Recent market reactions to earnings releases suggest a growing disconnect between market expectations and analyst forecasts.

In Brief

- Sentiment on AI is shifting from broad optimism to greater scrutiny of capital expenditure, return on investment, and balance sheet strength. However, 3Q earnings were resilient.

- Dovish comments from Federal Reserve officials prompted markets to strongly reprice a December rate cut.

- Several key areas of uncertainty remain, and investors should remain attentive to developments in monetary policy and corporate performance.

Global markets were largely unchanged in November, with the MSCI All Country World Index and the Bloomberg Global Aggregate Index returning 0.1% and 0.0%, respectively (in local currency terms). However, intra-month movements were anything but calm, as sentiment shifted towards central bank policy changes—notably the anticipated December U.S. Federal Reserve (Fed) rate cut —and whether the artificial intelligence (AI) hype was about to run out of steam.

Investor sentiment toward AI is starting to evolve from broad-based optimism to greater scrutiny of spending plans, financing, as well as return on investment and balance sheet strength. Despite these concerns, 3Q earnings continued to beat expectations—13.0% y/y growth and an 81% beat rate versus consensus—which helps to address doubts about demand for AI compute. Nevertheless, recent market reactions to earnings releases suggest a growing disconnect between market expectations and analyst forecasts. The previously straightforward relationship between earnings beats and positive price re-rating has become less pronounced, raising the bar for corporate earnings performance and further narrowing market leadership.

On the macroeconomic side, the end of the U.S. government shutdown after 44 days shifted market attention to the availability of official data to assess the economic damage and inform the Fed’s next policy decision. With the announcement that the October inflation report would not be released, investors turned to September’s non-farm payrolls as a pivotal indicator. Yet, the data offered little clarity: a stronger-than-expected 119k jobs gain was met with a rise in the unemployment rate, as the total labor force expanded. In contrast, a series of dovish comments from Fed officials—especially New York Fed President Williams’s remarks about possible rate cuts “in the near term”, despite contrasting with Chair Jerome Powell’s earlier hawkish tone—have prompted markets to price in an over 80% probability of a December rate cut.

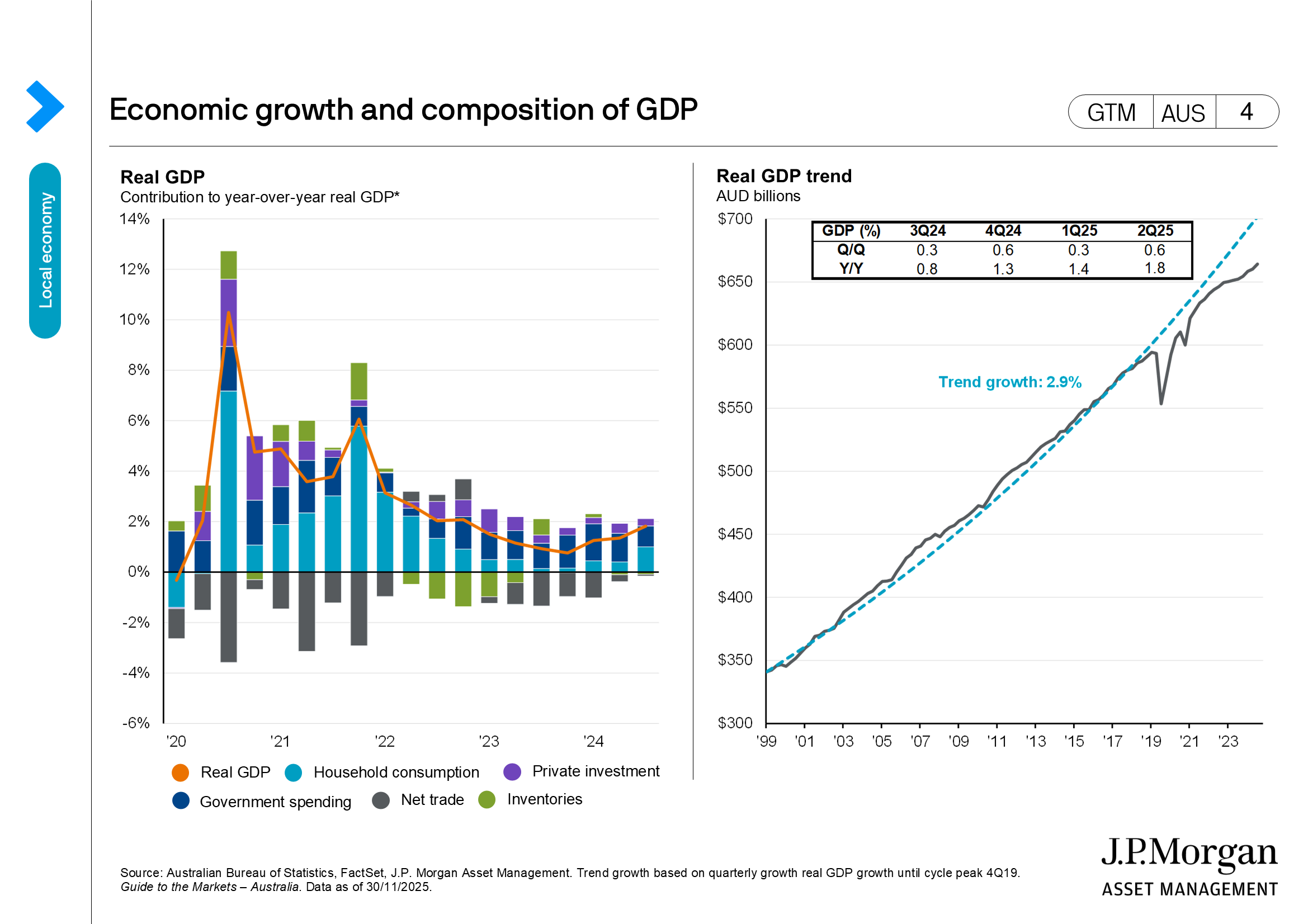

Importantly, interest rate uncertainty is not limited to the U.S. In Australia, stronger-than-anticipated economic data have seen the market move from pricing in rate cuts to a rate hike in the coming year. In Japan, persistent Japanese yen (JPY) weakness and decade-high wage growth have prompted Bank of Japan (BoJ) officials to signal the possibility of a December rate hike.

Seasonality analysis suggests that December is typically a less volatile period for financial markets. However, with several key uncertainties still in play, investors should remain attentive, as developments in monetary policy and corporate performance could continue to influence market direction as we close out the year.

Australian economy

- The Reserve Bank of Australia (RBA) kept the cash rate at 3.60% at its November meeting, with a unanimous decision among board members. That said, the RBA’s hawkish tone was evident across its messaging. The policy statement noted “evidence of more persistent inflation”, macro forecasts were revised higher, and trimmed mean inflation is expected to rise to 3.2% year-over-year (y/y) by 2Q26. The technical assumption on the policy rate was also recalibrated to 3.3% by the end of 2026, 40 basis points (bps) higher than the prior forecast. Governor Bullock’s comments at the press conference reaffirmed the RBA stance for an extended pause, noting the board did not discuss a rate cut this meeting and the focus was on “the strategy further out”, in addition to reiterating the lower need to ease monetary policy, as the RBA had tightened less than other central banks.

