BoE hike in May, recession gone away

11-05-2023

Olivia Maguire

Mohamed Abubakar

In Brief

- The Bank of England (BoE) raised the Bank Rate by 25 basis points (bps) to 4.50% in a split 7-2 vote as the Monetary Policy Committee (MPC) believes persistent inflationary pressures and a tight labour market justified a twelfth consecutive increase.

- Stronger global growth and lower energy prices, combined with fiscal support and an improvement in UK activity have led to a more favourable economic outcome than previously forecast. However, inflation has been higher than expected due to rising prices for core goods and food.

- The outlook for the economy remains uncertain and while the BoE’s confirmed the future path of rates will be data dependent, inflation risks remain to the upside.

MPC split 7-2 – again

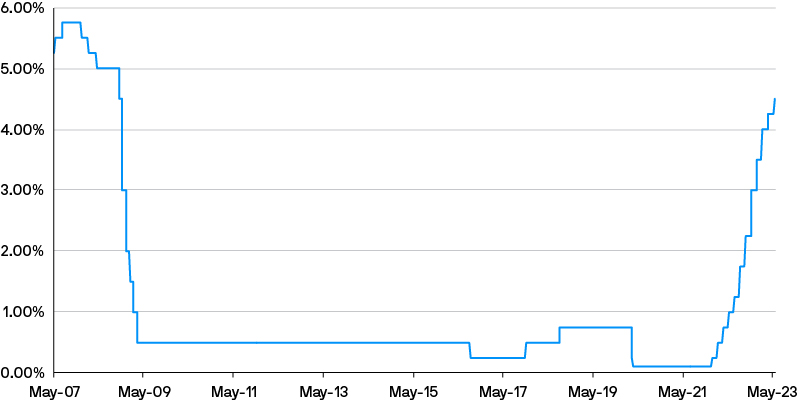

At its May 2023 meeting, the Monetary Policy Committee (MPC) raised the Bank Rate by 25bps to 4.50%, a new 15-year high (Figure 1). The increase was largely expected given that CPI (consumer price index) inflation remained elevated at 10.2%y/y in Q1 2023, alongside a persistently tight labour market. Seven MPC members voted in favour of the immediate increase, citing “the risk of more persistent strength in domestic price and wage setting, as represented by the upward skew in the projected distribution for CPI inflation”. Similar to the March meeting, two members – Dhingra and Tenreyro – dissented with a vote for rates to remain unchanged, suggesting base rates were already sufficiently restrictive with lagged effects from past rate increases still yet to feed through.

Figure 1: UK Bank Rate at 4.5% for the first time since October 2008

Source: Bank of England, as at 11 May 2023.

So long, recession

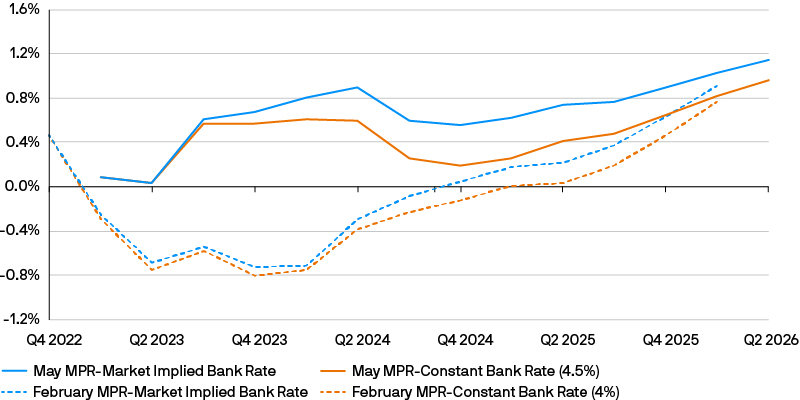

Despite recent global banking sector volatility, global growth continued to be stronger than forecast following the end of China’s zero-Covid policy, and resilience in both the euro-area and US economies. This strength combined with stronger domestic demand, lower energy prices and fiscal support measures introduced by the UK government in the Spring Budget, encouraged the BoE to lift their GDP economic forecasts to 0.25% in 2023 and 0.75% in 2024 – compared to -0.5% and -0.25% respectively in the February Monetary Policy Report. With first quarter GDP printing at 0.1%q/q, the UK is now expected to avoid a technical recession with quarterly growth projected to stay above zero (Figure 2).

