Overview

Demand for active exchange-traded funds (ETFs) has grown significantly in recent years. Global assets under management are now at USD 565 billion, which is a sharp increase from only USD 122 billion five years ago.1 This growth is likely to continue. According to the 2022 Global ETF Investor Survey from Brown Brothers Harriman, 39% of investors globally are planning to increase their active ETF allocation. However, in our conversations with clients, we still see many misconceptions about active ETFs. For this reason, we have created this guide to serve as an educational resource.

1 Bloomberg; Data as of 29 December 2023, US & UCITS only.

What is an active ETF?

A variety of “engines” or strategies can therefore be placed in the ETF structure to leverage its benefits.

“Active” refers to specific investment decisions, which are designed to achieve specific outcomes, such as outperforming an index (Alpha), generating income, or achieving control in terms of duration, yield or credit quality.

An active ETF provides access to these specific outcomes, all while maintaining the attributes of the ETF structure.

The ETF is just a wrapper and the content itself is independent of the vehicle

Active ETF overview

Demand for active ETFs

Active ETF assets have grown sharply in recent years. At the end of 2017 the global assets under management were only at 58bn US dollar, growing to 565bn US dollar end of 2023..2

2Bloomberg; Data as of 29 December 2023, US & UCITS only.

3Brown Brothers Harriman Global ETF survey 2023.

Demand for active ETFs is growing

Types of active ETFs

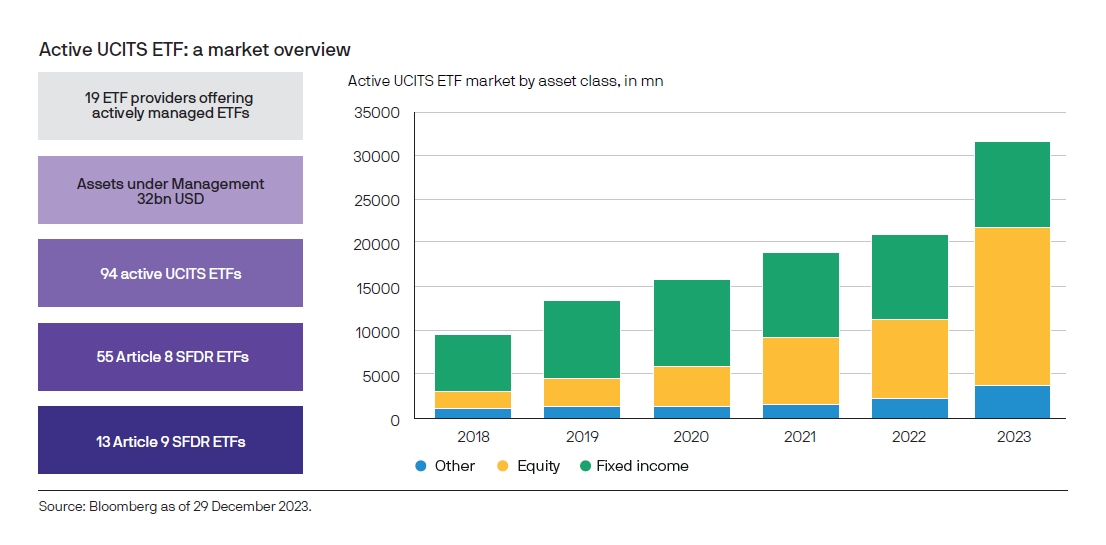

The first active ETF was launched in 2008. Since then, a lot of innovation has happened in the active ETF market. There are now 19 ETF issuers offering active ETFs – a number that has tripled over the last five years.

4Source: Bloomberg as of 29 December 2023.

Active UCITS ETF: a market overview

Why invest in active ETFs?

Actively managed ETFs in focus

Getting started

J.P. Morgan Asset Management: Advancing the potential of ETFs

J.P. Morgan ETFs are rigorously designed to push the boundaries of ETF investing so that investors can build diversified, competitively priced portfolios.

J.P. Morgan Asset Management launched its first UCITS ETF in November 2017. Since then, we have brought many innovations to the ETF market – from our successful Research Enhanced Index Equity strategies which now consists of ten ETFs, to the launch of the industry’s first active China equity and UK equity ETF, as well as a UCITS global equity version of the world's largest ETF.

J.P. Morgan Asset Management is the number 1 provider for active ETFs in the UCITS space and one of the largest globally.8 We have also been named “Best Active ETF Provider (USD 500 million +)” by ETF Express and got awarded "Best Active ETF" at the 2023 ETF Stream Awards.

Past performance is not a reliable indicator of current and future results.

8 Source: Bloomberg as of 31 March 2023.

Source: J.P. Morgan Asset Management, Bloomberg as of 31 December 2023, Funds Europe, ETF Express.

Explore our full range of ETFs

Past performance is not a reliable indicator of current and future results.

09ab221212093730