Solving for Fixed Income

Using Market Insights to achieve better outcomes

Since 2004, J.P. Morgan Has Produced “Market Insights” To Help Individual Investors Understand And Make Their Way Through Rapidly Shifting Markets.

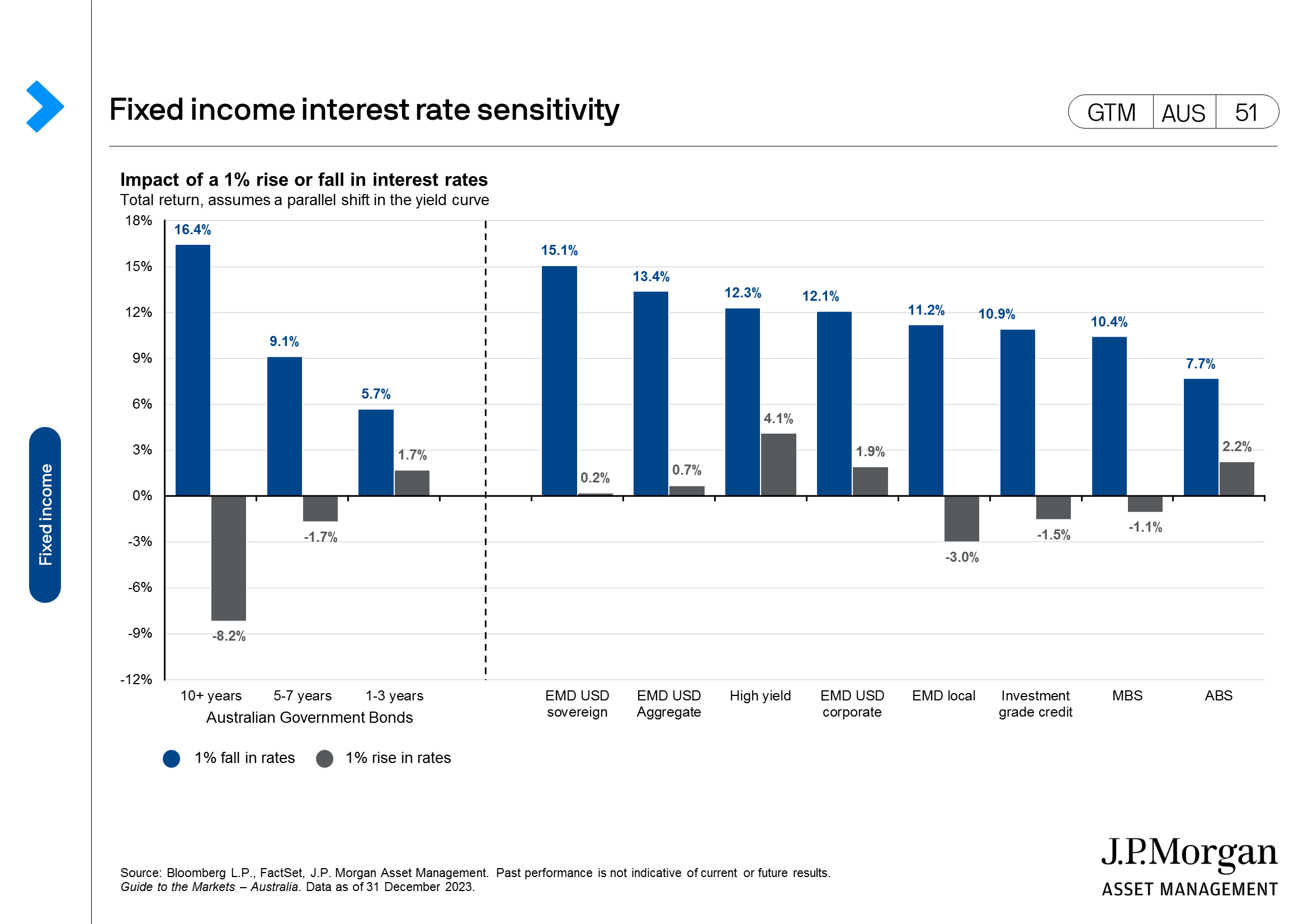

Fixed Income has a vital role to play in diversifying portfolio returns, helping to preserve portfolio value against volatility and providing a reliable source of income.

“Solving for Fixed Income” takes a look at how the current environment has affected fixed income’s role in a portfolio and at the many other opportunities that can accomplish its traditional objectives.

