Impact of technological developments on the ETF industry

Q7. What impact do you think technological development, such as automation, artificial intelligence, machine learning and data analytics, will have on the ETF industry? (Multiple answers were allowed)

Key Take Outs

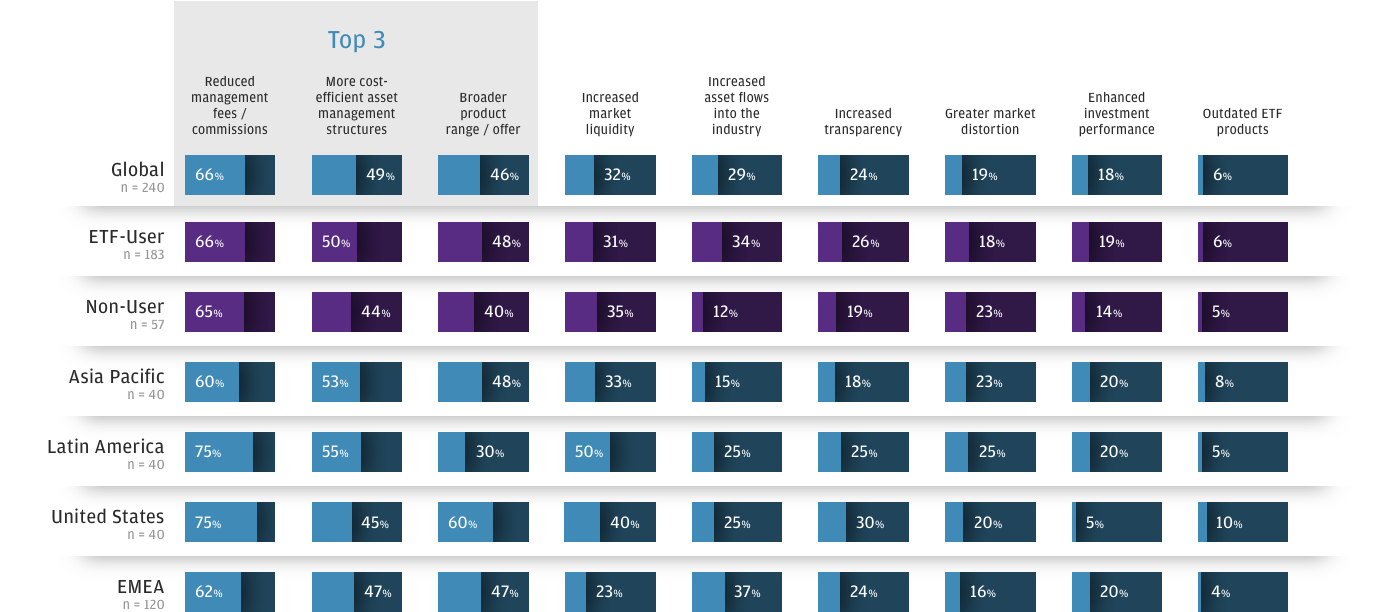

Professional buyers generally expect technological change to boost the existing advantages of ETFs, with two thirds expecting new technology to lead to reduced management fees and commissions, and nearly half expecting more cost-efficient management structures and broader product ranges from ETF providers to emerge.

New technology is also expected to lead to increased market liquidity by a third of respondents, although only 18% expect technology to drive enhanced investment performance.

Respondents that do not currently use ETFs are generally less positive about new technology than buyers of ETFs, with nearly a quarter of non users expecting technological change to lead to greater market distortions, compared to 18% of ETF users, while only 12% of non users expect technology to lead to increased ETF assets, compared to 34% of ETF users.

Thematic ETFs

Q8. What characteristics, if any, of thematic ETFs attract you the most? (Multiple answers were allowed)

