OUR APPROACH TO LIABILITY DRIVEN INVESTING

A pioneer in asset-liability management for 40+ years, our LDI philosophy is focused on maximizing alpha by capturing inefficiencies through dynamic sector rotation and security selection within spread sectors. Our integrated team takes both a top-down and bottom-up approach to design a range of solutions to solve for a variety of pension challenges.

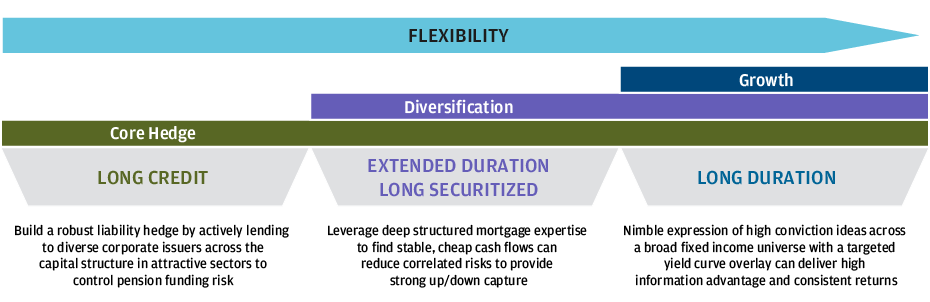

We offer a suite of solutions across the entire LDI spectrum to help investors solve a variety of pension challenges

0903c02a8286df39