In brief

- Markets have been volatile as a series of cross-currents have led to a broader distribution of outcomes

- Earnings have come in better than expected, with weakness concentrated in a few sectors

- Stock/bond correlations will remain positive for as long as inflation is a question

- Multiples will remain under pressure as rates rise, leaving earnings as the key driver of returns

Profits in a lonely world

2022 has proven to be a far more challenging market environment than what was expected at the turn of the year. Back in January, a handful of risks could be observed – a more hawkish Federal Reserve and higher interest rates, a pandemic that had not yet faded, and inflation that was proving to be stickier than expected. Four months into the year those risks remain, and coupled with the conflict in Ukraine and fears of slower growth, have contributed to the most significant realized volatility we have seen since 2020.

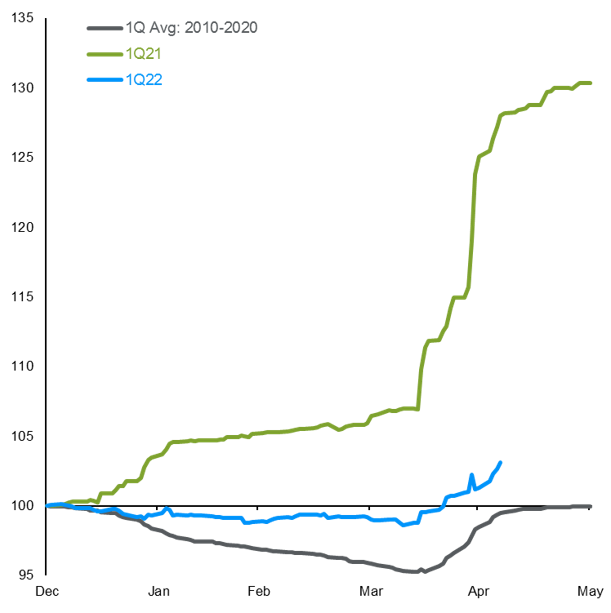

A re-rating of valuations has led to negative equity returns year-to-date, but importantly, earnings estimates have continued to trend higher. In an environment of rising rates, earnings will be the key driver of returns; with 90% of S&P 500 market capitalization reporting, our current estimates for 1Q22 earnings per share is $49.91. If realized, this would represent a quarter-over-quarter contraction of 12.0%, but year-over-year growth of 5.3%. Importantly, 1Q22 earnings have proven to be better than expected, despite the fact that we do look set to realize a quarter-over-quarter contraction in profits.

1Q consensus EPS estimates

Indexed to 100 on 12/31 of the prior year

Source: FactSet, Standard & Poor's, J.P. Morgan Asset Management. All data are as of May 6, 2022.

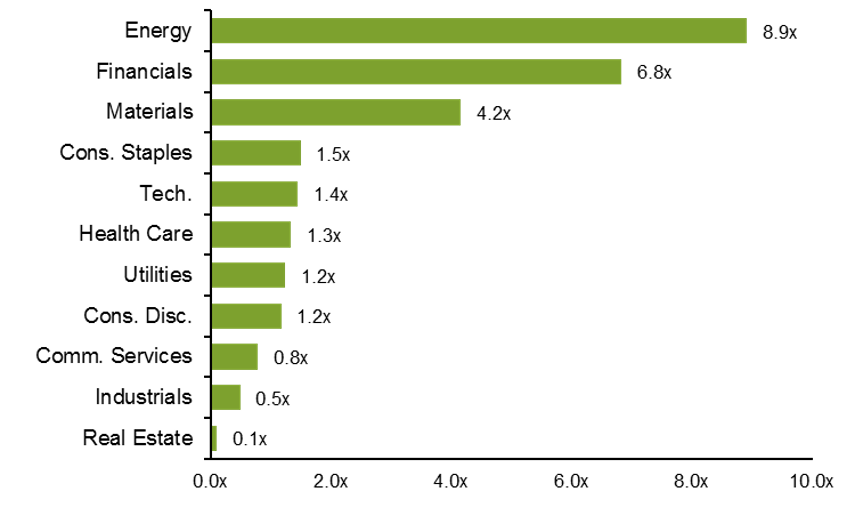

Against this backdrop, 65% of companies have beaten revenue estimates and 74% of companies are beating earnings estimates, although earnings surprises are tracking below their long-term average. Importantly, margins have come under pressure, but are still aligned with pre-pandemic highs; furthermore, given the first quarter saw the real economy contract, there is likely room for margins to expand over the coming quarters. Margins will be key for the earnings story this year, and as we think about opportunities in the equity market, we are focused on those industries and sectors with the greatest amount of operating leverage. In a robust nominal growth environment, those companies with greater fixed costs will find it easier to defend, or potentially increase, margins, thereby seeing the greatest benefit to the bottom-line.

S&P 500 operating leverage by sector

Weighted averages based on last 5 years

Source: Bloomberg, J.P. Morgan Asset Management. All data are as of May 6, 2022.