1. LOW RETURNS FROM CASH

|

Cash can be a real drag

In the short term, having a little extra cash can be beneficial if you need to allocate quickly to new opportunities. However, cash is not always king when it comes to generating long-term returns.

Central banks underwent the fastest rate hiking cycle in years in 2022 and 2023, and now rate will start to ease making other assets more attractive compared to cash.

Despite the uncertainty, the outlook for fixed income returns is the best it has been in many years.

2. THE IMPORTANCE OF INCOME

|

Maximize investment growth with bonds

The total return on fixed income investments consist of two components; price, or capital, appreciation and coupon return.

The steady stream of income earned from the coupons can offset the risk of price declines and serve a critical buffer for portfolios.

The sharp rise in bond yields now means that this buffer is larger.

3. MOVING BEYOND GOVERNMENT BONDS

|

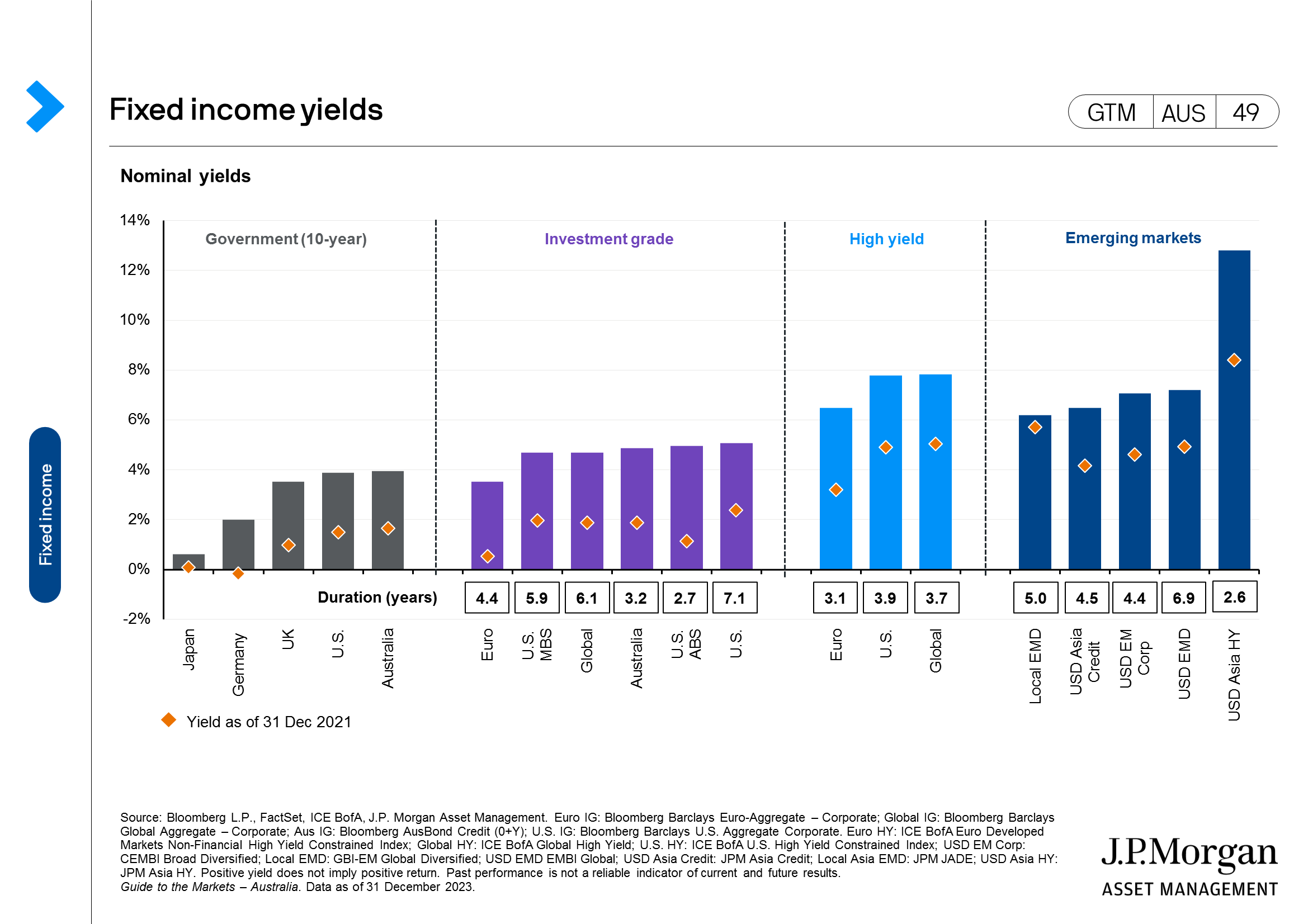

The search for higher yields

Yields of government bonds may be the closest to their highest in a decade, but yields are even higher across other sectors in the fixed income universe.

