Monetary Authority of Singapore: Policy sufficiently tight to pause

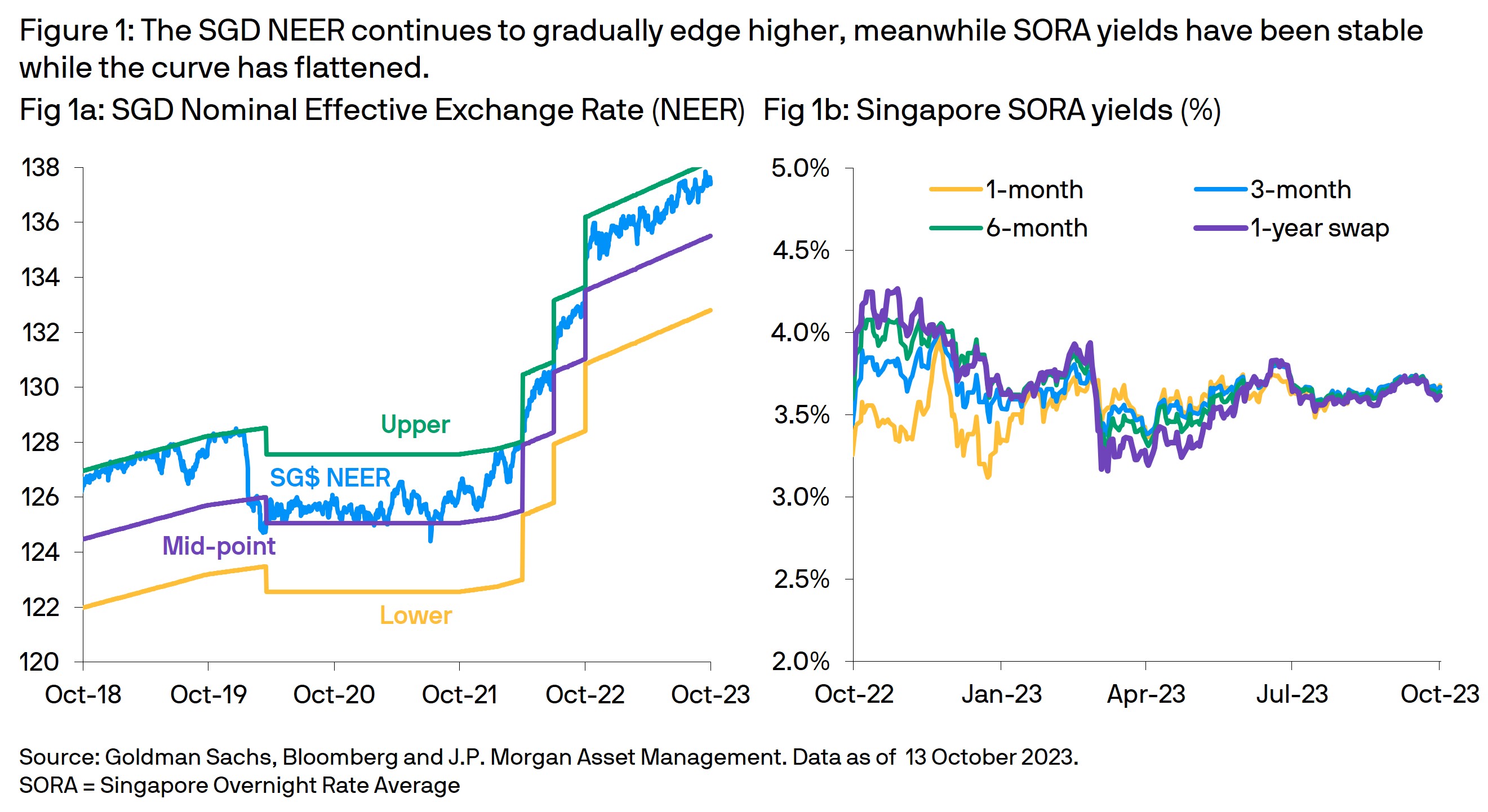

At its semi-annual monetary policy meeting on 13 October, the Monetary Authority of Singapore (MAS) decided to maintain its prevailing monetary policy stance (Fig 1a) for a second meeting - following five previous upward adjustments. The decision was In-line with expectations, with the central bank leaving the slope (currently upward sloping at 1.5%), band width, and mid-point of the Singapore Dollar Nominal Effective Exchange Rate (SGD NEER) unchanged. The central bank judged that current policy was ”sufficiently tight”, however, they remain hawkish, noting that “a sustained appreciation of the policy band is necessary to dampen imported inflation and curb domestic cost pressures”. Notably, the MAS will be shifting to a quarterly monetary policy schedule from 2024, with meetings in January, April, July, and October.