Some will win, some will lose

The communication services is currently tracking an operating earnings contraction of 5.1% despite revenues increasing 8.6% over the same time period. Within the sector, entertainment and streaming has struggled in particular due to a drop-off in gaming sales and subscribers as we return to pre-COVID trends. Additionally, the sector has felt the pressures of higher content acquisition costs (how much a social media company pays other websites to direct traffic to them), labor costs and energy costs (datacenters and cell-phone companies). That being said, it is unsurprising that the wireless communication companies have all posted strong earnings, as their services remain essential for consumers, thus enabling them to increase prices to offset costs.

Consumer discretionary

At the sector level, results have been mixed. The consumer discretionary sector is currently tracking an operating earnings contraction of 41.2% and a revenue increase of 9.7%, as costs, supply chains, geopolitical tensions and the outbreak of Omicron earlier in the quarter both weighed on margins. The big drop in earnings can also be attributed to a one-off investment markdown related to Amazon’s stake in Rivian. This was partially offset by strong results in the autos industry. While the U.S. automakers all cited mounting labor, commodities and freight-related costs, they were able to preserve profitability due to a positive pricing environment driven by strong demand outweighing supply. The outbreak of Omicron and continued lockdown measures in China put a dent in Hotels & Restaurants earnings, as travel became further restricted and disrupted supply chains have pushed food costs up further. In fact, many restaurant management teams noted that the higher than expected CPI readings in 1Q22 are understating the costs they are facing, which are increasing 10-13% y/y. Lastly, similar to the auto companies, the apparel industry has benefitted from price increases and expects further price hikes into 2Q22.

Industrials, material and energy are leading the S&P 500 sectors in terms of earnings growth, as all three are highly cyclical and highly levered to the U.S. in terms of sales. Moreover, both the industrial and material sectors are quite diversified in the sense they provide goods and services across all sectors. Within industrial, industries such as transport, construction, building products and electrical equipment have been the primary drivers of earnings, as they directly benefit from the surge in transportation and commodities costs. Airlines are still a weak spot but most, if not all, management teams expect profits to return in 2Q22 on the back-off rapidly recovering demand.

Information technology is currently tracking operating EPS growth of 21.3% y/y, as we continue to see secular growth in the demand for software products and services, which have become even more important amid higher inflation. Companies will need to further leverage their digital capabilities in order to address operating inefficiencies. Additionally, hardware sales, which were expected to decline, came in more resilient than expected due to strong consumer trends. Lastly, semiconductor chips remain high in demand relative to available supply, thus boosting profits among the large chip makers. In terms of delivery times, some management teams have suggested it may take until 2024 for the semiconductor supply chain to normalize due to a lack of tools needed for the production of chips.

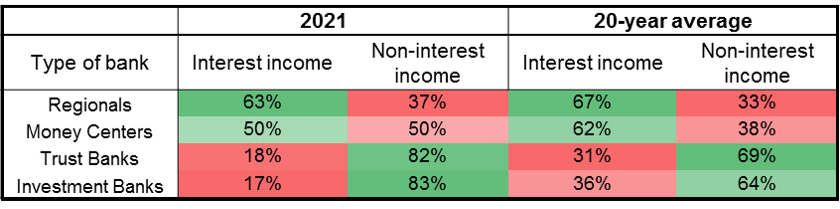

With almost the entire sector having reported earnings, 71% of financials have beat analyst earnings expectations. Yet despite the decent beat figure for financials, the sector as a whole is still tracking a y/y decline. Results have been hampered by huge loan loss reserve releases this time last year, a drop off in mortgage and capital markets activity and higher non-interest expenses due to rising compensation and continued business related investments. Additionally, given the uncertain economic backdrop over the next 12-months, some banks even built up provisions for losses in 1Q22, which acted as another drag on profitability.

Within the sector, the current macroeconomic environment seems to be more beneficial for the regional banks, as they tend to derive a larger percentage of their profits from interest income in contrast to the money centers and investment banks, which have a larger exposure to non-interest income streams.

U.S banking industry revenue breakdown

Source: Company filings, FactSet, J.P. Morgan Asset Management. All data are as of May 6, 2022.

Health care earnings seem to be benefiting from the hybrid state of the world where COVID-19 is still prevalent but economies have also re-opened. Our model is currently projecting earnings to grow 6.4% y/y. The rise in Omicron cases at the beginning of the quarter fueled surges in COVID-19 testing, treatment and vaccine sales. Additionally, the vaccine makers expect sales to increase again in 2H22 in anticipation of governments ramping up orders for the fall/winter seasons.

The real estate sector is tracking earnings growth of 42.1% y/y due to limited inventory and strong consumer and commercial demand. Moreover, the tight labor market and fierce competition for talent has made securing newer office space a bigger concern for companies. According to Vornado, 40% of leases signed in 1Q22 were for new or redeveloped assets that offer amenities and easy transit options for employees.

