In brief

- The Monetary Authority of Singapore (MAS) maintained its dovish stance. It slightly reduced the rate of appreciation of the SG$ NEER policy band but kept the width and centre-point unchanged.

- Singapore's GDP growth is expected to slow significantly in 2025 due to global trade tensions and policy uncertainties. The MAS also lowered its inflation forecast, anticipating that price pressures will remain contained. This signals that further monetary policy easing is likely.

- Short tenor SGD interest rates have declined but remain attractive. The slower pace of currency appreciation is expected to narrow the spread between Singapore and US interest rates, providing an opportunity to extend duration. Caution and diversification remain important due to ongoing market volatility.

The second easing in current cycle

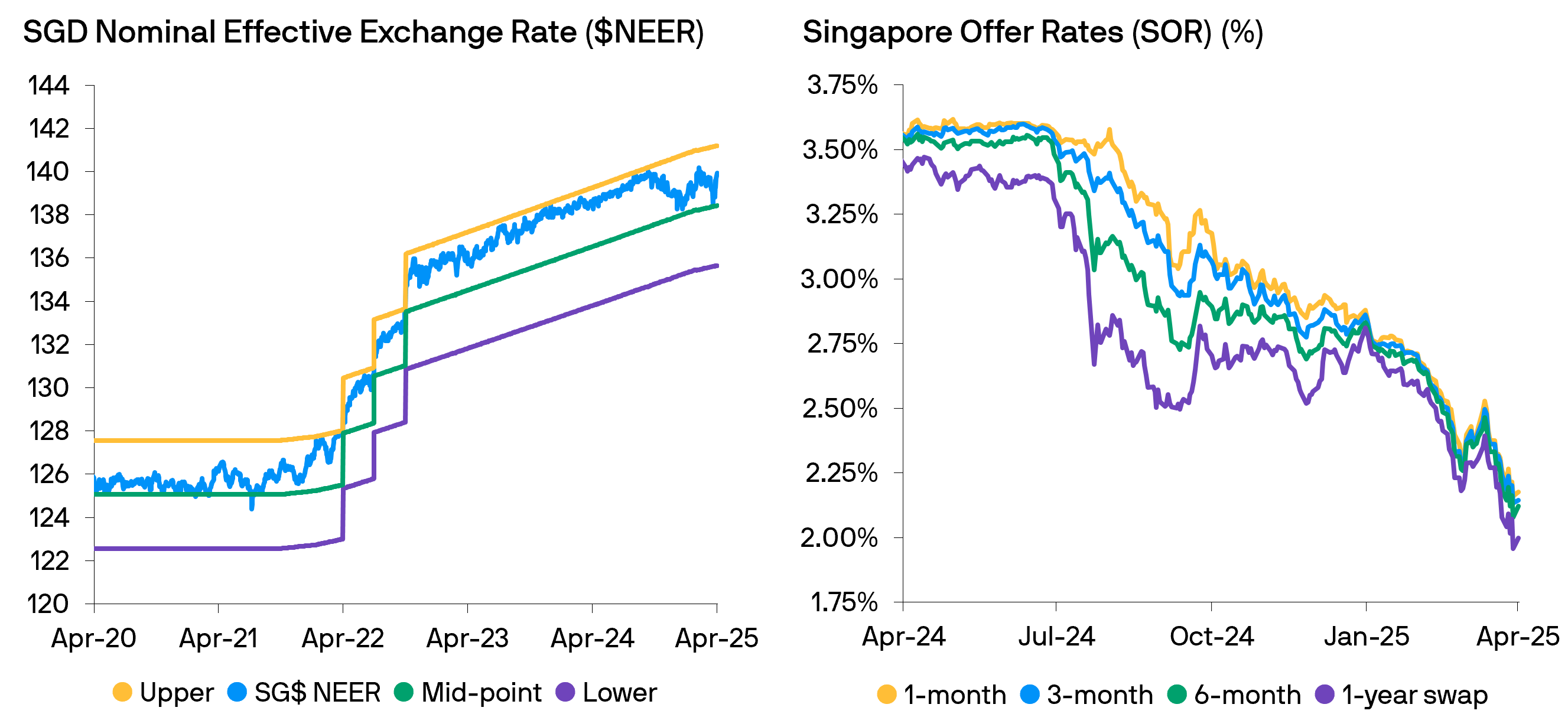

In its April monetary policy statement, the Monetary Authority of Singapore (MAS) reaffirmed its dovish approach. It slightly reduced the rate of appreciation of the Singapore Dollar Nominal Effective Exchange Rate (SG$ NEER) policy band. The width and centre-point of the band remain unchanged. This decision comes amid “weakening global economic activity” and “escalating trade policy uncertainties”.

The MAS noted increasing downside risks to Singapore’s economic outlook. These include financial market volatility, weaker consumer confidence, and a sharper-than-expected fall in final demand. The MAS’s decision marks its second policy easing in the current cycle. While the MAS did not disclose the exact details of the SG$ NEER, investors estimate the slope was reduced from 1.0% to 0.5%.

Fig 1: The MAS has further reduced the slope of the SG$ NEER; Singapore interest rates have fallen sharply in anticipation of global interest rate cuts.

Source: Goldman Sachs, Bloomberg and J.P. Morgan Asset Management; data as at 14th April 2025.

A pivot from inflation to growth

In January, the MAS forecasted GDP growth would moderate to 1.0–3.0% in 2025, down from 4.4% in 2024. This was amid steady trade conditions and resilient private demand. However, first quarter GDP increased by a weaker-than-expected 3.8%y/y due to contractions in the manufacturing and finance sectors.

Global and regional trade are slowing, and policy uncertainty is high. The MAS’s latest projection has revised 2025 growth significantly lower, to range between 0.0–2.0%. The slowdown is due to Singapore's high trade dependency and deep integration with global supply chains.

The central bank believes US tariffs and retaliatory measures will weigh on aggregate demand. This will exert widespread drags on production, trade, and investments in Singapore’s major trading partners. Domestically, the central bank has already noticed falling consumer and business confidence. Retail sales and capital expenditure intentions have softened, and local-oriented sectors have seen generally tepid activity.

Inflationary pressures have eased more than anticipated. MAS Core Inflation dropped significantly to 0.7%y/y in early 2025, from 1.9% in Q4 2024. The decline was across a wide range of goods and services. It was due to weaker demand, moderating cost pressures, and enhanced government subsidies. The MAS Core Inflation is now forecasted to average 0.5–1.5% in 2025. This reflects a continued moderation in the pace of price increases amid the weakening economic outlook.

Monetary policy outlook

Overall, the MAS’s April 2025 statement reflects a more cautious economic outlook compared to January. There are substantial downgrades to 2025 growth and inflation forecasts due to escalating global trade tensions and policy uncertainties.

Given these revisions, the policy band adjustment was surprisingly modest. The SG$ NEER is still on a slight appreciation slope. More frequent policy meetings and heightened economic uncertainty are clear reasons for a more cautious approach to monetary policy. Nevertheless, we believe the downside risks to growth and inflation suggest further monetary policy easing is likely.

For SGD cash investors, the current environment presents challenges and opportunities. Domestic interest rates have declined but remain attractive by historical standards. The flattening yield curves pose challenges for adding longer maturity securities without sacrificing yield. However, as the spread between Singapore and US interest rates is likely to narrow, the recent re-steepening provides opportunities to extend duration. Given elevated market volatility from geopolitical concerns and central banks' focus on data dependency, caution and diversification across different maturities and instruments remained important to achieve optimal risk-adjusted returns.