Figure 2: Bank of England modal GDP forecasts (% year-on-year) were revised significantly higher

Source: Bank of England, as at 11 May 2023. Forecasts are not a reliable indicator of future performance.

Hello skew

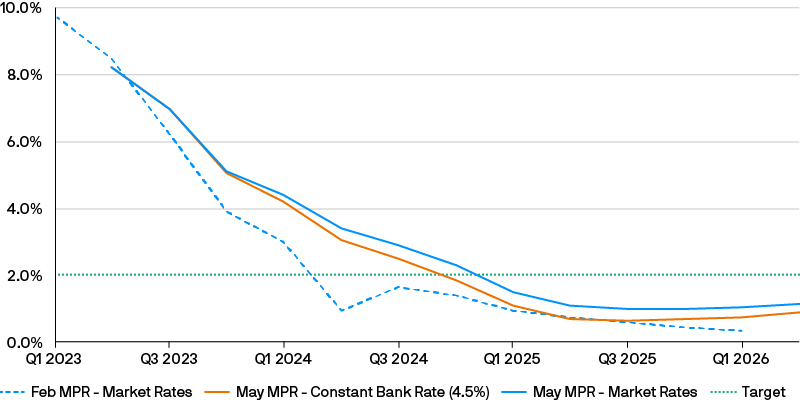

Inflation remains stronger than the BoE expected – 12 month CPI printed 10.2% in Q1 2023 – reflecting upside surprises and core goods prices, while services inflation and wage growth have been elevated but close to expectations. In addition, continued labour market tightness and a lower projected path of unemployment could also pose a risk of domestic price pressures from second-round effects. This suggests inflation may fall at a slower pace than previously projected, remaining above the Bank's 2% target until around the end of 2024 and then declining towards 1% in the medium term (Figure 3). The MPC noted “there remain considerable uncertainties around the pace at which CPI inflation will return sustainably to the 2% target” and “that the risks around the inflation forecast are skewed significantly to the upside”.

Figure 3: Bank of England modal CPI inflation forecast (% year-on-year)

Source: Bank of England, as at 11 May 2023. Forecasts are not a reliable indicator of future performance.

MPC closing comments were hawkish with the central bank committed to ensuring “CPI inflation will return to the 2% target sustainably in the medium term”. However, given the uncertain economic outlook, policy makers maintaining their previous guidance to “continue to monitor closely indications of persistent inflationary pressures” to determine if “further tightening in monetary policy would be required”.

Investor implications

Sterling cash investors welcome this further increase in Bank Rate as improved overnight rates will boost returns for liquidity strategies – albeit with a slight delay due to the need to reinvest term maturities – while ultra-short-term cash strategies are also well-positioned to capture the uplift in overnight rates.