Key Take Outs

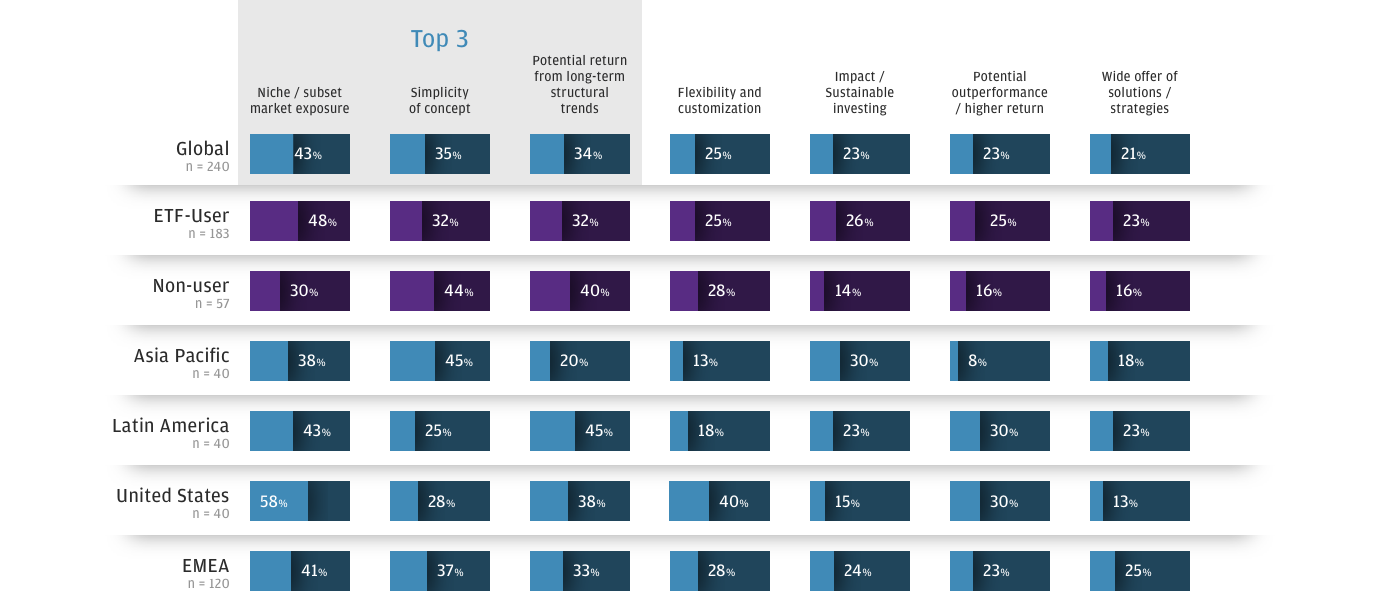

Thematic ETFs, which aim to benefit from long-term macroeconomic and structural trends, are a potential growth area for the ETF industry.

According to the survey, investors are most attracted by the niche market exposure, simplicity of concept and the potential return from long-term structural trends that thematic funds provide exposure to.

Respondents who don’t currently use ETFs were more attracted by the simplicity and potential return of thematic funds, while ETF users prefer the niche market exposure provided.

ETF Knowledge

Q9. What level of knowledge do you think your clients have about different types of ETF? (Scale 0-5; 0 = no knowledge and 5 = very knowledgeable; not knowledgeable % is total of 0, 1 and 2 scores)