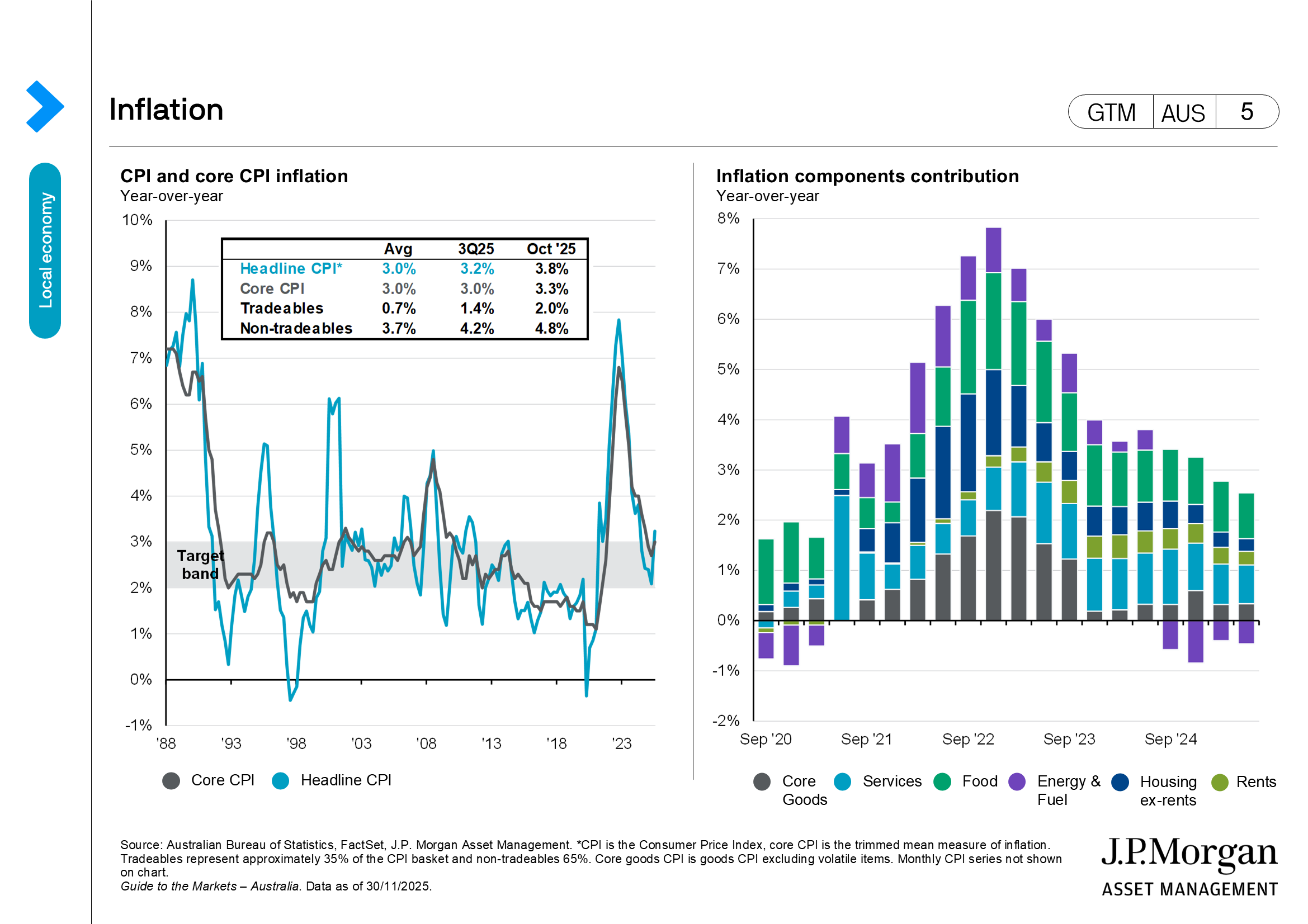

- The new monthly consumer price index (CPI) jumped to 3.8% y/y in October, while the trimmed mean inflation rose to 3.3% y/y. Housing was the largest contributor to inflation, with rents and new dwelling prices both increasing. Electricity prices were lower over the month due to increased subsidy payments, while fuel and clothing item prices were higher.

