Weekly Market Recap

Mind the gap

16/12/2024

Week in review

- Australia’s unemployment rate falls to 3.9%

- RBA holds rates at 4.35%

- U.S. CPI inflation 2.7% y/y

Week ahead

- Eurozone and U.S. PMI surveys

- U.S. FOMC meeting

- Australia consumer confidence survey

Thought of the week

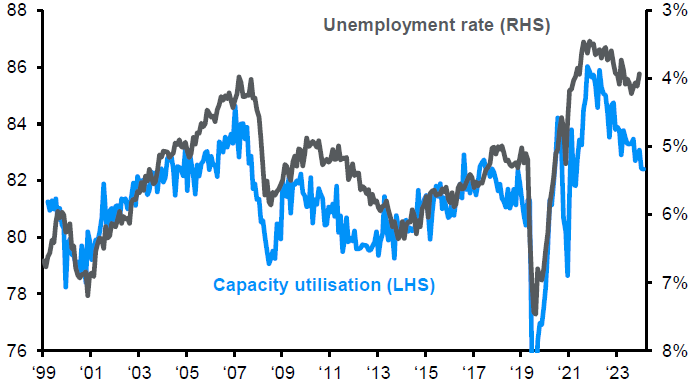

The RBA took a dovish turn last week, sounding more hopeful on the outlook for inflation. The fall in wage growth, but steady unemployment rate, suggested that the RBA would be able to cut policy rates sooner than being priced by the market. However, the November labour market report caused the market to think again. The unemployment rate fell to 3.9%, the lowest level since March 2024, and employment increased by 53,000. The strength in the labour market appears inconsistent with other economic data, such as the weak 3Q ’24 GDP or falling capacity utilisation. An economy running below potential should equate to less labour demand, not more. Fading inflation, soft growth and what should be a rising unemployment rate could see the RBA cut rates in February, but this remains a close call.

Australian labour market looks disconnected from the economy

Capacity utilisation (3m adv.) and unemployment rate

Source: ABS, FactSet, NAB, J.P. Morgan Asset Management. Data reflect most recently available as of 13/12/24.

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5