to a crisp, and his T shirt says Ape Innovation ETF. So there you go. My present to you.

Like 20 years ago, in 2002, 2022 was also a year when lots of unprofitable companies, not just NFTs, got repriced. The first chart here shows the remarkable similarity between the NASDAQ 100 spike and collapse 20 years ago to what happened this time around with all sorts of profitless innovation companies, online shopping, cryptos, backs, fintech, hydrogen metaverse, et cetera. The title of the chart is Dumb and Dumber. I think this time around was dumber, because we've all seen this movie before, and people should have been more in tune with it.

I've also got a couple of charts in here that update where we are on the YUKs and the MUCs. This is something I started writing about in our 2020 outlook, and it's how we monitor the price for equity risk. The YUCs are young, unprofitable companies. And the MUCs are the mega-valued companies with a PE of over 50. And roughly two-thirds of the YUC/MUC surge has now been reversed, which leaves a little bit left to go. But I think we're closer to the end of this YUC/MUC repricing than the beginning of it, for obvious reasons.

During the whole stimulus bonanza from the fed and from the treasury on fiscal policy, digital assets got priced at a hugely unrealistic premium, relative to physical assets. And now that monetary policy and fiscal policy are normalizing, I'm not surprised to see, for instance, a basket of farm equipment, office cleaning supplies and industrial REIT stocks outperforming one of the well-known innovation ETFs. And I'm also not surprised to see oil, gas and pipelines outperforming renewable energy again this year, for all the reasons that we discussed in our annual energy paper. You know, the world is a pretty tough and unforgiving place, and our job is to try and help you navigate that.

And on the energy issue, what was kind of remarkable this year is how many investors and politicians underestimated the importance of Russia. I mean, this is a country, how much damage could they do? Their share of world GDP is just 3%, which is the lowest in 200 years. And while that calculation was part of a broader underappreciation for thermal energy, ammonia, fertilizer and things like that, when the world was more captivated by what was going on in the wind and solar power industries. That's changing now.

Germany just finished building the first of five floating LNG regasification units. France is planning for a substantial nuclear renaissance. And China is importing as much Russian gas and coal as they possibly can as part of a broader geopolitical realignment. And so--and while Russia is laying waste to Ukraine's power grid, I wouldn't be surprised if there's a ceasefire at some point in the new year, partially driven by the need for Europe to regain access to some amount of Russian energy, probably oil, and whatever land-based pipelines can be reopened.

To finish up 2022, I've created three rules for investors to follow. And I'm going to briefly talk about them now. The first rule is the Gensler rule. Okay? So Gary Gensler is the SEC Commissioner. And obviously, this has to do with all of the stuff going on with FTX and people saying, well, why didn't the SEC do more? Existing rules give the SEC jurisdiction over crypto intermediary platforms, you know, exchanges and broker dealers, to prevent fraud, manipulation, front running wash sales and the usual suspects.

But in order for the SEC to get involved, they typically have to make a determination that this interim--crypto intermediary is trafficking in securities. And that's a very loaded phrase. And when it does so, the SEC is acting pursuant to a Howey test, H-O-W-E-Y, that's many decades old, although it's been upheld recently by the federal courts. And when they do act according to this Howey test, they're almost always acting over the objections of the entire crypto industry, a lot of politicians in both parties, very influential venture capital firms and even people within the SEC itself.

So you can criticize Gensler and the SEC here if you want, but the Gensler rule that I am proclaiming is that you can only criticize them for what happened at FTX if you meet all of the following six criteria. Okay? Number one, you have stated that cryptocurrencies, although not Bitcoin, many of them qualify as securities and not commodities. And at the SEC, we should be the one making that determination based on the existing Howey test, unless Congress makes a new one. Two, you believe that the SEC should have responsibility for regulating onshore and offshore crypto exchanges when they're dealing with US customers on securities.

It's not that hard for the SEC and the CFTC to establish jurisdiction on offshore entities, because whenever they have a nexus with UN individuals, that's all they need. That's not very difficult to do. It's an open secret that US crypto investors are--can easily evade jurisdictional firewalls. And one estimate from the Wall Street Journal was about 60% of all crypto derivative trades were actually executed by US entities on the offshore unit of FTX.

Litmus test number three, you support the many speeches that Gensler and his predecessor at the SEC, Jay Clayton, made on crypto risks. You support the SEC's 100-plus crypto enforcement actions to date against things like Grayscale, Telegram, BlockFi, Coinbase, LBRY, et cetera. Number four, you're not one of the senators or congressional representatives that received campaign contributions from Coinbase, Digital Currency Group, Ripple, Blockchain Capital and places like that, that typically argue against SEC jurisdiction.

And you're also not one of the eight House members that wrote to Gensler in the SEC in March of this year complaining about SEC information gathering from FTX and other crypto exchanges. These eight House members, for each and in each party, wrote that these information requests were burdensome and stifling innovation. So there you go.

Fourth litmus test, you acknowledge that Binance and Deribit and Bitfinex and a lot of these other entities domicile outside of the United States because of more stringent US rules. US investors don't transact in crypto offshore because there's not enough regulatory clarity onshore, it's that they don't like the regulatory clarity that exists. US investors, crypto investors transact offshore since that's what the crypto industry offers the highest margin lending and the widest selection of token and derivative products.