Inflation moderating and growth improving:

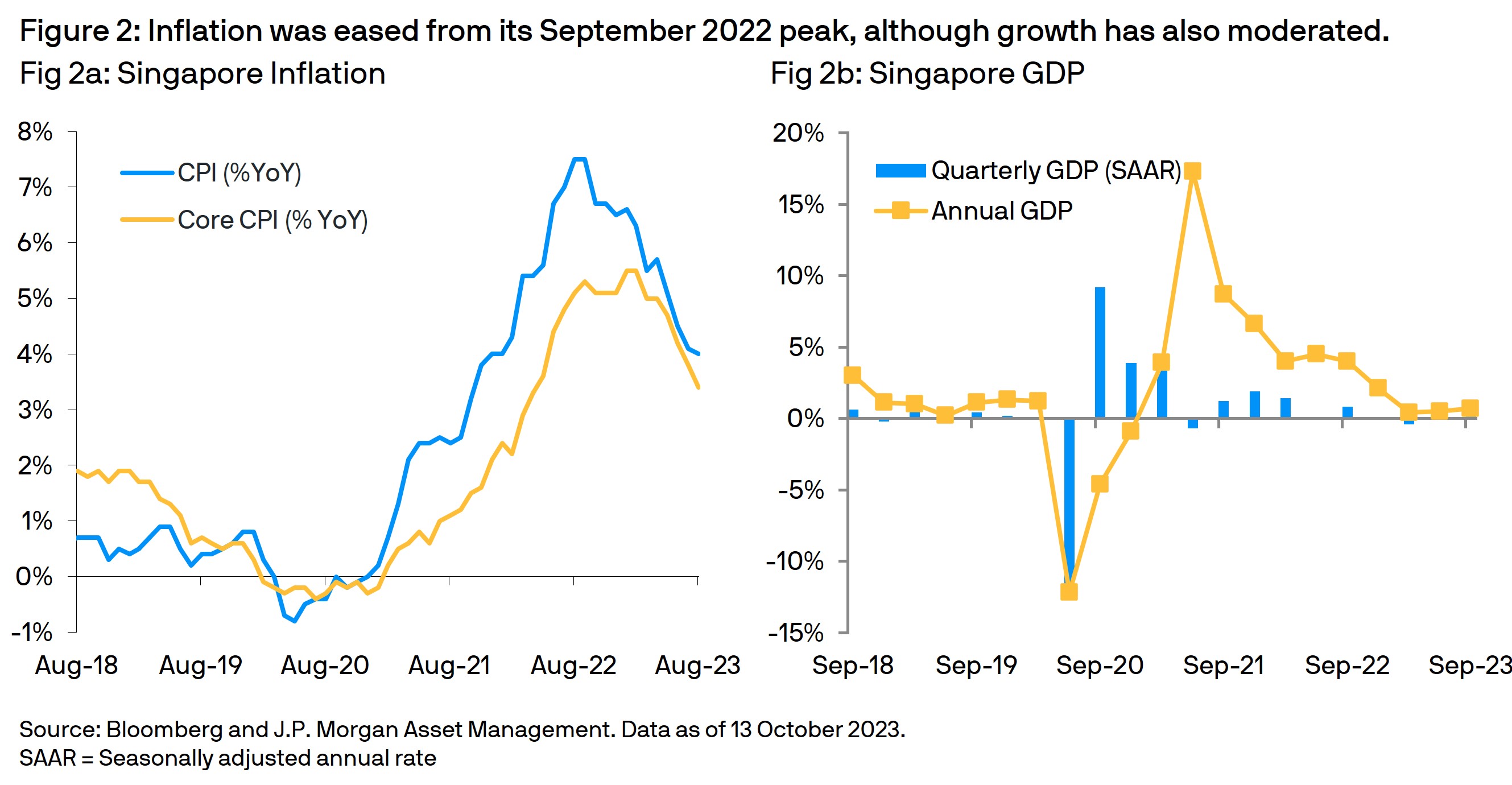

Advanced third quarter GDP beat the market expectation, increasing by a robust 1.0%q/q (Fig 2b) as improvements in the manufacturing and solid services offset weaker domestic demand. This pushed the annual pace to a three quarter high of 0.7%y/y. The MAS forecast that “prospects for the Singapore economy are muted in the near term”, but “growth is expected to improve gradually over 2024”.