Key Take Outs

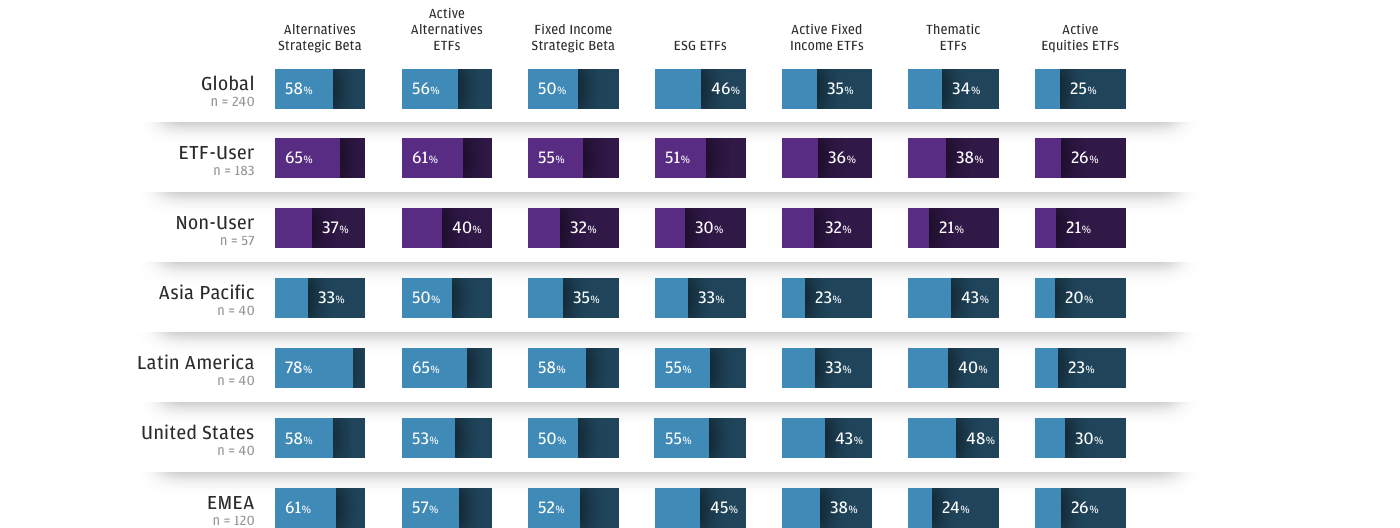

Respondents said that their clients have a relatively high level of knowledge of active equity ETFs (43% of respondents think that their clients are very knowledgeable).

In contrast, just 8% of respondents think that their clients are very knowledgeable about active alternative ETFs.

Regionally, Asia Pacific respondents appear to have the most knowledgeable clients across most types of ETF, while Latin American respondents have clients with particularly low levels of knowledge of alternative strategic beta and active alternative ETFs.

Future ETF Interest

Q10. Which of the following types of ETF do you think your clients will be interested in over the next two to three years? (scale 0-5; 0 = not interested, 5 = very interested; % interested score is total of 4s and 5s)

Key Take Outs

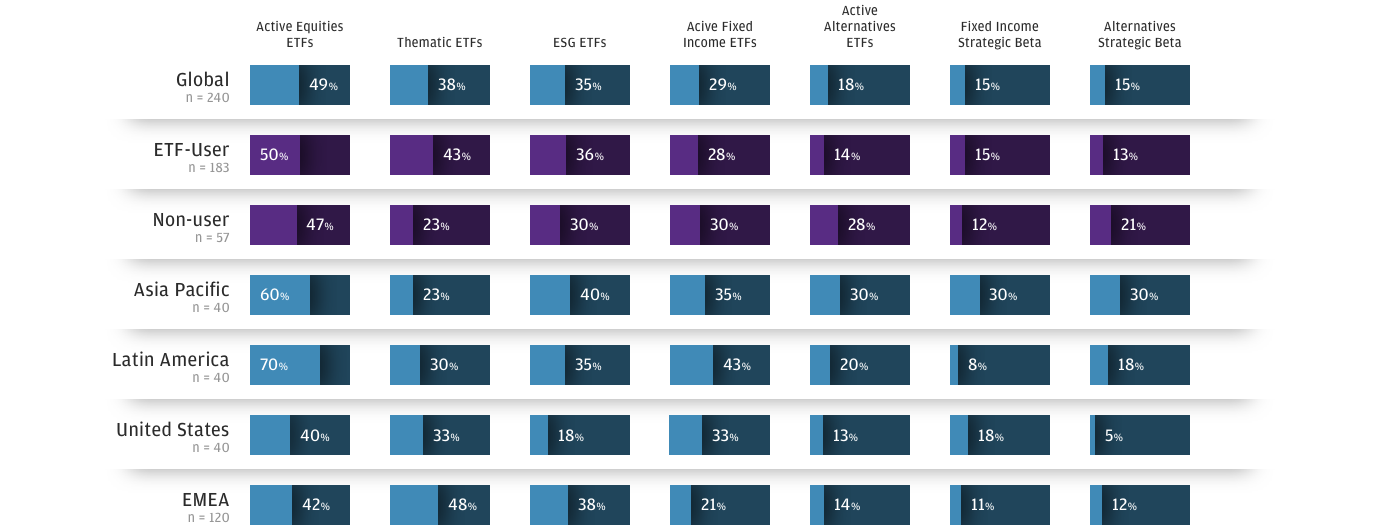

The highest percentage of respondents (49%) think that their clients will be interested in investing in active equity ETFs over the next two to three years, which also corresponds to a relatively high level of perceived client knowledge in active equity ETFs (see question 9).

Thematic ETFs, and ETFs with an environmental, social and governance (ESG) focus, are expected by respondents to receive a relatively high level interest from their clients, in line with growing client knowledge shown in question 9.

Respondents generally think that their clients will have a relatively low level of future interest in alternative strategic beta, fixed income strategic beta and active alternative ETFs-again reflected low levels of client knowledge recorded in question 9.

0903c02a826c4686