And then the sixth one, litmus test, is you can't own any books or articles or pamphlets by Ayn Rand. If you do, you can't complain about the lack of SEC jurisdiction. The bottom line is, all of these comments from the crypto industry about the FTX failure being a consequence of lack of regulatory clarity is, in my opinion, a lot of self-interested nonsense. Securities regulations are rarely prescriptive and they're part of a broader framework that's designed to be flexible enough to apply to new instruments as they get creative.

The crypto industry litigated against requirements in the Infrastructure Act to prevent retailer fraud. They complained bitterly about SEC efforts to put crypto exchanges under their purview. I would advise you to simply ignore everything that they complained about as it relates to FTX and the SEC and everything else.

So for two very different views on the crypto world, I'll end this section by saying, just read our Maltese Falcoin piece from February of this year on crypto and compare that to the absolutely hilarious profile of deposed FTX CEO Fried that had--that was posted, at one point, on Sequoia Capital's website. But they took it down, but you can still find it archived online.

Two more rules for 2022, and then we'll wrap it up. One of them is the Siren's Rule. In Greek mythology, the Sirens lured sailors to their deaths. They would sing beautiful songs, and then the sailors would come in and they would drown them. The same thing happens sometimes in emerging markets. And the Siren's Rule is beware of false promises and shifting priorities.

The classic example, of course, is Argentina, that borrowed tons of money right before it defaulted in 1989, 2001 and 2020. And most of that money they borrowed was external debt. So the blueprint is, borrow lots of foreign capital and then default on it.

Another example is Russia. Russia has a long history of nationalizing foreign assets. They did so as far back as 1917. And then Putin revived that when he came into power. And by 2008, half of all of Russian industrial output was produced by companies that were under state control.

Despite that history, there was a lot of foreign direct investment in Russia from 2005 to 2013, right before Russia's invasion of Crimea. And then that prompted some sanctions. And then the sanctions were tightened again this year after it invaded the rest of Ukraine. There's lots of foreign direct investment at risk here from the big oil companies, German automakers, and 4,000 German companies that are doing business in Russia. So that's another example of watch out for shifting priorities.

And the last one is China. China enacted a lot of market friendly policies and--that lured MSCI into increasing China's weight in the Emerging Market Index to 40% by January of 2021. I mean, it was only 15% a decade before that. So right when China hits 40% of the whole EM equity index, drawing in lots of foreign capital, Xi's campaign, of what we can call progressive authoritarianism began, which obviously changed the business dynamics and valuations for a lot of Chinese companies that fell afoul of what the Chinese government was trying to do.

And then led to the largest underperformance of Chinese equities on record. Over the last three years, they've underperformed the rest of the world by 50%. So another example of that Siren's Rule, Chinese policies were very market friendly, lured in lots of capital, then the rules changed and foreign investors lost a lot of money.

The last--the last rule for this year for investors is the Summers' Rule, which I'm naming after Larry Summers. I know Larry a little bit, and what I know of Larry is that he's willing to take very unpopular positions when he thinks he's right, even if they conflict with some of the economic orthodoxy of the day. And so the Summers' Rule is that when Larry talks, you should probably listen to him.

In February of 2021, Larry was the one, before anybody else was doing it, arguing that the labor market was going to heal really rapidly, there was going to be a lot of pent-up savings deployed, and that stimulus tacked onto already massive deficits was going to--was going to reignite wage and price inflation. Very few people were saying it, very few people believed him. He was totally spot on. And I was one of the people that listened to him.

At the time, in our February Eye on the Market, right after his op-ed, I wrote that I think that Larry is onto something here and that Powell was going to face some difficult decisions well before the midterms. Markets were pricing in a Fed that was on hold for years. And I wrote that even if the Fed went slow on the policy rate, there was a big question for markets as to what happened when it would rise. And that that journey would involve substantial equity and credit market corrections, depending on the speed, which is exactly what happened. So Larry's inflation roadmap ended up being a useful roadmap for us, as well, on markets.

So let's see, good news and bad news. First, the bad news. The NFT that I've made for you has declined in value by 25% since you started listening to this podcast. The good news is our 2023 Eye on the Market will be released, as usual, on January 1st of next year. And I'd like to wish everybody a safe and happy holiday season. So long.

FEMALE VOICE 1: Michael Cembalest's Eye on the Market offers a unique perspective on the economy, current events, markets and investment portfolios, and is a production of JP Morgan Asset and Wealth Management. Michael Cembalest is the Chairman of Market and Investment Strategy for JP Morgan Asset Management and is one of our most renowned and provocative speakers. For more information please subscribe to the Eye on the Market by contacting your JP Morgan representative.

If you'd like to hear more, please explore episodes on iTunes or on our website. This podcast is intended for informational purposes only and is a communication on behalf of JP Morgan Institutional Investments Incorporated. Views may not be suitable for all investors and are not intended as personal investment advice or as solicitation or recommendation. Outlooks and past performance are never guarantees of future results. This is not investment research. Please read other important information, which can be found at www.jpmorgan.com/disclaimer-eotm.

[END RECORDING]