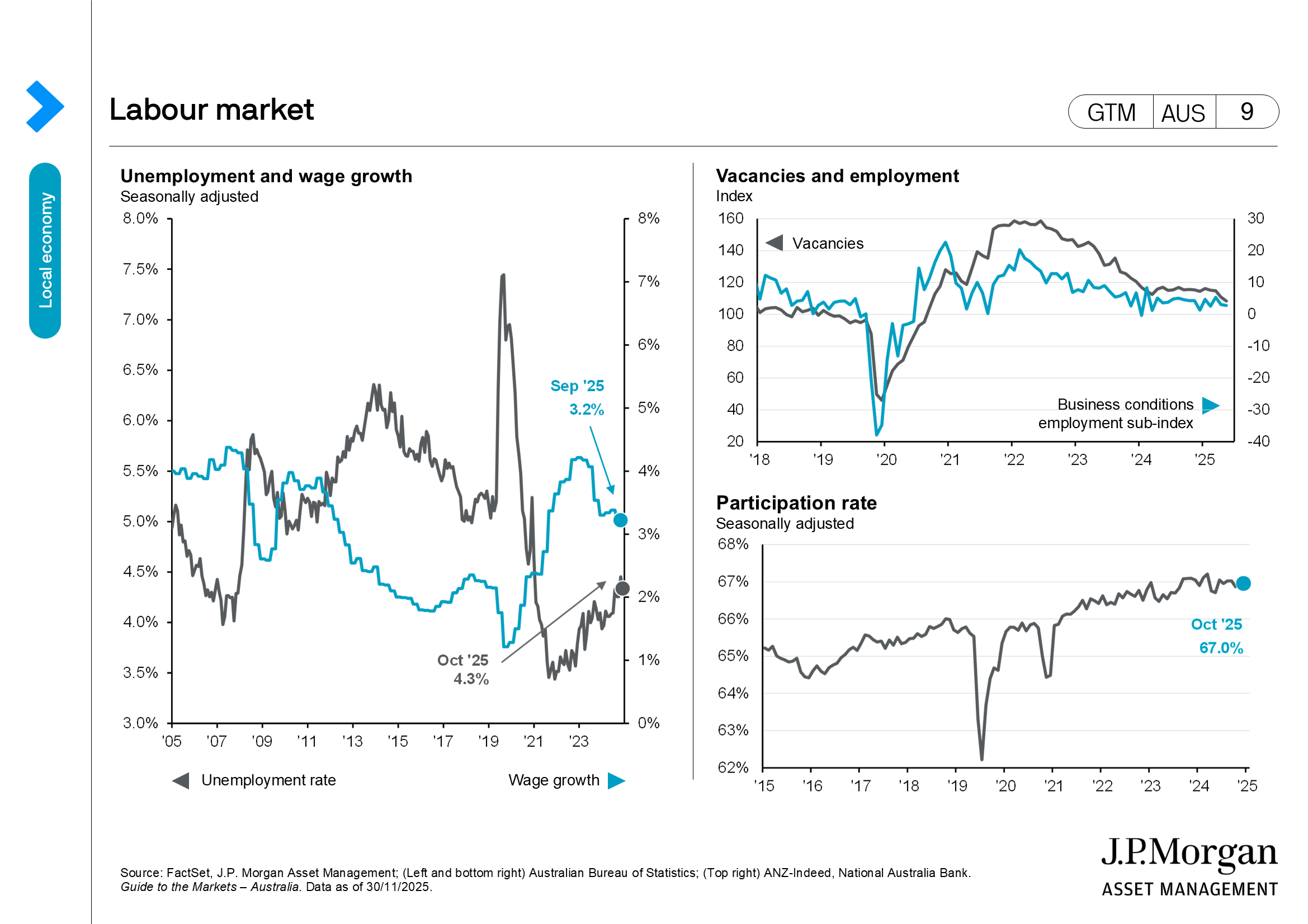

(GTM AUS page 5) - Wage growth remained at 3.4% y/y in 3Q, with private-sector wage growth outpacing public-sector wage growth. The unemployment rate fell to 4.3% in October, reversing last month’s strength. Total employment increased by 42.2k, well above consensus estimates, while the participation rate was unchanged at 67.0%, hinting at a firming labour market.

(GTM AUS page 9) - Household spending rose 0.2% month-over-month (m/m) in September, with the increase primarily driven by non-discretionary spending, while discretionary spending was flat.

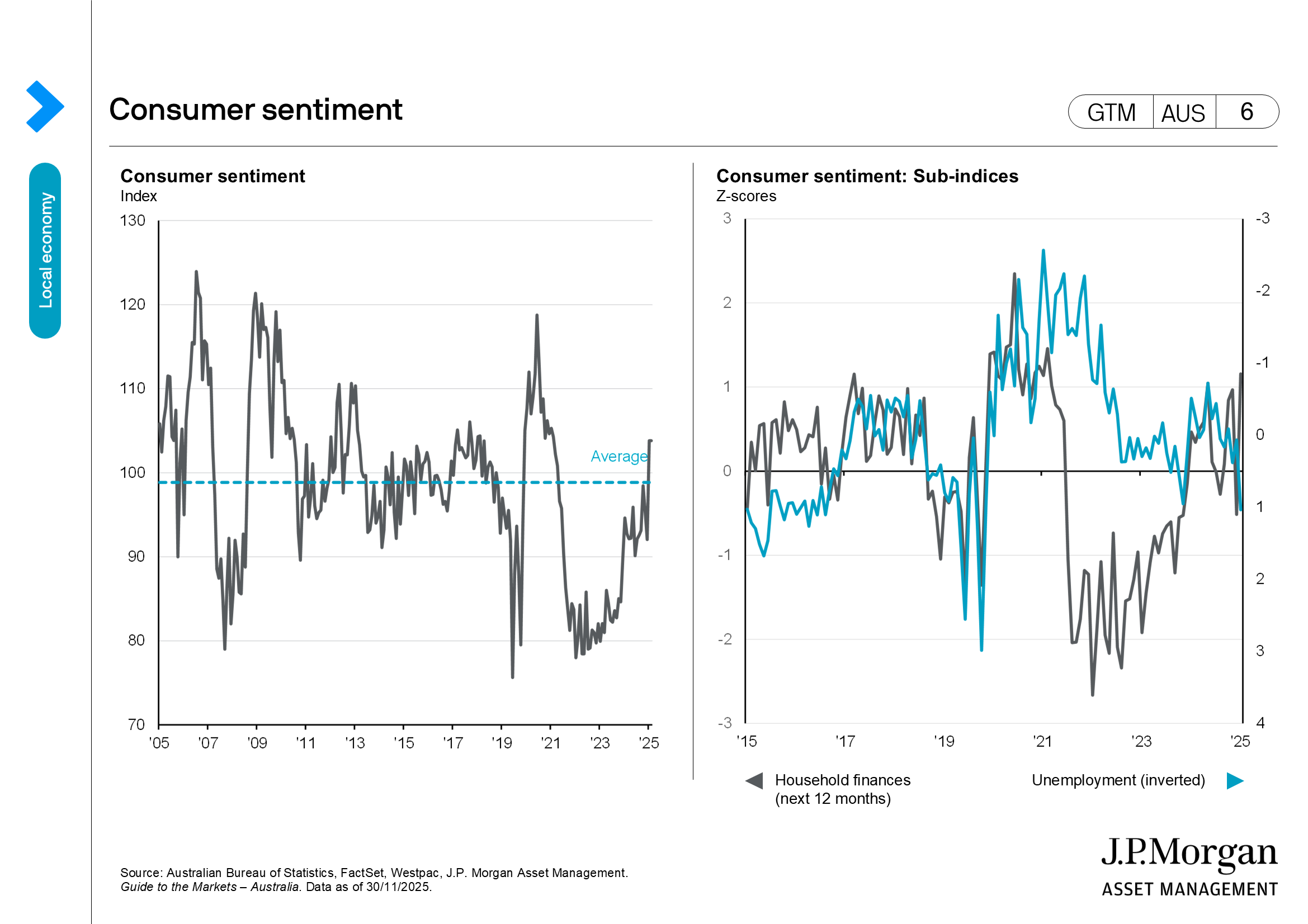

- Consumer sentiment rose sharply in November, with the index up 12.8% to 103.8, despite concerns about elevated inflation and expectations for an extended rate pause.

