The latest bout of geopolitical conflict in the Middle East could pose some upside risk to oil and energy prices in the near term, which in turn would also push food prices higher given more expensive fertilizers and transportation costs.

In brief

- Supply cuts by Saudi Arabia and Russia have lifted oil prices. The latest conflict in Israel is a fresh source of upside risk, if oil production or supply chain in the region is disrupted.

- Higher energy costs may not fuel central bank hawkish stance, especially if consumption growth is at risk. This is a reminder to policymakers to be mindful of the downside risk to growth.

- Rise in energy price and broader market volatility from the latest conflict reinforces our view of focusing on fixed income and high quality stocks.

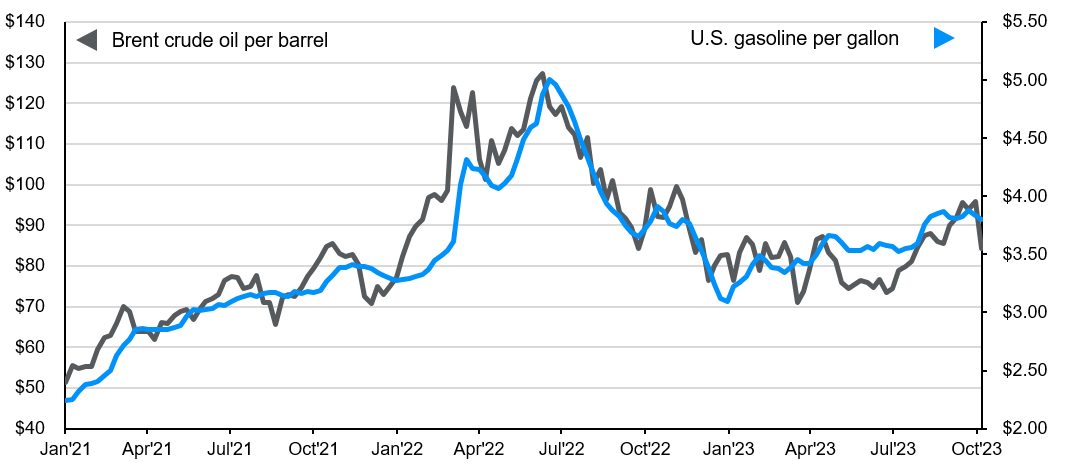

Oil prices have been rising abruptly since hitting a recent low in June. Brent crude rose from $72 per barrel (pb) to the year-to-date high of $96.5pb in late September. It did correct to below $85pb, but the latest military conflict in the Middle East has triggered another spike in oil prices.

Additional risk premium on oil from Middle East conflict

The latest run in oil prices started with the fundamentals of supply and demand. On the supply side, Saudi Arabia extended on September 5 its 1 million barrels per day (bd) supply cut for the rest of the year, alongside with Russia’s 300,000bd reduction. The production cuts were aimed at lifting oil prices to support their fiscal revenues. Meanwhile, in the U.S. strategic oil reserves have been drastically reduced, raising questions on the effectiveness of this additional buffer against external oil supply shocks and further adding to market supply concerns. That said, other OPEC members and non-OPEC producers have been steadily raising production and helping to address the tight supply.

As supply has been restricted, demand has been stronger than anticipated. Oil demand growth continues to be strong in 2023, with a lion share driven by China. Global demand expanded by 2.1mbd in the first eight months of the year. Despite China’s lackluster economic recovery overall, demand for transport related fuel has been strong given the rebound in domestic travel.

The latest Israel-Hamas confrontation has triggered a renewed spike in oil prices reflecting a possible supply risk premium. The wildcard here would be the role of Iran and other Middle Eastern nations in this conflict and whether this could impact the outlook for oil production or supply disruptions in the region. While Iran has so far denied direct knowledge of the latest attack, it has been a supporter of Hamas. Impact on the oil market could potentially come in the form of stronger enforcement of Iranian export ban, or disruption in the critical shipping channel in the Strait of Hormuz. For now, such risk is low, but this deserves monitoring as the event continues to develop.

Going forward, the supply response and the possible slowdown in the global economy in the next 12 months should help to cap the upside in oil prices. However, geopolitics is once again the source of uncertainty in the weeks and months ahead.

Exhibit 1: Crude oil and U.S. gasoline prices

U.S. dollars

Source: Commodity Research Bureau, U.S. Department of Energy, FactSet, J.P. Morgan Asset Management. Data reflect most recently available as of 09/10/23.

How would central banks react?

The rise in energy prices since June have prompted concerns that central banks, especially the Federal Reserve, would need to remain on the hawkish side for longer to tame inflation. While the Fed is indeed advocating ‘higher for longer’ in its interest rate policy, higher energy prices may have less to do with this stance.

Average gasoline price in the U.S. did rise from $3.9 per gallon in June to the year-to-date high of $4.35, tracking the rise in crude oil price. It has since settled at around $4.26. The current level is still about 3% lower than a year ago, and 22% lower than the June 2022 peak.

Moreover, gasoline and energy prices are unlikely to be influenced by monetary policy, since this is largely driven by global supply and demand dynamics. Policymakers would also need to take into account the possible drop in spending on discretionary items if households need to allocate more of their disposable income on gasoline and fuel. Hence, high oil prices could be seen as a tax on growth instead of a source of inflation.

This could be more of a challenge for selected emerging market (EM) economies. EM households typically spend a higher proportion of their income on fuel and food, which would have a greater impact on both headline inflation and the negative income effect. Oil importing nations could also see wider trade deficits from more expensive fuel imports, which could add depreciating pressure on their currencies. Their central banks could need to raise rates to stabilize their foreign exchange markets.

Investment implications

The latest bout of geopolitical conflict in the Middle East could pose some upside risk to oil and energy prices in the near term, which in turn would also push food prices higher given more expensive fertilizers and transportation costs. While the near-term impact rising headline rates of inflation around the world, the longer-term impact could be on consumer discretionary spending, and profit margin compression for those sectors relying on these commodities as an input.

Fiscal support could also play an important role. With elections on the cards in a number of countries in 2024 (U.S., Mexico, India, Indonesia, Taiwan, UK to name a few), the increase in the cost of living is already high on voters' agenda. A renewed surge in fuel prices could prompt governments to either tap strategic reserves or dampen the impact to the general public via fiscal measures where appropriate.

Overall, the possible rise in oil price and broader market volatility from this conflict reinforces our emphasis on fixed income (government bonds and investment grade corporate debt), as well as high quality equities.