Income seekers have an opportunity to pick up even higher rates of income by moving past government bonds and looking into the credit market or even emerging market bonds.

4. GLOBAL INVESTMENT GRADE BONDS

|

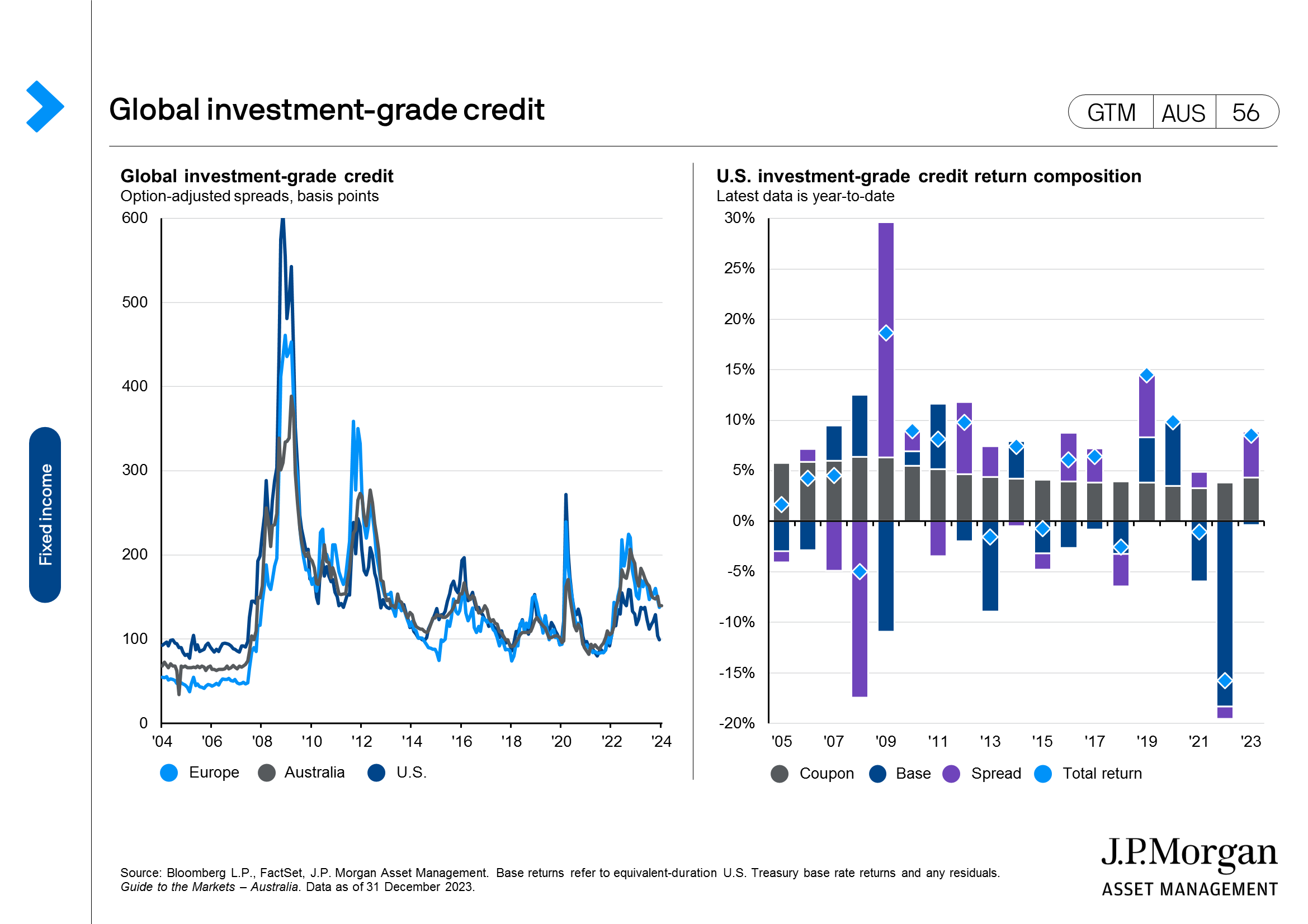

The safety of high-quality credit

Investment-grade bonds are the debt issued by companies that have a very low chance of default or represent a low credit risk.