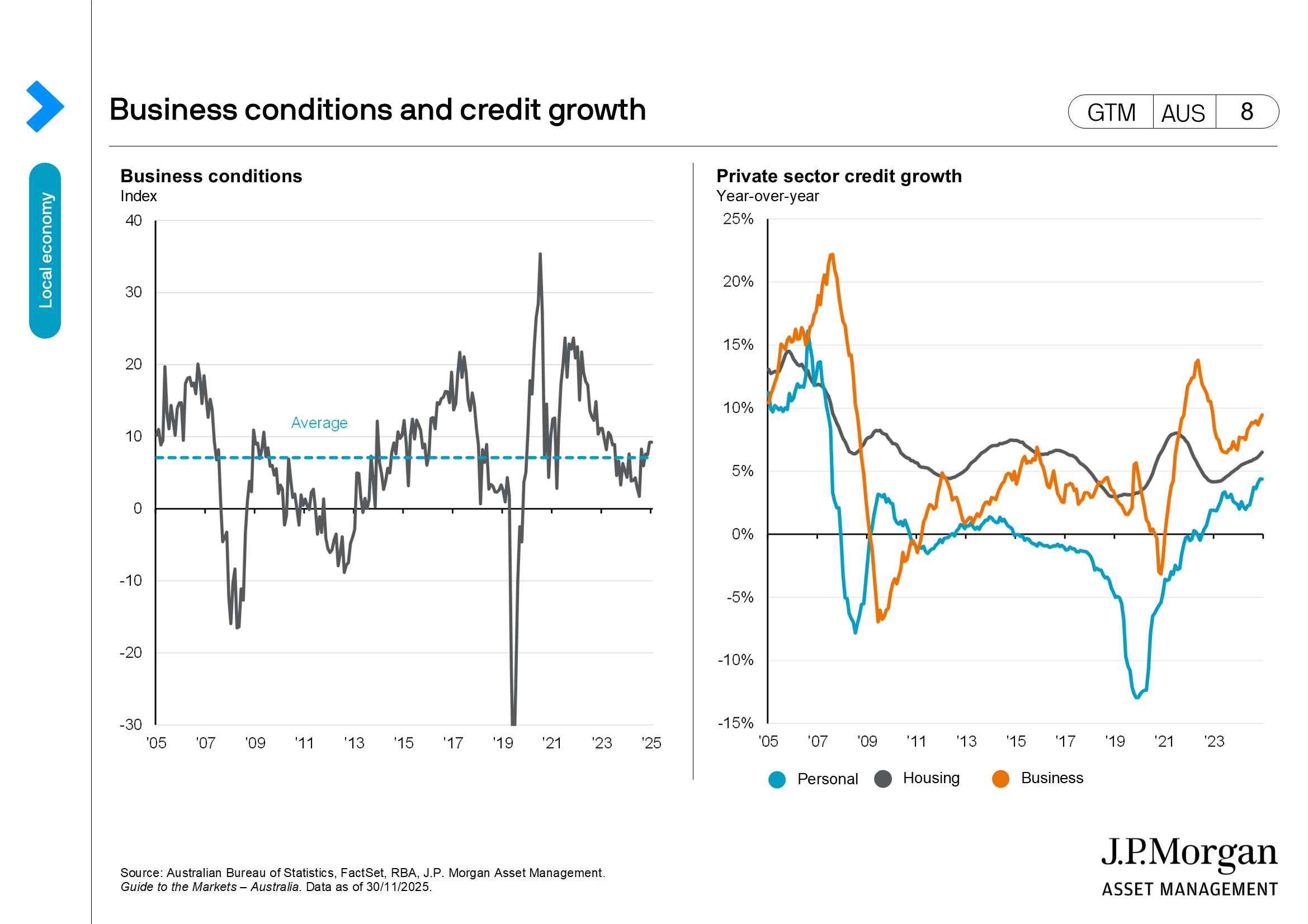

(GTM AUS page 6) - Business conditions ticked up to +9 in October, with gains in the trading and profitability sub-indices, while the employment sub-index was flat.

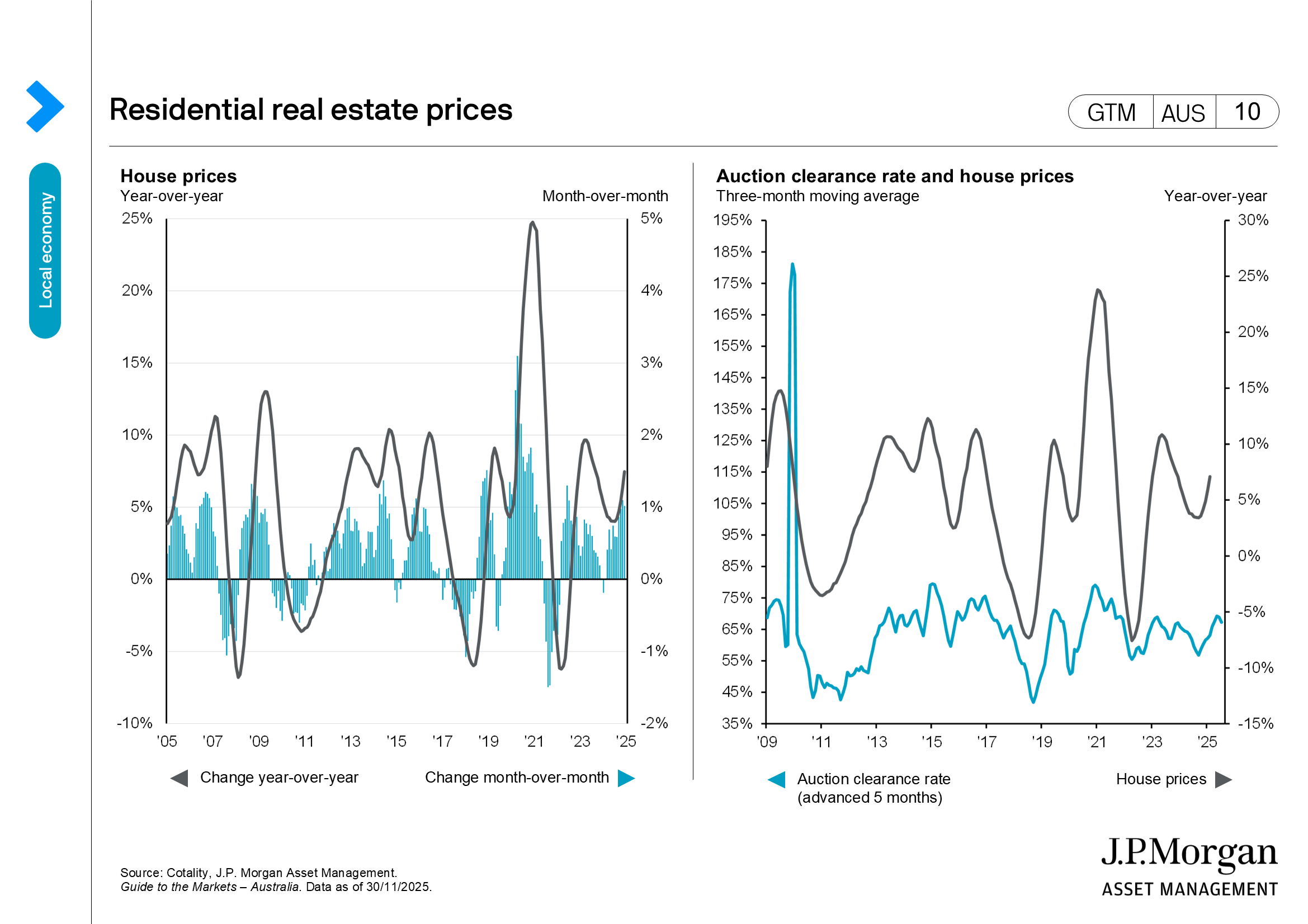

(GTM AUS page 8) - Housing prices rose 1.0% m/m in November, with gains still broad-based across capital cities, although this was accompanied by a decline in auction clearance rates.

(GTM AUS page 10)

Equities

- The ASX 200 dropped 2.7% in November, as the confluence of weak earnings in financials, growing concerns over AI bubble valuations, a hawkish-leaning RBA, and a repricing for fewer rate cuts on firmer macro data all pressured equity markets. Only four sectors rose, with healthcare (+2.0%) leading and technology being the worst performing sector (-11.6%).