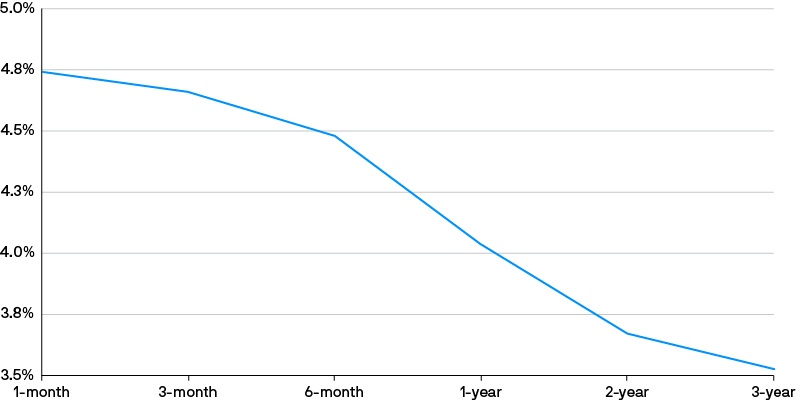

While the market anticipates the BoE may be nearing the end of its current rate hiking cycle (Figure 4), the path for interest rates remains unpredictable, exacerbated by ongoing geopolitical tension, volatility in overseas banking sectors, an increasing emergence of economic slack and an uncertain outlook for inflation.

Against this uncertain backdrop, we expect sterling cash investors to adopt a cautious and disciplined investment approach to cash segmentation, prioritising a combination of diversification and liquidity.

Figure 4: UK SONIA forward curves are projecting cuts to bank rate

Source: Bloomberg as of 11 May 2023. SONIA - Sterling overnight index average rate. Figure shows forward SONIA rates expected to be prevailing 1 year ahead.

09qk231505094758

NOT FOR RETAIL DISTRIBUTION: This communication has been prepared exclusively for institutional, wholesale, professional clients and qualified investors only, as defined by local laws and regulations. The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from J.P. Morgan Asset Management or any of its subsidiaries to participate in any of the transactions mentioned herein. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. In addition, users should make an independent assessment of the legal, regulatory, tax, credit and accounting implications and determine, together with their own financial professional, if any investment mentioned herein is believed to be appropriate to their personal goals. Investors should ensure that they obtain all available relevant information before making any investment. Investment involves risks, the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Both past performance and yield are not a reliable indicator of current and future results. J.P. Morgan Asset Management is the brand for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide. To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our privacy policies at https://am.jpmorgan.com/global/privacy. This communication is issued by the following entities: In the United States, by J.P. Morgan Investment Management Inc. or J.P. Morgan Alternative Asset Management, Inc., both regulated by the Securities and Exchange Commission; in Latin America, for intended recipients’ use only, by local J.P. Morgan entities, as the case may be; in Canada, for institutional clients’ use only, by JPMorgan Asset Management (Canada) Inc., which is a registered Portfolio Manager and Exempt Market Dealer in all Canadian provinces and territories except the Yukon and is also registered as an Investment Fund Manager in British Columbia, Ontario, Quebec and Newfoundland and Labrador. In the United Kingdom, by JPMorgan Asset Management (UK) Limited, which is authorized and regulated by the Financial Conduct Authority; in other European jurisdictions, by JPMorgan Asset Management (Europe) S.à r.l. In Asia Pacific (“APAC”), by the following issuing entities and in the respective jurisdictions in which they are primarily regulated: JPMorgan Asset Management (Asia Pacific) Limited, or JPMorgan Funds (Asia) Limited, or JPMorgan Asset Management Real Assets (Asia) Limited, each of which is regulated by the Securities and Futures Commission of Hong Kong; JPMorgan Asset Management (Singapore) Limited (Co. Reg. No. 197601586K), this advertisement or publication has not been reviewed by the Monetary Authority of Singapore; JPMorgan Asset Management (Taiwan) Limited; JPMorgan Asset Management (Japan) Limited, which is a member of the Investment Trusts Association, Japan, the Japan Investment Advisers Association, Type II Financial Instruments Firms Association and the Japan Securities Dealers Association and is regulated by the Financial Services Agency (registration number “Kanto Local Finance Bureau (Financial Instruments Firm) No. 330”); in Australia, to wholesale clients only as defined in section 761A and 761G of the Corporations Act 2001 (Commonwealth), by JPMorgan Asset Management (Australia) Limited ABN 55143832080) (AFSL 376919). For U.S. only: If you are a person with a disability and need additional support in viewing the material, please call us at 1-800-343-1113 for assistance. Copyright 2023 JPMorgan Chase & Co. All rights reserved.