The risk is not zero and this means that investors can earn extra yield compared to a government bond. This spread between corporate and government debt represents another source of income for investors.

5. HIGH YIELD BONDS

|

Take advantage of higher yields

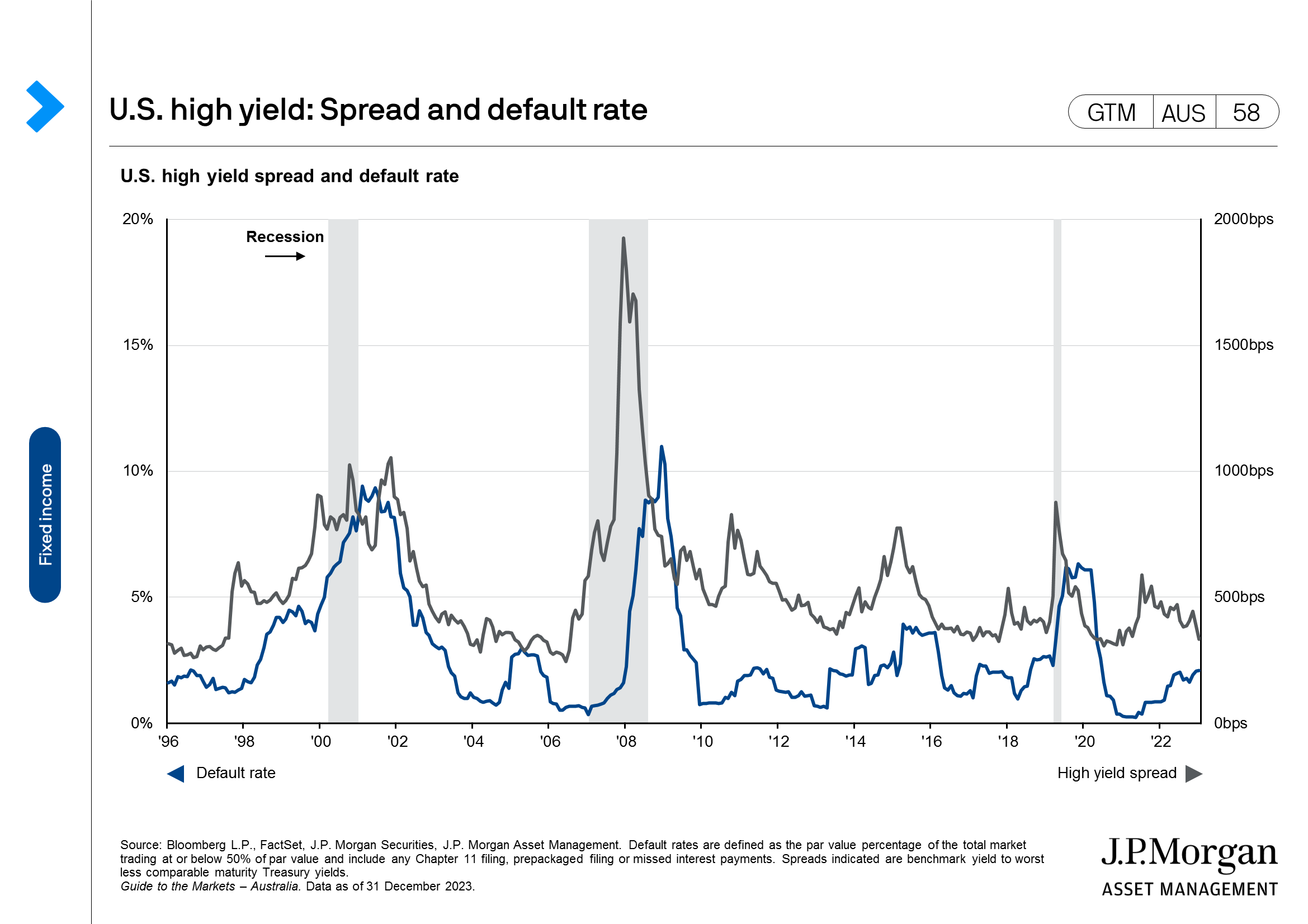

Beyond investment-grade bonds are high yield bonds. This is debt issued by companies with slightly higher credit risk.