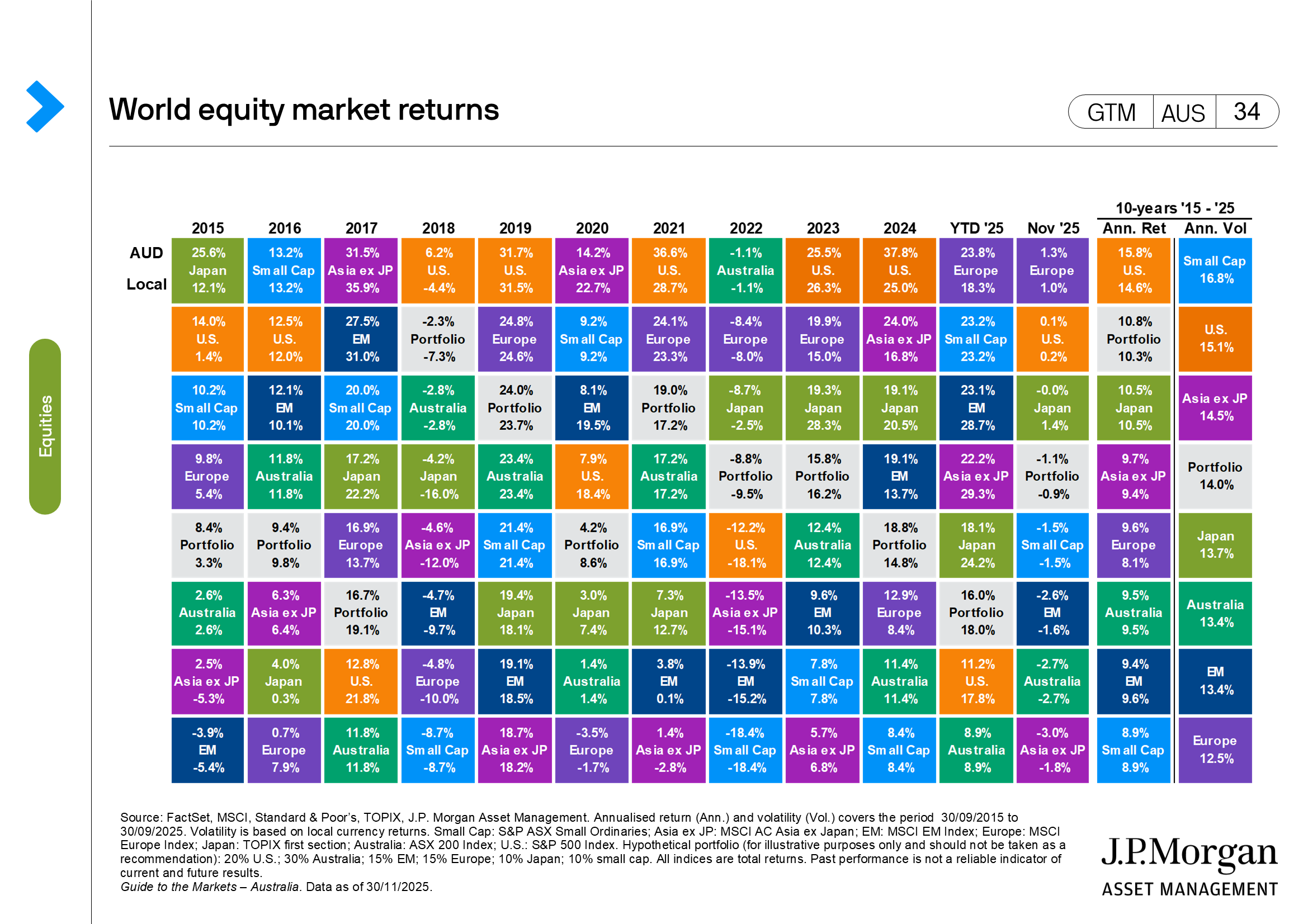

- Global equity markets were largely flat in November. Developed markets gained slightly, with the MSCI World Index up 0.3%, while emerging markets saw negative performance, with the MSCI EM Index down 1.6% for November. Much of the first half of the month saw a sell-off due to tech related weakness. Investors pulled back as AI related sentiment became more volatile, with ongoing concerns about stretched valuations and the possibility that AI-associated themes were in a bubble.

(GTM AUS page 34) - In the U.S., the S&P 500 was flat, with the tech sector being the major culprit. Despite strong earnings and revenue beats from the 3Q25 reporting season, the results failed to drive markets further upward, reflecting investor expectations and concerns over lofty tech valuations.

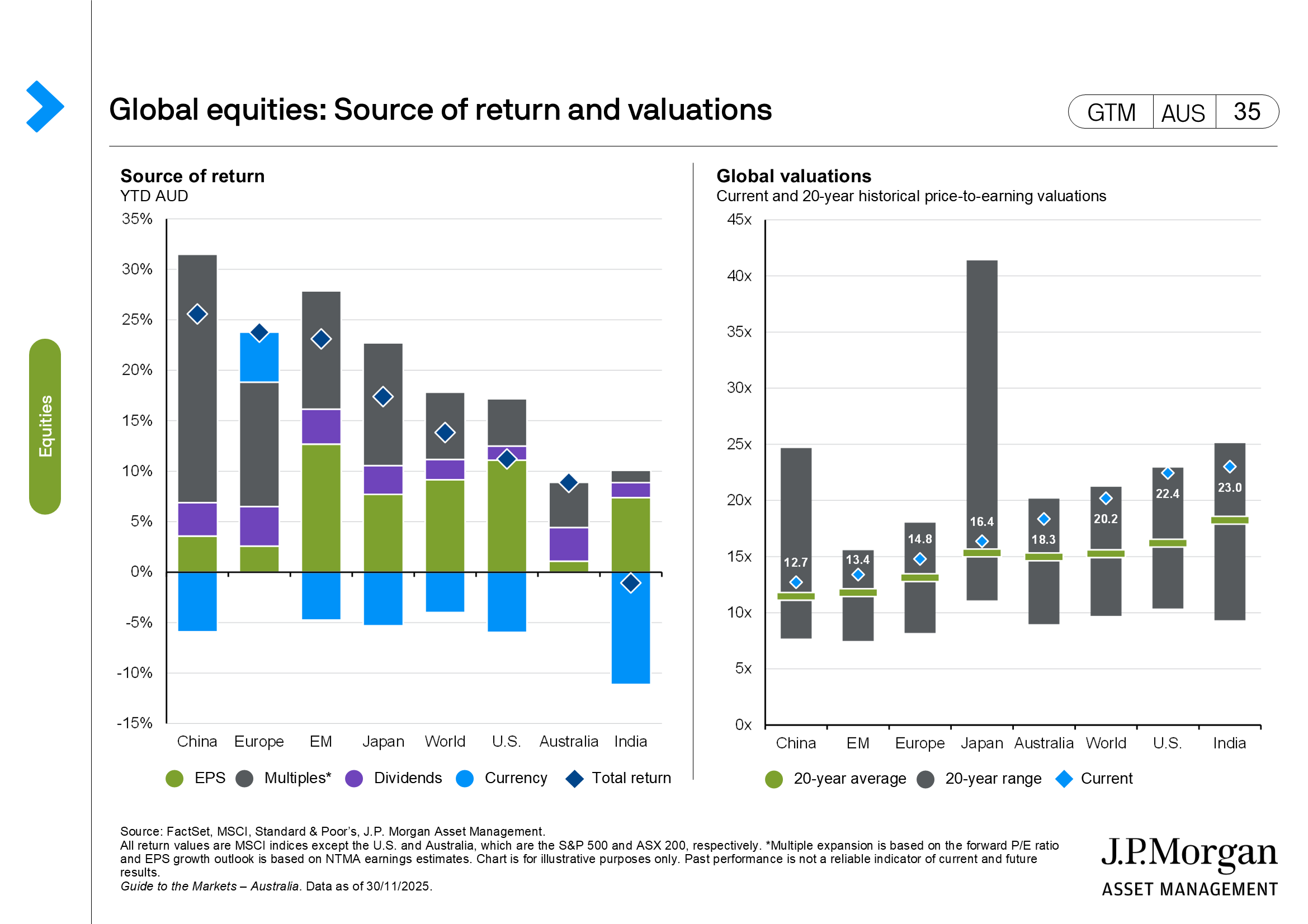

- Equity valuations retreated across most developed markets, with the forward price-to-earnings (P/E) ratio for the S&P 500 at 22.4x, MSCI Europe at 14.8x, MSCI Japan at 16.4x, and the ASX 200 at 18.3x.