Everybody wants a thrill

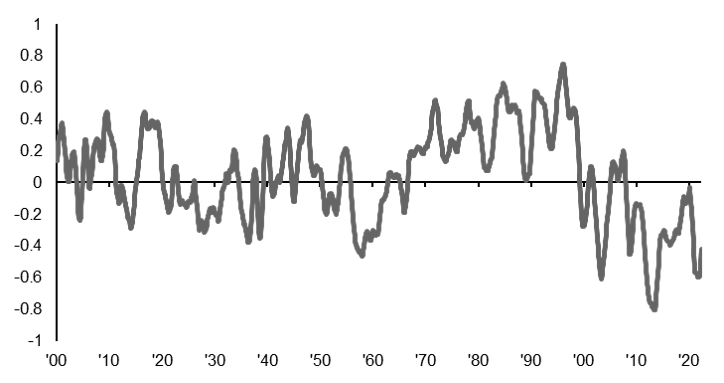

The most thrilling part of the first quarter was that stocks and bonds sold off together. While the past two decades have seen stock and bond prices move inversely, this has not always been the case. As shown below, stock/bond correlations are unstable over time, and were positive for significant periods from the late 1970s through the late 1990’s. This period coincided with elevated inflation and – at times – aggressive monetary policy, which seems to rhyme with the environment today. Investors may need to rethink what it means to be diversified, particularly if inflation proves more difficult to contain than expected.

Stock-bond correlations

S&P composite, 12-month rolling correlations, 1900 - present

Source: Robert Shiller, Yale University, J.P. Morgan Asset Management. All data are as of May 6, 2022.

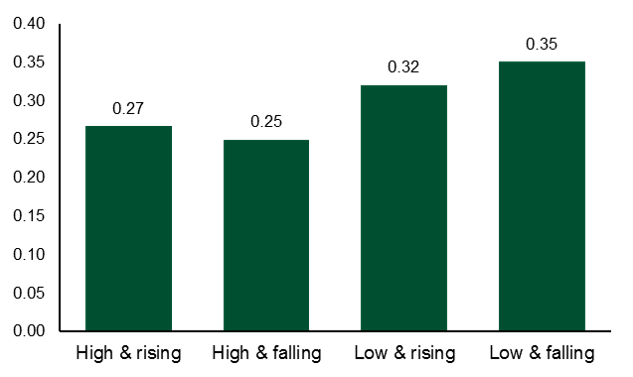

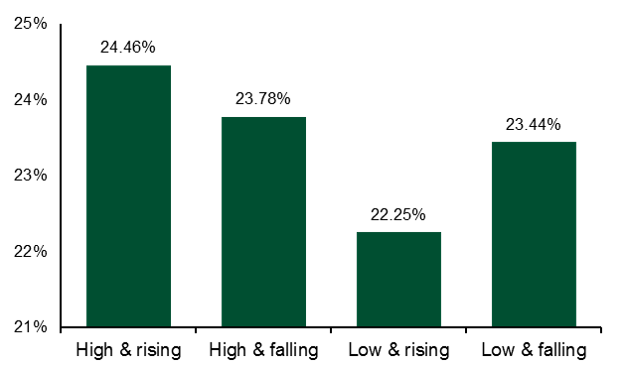

That said, an environment of higher inflation may not be bad for active managers. As shown in the two charts below, correlations have been lower and return dispersion has been higher in environments where inflation has been above the median for the full period. The key to navigating equity markets will be to balance earnings potential with valuation, particularly as certain names in the growth space begin to look attractive from a valuation perspective.

S&P 500 realized correlation*

1991 - present

S&P 500 return dispersion**

1991 - present

Source: Standard & Poor's, U.S. Department of Labor, FactSet, J.P. Morgan Asset Management. *Realized correlation is provided by Standard & Poor’s and is a measure of the daily returns of the S&P 500 constituents during the month, calculated via the ratio of index variance to the index-weighted average constituent variance. ** Return dispersion is provided by Standard & Poor's and is the annualized, index-weighted standard deviation of the S&P 500 constituents' full-month total returns." All data are as of May 6, 2022.

Investment implications

Economic volatility has translated into interest rate volatility, which has destabilized capital market volatility. As yields move higher multiples will be pushed lower, but gradually markets will come back into balance. In this type of environment, identifying the sectors and industries which stand to benefit from the broader macroeconomic environment will be key – we like industrials, materials, energy, and technology. Structurally, we continue to see an opportunity in health care.

Markets will remain bouncy as uncertainty around the Fed’s ability to control inflation lingers on the horizon. However, the path that has been outlined may be effective as global growth shows signs of slowing. The key for a "soft-landing" will be how quickly the private sector can recover from the supply-side shock, as healthier supply chains and an increase in labor will help moderate price pressures in the economy.

09xe220905193216