However, investors can find themselves being compensated for this additional risk through additional yield.

The price of high yield bonds can fall sharply if the economy moves into recession. Investors will have to be mindful of just how much exposure to high yield debt they have in a weak macro economic climate.

6. DIVERSIFICATION AND FLEXIBILITY

|

Why diversification works

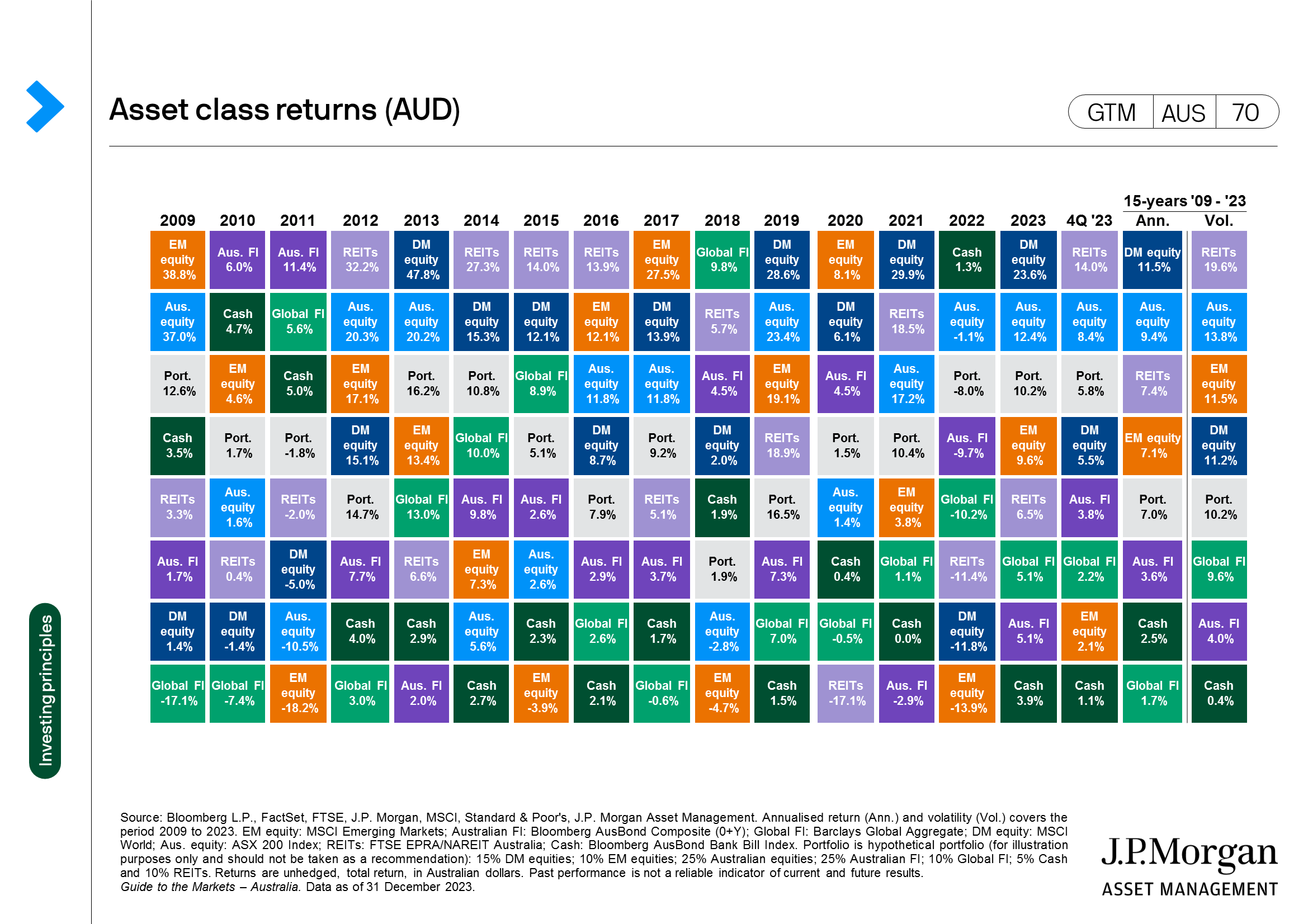

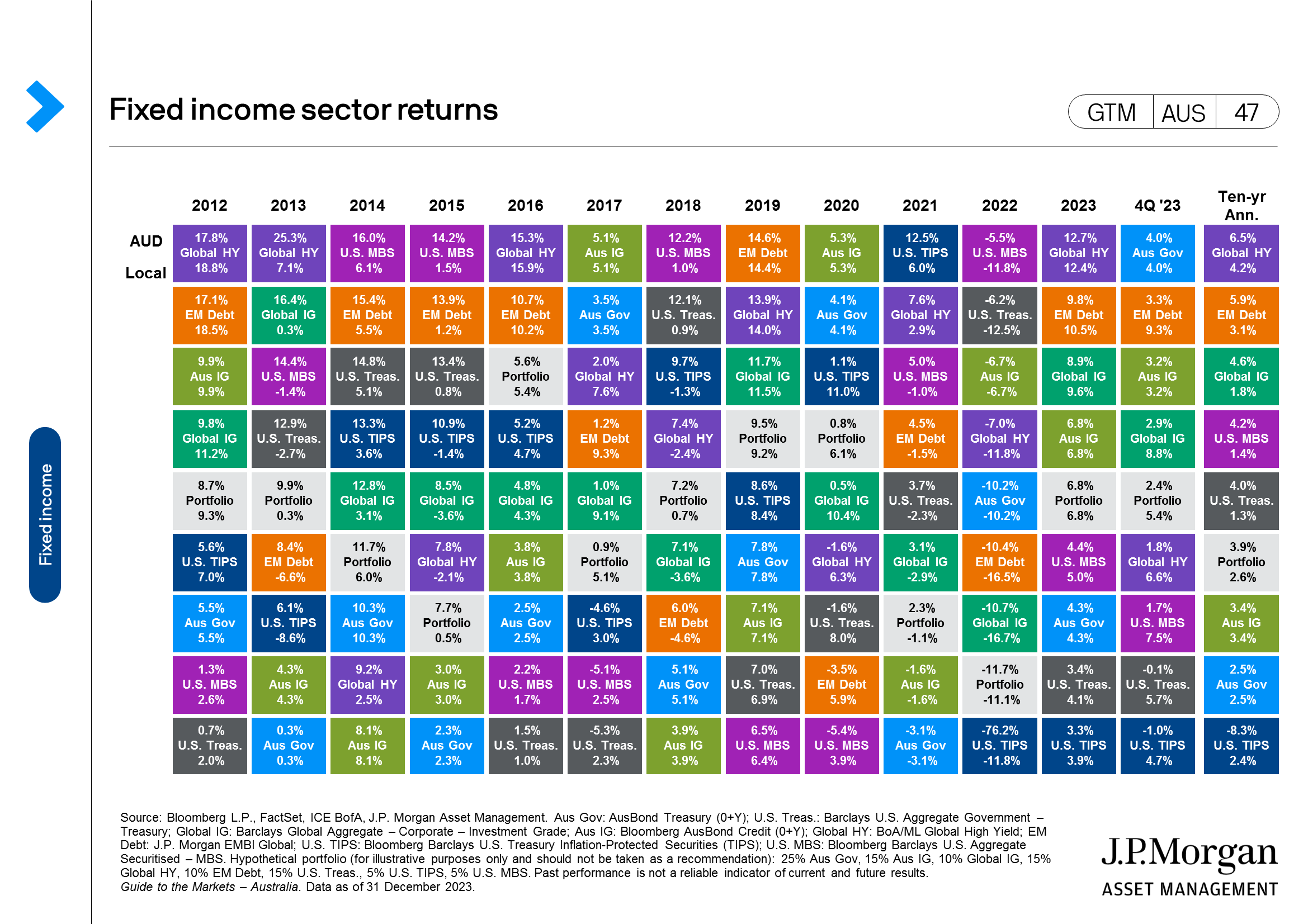

Fixed income investments diversify the risk from other assets in a portfolio. Bonds have a negative correlation to equities over time.

This diversification principle applies within an asset class as well as between them.

Including a wider array of fixed income instruments has yielded a better result than simply trying to pick the best one.

Fixed income doesn’t mean investors have to be fixed in their allocation. Being dynamic to take advantage of a shifting economic environment or better pricing can be an attractive strategy.

0903c02a8202ccc3