(GTM AUS page 35)

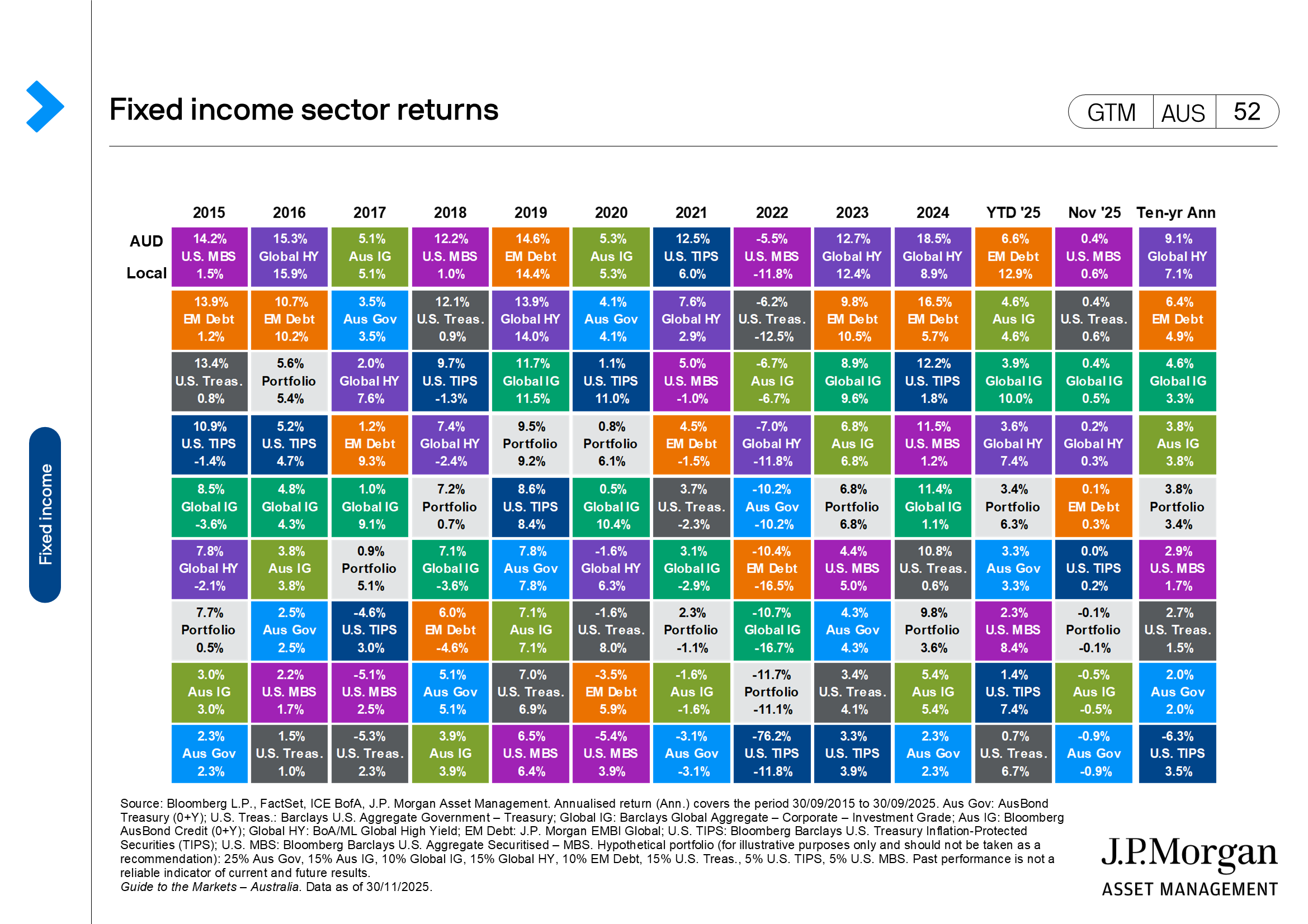

Fixed income

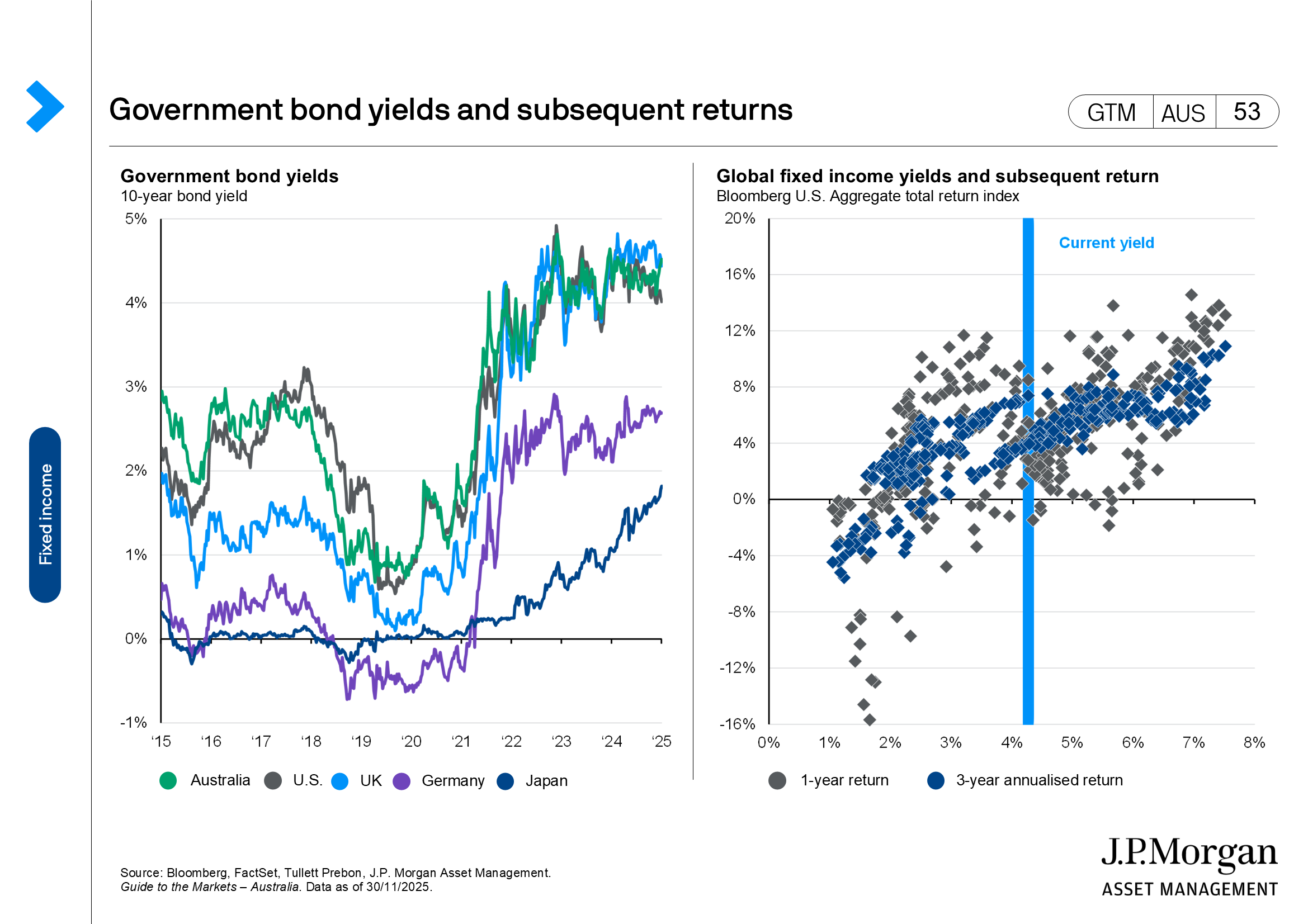

- The 10-year yield on Australian government bonds rose sharply by 22 bps in November to 4.52%, as markets priced out any near-term cuts. U.S. Treasury yields (USTs) were firmer over the month, with the curve steepening–yields on the 2-year fell by 10 bps, the 10-year was down 8 bps, while yields on the 30-year were flat. Despite a mixed picture on the September non-farm payroll data, a series of dovish Fedspeak have guided market pricing sharply to above 80% for a December rate cut, pressuring on front-end rates. Yields on Japanese government bonds were notably higher, as strong wage data and hints from BoJ officials guided markets that a rate hike remains possible in December, with the 10-year yield up 17 bps to 1.82%.

(GTM AUS page 53) - Spreads on both investment-grade and high-yield bonds narrowed modestly, as the string of robust earnings results reassured corporate fundamentals, with global investment-grade and high-yield bonds returning 0.5% and 0.6% in USD total return terms, respectively.

(GTM AUS page 52)