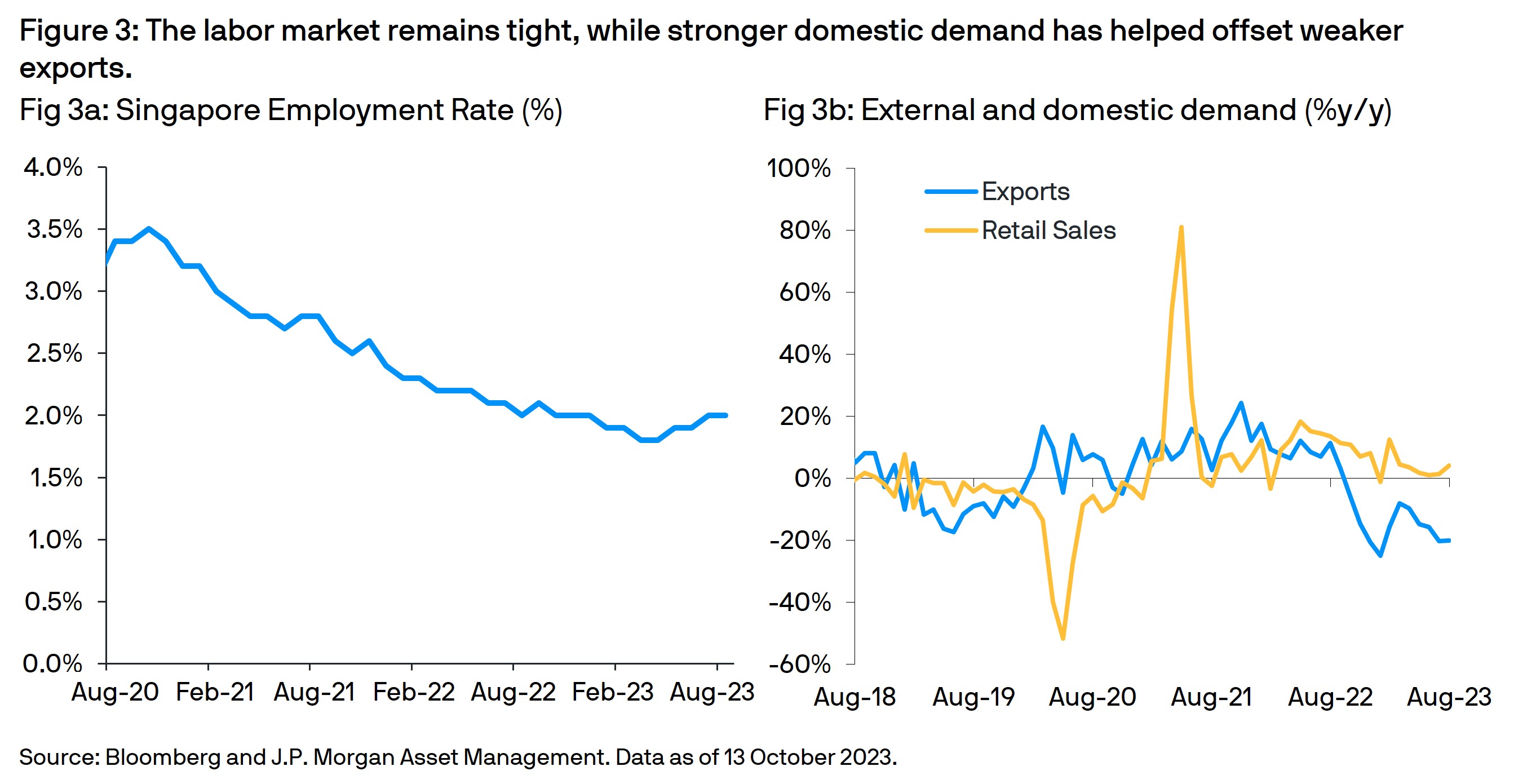

Year-to-date, inflation pressures (Fig 2a) in Singapore have been more persistent than expected – due to higher Certificate of Entitlement (COE) premiums, petrol prices and accommodation costs. The MAS is predicting average inflation for 2023 will print at 4% while core inflation will only slow to 2.5 – 3.0%y/y by year-end. Nevertheless, the central bank believes “core inflation should be on a broad moderating trend” as prices of food and goods ease while a cooling employment market (Fig 3a) will reduce labor costs. The policy statement confirmed the first official inflation forecasts for 2024 at “2.5-3.5%y/y for core inflation and 3.0-4.0%y/y for headline inflation” (priced in the GST rate change for consumers).

Despite these optimistic trends, risks remain – especially due to the uncertain global economic backdrop. Inflation remains elevated and is only likely to fall gradually. Concurrently, weak export demand, fading domestic spending (Fig 3b) and lower consumer confidence continue to weight on the economic growth outlook. Fortunately, the unemployment rate remains low and proactive government fiscal measures have supported consumption.

Market reaction

Following today’s announcement, the SGD NEER was broadly unchanged atand remains above the mid-point of the policy band. The SGD currency weakened while bond yields moved marginally lower.

Conclusion:

While the MAS appears comfortable to pause its two-year rate hiking cycle for a second time, it has retained its decidedly hawkish bias. With inflation risks still prevalent, we believe it is still far too early for MAS to feel comfortable reducing the pace of SGD NEER appreciation. This implies interest rates are likely to stay at current high levels for the foreseeable future. For SGD cash investors, the current interest rate environment presents relatively attractive investment opportunities for their liquidity and ultra-short duration strategies.

This information is generic in nature provided to illustrate macro trends based on current market conditions that are subject to change from time to time. This generic information does not take into account any investor’s specific circumstances or objectives and should not be construed as offer, research or investment advice.

09z8231310082802