Other assets

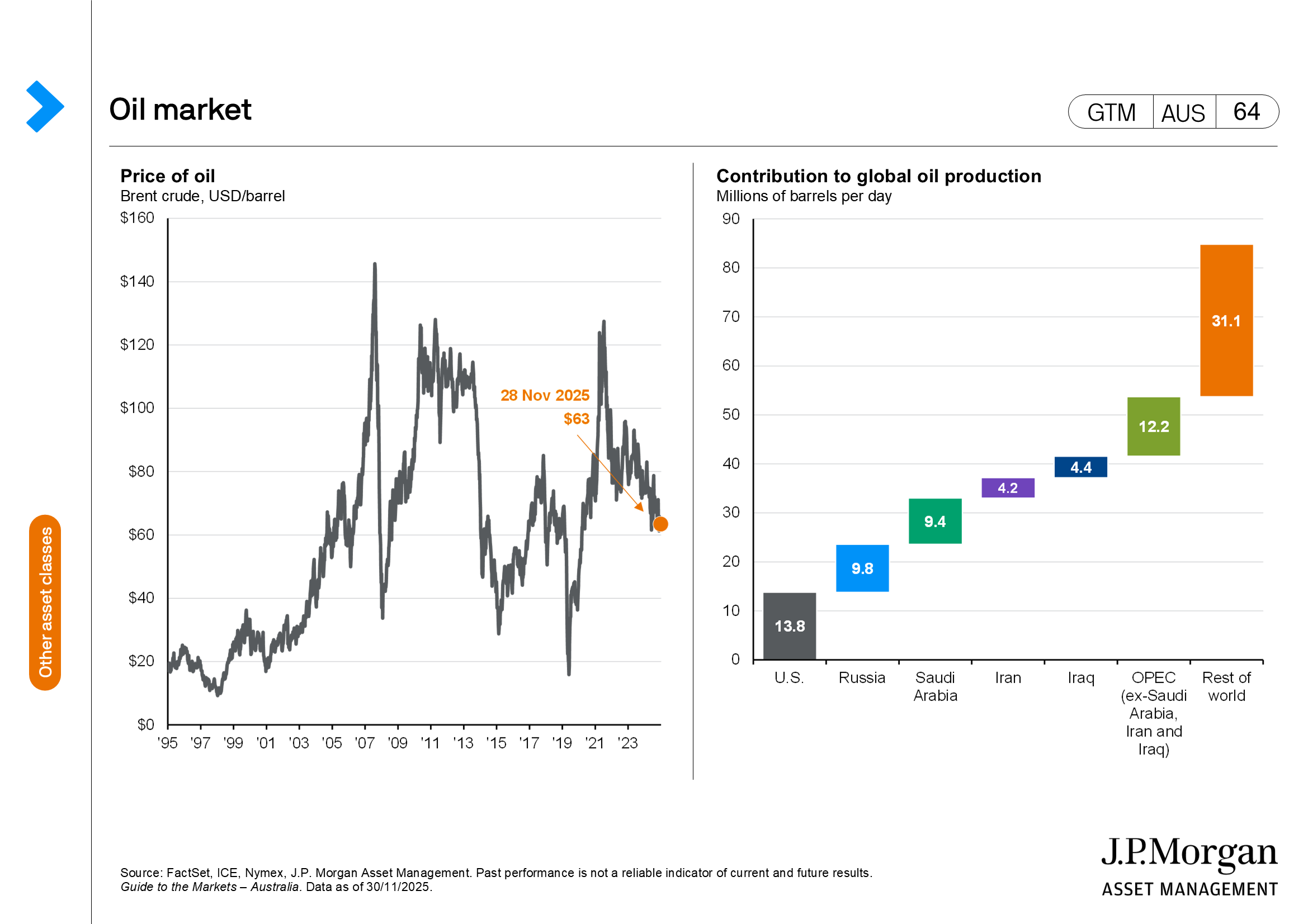

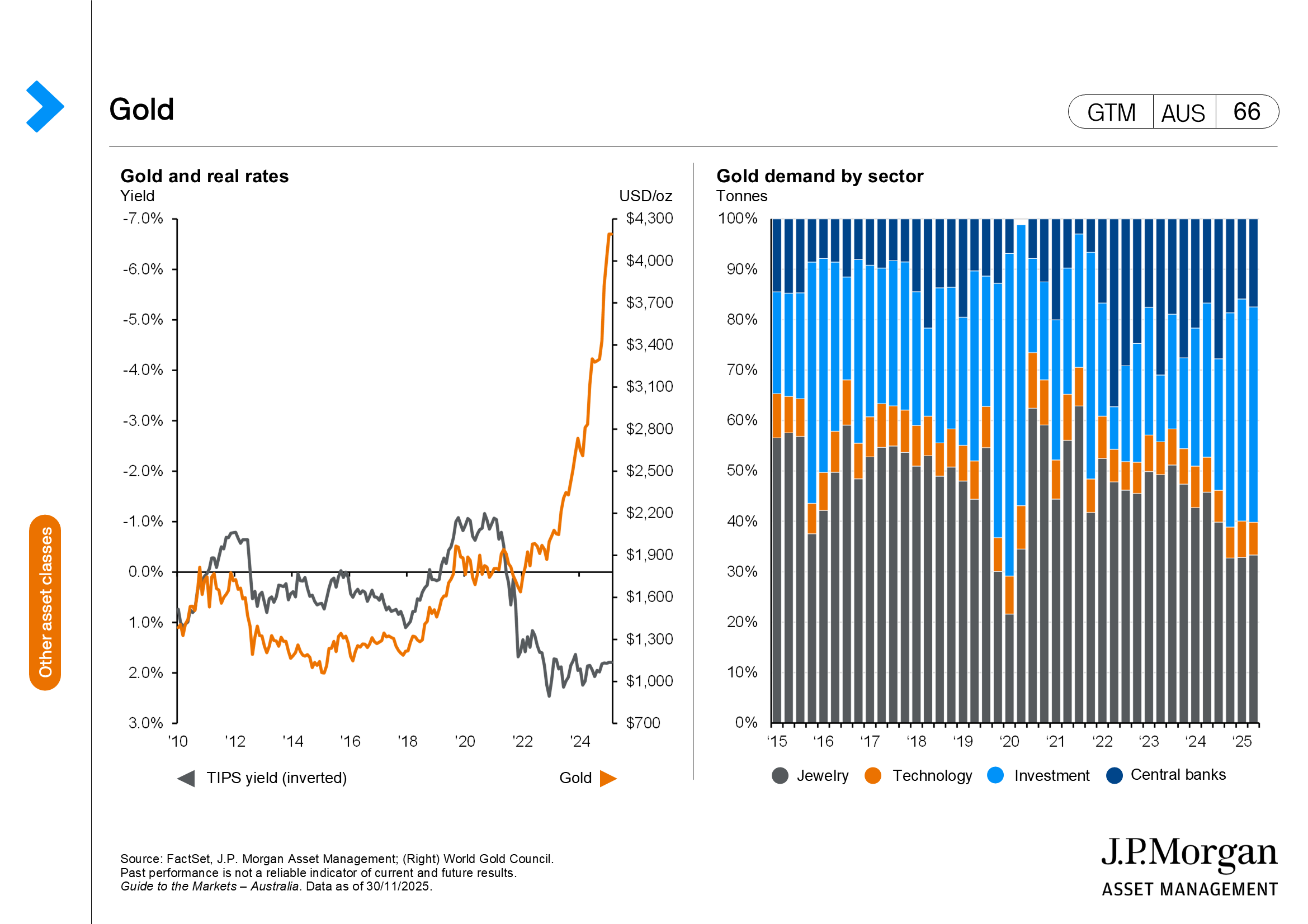

- Oil prices dropped in November, as OPEC+ approved another December output hike. Gold continued to creep upwards, as falling U.S. yields and central bank demand continued to drive prices.

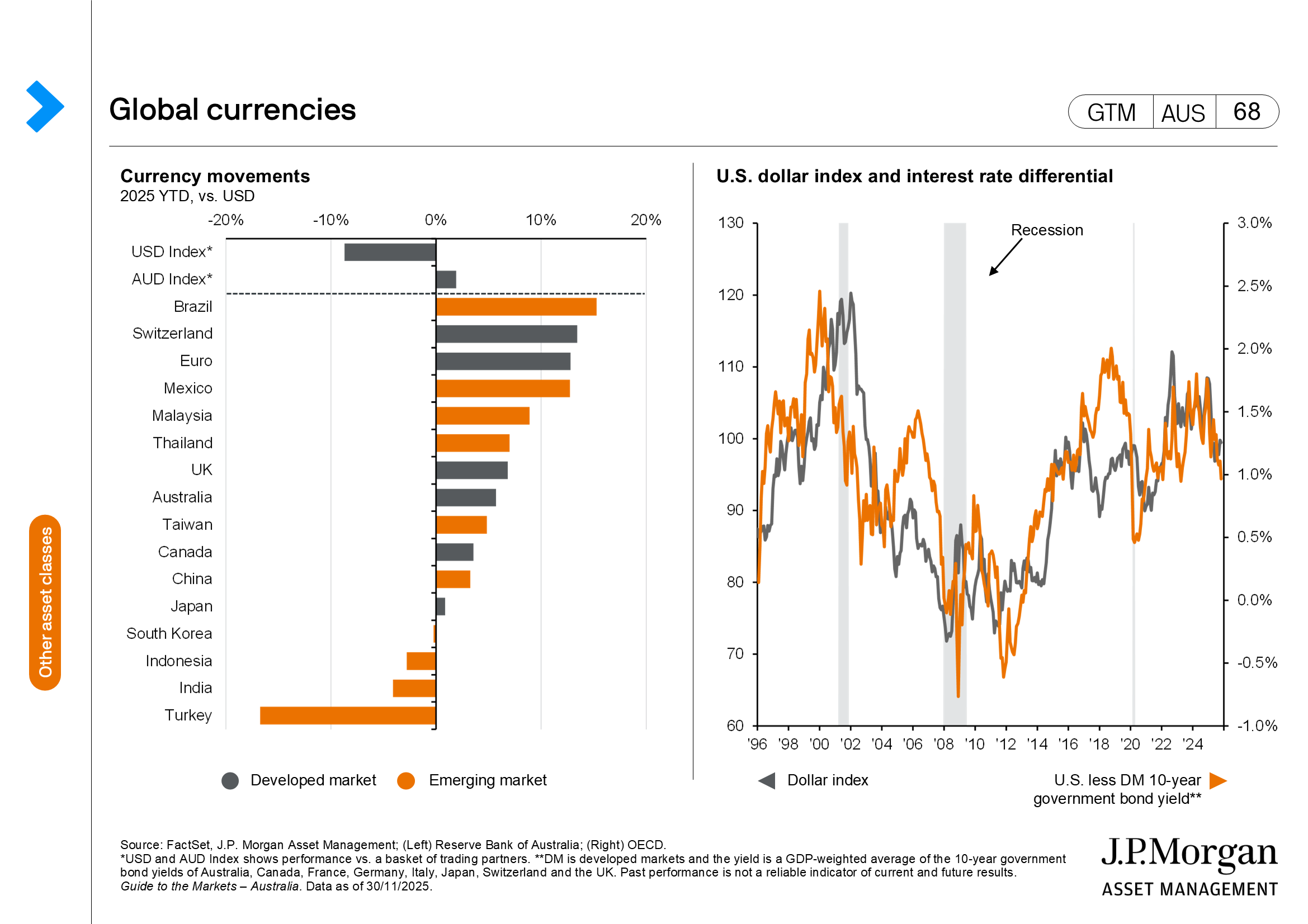

(GTM AUS page 64, 66) - The U.S. dollar DXY Index edged down 0.3% in November, as dovish surprises were crowded in the U.S. while other developed markets saw hawkish surprises. The JPY was again the weakest G10 currency, falling 1.3% against the U.S. dollar to the 156.05 level. Most Asian currencies were also slightly lower over the month.

(GTM AUS page 68)